Receive free Country Garden Holdings Co Ltd updates

We’ll send you a myFT Daily Digest email rounding up the latest Country Garden Holdings Co Ltd news every morning.

Chinese property developer Country Garden made payments on two dollar bonds within their grace periods on Tuesday, ending a month-long saga that had become the focal point of global investors’ concerns about China’s struggling property sector.

The company’s Hong Kong-listed stock pulled back from a drop of almost 5 per cent to 3 per cent in late-morning trading, following local media reports that it had made the late coupon payments totalling $22.5mn on two $500mn international bonds.

A person close to the company and a bondholder told the Financial Times that Country Garden had made the payments, for which it had missed an initial deadline in early August. Country Garden declined to comment.

The payments mean the cash-strapped developer has narrowly avoided a technical default, but traders said this would not change the narrative of widespread and worsening financial strain in China’s vast and economically important real estate sector.

Last month’s missed payments by Country Garden stoked concerns over a company that had once been viewed as one of the safest and financially healthiest developers in China. Despite a recent rally, its shares are down more than 60 per cent year to date.

The developer has scrambled in recent weeks to fend off default on both the dollar bond payments and obligations to domestic creditors.

On Friday, it obtained approval from creditors to extend the payment deadline for a nearly Rmb4bn ($550mn) bond that had been set to mature on Saturday, allowing the developer to repay the debt in a series of instalments over the course of three years. It may start negotiations with bondholders on publicly traded bonds for a similar extension, one holder of a Country Garden public bond said.

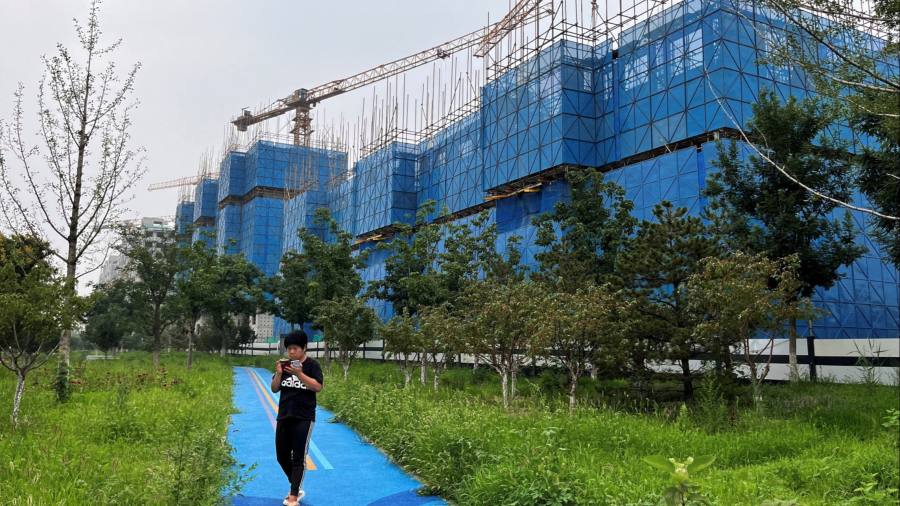

The close call on the coupon payments for Country Garden comes as Beijing seeks to manage the decline of China’s real estate industry, which typically accounts for about a quarter of annual economic activity.

The pace of easing of mortgage rules by Chinese authorities has picked up this month, after years of cracking down on excess leverage in the sector. Major cities, including Beijing and Shanghai, lowered minimum mortgage interest rates for first-time homebuyers last week.

However, there is little sign that the liquidity crisis in China’s real estate industry is meaningfully improving. And so far, policymakers in Beijing have remained reluctant to engage in large-scale easing that many analysts believe is necessary to put a floor beneath falling home sales.

Developers still face $38bn in dollar and renminbi bond payments before the end of this year and Country Garden alone had liabilities of about Rmb1.36tn as of the end of June.

Read the full article here