Receive free Chinese business & finance updates

We’ll send you a myFT Daily Digest email rounding up the latest Chinese business & finance news every morning.

If there is one thing China takes seriously, it is a test. From the ancient keju civil service exam to today’s ultra-competitive gaokao university entrance exam, a high ranking has been vital to success.

That might help explain Beijing’s latest obsession: acing the World Bank’s ease of doing business index, the world’s premier ranking of countries as investment destinations, which is being revamped and expected to relaunch next year.

Local government officials in cities such as Shanghai have been swotting up since June on how their jurisdictions can achieve a good score in the annual index that ranks countries according to their investment and business conditions. Beijing has also submitted 71 suggested changes for the new survey, to be known as the Business Ready index.

The new system will be based on consultations with mainly private sector experts and a survey of private sector companies.

Given the dominance of the government in its economy, China could “fall significantly”, vice-finance minister Wang Dongwei warned in a recent conference. He urged his counterparts in China’s large cities and provinces to prepare well for the surveys. “This is an opportunity for us to showcase . . . Chinese-style modernisation,” Wang said.

The rollout of Business Ready — which will start as a pilot programme next year before being widened to include China among 180 countries — follows the World Bank’s suspension of its earlier Doing Business report in 2020. The multilateral lender had identified “data irregularities” in the old system that critics said had overstated China’s ranking. China shot up to 31 in 2020 from 78 four years earlier.

The controversy sparked a scandal centred around Kristalina Georgieva, the former World Bank chief executive who later joined the IMF as managing director. She was accused of pressuring World Bank staff to manipulate data to China’s benefit, allegations she has denied. After an internal investigation, the IMF said she had its full confidence.

Responding to questions about the new Business Ready system, the World Bank said it believed growing the private sector was the surest way of lifting people out of poverty and fully utilising the talents of young people.

“This requires attracting investment — and this project is another important step in our efforts to do so,” it said. “Business Ready will offer countries a reliable, standardized way to measure their progress in improving incentives for investment.”

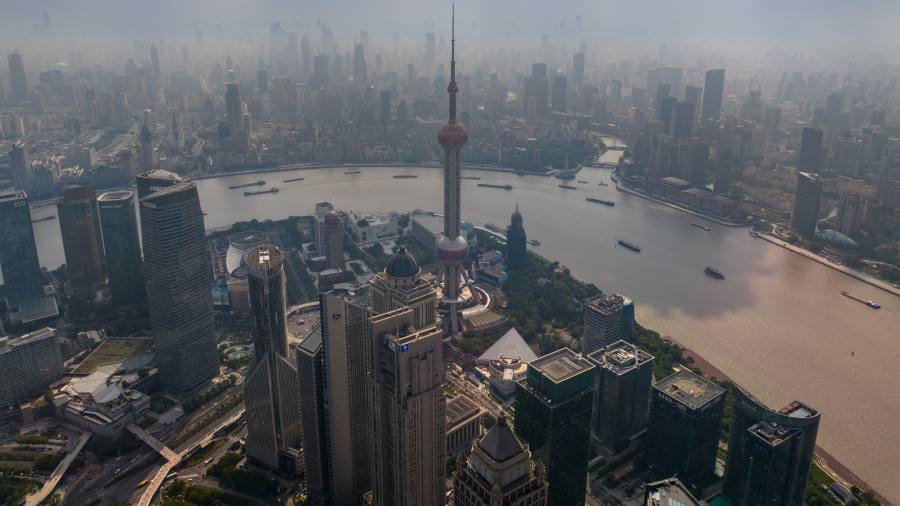

The revamped rankings would be a source of “huge unease for the Chinese government because business confidence is way down”, said Shaun Rein, founder of China Market Research, a Shanghai-based consultancy that advises foreign investors. “Multinationals will take this survey seriously, and they will look to see whether or not China is still investable.”

A senior official in Shanghai said the biggest challenge for China under the new methodology would be its planned nationwide survey of more than 2,000 private companies, many of which are suffering from growing state intervention and only just emerging from the effects of Covid-19 lockdowns.

“The improvements China has made, such as faster approval of business licences, are all superficial,” said Ma Liang, a professor at Beijing-based Renmin University and an expert on China’s business climate. “There is little progress on more structural issues, like giving private companies the same access to government contracts as state firms.”

Multiple officials and scholars said the government could pressure private sector survey respondents to react positively. But “there could be a backlash from private companies if local authorities push too hard”, said an official in the central Chinese city of Wuhan who has worked on business climate surveys.

The index also covers political and legal areas that might not favour China, such as arbitration in disputes with the state, forced labour, collective bargaining and state-owned enterprises’ dominance over certain industries.

Some analysts questioned China’s obsession with the study given that Beijing has long championed a state-led economic model very different from that espoused by the World Bank but which has still produced rapid development.

“It strikes me as far too insecure on China’s part,” said Justin Sandefur, senior fellow at the Center for Global Development, a Washington-based think-tank, and an external reviewer of the Doing Business report.

Read the full article here