Investment Thesis

Cerence (CRNC) specializes in developing AI-powered virtual assistant solutions for the transportation industry, with a primary focus on automobiles.

Their AI prospects are centered on innovation and creating immersive companion experiences.

Cerence’s technology enables intuitive interactions between vehicles and drivers ultimately aiming to enhance the overall mobility infotainment experience.

In sum, Cerence has a very compelling narrative, with high gross margins. That’s the good news. The bad news is that the business is about to finish fiscal 2023 with free positive cash flows (barely) and its balance sheet carries around $150 million of net debt.

Consequently, I stay on the fence on this stock.

Cerence’s Near-Term Prospects

Cerence is a player in the field of AI-powered virtual assistants for the transportation industry. Their core business revolves around creating advanced virtual assistants that facilitate natural and intuitive interactions within automobiles. These virtual assistants are designed to connect vehicles, drivers, passengers, and the broader digital world seamlessly.

Cerence provides customers with white-label solutions that enable the customization and branding of virtual assistants. Their technology leverages cutting-edge speech recognition, natural language understanding, and other AI technologies to support interactions through speech, touch, handwriting, gaze tracking, and gesture recognition.

This allows for a wide range of human-vehicle interactions and integration of third-party virtual assistants. Cerence’s vision is to make transportation safer and more enjoyable, and their solutions are in high demand as consumer expectations for hands-free access to virtual assistants continue to grow.

Cerence’s software platform, with its hybrid architecture combining edge and cloud-connected components, provides a versatile and customizable solution for creating integrated virtual assistants in automobiles. Cerence offers a wide array of edge software components, including speech recognition, voice biometrics, and wake-up word detection, tailored to specific vehicle models.

Cerence generates revenue from software licenses and professional services offered during the vehicle design and deployment phases.

Cerence’s near-term strategy revolves around its strategic moves in emerging markets, offering specific software components to OEMs. This approach not only establishes a presence in these markets but also lays the groundwork for potential expansion as these OEMs adopt more of Cerence’s technology, ultimately boosting revenue per vehicle. Cerence’s entry into the two-wheeler market is another significant step, with some design wins already. While the revenue contribution from this segment may be modest initially, it positions Cerence for growth in FY24 and beyond.

Furthermore, Cerence is dedicated to winning new business by securing strategic contracts.

Cerence believes it has strong AI prospects driven by its focus on the integration of large language models and generative AI into its products. They aim to create intuitive user interfaces and empower customers to deliver high-value in-car experiences. The Next Generation Cerence Assistant, powered by generative AI, offers natural interactions and deep customization. Cerence is expanding its AI architecture and positioning itself to unite various technologies in the car.

On the surface, it’s difficult not to get excited about its alluring narrative. What’s not to like about this large total addressable market with Cerence’s high gross margin business?

Revenue Growth Rates Are Erratic

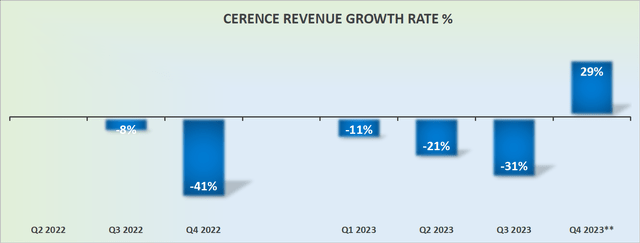

CRNC revenue growth rates

Now, let’s press the break and adjust our seating. The fact of the matter is that Cerence’s growth rates are erratic.

This underscores that even though this company positions itself as the next big infotainment opportunity, and that it is determined to reach its long-term objectives of sustainable double-digit revenue growth with robust EBITDA margins, and yet reality is quite different.

That being said, realistically, I don’t believe that fiscal 2024 will be quite as brutal as fiscal 2023. If for no other reason than its comparables next year is significantly easier.

However, one thing we can be sure about, this is not a long-term secular growth story of strong market penetration and compounding revenues, even if Cerence’s narrative sometimes leads one to believe otherwise.

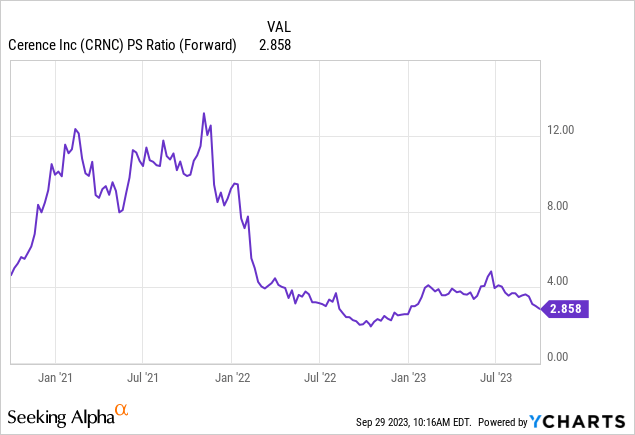

CRNC Stock Valuation – Under 3x Forward Sales

There was a time when this stock was priced at more than 10x forward sales. But that’s clearly no longer the case.

That being said back then the business was consistently reporting around 10% CAGR. And that’s clearly no longer the case right now.

Furthermore, we have to keep in mind that not only Cerence carries slightly more than $150 million of net debt on its balance sheet, but also, Cerence is just barely expected to end fiscal 2023 with positive free cash flows.

On balance, this is evidently not a thriving business.

The Bottom Line

I find myself somewhat uncertain about Cerence’s near-term prospects and AI strategy. On the one hand, the company specializes in AI-powered virtual assistants for automobiles.

However, my uncertainty arises from the erratic nature of Cerence’s revenue growth rates, which suggests challenges in achieving sustainable growth.

Even though the company presents an enticing narrative and has high gross margins, there’s more to this story.

Moreover, Cerence’s fiscal 2024 outlook remains uncertain, and it’s not yet clear whether it can deliver on its long-term objectives of double-digit revenue growth with strong EBITDA margins.

The stock valuation, currently under 3x forward sales, reflects the market’s cautious sentiment. With a significant amount of net debt on its balance sheet and only expected to end fiscal 2023 with positive cash flows, Cerence’s path to sustained growth appears challenging.

In conclusion, while Cerence’s AI prospects are promising, the company’s financial performance raises questions about its ability to deliver consistent and substantial returns in the near term.

Read the full article here