This article was first released to Systematic Income subscribers and free trials on June 27.

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the last week of June. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

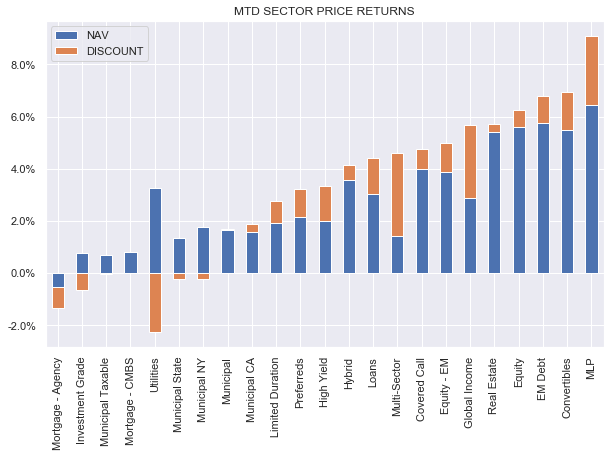

CEFs had a great week, rounding off a very strong June. Higher-beta sectors like REITs and Convertibles finished in the lead with high single-digit total returns.

Systematic Income

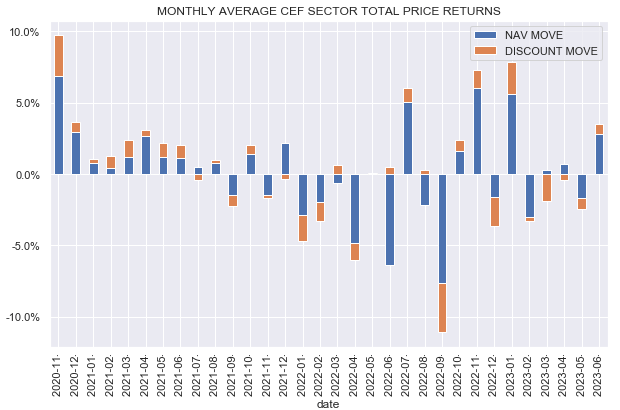

June was the second strongest month this year, only behind January.

Systematic Income

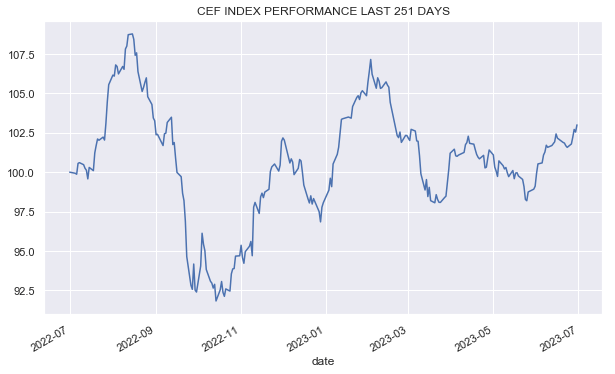

The CEF market pushed above its pre-bank tantrum level, erasing all post-March losses.

Systematic Income

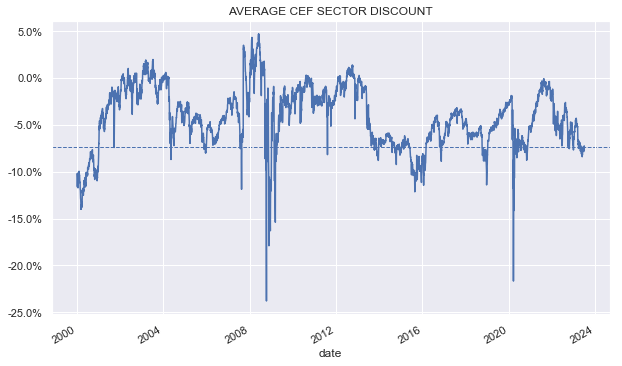

Discounts tightened slightly but remain at historically wide levels. Given the combination of recent NAV strength and cumulative distribution cuts, it’s quite possible that discounts will settle down at the wider end of their historic range as the “new normal”.

Systematic Income

Market Themes

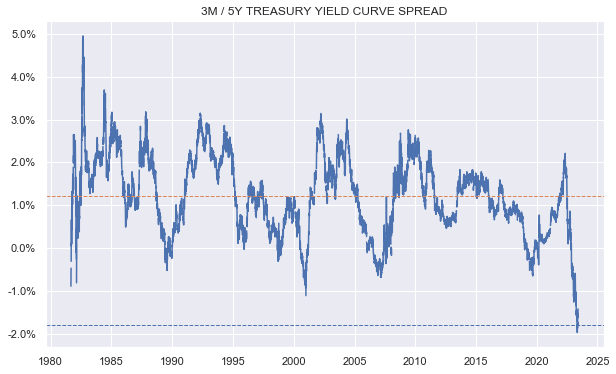

As many investors are well aware, the yield curve is inverted. For the typical leveraged corporate bond CEF, the relevant yield curve is the 3-month / 5-year Treasury one which is shown below.

Systematic Income

We can see that the yield curve is near its most inverted level for over 40 years (if not longer). The current figure of around -1.8% is about 3% below its longer-term average level of 1.2%.

This means that leveraging corporate bonds is much less attractive from a net income perspective as leveraged assets face a 3% headwind relative to the historical average. The very rough rule of thumb is that the net income of leveraged assets is reduced by the (3-month rate + 2%), where the 2% is the sum of the financing spread and overall fund expenses. This means that leveraged assets are over 7% “in the hole” from the outset. So, for example, a typical B-rated corporate bond which has a yield of, on average, 8.8% passes on only 1.8% of its yield or just a fifth of its overall yield. And once we factor in the drag from potential defaults, that figure goes even lower.

Given leveraged assets are about a third of total assets of a typical leveraged CEF, this net income aspect is worth considering. At the same time, however, there are a number of other factors that, at least, partially, counterbalance this negative element of leveraged CEFs in the current environment.

One, is the additional alpha that a given fund may provide to investors. Two, the potential upside from a rally in assets which would be larger in a leveraged fund than an unleveraged one. And three, many corporate bond CEFs have floating-rate holdings that have offset some of the drag from higher leverage costs.

The fact that CEF discounts remain at historically wide levels is a sign that investors are demanding additional compensation from CEFs in order to make up for this net income headwind.

Market Commentary

Cohen & Steers CEFs declared distributions for the next 3 months. Two (of 3) preferred CEFs (LDP) and (PSF) cut distributions by 3-7%. Interestingly, the third Cohen preferred CEF (PTA) has not cut despite all 3 having much the same NAV distribution rate. This is likely due to two factors. One is that PTA leverage looks to be slightly higher and, more importantly, PTA locked in a higher amount of its leverage and at a lower rate.

LDP and PSF canceled their managed distribution policies under which they distributed LT capital gains. The reasoning is quite clear – there are not many capital gains to find in the preferreds market given the double hit from the rate backup in 2022 as well as the March bank tantrum. Both funds adopted a new policy of making level distributions – similar to what PTA is doing now. In fact this is what most CEFs without an explicit managed distribution policy are doing.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here