Healthcare stocks have generally not performed well this year, as the healthcare sector topped out in December 2022. The Health Care Select Sector SPDR Fund ETF (XLV) has also struggled for momentum, even as it recovered from its March 2023 lows.

Leading healthcare services company The Cigna Group (NYSE:CI) has been battered since it topped out in December. However, CI and its managed care peers were hit by fears over their ability to overcome increased near-term cost concerns on Medicare procedures.

UnitedHealth (UNH) stock led a steep selloff in mid-June, but it has recovered some of its losses as buyers defended the pullback. CI has continued to rally through this week, suggesting investors are likely less concerned over its near-term impact.

Moreover, management is confident in its cost management efforts discussed in its Q1’23 earnings call in early May. In addition, the company also highlighted its optimism on the macroeconomic conditions, as it didn’t glean “signs of economic pressure in its book.”

As such, market operators are likely satisfied with the company’s ability to leverage its leading position as one of the leading pharmacy benefit managers or PBMs, and as a “top-tier health insurer in the US.” As such, Cigna is expected to continue leveraging its robust business model to deliver predictable growth in its adjusted EPS.

Keen investors should recall that management maintained its confidence to sustain its long-term “10% to 13% compounded EPS growth over the strategic horizon, along with providing an attractive dividend.” With the market now focused on the AI hype train and ignoring leading healthcare plays like CI, I believe it’s time for healthcare investors to pay attention.

Regulatory risks on improving affordability further for end consumers have always been a bugbear for highly regulated companies like Cigna. That hasn’t changed and remains the most significant risk investors should consider.

Despite that, the company also reminded investors that it has robust “contractual frameworks that consider unanticipated immediate legislative or regulatory changes.” Management added that such immediate changes are “unlikely,” giving investors clarity on its profitability margins.

As such, I don’t expect Cigna to adjust its long-term EPS growth outlook, which should provide solid reasons for investors to consider CI an attractive opportunity.

CI last traded at a forward adjusted P/E of 10.2x, slightly below the one standard deviation zone under its 10Y average. In other words, CI’s valuation is attractive. However, it’s also important to note that CI topped out in December at the 14x PE mark, which I wouldn’t consider an aggressive valuation. The Healthcare sector trades at a P/E of about 17x currently, corroborating my assessment.

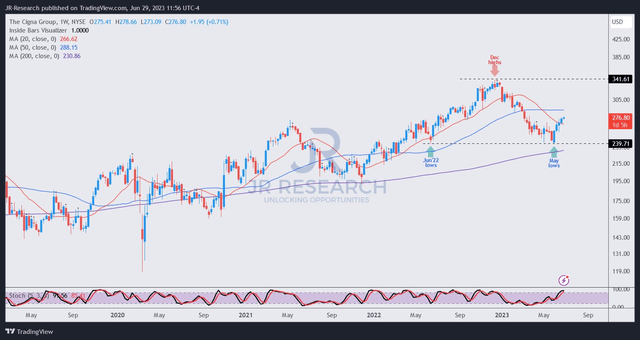

However, with long-term regulatory concerns as a critical headwind, I assessed that a significant discount against the sector’s valuation is justified and should be reflected accordingly. Despite that, my analysis suggests that CI seems to have bottomed out convincingly in May and is likely in a nascent reversal from a downtrend to an uptrend.

CI price chart (weekly) (TradingView)

As seen above, CI formed its lows in May and has continued to recover. However, after a strong rally through this week, I expect a pullback. Despite that, I do not anticipate CI returning to those levels, suggesting that it should regain composure to retake its 50-week moving average or MA (blue line) subsequently.

CI’s underperformance against its healthcare peers represented in the XLV looks primed to narrow, corroborating its recent outperformance against its managed care peers.

Investors who picked CI’s lows in May need not rush to add more exposure. However, if a pullback occurred, I would be an aggressive buyer to average down my costs further.

Rating: Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here