Investment Thesis

With the FY22 results out, I wanted to take a look at how Cognizant (NASDAQ:CTSH) may perform in the future, given the rapid digitization efforts of many companies in most sectors. I will look into the IT sector outlook briefly, which will give me a guide to how well the company can perform in the future. With the current negative sentiment all around the economy and conservative estimates, my DCF model suggests the company is valued fairly and I will assign CTSH stock a Hold rating for now, until the economic headwinds clear up a little more, as I believe the volatility will present a better entry point for anyone interested in the company.

Briefly on FY22 Results

Total revenue was up 5% y-o-y, and gross and net margins saw a slight contraction of around 100bps which suggests the headwinds have begun to affect the company’s efficiency and profitability. Overall, it looks like the company had a decent year, not too impressive and not that bad, considering the year we’ve had. The weakest segment was financial services which has been penetrated the most by digitization for quite a while now and the best performing segment was Communications, Media, and Technology, which was the only one to see low double-digit revenue increases y-o-y.

IT Services Industry Outlook

By looking at the average projected growth in the industry, I will be able to come up with some reasonable estimates for what the company will be able to do in the future. The industry is still growing quite decently. I’ve been seeing for some time now while listening to earnings calls from many different companies that may not necessarily be tech companies but are starting to embrace digitization in the workplace to enhance operations and improve efficiency, which in turn improves margins and profitability. Digitization is, in my opinion, the best way any company can achieve better operational efficiency and many companies that embraced technology have seen vast improvements.

I am sure that ever since the pandemic panic, many companies opted to accelerate their digital transformation, and companies like CTSH will continue to see the benefits of companies trying to adapt to a hybrid-working environment, which means getting involved with the cloud infrastructures, upgrading their outdated applications to something that is more user friendly and streamlined. Many workplaces these days, especially in financial services, only require a stable internet connection and a laptop. Ever since the pandemic hit in 2020, my former employer hasn’t forced anyone to go back to the office and the colleagues that I keep in touch with said they haven’t seen the inside of an office in 3 years, cutting their commute completely.

A new avenue that the company will be able to take advantage of right now, which is the hot buzzword of this year already, is AI. A lot of industries are starting to look into practical uses of AI that can improve their operations in a way that a human wouldn’t be able to. If the company can attract bright, new talent that has expertise in AI, CTSH will have an extra revenue stream when they develop their own AI service. The new CEO has mentioned in the earnings transcript that he is seeing a “strong push now to bring AI into the business landscape” and that “AI will reengineer enterprises as completely as enterprise software did three decades ago”. These are strong words from the boss, and I tend to believe him there also.

The IT services industry is projected to grow at 6.86%, which may not seem very high, but by the end of ’27, the industry will reach $1.6T. That is quite a big number and for an industry to still grow at that rate is remarkable in my opinion.

In general, I think digitization will continue to chug along at such a rate for quite a while, and with more and more different technological advancements coming out now and then, there will always be the demand for companies like CTSH to help them navigate a complex digitization environment. As long as the company can attract the top talent, it will do well.

Financials

The company finished FY22 with $2.2B in cash and $310m in short-term investments, while long-term debt stood at $638m. The debt is not an issue at all, as the company produces a very high EBIT and very consistent high cash flow from operations. Furthermore, short-term investments seem to offset the interest on the debt. The company would be fine in taking on more debt to fund organic or inorganic growth in the future, although, with over $2B in cash, it may not need to do it at all.

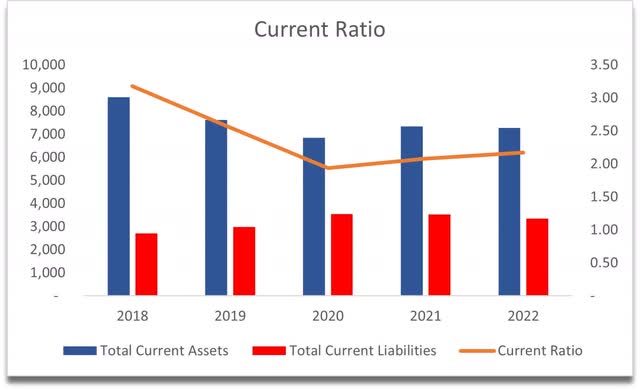

Speaking of liquidity, the company’s current ratio is very good. It is well above the very bare minimum of 1.0, sitting at a little over 2, which means that the company is able to cover its short-term obligations twice over, and that is a very good position to be in.

Current Ratio (Own Calculations)

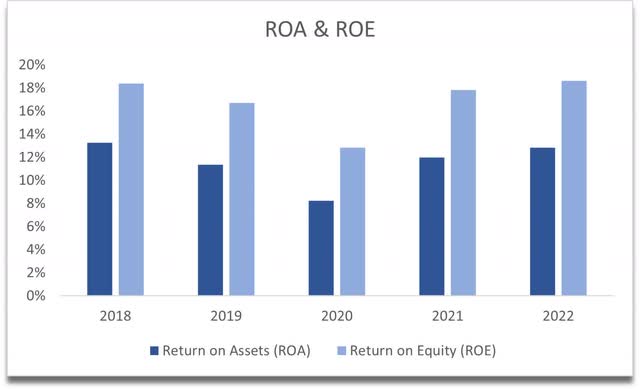

Going down to efficiency and profitability ratios, the company is very solid here also. The company can achieve quite good returns on assets and equity, meaning the management is able to deploy the assets and the shareholders’ money very efficiently and that turns into great returns overall.

ROA and ROE (Own Calculations)

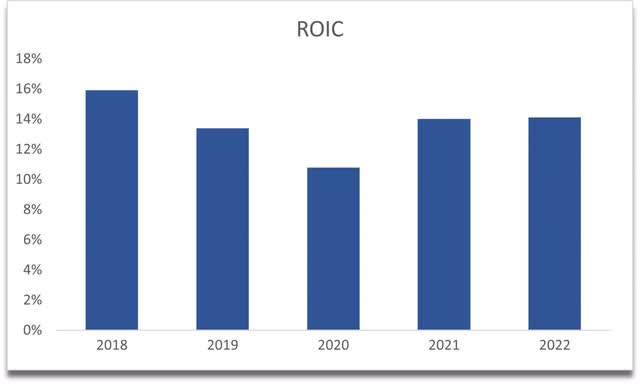

Return on invested capital is also quite decent. Anything over 10% I consider to be pretty good. The company is able to put the capital available into high NPV projects that bring in more than invested initially. This also suggests that the company has a competitive advantage and a good moat. Furthermore, the company has been on an uptrend since the pandemic panic, which is also a positive.

ROIC (Own Calculations)

The company seems to be in a good position financially. Even during ‘20, the company experienced only a slight drop in the above metrics that recovered swiftly the year after. I don’t see anything that would stick out to me as a red flag at all. I know some people don’t like debt; however, debt can be used for many things that can generate really good value if used correctly. I believe the company will have no issues during the economic downturn that we are going to experience in the next 12-24 months.

Valuation

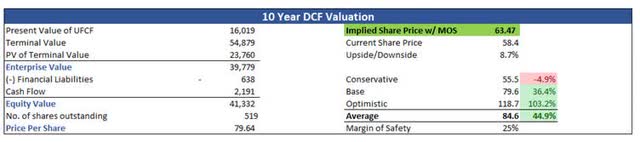

I decided to go with slight declines in revenues and gross margins in ’23 to account for the economic headwinds that we may experience, which in the short run may decrease efficiency and profitability. -5% in revenues and 100bps contraction in gross margins. In ’24, the company will see a slight bounce in revenues of around 8% and return to the margins it saw at the end of FY22. The revenue growth will linearly decline to 5% by ’32. This will give my base case scenario a 5.4% average growth over the next decade. For the optimistic case, I went with a 7.4% average over the decade, while in the conservative case, I went with 3.4%.

These are, in my opinion, slightly on the conservative side of growth, as the sector is projected to grow at around 140bps more than my base case, which is fine with me because I do tend to fall on the conservative side just to be safe.

I left margins relatively the same over the next decade, although I’m sure the management will be able to achieve higher profitability and efficiency over time due to technological advancements.

On top of these conservative assumptions, I’ll add a 25% margin of safety to be even more on the safer side. 25% is the minimum I add, and it only increases if the balance sheet of the company I analyze isn’t very good. In the case of CTSH, it is pretty good in my opinion.

With that said, the intrinsic value of Cognizant with conservative assumptions is $63.47 a share, which implies an 8.7% upside from current valuations.

10-Year DCF Valuation (Own Calculations)

Closing Comments and the Takeaway

In my opinion, the 8.7% upside is hardly an upside. Seems to me that the company is fairly valued right now if you believe the assumptions I presented are reasonable, and if the margin of safety I gave is big enough. I only give a hold rating for the company because of the overall sentiment of the global economies, and the fact that we are about to go into a mild recession, which will bring in further volatility to every stock. This, with time, will present a more attractive opportunity to invest in a company that seems to be going quite steadily.

There is one issue I have with how the stock has been performing. It’s been underperforming SPY and QQQ by a long mile in the last 10 years. Since ’98 however, the company has returned 25,000% which is quite impressive. I’m a little worried that the company might continue to underperform against a diversified investment like SPY in the future.

The new CEO might be able to inject new growth going forward as he does sound quite excited to take over and try new things which may revitalize this company going forward, however, we will have to wait a while longer until we see some results from him.

Read the full article here