The AI Story Might Need Some Sobriety

In the current hype phase surrounding the potential beginning of an AI revolution, Nvidia (NVDA) clearly stands out as the most prominent example, often described as the “shovel seller in the gold rush.” However, in such a gold rush, everyone suddenly wants to find someone who also sells shovel handles, and Coherent is being touted in some circles as a “hidden gem” in this regard.

Allow me to clarify right from the start – I am not a technical expert in the fields where Coherent operates. Instead, I evaluate what the recently reported fiscal Q4 2024 numbers reveal, what the management says, and whether all of this truly indicates a hidden beneficiary.

My conclusion will be that while Coherent appears to be benefiting, from what we see today it is not a hot AI stock or a hidden gem. Those interested in the company should analyze it in its entirety rather than getting caught up in the AI hype.

I also analyzed Nvidia two months ago from a non-tech-expert perspective, focusing on valuation and market expectations. Nvidia is fundamentally in an entirely different league than Coherent, and in part, its hype is justified. However, my call for an overdue double-digit correction turned out to be correct, with an interim 19% correction from the time of publication and 27% from the top to the correction low. I initiated a small position below $100, approximately as my transparently laid-out strategy in the article indicated.

Q4 and Outlook Figures Deep Dive

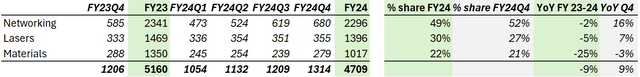

Q4 2024 revenue came in at $1.31 billion, surpassing consensus estimates of $1.28 billion and even exceeding the upper end of the range, which was set at $1.3 billion. This brings FY-24 revenue to $4.71 billion, a decline of 9% from the previous year’s revenue of $5.16 billion. However, Q4-24 revenue grew by 9% year-over-year, primarily driven by mid-teens growth in the company’s largest segment, Networking, which is becoming increasingly important.

Author | Data: COHR Q4-24 Earnings, dividendstocks.cash

While the company’s technologies are used for laser welding of EV batteries, advanced medical devices, and UV lasers for mobile and high-end TV displays, among other applications, the core area of investor interest is currently the Communications market. This segment is expected to benefit from the expansion of cloud computing, AI, and machine learning, with its datacom transceivers that must handle increasingly higher data throughput rates.

See below that, with 52%, Communications was the most significant market recently and also the one growing double digits year-over-year, driven by double-digit increases primarily in North America and China.

Author | Data: COHR Q4-24 Earnings

“Networking,” “Communications,” “datacom transceivers” – the areas with the highest observable growth rates so far. So, we can see where this is heading. Overall, the company sees itself within a $64 billion total addressable market, which implies it holds 7% as per FY-24 revenues. Within that market, Communications is estimated to be the largest one, with a $23 billion market size and an expected CAGR of 14% through 2028, with COHR holding a 10% market share based on FY-24 revenues.

I applied the company’s researched market CAGRs of each market to the respective market revenues of the company and arrived at a 12% weighted total company revenue CAGR through 2028 using these assumptions. This also implicitly assumes maintaining its market position. One can compare the resulting $5.9 billion in revenue for 2026, for example, with analysts’ estimates, which are in approximately the same range, around $6 billion. More about analysts’ forecasts in a second.

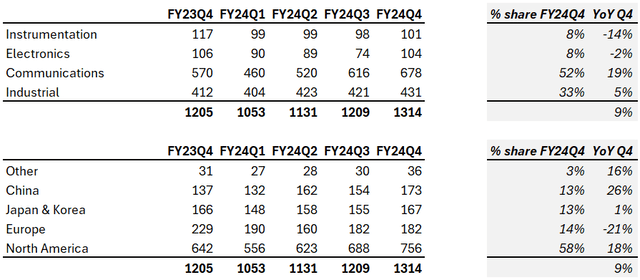

See below the AI story that investors seem to be mainly focusing on. The demand for datacom transceivers overall is expected to double over the next five years, driven by increasingly powerful 800G, then 1.6T, which the company expects to ramp next year and has already delivered samples of, and eventually emerging 3.2T transceivers.

COHR Q4-24 Earnings

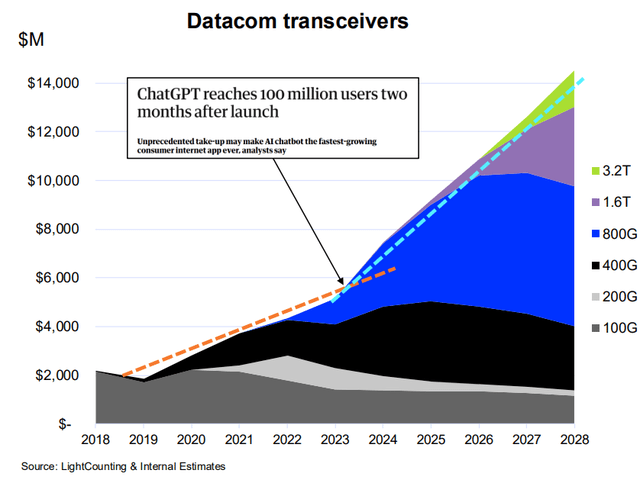

Coherent, however, is not solely defined by this allegedly rapidly growing group of products, which is why overall revenue is only expected to grow in the low mid-teens, as previously derived. Below is a summary of the latest actuals and estimates per quarter. I’ve again highlighted last quarter’s beat, but the outlook for the next quarter didn’t significantly differ from existing estimates. This does not appear to be a skyrocketing AI story comparable to Nvidia’s.

Author | Data: Seeking Alpha, COHR Q4-24 Earnings

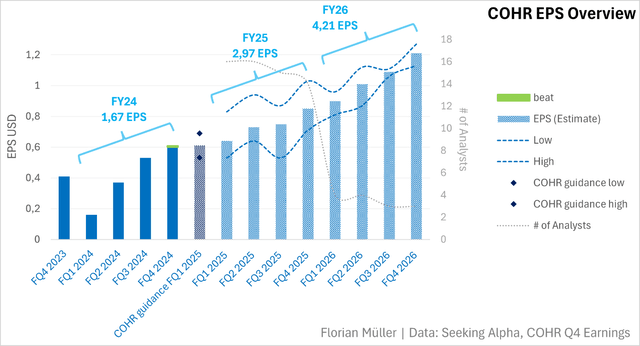

Next, I have prepared a similar overview for EPS, which exceeded expectations slightly at $0.61 in Q4-24. The new outlook for the next quarter, Q1-25, has even slipped slightly below previous expectations. For the full year, EPS for 2024 has declined by about -45%, which also puts future growth rates into a somewhat sobering perspective. Additionally, it’s important to note that we are referring to Coherent’s own Non-GAAP EPS, which adjusts for share-based compensation, amortization of acquired intangibles, and integration and restructuring costs.

Author | Data: Seeking Alpha, COHR Q4-24 Earnings

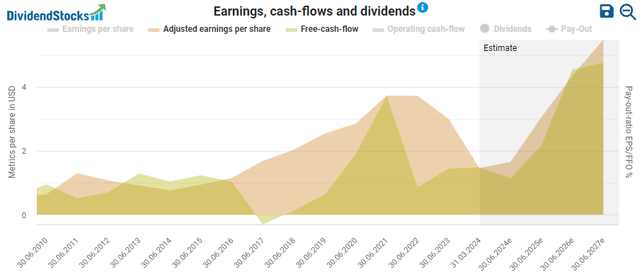

That is why I find it particularly critical and insightful to compare these adjusted EPS figures with the free cash flow (FCF) per share. I will use this comparison to ultimately attempt a simplified valuation of Coherent based on the FCF.

dividendstocks.cash

Earnings Call And Margins

While revenue is estimated to grow in the low teens, EPS is expected to increase by around 80% and 40% over the next two years, partly due to favorable comparisons as mentioned earlier. Furthermore, new transceiver models are generally more profitable than older ones, as the latter become increasingly commoditized. Another positive factor is the CEO’s proactive focus on expanding gross margins. According to CEO Jim Anderson, the company’s “sustainable gross margin” should exceed 40%, though recent figures were at 37%, with similar expectations for the next quarter, partly due to underperformance in some business areas. However, Anderson notes that improving gross margins takes time. The company plans to host an Investor Day in the upcoming quarters to outline its strategy, business model targets, and focus on gross margins.

About strategically overthinking some make-or-buy decisions, Anderson said,

“(…) there’s a number of places where we’re vertically integrated. And we build, for instance, not just the datacom transceiver but we build a number of the components that go into that transceiver. And to the extent that, that provides us differentiation or faster time to market or generates real value for our customers, that’s fantastic and we will continue to do that. But what I want to make sure that we’re careful about is not just building it internally for the sake of building it internally (…)”

Valuation

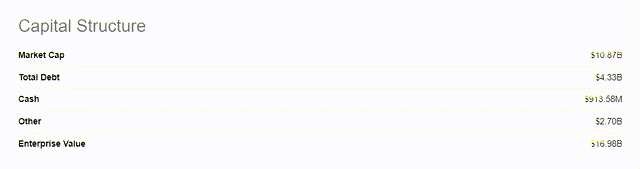

Coherent has been a particularly volatile stock, exhibiting significantly elevated 24M and 60M Beta Factors according to Seeking Alpha. After averaging these Betas and applying the lowering blume adjustment, I arrive at a beta of 1.8, which drives the cost of equity up to around 13%. The WACC is lower at 11%, as the company’s cheaper debt load plays a significant role.

I rely on FCF forecasts from DividendStocks for 2025 and 2026, which closely align with Seeking Alpha’s EPS consensus estimates. For 2027 and 2028, I apply the previously calculated 12% market growth rate at the company level, assuming that margin expansion will be fully realized by then. In the Terminal Value calculation, I use a Free Cash Flow conversion of less than 100% of the adjusted EPS. This reflects historical observations and the need for long-term growth CAPEX, while FCF in the forecasting period from 2025 to 2028 is fairly close to the adjusted EPS. Additionally, I apply a generous terminal growth rate of 7%.

This results in an enterprise value of $13.9 billion. From this, I deduct net debt of $3.377 billion, preferred convertible stock of $2.365 billion, and minority interest of $0.371 billion to arrive at an equity value of $7.8 billion, compared to a market cap of $10.9 billion. While this valuation doesn’t scream “run,” I will refrain from buying and consider Coherent an expensive and speculative company, whose growth trajectory requires strong belief to justify investment.

Seeking Alpha

Takeaway

At the end of the day, Coherent certainly benefits from the increasing performance demands driven by AI and cloud services with its datacom transceivers. Growth in this area is also significantly in the double digits, and newer generations are expected to be more profitable than the older, less powerful models, leading to disproportionate profit growth. Market share gains, of which there are still plenty, would certainly have a surprisingly positive and accelerating effect. However, beyond that, the growth of the datacom transceiver segment somewhat blends into the overall company performance, mixed with other underperforming business areas. Additionally, much of this Coherent Corp. growth seems already priced in. I will pass for now and continue to monitor the numbers closely.

Read the full article here