Concrete Pumping Holdings (NASDAQ:BBCP) offers waste management and concrete pumping services in the U.S. and the United Kingdom. They also lease concrete pumping equipment and containers. BBCP recently announced its Q2 FY23 results. I will analyze its Q2 FY23 results in this report. I think they are on a solid growth trajectory, and the current valuation seems attractive. Hence I assign a buy rating on BBCP.

Financial Analysis

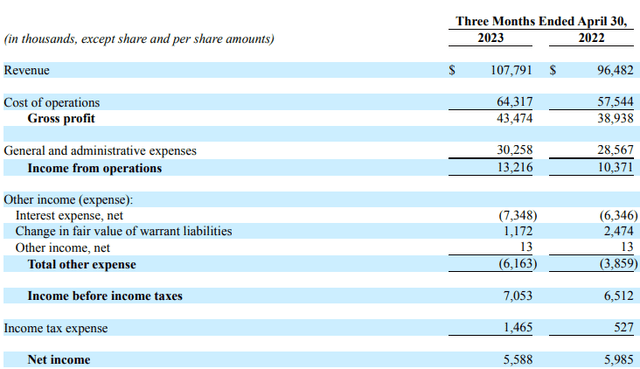

BBCP recently posted its Q2 FY23 results. The revenue for Q2 FY23 was $107.7 million, a rise of 11.7% compared to Q2 FY22. I believe strong growth across all its segments was the main reason behind the revenue increase. The revenues from its U.S. Concrete Pumping segment grew by 9% in Q2 FY23 compared to Q2 FY22. I think the rise was mainly due to contributions from its Coastal Carolina acquisition. The revenues from its U.S. Concrete Waste Management Services grew by 26% in Q2 FY23 compared to Q2 FY22. I believe the increase was mainly due to pricing improvements and strong organic growth. Now talking about the revenues from its U.K. operations, the revenues increased by 13% in Q2 FY23 compared to Q2 FY22. I believe an increase in pricing was the main reason behind the revenue increase from its U.K. operations.

Seeking Alpha

The gross margins for Q2 FY23 were 40.3%, which was 40.4% in Q2 FY22. I think a slight decline in the gross margins was mainly due to higher labor costs and lower equipment utilization due to adverse weather conditions. The net income for Q2 FY23 was $5.5 million, a decline of 6.6% compared to Q2 FY22. I think higher interest and income tax expense was the main reason behind the decline in net income. In my opinion, despite a slight decline in its gross margins and net income, its financial performance in Q2 FY22 was impressive because there were many headwinds that it had to face in the quarter, like above-average rainfalls in several of its markets, which affected its performance. However, they still managed to grow the revenues which is encouraging.

Technical Analysis

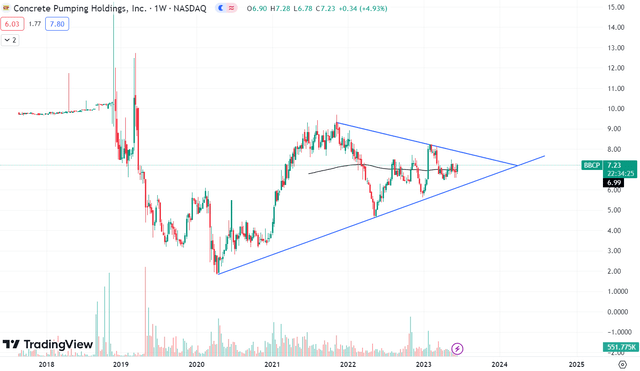

Trading View

BBCP is trading at the $7.2 level. The stock is in an ascending triangle pattern and is currently taking support from its 200 ema, which is at the $7 level. In addition, the stock is making higher lows which indicates bullishness. I think now is the right time to buy the stock because the price is near the lower trendline, which is strong support for the stock. Historically, whenever the stock price has touched the lower trendline, the price has gone up by at least 35%. So several positive indicators convince me to give it a buy rating based on its technical chart, like the higher lows made by the stock and the support of 200 ema and trendline.

Should One Invest In BBCP?

First, talking about its valuation. I will use EV / EBITDA and Price / Sales ratios to judge the company’s valuation. One can calculate EV / EBITDA ratio by dividing a firm’s enterprise value by the EBITDA, and the Price / Sales ratio can be calculated by dividing a company’s market capitalization by its annual revenue. BBCP has an EV / EBITDA [FWD] ratio of 6.83x compared to the sector ratio of 10.95x and has a Price / Sales [FWD] ratio of 0.91x compared to the sector ratio of 1.35x. After looking at both financial metrics, I believe BBCP is undervalued and has a lot of room for growth.

BBCP has constantly been performing well financially, and the Q2 FY23 was its seventh consecutive quarter with double-digit revenue growth; the growth came in when the market conditions were not favorable for its business, and the infrastructure market was facing headwinds like high-interest rates. So its growth becomes even more impressive, and it shows the efficiency of the management. Additionally, its revenues in the first two quarters are often smaller, so as we get into the second half, the revenue is typically larger than it was in the first two quarters and talking about the peak construction season in the U.S., it is usually around the month of May to September. So the company is entering the busiest period, which might be a tailwind for them regarding revenue growth. In addition, the management has provided revenue guidance for FY23 to be around $435 million, which is 8% higher than FY22 revenues which is an optimistic sign, and looking at the tailwinds; I think they might achieve the revenue targets.

Hence looking at its solid growth trajectory, attractive valuation, and positive price action, I assign a buy rating on BBCP.

Risk

Brexit is the term for the United Kingdom’s withdrawal from the European Union (“E.U.”) on January 31, 2020. The U.K. and E.U. signed a deal on December 24, 2020, outlining the terms for their future coexistence in terms of commerce, employment, and living arrangements. The transition ended on December 31, 2020, and the U.K. left the E.U.’s single market and customs union. Although the vast majority of the work carried out by its U.K. Operations segment is still done domestically in the U.K., the effects and perceptions of the impact of the U.K.’s withdrawal from the E.U. continue to have the potential to negatively affect business activity and economic and market conditions in the U.K., the Eurozone, and globally. They may also contribute to instability in global financial and foreign exchange markets, including fluctuating euro prices and the pound sterling. As previously stated, due to adjustments and limitations surrounding the free movement of people into the U.K. from the E.U., Brexit may continue to result in further political, legal, and economic upheaval in the E.U. or labor shortages. Any of these Brexit-related repercussions, as well as unanticipated ones, could have a negative impact on the value of their UK-based assets, their business, financial situation, operating results, and cash flows.

Bottom Line

BBCP has been performing consistently in tough market conditions, and the management’s guidance suggests that they expect its revenue to grow in the coming quarters. Hence I believe positive financial results in the coming times might increase its share price. In addition, its valuation seems attractive. Hence I assign a buy rating on BBCP.

Read the full article here