I upgraded my thesis on The Coca-Cola Company (NYSE:KO) stock in mid-September 2023, assessing it was reasonable to be more constructive after it fell from its April 2023 highs. However, I also cautioned investors that I hadn’t evaluated a robust bottoming opportunity yet, suggesting investors “must be prepared to average down” if they decided to add KO.

As a result, KO’s further decline toward its October 2022 lows wasn’t entirely surprising, although I didn’t expect the market to hammer KO so aggressively. However, the good news is that KO bottomed out resoundingly at the $51 level after taking out its October 2022 lows, compelling a round-trip. In other words, dip buyers returned aggressively to defend KO from a further slide, as they likely assessed a solid buying opportunity. With KO recovering 18% through this week’s highs, I believe determining whether the risk/reward is still attractive at the current levels to buy more shares is timely.

Seasoned KO investors know that Coca-Cola’s long-term bullish thesis is simple. It’s a defensive consumer staples (XLP) play that has proved its resilience in high inflationary environments and challenging macroeconomic conditions. Coca-Cola has demonstrated its solid investment thesis by registering a 5Y GAAP ROIC CAGR of 11.39%, justifying its wide-moat business model. Seeking Alpha Quant’s best-in-class “A+” profitability grade lends credence to its robust fundamentals as the market leader in the beverages space.

Coca-Cola’s third-quarter or FQ3 earnings release highlighted the company’s ability to leverage its volume and pricing levers to bolster its topline growth as it raised its guidance. In addition, Coca-Cola has continued to explore new growth vectors as it looks to scale in the ready-to-drink alcoholic beverages category. However, management underscored that these developments are still in the “nascent stages,” urging investors on the “need for impatient patience due to the time required to build scale in new categories.”

Despite that, Coca-Cola is confident that its overall strategy is positioned to help the company achieve its long-term organic sales growth of 4% to 6%. It continues to execute its revenue growth management strategies, improving its efficiencies in generating topline growth. In addition, the company has also delved deeper into its market segmentation, as it is “increasingly precise in understanding consumer segments.” Coupled with its world-class branding and massive scale advantages, Coca-Cola has demonstrated its long-term resilience to thrive in different economic cycles. In addition, the company has strengthened its partnership with its bottling partners, leveraging KO’s pricing and branding advantages in global markets. Accordingly, “Coca-Cola’s incidence-based pricing model aligns its economic interests with its bottlers.”

CFO John Murphy encapsulates the strength of Coca-Cola’s relationship with its partners, highlighting the company’s move toward “harmonization” with its bottlers. As a result, the shared mission to outperform leading competitors has gained traction, allowing KO and its partners to embrace “investment ahead of the curve and comfortable risk-taking.” In addition, it also plays a vital role in Coca-Cola’s “flywheel” approach, as it tackles the various challenges in different markets. As a result, it improves the company’s responses to a more “complex portfolio.” It is also expected to bolster Coca-Cola’s innovation capabilities, providing a firm “foundation for an expansive growth mindset and experimentation.”

With that in mind, I’m confident about the market continuing to support KO’s growth strategy, which could undergird the continuation of its long-term uptrend bias. Notwithstanding the recent surge from its October lows, as KO hit peak pessimism, I assessed KO has not been fully re-valued.

Accordingly, KO last traded at a forward EBITDA multiple of 18.9x, slightly below its 10Y average of 19.2x. However, its bottom line growth is expected to remain robust through FY25, leading to an implied FY25 EBITDA multiple of 17.4x. Therefore, I believe the market is still cagey about the execution risks within the CPG category, as investors worry about the long-term impact of the weight loss (GLP-1 linked) drugs. While caution is justified, I’ve confidence in Coca-Cola’s market leadership in circumventing these headwinds, repositioning its portfolio for long-term success ahead of its peers.

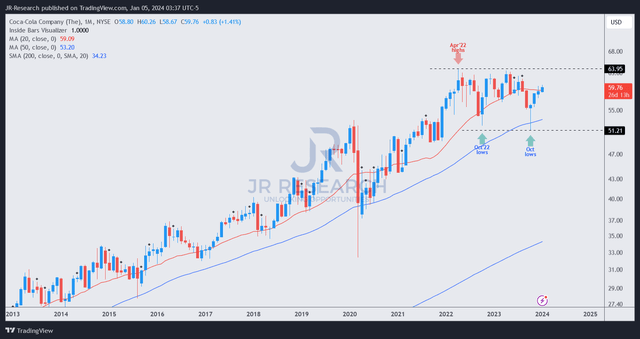

KO price chart (monthly, long-term) (TradingView)

KO’s long-term uptrend remains undefeated, supporting my confidence. Its recent capitulation in October 2023 was an astute move to shake out weak holders, as it fell to a 52-week low. I assessed robust dip-buying support as investors assessed KO’s unjustified hammering, providing the impetus for a recovery over the past four months.

While KO’s long-term resistance level of $64 since April 2022 is expected to remain in play, I view the recent bear trap (false downside breakdown) in October 2023 as a signal suggesting the continuation of KO’s long-term uptrend. In other words, we should anticipate a higher-high price structure taking out the $64 level subsequently, supported by a relatively attractive valuation.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here