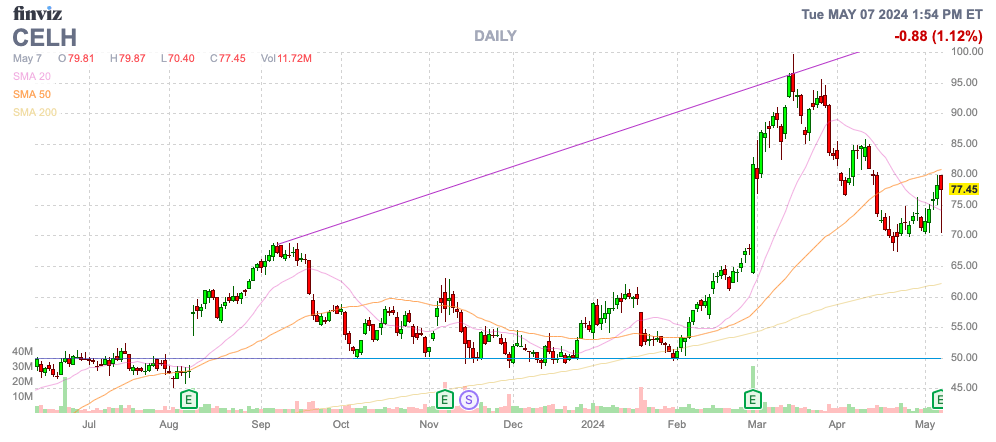

After a year of impressive results, Celsius Holdings, Inc. (NASDAQ:CELH) reported a disappointing quarter due to a surprise inventory issue. The healthy energy drink company has stumbled a couple of times in the last few months, leading to the opportunity to buy the stock far below the recent highs. My investment thesis remains ultra-Bullish on CELH stock, with the growth story unaltered despite the market hiccups.

Source: Finviz

Hidden Growth

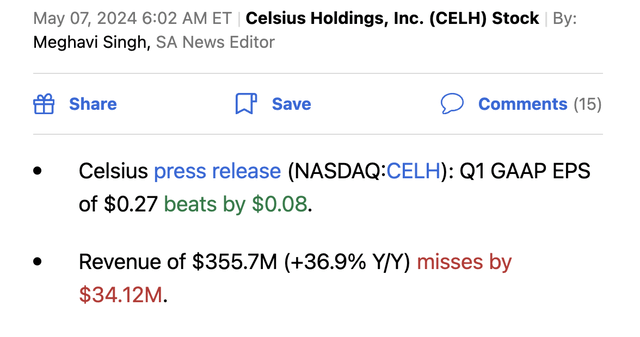

Celsius reported the following Q1 ’24 results that disappointed the market:

Source: Seeking Alpha

After years of massive growth, Celsius reported a huge sales blip due in part to an unexpected inventory issue with PepsiCo (PEP). The only problem is that the company reported a $34 million revenue miss for the quarter on $356 million in sales, while the inventory explanation was only $20 million.

On the Q1 ’24 earnings release, Celsius described the Pepsi inventory issues as follows:

..offset in part by inventory movements within our largest distributor where first quarter 2024 inventory days on hand declined versus the fourth quarter resulting in an approximate $20 million impact, while first quarter 2023 revenue benefited from an inventory buildup of approximately $25 million.

While the company blows off the inventory situation with Pepsi and other retailers, Celsius did announce a surprise new incentive program with their largest distribution partner in March. The timing is something to watch with the inventory reset.

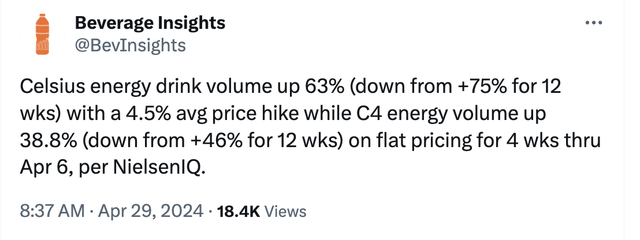

Ultimately, though, scan data continues to show Celsius growth remaining strong. The company reports Circana sales were up 72% in Q1, and NielsenIQ data reported 63% volume growth for the 12 weeks through April 6.

Source: Twitter/X

Without the inventory adjustment for days on hand (in essence, less inventory per daily sales), Celsius suggests sales would’ve grown in the 60% range. The sales data appears to support the conclusion that actual sales remain strong.

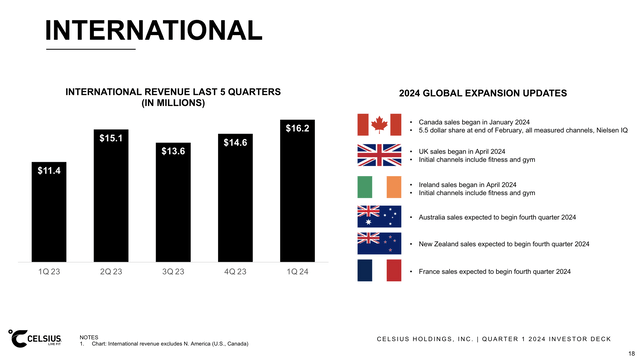

The company continues to ramp up international sales, with Q1 ’24 topping $16 million. While the revenue number excludes the successful launch in Canada, Celsius has UK and Ireland sales currently ramping up and Australia, France and New Zealand already lined up for Q4.

Source: Celsius Q1’24 presentation

While sales should return to strong growth with inventory corrections over, international expansion and larger shelf space at U.S. retail stores, the big question is the profit view with the incentive program for Pepsi. The company just reported Q1 EPS more than doubled to $0.27 in the March quarter, with the gross margin jumping from 44% last Q1 to 51% now.

The stock has fallen to $75 and trades at about 70x EPS targets of $1.10 for the year. The consensus numbers should jump after the big EPS beat for Q1.

The consensus estimates have EPS topping $2 in 2026. Analysts should have adjusted numbers now for the new incentive program for Pepsi, and investors will closely watch where margins go the rest of the year.

On the earnings call, management danced around whether the program would hit margins other than for the CFO to suggest the program had a multi-month ramp period as follows (emphasis added):

So, the incentive program is for Pepsi. It’s incentive based, right? So obviously we’re going to get something for it. So, the idea is to really drive what our priorities are, what their priorities are across energy. We want to be the number one energy brand in the world. It’s also really to drive alignment. And so, from that perspective, it’s an incentive program. So, the idea is to really push us to the next level… So, there is obviously a cost to that program. So, it’s something that I would look to see ramping up across call the first six, seven, eight months of the year and to really be cruising by the time we get to the back part of the year.

Bargain Stock Again

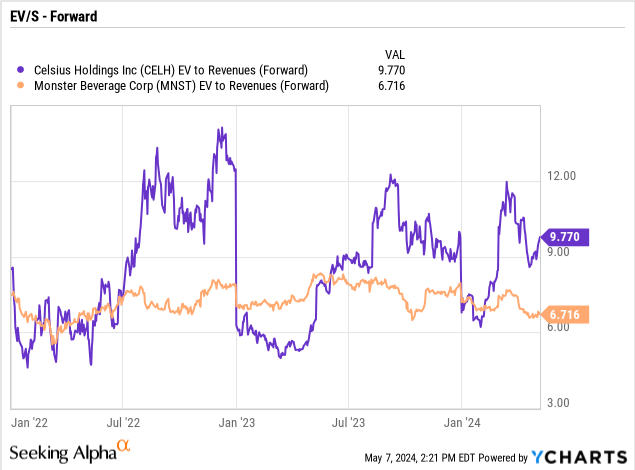

As highlighted in the past, Celsius remains a bargain stock when the forward EV/S multiple dips below 7x. The stock is an extreme bargain when the multiple dips below the Monster Beverage Corp. (MNST) multiple by a wide margin, considering the growth rates aren’t even comparable.

The company has seen the energy drink U.S. MULO C (Multi Outlet with Convenience Stores) dollar share rise to 11.4% share in Q1 ’24. In comparison, Monster and Red Bull both have around 30% share, providing a long growth path for Celsius before the market size is detrimental to future growth.

As an example, Monster Beverage only grew 12% in the last quarter, with revenues reaching $1.9 billion. The company still reporting 12% growth is at this size is impressive, but Celsius reported triple the growth rate, even with the Pepsi inventory hit. The energy drink company likely has 5x the revenue growth rate and trades with a lower valuation multiple.

Takeaway

The key investor takeaway is that Celsius Holdings, Inc. continues to produce strong growth in sales volumes, and the inventory issue will work itself out over time. The stock trades discounted to a slower growing peer, which typically signals a good time to load up on the stock.

Read the full article here