The Chinese economy was already on shaky footing in 2023, but several new developments have signaled that the downward spiral may be intensifying.

Recent data indicates that foreign direct investment (FDI) in China has fallen off a cliff, and is now brushing against some of the lowest levels observed in the 21st century.

In the first quarter of this year, FDI into China dropped to $20 billion, which represented an 80% drop from the $100 billion in FDI observed during Q1 2022. However, the FDI situation deteriorated further in Q2, when FDI dropped to a mere $4.9 billion-the lowest level observed since 1998.

Last year, China was the second-largest overall recipient of global FDI, right behind the United States-the two attracted $189 billion and $285 billion in FDI last year, respectively.

The U.S. has also seen a drop in FDI in 2023, but it’s been far less severe than what’s been observed in China. In the United States, FDI declined by about 20% during the first five months of the year.

Moreover, for China, declining FDI appears to be a symptom of a larger problem. In addition to losing interest from foreign investors, China’s currency has also been spiraling lower. On August 17, the dollar/yuan exchange rate slipped to 7.32, which was the weakest level for the yuan since 2007. However, the yuan has strengthened slightly since then.

Today, roughly 7.20 Chinese yuan are required to purchase a single U.S. dollar, as compared to 6.40 at the start of 2022, as illustrated below.

Bloomberg

Much like the precipitous drop in FDI, depreciation in the yuan has been linked to declining confidence in the Chinese economy.

Speaking to the current environment, John Ramig-a lawyer at Buchalter law firm-recently told Reuters, “I don’t have one client wanting to invest in China. Not a single client.” And this represents a sharp shift from several years ago, when global firms were clamoring to inject fresh capital into the Chinese economy.

Elaborating on the shift in sentiment, Ramig said, “Everyone is looking to either sell their Chinese operation, or if they’re sourcing products in China, they’re looking for an alternative place to do that.”

Providing further evidence of these trends, the Wall Street Journal recently reported that Crane-a large American manufacturer of vending machines-has been ratcheting back its investments in China, in part due to increased “policy uncertainty” related to China.

As most investors and traders are well aware, the United States government has been steadily reducing the outflow of hi-tech exports to China, especially of advanced semiconductors. Further, export limitations are expected to be announced in the near future.

Fallout from the U.S.-China Trade War

China has certainly faced headwinds related to its domestic economy in 2023, but the continuing cross-border trade war has weighed heavily on the Chinese economy, as well.

Looking beyond the flagging yuan, and a precipitous drop in FDI, there have been plenty of other negatives that have emerged as a result of China’s ongoing trade war with the United States.

During the first six months of 2023, Chinese exports to the U.S. only accounted for about 13% of the overall total, which represented a significant decline from 2017 (the year before the trade war started), when that figure was closer to 22%-according to data compiled by the U.S. Census Bureau.

That also represented the lowest percentage since 2003, which means Chinese exports to the U.S. have fallen to a 20-year low, by that measure. And as one might expect, other countries have been clamoring to pick up the slack.

Some of the biggest beneficiaries of China’s declining influence in the American market include several of its neighbors in the Asia-Pacific region, as well as Mexico. For example, India, Thailand, and Vietnam now account for nearly 25% of all U.S. imports, according to Census Bureau data.

Mexico, for its part, has also stolen some of China’s thunder. When accounting for the combined value of all imports and exports, Mexico is now the top trading partner of the United States. China has now dropped into third place, while Canada remains in second.

During the first half of 2023, Mexico and Canada accounted for 15.7% and 15.4% of U.S. imports, respectively. As mentioned previously, China’s percentage of American imports has drooped to 13%.

And there are plenty of practical examples that help illustrate where these losses are coming from.

For example, Apple (AAPL) has been slowly shifting production out of China, and into other countries-especially India. As a result, the Chinese share of U.S. smartphone imports has dipped below 80%, which was the standard for many years.

Similarly, U.S. furniture imports have also slowly been shifting away from China in favor of Canada, Mexico, and Vietnam. Back in 2020, those three countries accounted for about 40% of U.S. furniture imports, but in 2023, that figure has risen to 50%.

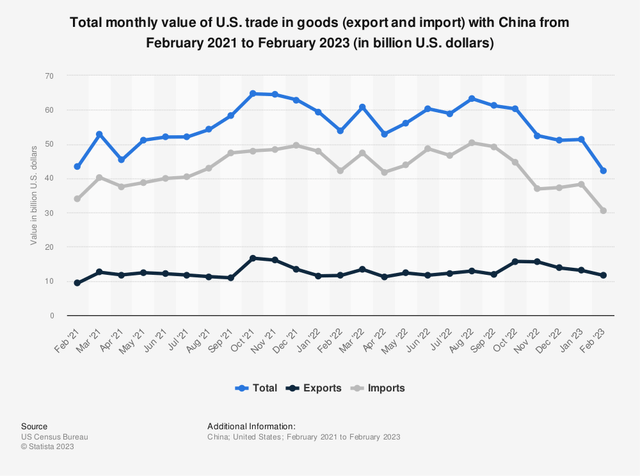

Trends like these have contributed to a slow erosion of China’s coveted trade relationship with the U.S., as highlighted below.

U.S. Census Bureau

The data above highlights how the U.S.-China trade relationship has been shrinking since the onset of the trade war in 2018.

China’s spiraling economy and the property crisis

The trade war has created negative outcomes for both countries, but the overall impact has arguably been worse for the Chinese economy, which is now growing at its slowest rate since the early 1990s.

In contrast, growth in the U.S. economy has been relatively resilient in recent quarters, despite the significant headwinds presented by elevated interest rates.

Considering that position of relative strength, the U.S. government hasn’t been inclined to make the concessions necessary to resolve the trade war. Instead, the U.S. appears to be trying to press its advantage in an attempt to finally win some concessions from China.

In a July 17 appearance on Bloomberg Television, Treasury Secretary Janet Yellen said China had failed to address the unfair trade practices which originally triggered the trade war, and that the U.S. wouldn’t be willing to remove the tariffs until those concerns were addressed with meaningful reforms.

Taken all together, the news out of China hasn’t been favorable, and could get marginally worse going forward.

The Chinese yuan is down 15% against the dollar, FDI into China has fallen off a cliff, and China’s share of overall imports into the U.S. has dropped to a 20-year low.

As if all that wasn’t enough, one of China’s largest property developers, Country Garden, failed to make the required interest payments on some of its dollar-denominated bonds in early August, and as a result, is currently teetering on the brink of default.

Country Garden’s downfall is especially concerning because one of China’s other large property developers, Evergrande officially filed for bankruptcy on Aug. 17. And according to the credit ratings agency Standard & Poor’s, more than 50 Chinese property developers have defaulted or failed to make debt payments in the last three years.

As a result, the problems in China’s real estate market are starting to look systemic, as opposed to being isolated within a small group of companies/regions.

As highlighted by Larry Hu, the Chief Economist on the Chinese economy at Macquarie, any further deterioration in the Chinese economy could create a ripple effect. Hu recently told the New York Times, “The slowdown in China is definitely going to weigh on the global economic outlook. Because China is now the No. 1 commodity consumer in the world, the impact is going to be pretty big.”

For the aforementioned reasons, investors and traders may want to monitor the health of the Chinese economy closely going forward, because any further erosion of financial conditions in China could ultimately spill over into the global financial markets.

To track and trade the Chinese financial markets, readers can add the following China-focused country ETFs to their watch lists:

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR).

- KraneShares CSI China Internet ETF (KWEB).

- iShares MSCI China ETF (MCHI).

- iShares China Large-Cap ETF (FXI).

- SPDR S&P China ETF (GXC).

- Invesco China Technology ETF (CQQQ).

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE).

- KraneShares Bosera MSCI China A Share ETF (KBA).

- Global X MSCI China Consumer Discretionary ETF (CHIQ).

- iShares MSCI China A ETF (CNYA).

To learn more about trading country ETFs like those listed above, check out this installment of Options Jive on the tastylive financial network. To follow everything moving the markets on a daily basis, tune into tastylive: A Financial Network for Options & Futures Trading-weekdays from 7 a.m. to 4 p.m. CDT.

This article is courtesy of Luckbox magazine.

Read the full article here