Chevron Corporation (NYSE:CVX) investors have seen their stock struggle for traction as value stocks failed to participate in the AI-driven rally that lifted the S&P 500 (SPX) and the Nasdaq (NDX).

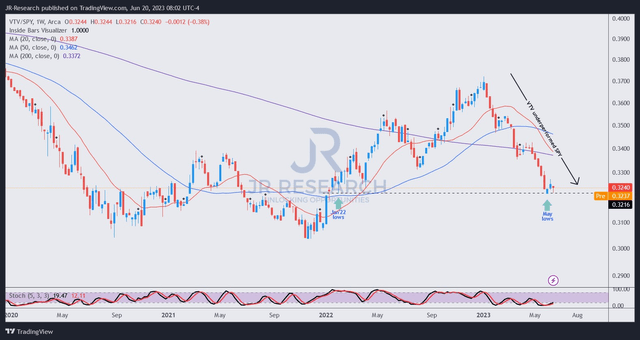

VTV/SPY price chart (weekly) (TradingView)

The underperformance of value stocks against the broad market was so significant that VTV/SPY reached lows last seen in January 2022. It topped out in January 2023 as investors rotated back into growth and tech stocks, despite their relatively more expensive valuations.

Even though the energy sector (XLE) is trading at a forward normalized P/E of 10.5x, investors aren’t keen to re-rate the sector’s valuation much higher, despite the discount against the SPX.

As such, the underlying rotation likely surprised energy investors, as CVX also underperformed. I cautioned in several articles over the past year, urging energy investors to capitalize on their remarkable run and take profits, as it could top out.

With CVX moving into a medium-term downtrend recently, I assessed it marks a pivotal development in its price action. Therefore, I implore investors to pay close attention to whether CVX is still a reasonable buy on pullbacks, as its momentum has reversed. Does it look bad? Let’s take a closer look.

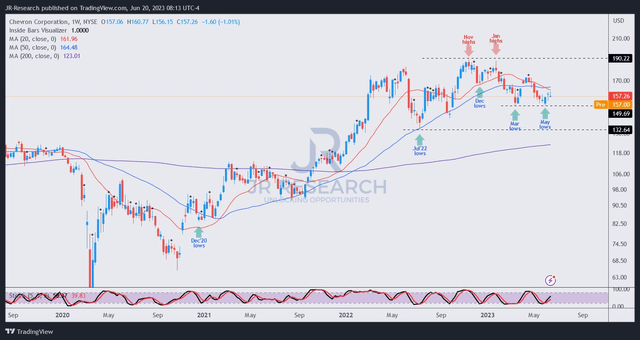

CVX price chart (weekly) (TradingView)

As seen above, CVX has decisively lost its key moving averages, particularly its 50-week moving average or MA (blue line). Losing the support of that line is critical, as it indicates that momentum investors are not likely to support dip buying opportunities, leaving investors who buy such dips potentially ending up catching a falling knife.

That’s an important distinction, as not every dip is buyable. Assessing whether momentum investors are by your side is essential to help bolster buying sentiments at critical support zones, giving confidence to more investors to return.

Looking at how the 50-week MA supported CVX’s medium-term uptrend from December 2020 until it was lost recently highlights how critical that dynamic support zone is for compelling dip buying opportunities.

With that in mind, a death cross also formed in late May, corroborating the tops I warned about late last year and earlier this year as bullish energy investors went into overdrive.

However, by the time you wait for the stars to align, seeing the death cross before taking decisive action, you would have missed selling or cutting exposure at much more attractive levels.

I don’t question Chevron’s wide economic moat and its inherent cost advantages in the Permian Basin as its primary growth driver. Moreover, its robust balance sheet with $15.8B in cash and short-term investments and net debt of $7.41B are much healthier metrics than a few years ago. Moreover, its trailing twelve months or TTM ROIC of 16.3% supports the company’s recovery from its peak pessimism in April 2020.

However, investors need to consider forward-looking price action as a critical decision-making tool when assessing whether to buy the recent dips in CVX. Value factors could benefit from a rotation from the overstretched big tech stocks as they surged toward their recent highs. However, the volatility in the underlying energy futures (CO1:COM) (CL1:COM) could impede a significant improvement in buying sentiments in CVX in the near term. Coupled with the recent infighting between Saudi Arabia and Russia in OPEC+ over production levels, investors must be prepared for more uncertainties.

Notwithstanding, I also believe that some of the best opportunities exist when markets are fearful, leading to steep pullbacks and opening up noteworthy dip-buying levels.

CVX could consolidate at the current levels, supported by its March lows. However, a premium valuation against its sector peers (rated “D+” for valuation by Seeking Alpha Quant) suggests it isn’t compelling enough to be aggressive.

As such, I urge holders looking to add more exposure to give CVX more time to prove itself in the current consolidation zone while assessing an opportunity to add more shares or start a new position.

With my Sell thesis playing out accordingly, I’m ready to move to the sidelines here while observing the consolidation.

Rating: Hold (Revised from Sell).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here