Investment Thesis

Coherent Corp. (NYSE:COHR) is a supplier of optical communication modules. It delivered investors a negative surprise in its fiscal Q4 2023 results. Investors were quick to latch on to its unimpressive and unappetizing guidance for fiscal 2024 (the year ahead).

As investors headed into this earnings report, hope percolated that the Artificial Intelligence and Machine Learning (AI/ML) secular growth story, part of its Networking segment, would be strong enough to deliver Coherent with a better-than-expected outlook for fiscal 2024.

However, not only did Coherent’s guidance leave investors unenthused, but its bottom-line profitability appears to be moving rapidly in the wrong direction.

In sum, it’s difficult to remain bullish given this setup.

Coherent’s Near-Term Prospects

Coherent specializes in photonics and laser technology, providing solutions for various applications, including industrial manufacturing. Photonics refers to the science and technology of generating, detecting, and manipulating light.

Coherent’s products play a crucial role in advancing technology across industries that require precise and powerful light-based tools.

Coherent produces lasers that emit intense and focused beams of coherent light with unique properties, enabling applications such as materials processing. Coherent’s lasers find applications in semiconductor wafer inspection and various industrial processes, playing a role in advancing technology across multiple sectors.

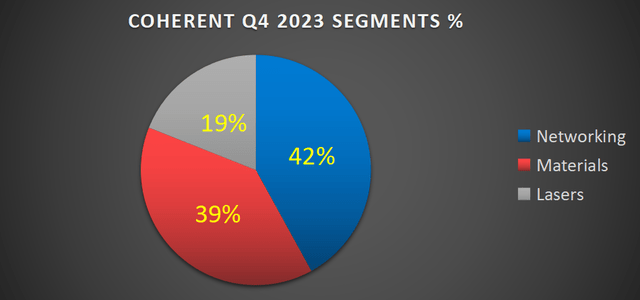

Author’s work, COHR

As you can see above, Coherent’s biggest segment, its Network segment accounts for just under half of the full business. Meaning that, even if the AI/ML story is still intact, it isn’t enough to increase Coherent’s total revenues.

And that’s what we’ll discuss next.

Revenue Growth Rates Turn Negative

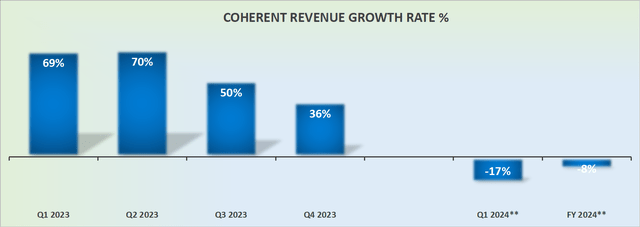

COHR revenue growth rates

Coherent’s revenue growth rates for the year ahead don’t leave a lot of room for optimism. Perhaps, that’s an understatement. Case in point, investors were eyeing up fiscal Q4 2023 and had been expecting to see mid-30% y/y growth rates. The fact that Coherent actually beat against consensus estimates was given absolutely no consideration by investors.

Incidentally, note that Coherent’s pro-forma revenues were actually down 4% y/y.

Nevertheless, all that investors can now see is that the year ahead will be challenging. Consequently, investors are now thinking, Coherent’s fiscal 2023 is probably as good as it’s going to get for a little while.

Furthermore, allow me to remark, it’s not that analysts and investors had been expecting fiscal 2024 to look similar to fiscal 2023. That was never on the cards. Indeed, analysts had Coherent’s revenue growth rates for next year at very low single-digit negative rates already.

Of course, investors were hoping that Coherent would beat those expectations. In actuality, investors would have undoubtedly hoped that perhaps Coherent would guide for a flat year of revenue growth rates.

However, what ultimately transpired wasn’t even close to investors’ expectations, as Coherent guided for about negative 8% y/y revenue growth rates.

For a company that just reported such strong growth rates – albeit negative 4% on a pro-forma basis – for next year to start off at negative double-digit revenue growth rates, well, that was news that wasn’t taken too kindly.

But this isn’t where this story ends.

Profitability Profile Looks Disagreeable

The problem right now is that profitability for fiscal Q1 2024 is pointing to about $0.20 of non-GAAP EPS. Looking back to the same period a year ago, Coherent saw $1.04 of non-GAAP EPS. This has two implications.

The first one, and the most obvious, is that few investors would have been seriously considering that when Coherent guided for its fiscal Q1 2024 that it would be anywhere near $0.20 of non-GAAP EPS.

After all, that would mean that Coherent’s profitability for the quarter ahead would be approximately half the profitability of the quarter just reported, fiscal Q4 2023.

And secondly, and most importantly, these lackluster results guided for fiscal Q1 are expected to remain for the majority of fiscal 2024. Meaning that, looking out to the full year fiscal 2024, Coherent’s non-GAAP EPS is pointing to about $1.50 of non-GAAP EPS.

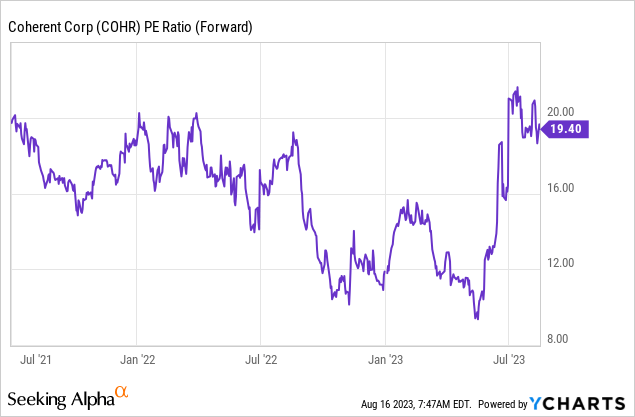

This leaves Coherent priced at about 24x forward non-GAAP EPS. So, how should readers think about this valuation? Allow me to provide some context.

What you see above are the multiples that investors have been willing to pay for Coherent on a forward EPS number. Furthermore, there are two takeaways from the graphic above.

Firstly, as we headed into this earnings period, Coherent’s share price had jumped more than 50% for the most part due to its multiple expanding. This happened as investors caught onto the belief that AI/ML would deliver Coherent with strong prospects for the year ahead.

Secondly, and perhaps more notable, Coherent has not traded at 24x forward non-GAAP EPS at any point in the past 3 years. That’s not to say that it cannot trade at this multiple. It can. But it can’t trade a premium valuation while it’s looking down at a period of shrinking revenues.

The Bottom Line

Coherent disappointed investors with its fiscal Q4 2023 results and unappealing guidance for fiscal 2024. The hope that the Artificial Intelligence and Machine Learning (AI/ML) growth story within its Networking segment would drive a better outlook for the upcoming year was dashed.

Furthermore, the company’s profitability outlook is concerning, with a substantial decline in non-GAAP EPS projected for fiscal Q1 2024 and beyond.

Coherent Corp.’s negative revenue growth rates and deteriorating profitability raise doubts about its valuation, as the stock’s multiple expanded due to optimism around AI/ML prospects, even though it has not historically traded at such premium levels.

Read the full article here