(Note: This article was in the newsletter on June 7, 2023.)

Chart Industries, Inc. (NYSE:GTLS) management appears to understand that the market needs the same message repeated “constantly” to overcome apprehensiveness about the situation. Mr. Market has long focused on leverage. But Chart management has an excellent counter to the leverage concern in the form of “certainty” of earnings from a long-lead-time backlog. Even in fiscal year 2020, when the Chart Industries stock price declined about 95% from its high amid all the coronavirus challenges, business did not materially change. Of course, GTLS stock then returned to previous levels (and then some) as orders quickly bounced back.

Chart often focuses on larger projects that continue regardless of the economic conditions. Fiscal year 2020 demonstrated this better than any corporate communication could. That helps when management is now trying to get across the message that the increased leverage from the recent purchase has risk offsets in the form of relatively certain future earnings. Management has to execute and not lose control of quality and costs. But this is something that a management with a long history of acquisitions and fast growth should be able to do. All that past practice is now showing itself to be a huge advantage. That makes Chart Industries a glaring exception (at least right now) to the damage that too much leverage can do.

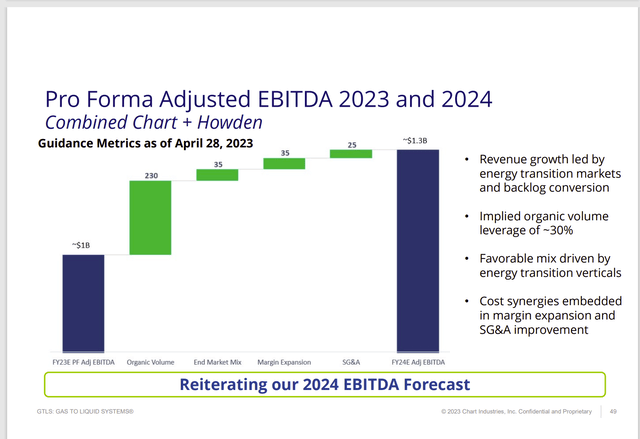

Chart Industries Guidance Reaffirmation Fiscal Year 2024 (Chart Industries June 2023, Corporate Presentation)

Interestingly, there is nothing new in the above graph. Management has said the same thing all along. What is even more interesting is that the minute management gets done restating that nothing has changed, the stock sags (and before you know it, doubts creep into the news). But this management has figured out the way to keep the stock price from spiraling out of control is to keep repeating the message as long as it is true. It is likely to remain true for a long time.

The reason for this is that the long lead times assure a fiscal year 2023 with only minor changes possible. Now, it could be that there is a delay for one reason or another to push some orders into 2024. But as far as the market is concerned, the key issue is that the orders are not “lost.” Besides, the fiscal first quarter is historically the slowest quarter. Therefore, that quarter can easily handle any “overflow” issues.

What can change is fiscal year 2024. But even in that case, fiscal year 2024 is at this point at least halfway “nailed down.” Therefore, the future here is unusually visible for the market to offset the financial leverage risk. Reiterating, the 2024 guidance is not as “pie in the sky” as an observer may think.

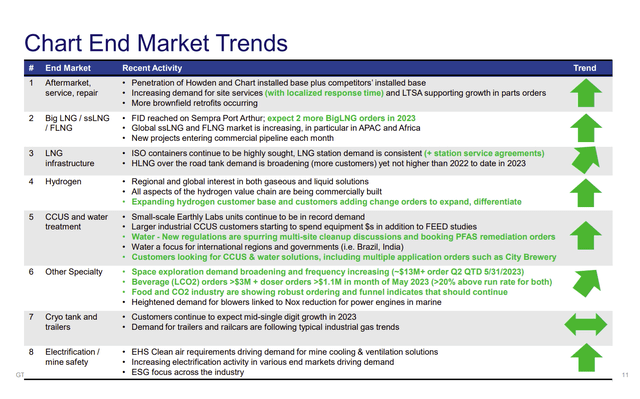

Chart Industries Market Growth Trends As Of Right Now (Chart Industries June 2023, Corporate Presentation)

Another reduction in uncertainty comes from the management update that the currently rapidly growing markets are continuing to grow. Management has put together products that serve a combination of growing markets as well as mature or declining markets to overall grow rapidly.

A further risk reduction comes in the form of management keeping acquired company management and the acquired facilities as well (with small exceptions). In that fashion, quality is not a risk, as the personnel that make and ship the products are still doing that.

What does happen is that the sales effort is combined in a way that benefits Chart. Therefore, a lot of the growth benefits come from offering a product line that meets a lot more expectations. There are also expanding location benefits as well.

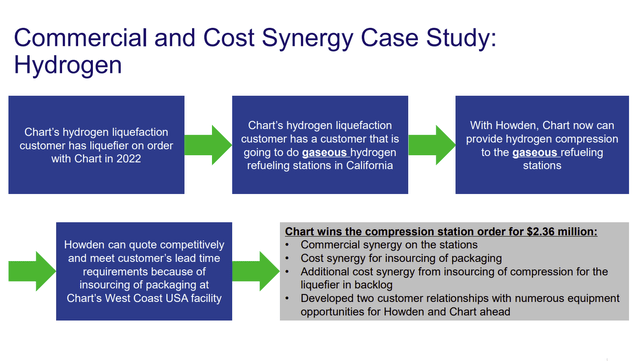

Chart Industries Combined Sales Effort Example (Chart Industries June 2023, Corporate Presentation)

Many of the markets that Chart serves are large and fractured. No one company really dominates the whole market. Now, it is possible that Chart is able to build some niches that allow for a marginal increase in profitability. Certainly, the “one-stop shop” concept is a huge plus as long as management continues to make sure every part of the “one stop” is “pulling its own weight.”

In effect, the company is fairly decentralized on the manufacturing side while centralizing and coordinating the sales efforts. Acquired companies can still sell to their markets. But there is now the additional opportunity from combined sales efforts.

Handling Leverage

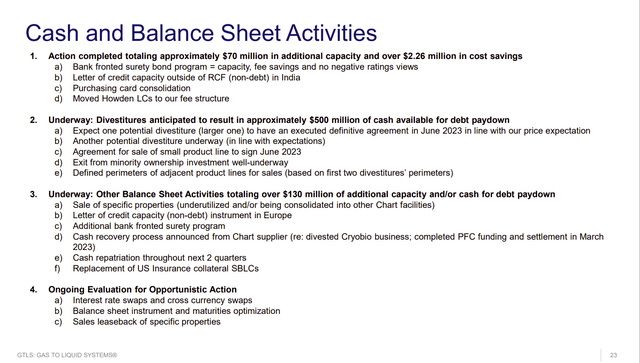

Chart Industries management took out additional “insurance” in the form of not including any divestitures in the guidance. In addition to the guided activities listed below is some guidance that material divestitures are on the way. This will again put the company ahead of its original guidance schedule.

Chart Industries Deleveraging And Other Balance Sheet Activities (Chart Industries June 2023, Corporate Presentation)

Management had long identified two major divestitures that it would like to make. It now appears those divestitures are likely to happen this year. If that is the case (and there is always the risk these deals fall apart), then management will be materially ahead of its deleveraging guidance for the foreseeable future.

Chart did announce that an agreement was signed for a $300 million deal with Ingersoll Rand (IR). The stock definitely reacted positively to the news.

The advantage of participating in hot markets is that noncore products are often in demand elsewhere, so that selling noncore divisions is not an issue. Still, the market is likely to react positively to material sales.

Management did give itself a lot of upside potential in this financially risky endeavor by giving out very conservative guidance that “could not go down” except in extraordinary circumstances. But that same guidance was subject to a lot of upward revisions that would leave room for an occasional backstep if one happened. Right now, the chances of going backward look slim.

Key Takeaways

The market originally hated the news of the high leverage to finance this acquisition. Then it hated the guidance that came out for being conservative. The whole scenario led to a pretty big stock price crash.

But Chart Industries management appears to be well on its way to digging itself out of this whole thing. The Howden deal is by far the largest made by the company. But management had a lot of acquisition experience before this. Therefore, there is a very good chance that management knew what to do. It just had to do it on a larger scale than was ever the case before.

Chart Industries tends to reduce acquisition risks by keeping the acquired company management. In fact, that is likely an acquisition requirement (similar to what Warren Buffett does). The benefits of the acquisitions come from the increasingly large “one-stop shop” of well diversified products that appeal to more industries outside the original oil and gas business.

Management has worked hard so that no one division defines the company anymore. Therefore, the next oil and gas downturn is likely to slow growth for the duration of the downturn. But it likely will not affect Chart Industries, Inc. anywhere nearly as much as in the past.

Read the full article here