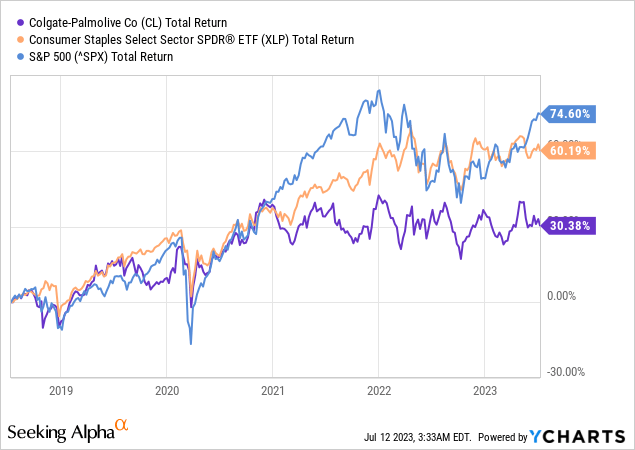

Colgate-Palmolive Company (NYSE:CL) is rarely seen as an attractive investment opportunity as the company significantly underperformed the S&P 500 and the consumer staples sector in particular over the past 5-year period.

Having said that, however, investors should take two major factors into account:

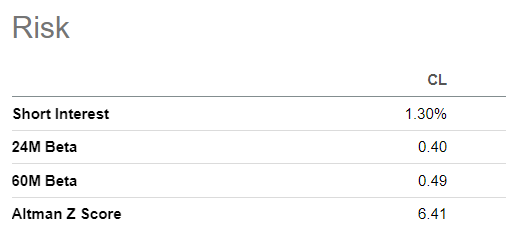

- Firstly, its Colgate-Palmolive’s low beta coefficient which makes recent performance at par with the broader equity market once we adjust for risk;

Seeking Alpha

- Secondly, it’s the strong U.S. Dollar, which bottomed in early 2021 – at the same time that CL begun underperforming the Consumer Staples Select Sector SPDR® Fund ETF (XLP).

The strong dollar has been a major hurdle for Colgate’s share price as most of the company’s products are sold overseas. However, with the greenback falling down recently, this headwind is no longer such an issue.

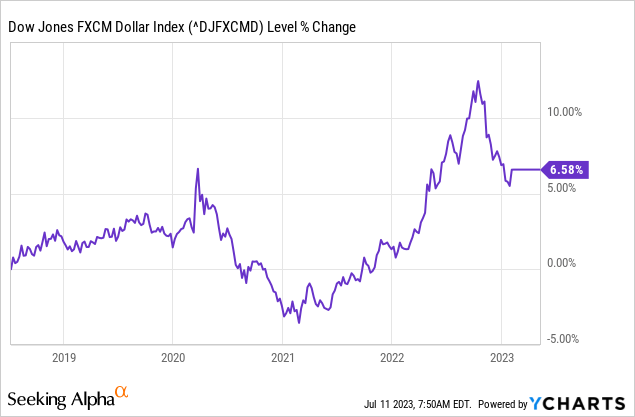

The fall in Colgate’s volumes has also been a source of concern, as recently showed. During the first quarter of 2023, however, this has changed and volume declines are now easing, while pricing remains strong.

Colgate-Palmolive Earnings Release Q1 2023

As a result of all that, prospects for CL now appear more favourable, but the big question mark regarding profitability remains.

The Only Game In Town

Although topline growth is often the metric that excites investors, the only game in town for Colgate-Palmolive is return on capital and more specifically – profitability.

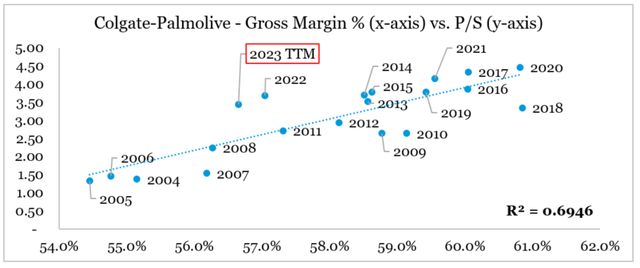

Given that the company’s main competitive advantage is the pricing power of its brands, gross margin is by far the most important profitability metric. On a historical basis, gross margin explains a large proportion of variance in the company’s price-to-sales multiple (see below).

prepared by the author, using data from SEC Filings and Seeking Alpha

As gross profitability fell, however, the current sales multiple seems to be out of balance. This suggests that either investors are expecting that gross margins would improve significantly or CL is headed for a major downward repricing.

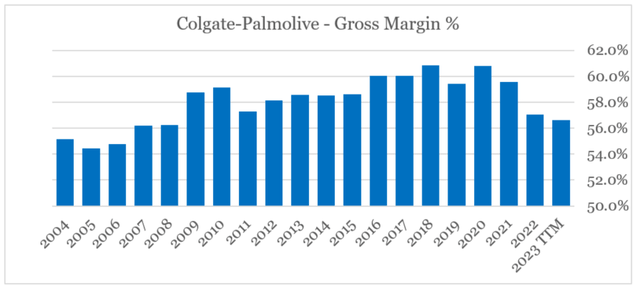

The current drop in profitability is significant and one of the largest ones in more than 20 years. As inflationary pressures intensified, Colgate-Palmolive’s gross margin has now fallen to levels last seen in the 2007-08 period.

prepared by the author, using data from SEC Filings

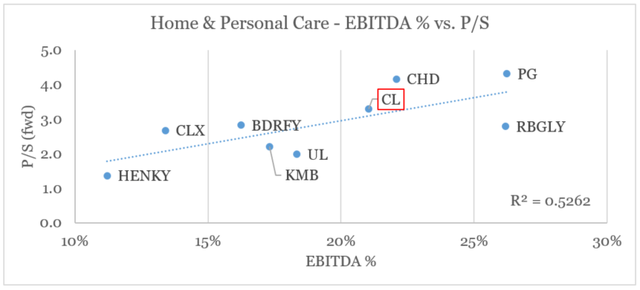

On a cross-sectional basis (against peers), EBITDA margin is the most important metric when trying to explain differences in sales multiples. This is due to the fact that some business models are oriented towards lower margin, but higher turnover products, while at the same time companies differ materially in M&A strategies.

prepared by the author, using data from Seeking Alpha

When EBITDA margins are considered, however, CL appears fairly valued as gross margin improvements are likely to be offset by the higher level of fixed costs going forward.

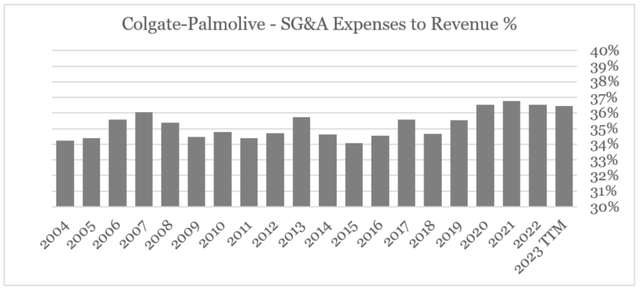

On one hand, market participants are likely expecting selling, general and administrative (SG&A) expenses to remain elevated relative to net sales (see below) and on the other advertising expenses are going to increase due to the high ROI in certain areas.

prepared by the author, using data from SEC Filings

We’re seeing great ROIs on digital and our programmatic and the personalized content that we’re delivering in the market. We’re seeing growth in market shares relative to where we’re spending the money, particularly around the Hill’s business, and our Oral Care and Skin Health businesses. So we’re really pleased with the fact that the advertising levels continue to deliver against the expectations that we have.

Source: Colgate-Palmolive Q1 2023 Earnings Transcript

Changing Dynamics In Gross Profitability

With all that in mind, the currently expected improvements in gross margin would be the key area for investors to focus on.

Colgate-Palmolive Investor Presentation

Not only is gross profitability a key metric for the condition of Colgate-Palmolive’s brands, but gross margin improvements would also be needed to offset the higher level of fixed costs going forward.

Innovation in recent years has positioned Colgate’s brand portfolio very well by securing various premium categories in oral care and having a wide-range of offering across all pricing points.

Colgate-Palmolive Investor Presentation

As a result, both pricing and volumes are now in positive territory in one of the company’s major markets – North America.

Importantly, as we saw in the quarter, our Oral Care business was up double digit, and that’s both positive pricing and positive volume in toothpaste, and we saw good share growth in the first quarter on toothpaste in North America.

Source: Colgate-Palmolive Q1 2023 Earnings Transcript

In pet food, expanding capacity has been a drag on profitability, but this is expected to change. In Red Collar facilities, specifically, the management expects efficiency to continue to improve and higher margin production to slowly make its way through production pipelines.

As we look forward, strategically, margins will improve sequentially as we move through the back half of the year. Plant efficiencies will continue to deliver progress in that regard. (…)

Now through time, that private label will wind down, and that will be over the next couple of years as we slowly wind down that contract and then backfill it with Hill’s volume at Hill’s margin.

Source: Colgate-Palmolive Q1 2023 Earnings Transcript

The large Tonganoxie plant is also progressing well and is now expected to provide a benefit to margins in the coming fiscal year.

So getting that plant up and running will be strategic for the continued growth of that business. That will happen towards the tail end of the third quarter. And we anticipate, obviously, we’ll have some start-up costs associated with that as we move through the transition of that facility. But overall, we should see that benefit us moving into 2024, particularly at the margin line as our wet business is margin accretive to us and will certainly benefit the Hill’s business longer term.

Source: Colgate-Palmolive Q1 2023 Earnings Transcript

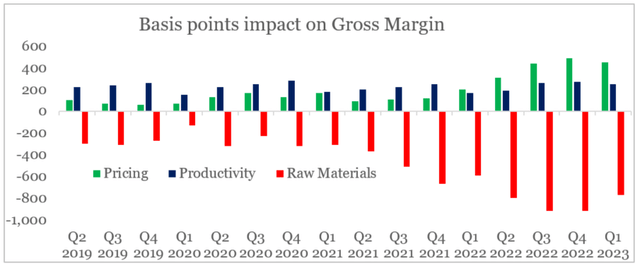

This makes a solid case for Colgate’s gross margin improving going forward as pricing tailwinds would most likely be sustained in the face of a diminishing negative impact of raw materials.

prepared by the author, using data from quarterly reports

As a long-term investor, I remain cautious for the time being as the dynamic between the two forces could change on a quarter-by-quarter basis. Nevertheless, the case for a strong gross margin improvement in the coming months has strengthened.

(…) we’ll see the compounding impact of pricing across many categories as we move into the back half. And I expect a better balance between pricing and volume as we move through the back half (…)

Source: Colgate-Palmolive Q1 2023 Earnings Transcript

Higher advertising costs would put pressure on operating margins in the short-run, but Colgate’s management is using that to capitalize on far more important long-term targets.

The pricing we have taken over the past two years helps provide us with the flexibility to fund increased brand investment to support our pricing, build brand health, and drive volume and household penetration.

Source: Colgate-Palmolive Q1 2023 Earnings Transcript

Conclusion

Colgate-Palmolive’s gross profitability remains in the spotlight as management is fully capitalizing on Colgate’s strong brand portfolio. So far in 2023, volumes are reacting well to recent pricing actions and as inflationary headwinds are dissipating the prospects for margin improvement has strengthened. The company remains very well-positioned to compete, but in the short-term the market would be looking for much better than expected results as margin improvement is already priced-in.

Read the full article here