The EV Charging Investment Thesis Has Been Boosted By Recent Big Auto Development

We previously covered ChargePoint (NYSE:CHPT) in March 2023. The stock had been sold off then, attributed to the double misses in the FQ4’23 earnings call and softer FQ1’24 guidance. However, we believe that the market had overreacted, due to the management’s guidance of positive Free Cash Flow [FCF] generation by the end of FY2024.

Unfortunately, the stock has been further impacted by the Supercharger collaboration between Tesla (TSLA), Ford (F), and General Motors (GM), triggering mixed sentiments for many EV charging stocks, CHPT included, due to the potential impact on its adoption and top/ bottom line.

With CHPT similarly jumping on the bandwagon by offering connectors for TSLA’s charging standard, it appears that the deal is sealed, relegating the NACS connector as the accepted convention for most EV charging moving forward. These optics point to TSLA’s growing dominance in the EV charging space, in our view.

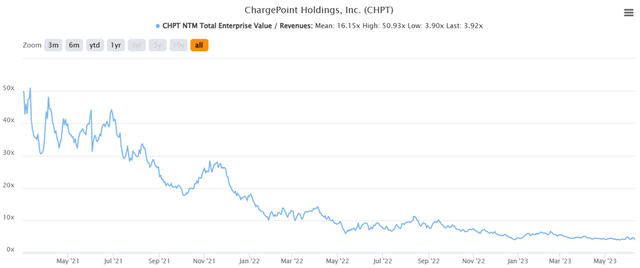

CHPT 2Y EV/Revenue

S&P Capital IQ

Therefore, it is unsurprising that CHPT’s valuations have been impacted, moderating to NTM EV/ Revenues of 3.92x at the time of writing, down from its 2Y mean of 16.15x. However, we believe the pessimism is unwarranted, since the charging company is expected to record a top-line growth of +45.8% through FY2026, compared to the hyper-pandemic levels of +48%.

In addition, the management remains committed to positive adj. EBITDA by the end of CY2024, or the equivalent of FY2025. By the latest quarter, we are already seeing exemplary improvements in its gross margins to 23.5% (+1.9 points QoQ/ +8.7 YoY).

This is on top of the visible restraint in CHPT’s operating expenses at $110.46M (in line QoQ/ +8.3% YoY), resulting in adj. EBITDA margins of -37.6% (+9.3 points QoQ/ +44.5 YoY) after other adjustments. Assuming a similar cadence, we may see the company turn its profitability around over the next few quarters.

Combined with its FQ2’24 revenue guidance of $153M at the midpoint (+17.6% QoQ/ +41.2% YoY), we remain cautiously confident about its execution in the near term.

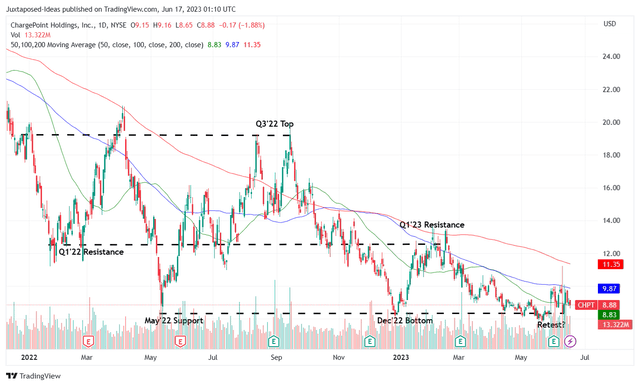

CHPT 2Y Stock Price

Trading View

Either way, CHPT has also been overly sold off, thanks to TSLA’s growing partnerships. The stock is already retesting its previous May and December 2022 support levels, suggesting further volatility ahead. Assuming that these levels hold through the worst of the pessimism, we may see it emerge much stronger in the intermediate term.

Risks Remain In The CHPT Investment Thesis

However, investors may also want to monitor CHPT’s deteriorating balance sheet, with cash/ equivalents of $314M by the latest quarter (-14.9% QoQ/ -41.9% YoY). While debt has remained stable at $295M, the company has also recently raised $18M of capital, further diluting long-term shareholders.

While its footprint continues to expand to 243K ports by the latest quarter (+8% QoQ/ +29.2% YoY) as well, most are attributed to slow charging at Level 2, since only 21K (+10.5% QoQ/ +75% YoY) is DC fast-charging.

The latter has likely caused lower usage, with the recent quarter only recording an average of 153.8K daily charging sessions, based on 14M charging sessions between March 02, 2023, and June 01, 2023. Compared to an average of 274.7K daily charging sessions in Q1’23, the decline is a cause for concern indeed, despite the improvement from the Q4’22 average of 107.5K charging sessions daily.

With market analysts projecting a contribution of up to $1.1B from non-TSLA customers, it is unsurprising to see the pessimism embedded in CHPT’s stock prices.

Combined with TSLA’s growing number of Supercharging connectors to 45.16K by Q1’23 (+6.4% QoQ/ +34% YoY), CHPT may face further demand headwind indeed. The difference in their offerings further widens the gap, between Supercharger’s faster charging option of up to 200 miles within 15 minutes and CHPT’s Level 2 charging at approximately 25 miles of Range Per Hour.

Despite So, We Believe The Risk Reward Ratio Remains Attractive

Then again, we remain confident about CHPT’s larger footprint, especially due to the different use cases for slower charging speeds at workplaces, shopping malls, and homes. In addition, the company offers on-site/ home fleet and business charging, suggesting its well-diversified strategy.

Most importantly, the EV charging market remains nascent enough to accommodate multiple players, with both CHPT and TSLA likely to benefit from the improved charging infrastructure and, consequently, reduced range anxiety and increased EV adoption.

With the EV sales in the US remaining brisk at 257.5K (+63% YoY) in Q1’23 and the EU at 197K for plug-in electric cars (+25% YoY)/ 120K for all-electric (+50% YoY) in April 2023, consumer demand remains more than healthy, despite the uncertain macroeconomic outlook.

As a result of CHPT’s depressed stock prices and valuations, we are cautiously rating the stock as a Buy here. However, due to its lack of profitability and potential volatility, investors may want to size the portfolio accordingly.

Read the full article here