Investment Thesis

ContextLogic Inc. (NASDAQ:WISH) also known as Wish, is a business that faces numerous problems. Meanwhile, despite writing clearly bearish analysis on this stock, many readers have reached out to me asking why I haven’t put a sell rating on this stock. Is it that I’m still hopeful?

Rather than answer individually, I’ve decided to pen out my analysis. Here, I argue that even though I recognize the structural issues plus ongoing concerns Wish faces, I also recognize that the full bear case, namely, liquidation, can take a long time.

In the interim period, given its high short ratio, the stock is primed to exhibit high levels of volatility. In other words, although I believe I’ll be right in the long term, the short term may be punctuated with periods of excessive volatility and short covering.

Consequently, opening up a sell rating at this price point doesn’t offer me a compelling risk-reward. Nevertheless, this does not change the stark truth that this company will fail in the long run.

Rapid Recap,

Back in April, I said:

I believe that within 12 months, ContextLogic will be out to raise capital to shore up its balance sheet. This will mean a shareholder dilution and reverse stock split is likely to happen within a year.

At the time the share price was above $11.

Author’s work on WISH

Following on from that analysis, I proceeded to declare in a follow-up analysis:

The best way to compound capital is to buy into healthy and growing businesses. ContextLogic is neither of these.

[…] Wish declares that it is making progress with its customer retention figures. Although, from the evidence I see in front of me, it appears that Wish’s MAU figures are moving in the wrong direction.

With this context in mind, several readers retorted that Wish wasn’t going to need a capital raise, given the strength of its balance sheet. I’ll address this topic momentarily, as that is undeniably where the bull case finds itself for Wish.

But before that, I highlight Wish’s customer adoption decline.

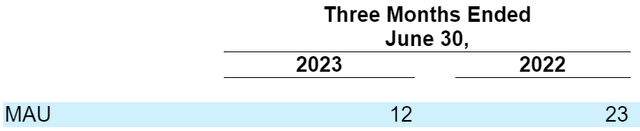

WISH SEC filing

What you see above is that Wish’s MAU figures for Q2 2023 are down nearly 50% y/y.

Whatever words we employ as we strive to describe Wish’s developments, I believe most reasonable minds would conclude that the business is unstable and lacking vitality.

With this in mind, let’s discuss Wish’s recent progress.

Wish’s Updated Progress

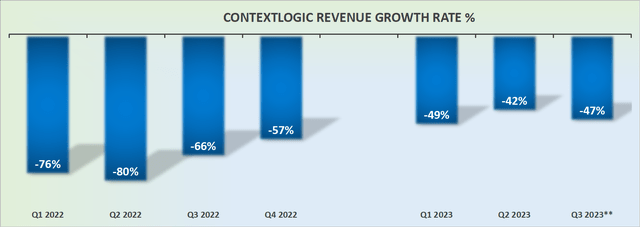

WISH revenue growth rates

The graphic above shows numerous quarters of negative y/y revenue growth rates. This is not a single bad period. This is concrete evidence that this business’ value proposition has eroded. Wish’s raison d’etre is gone.

Even if there was any doubt over the temporary nature of Wish’s disappointing prospects, consider the following highlight.

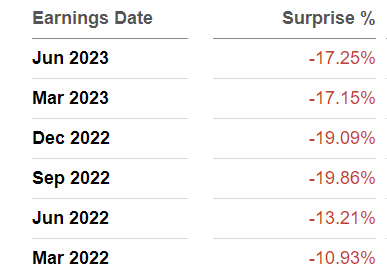

SA Premium

What you can see above is that Wish has a history of dramatically missing analysts’ expectations (as well as their own).

For example, in Q1 2023, Wish guided to $91 million in revenues at the low end of its guidance. With the low end of its revenues being a figure that neither management nor investors seriously expected Wish to end up delivering.

And yet, when Wish’s Q2 results came out, its revenues were at $78 million. A clear discrepancy between Wish’s own expectations and what they ultimately delivered. With this context at the forefront of our discussion, let’s now return to debating Wish’s bull case.

The Bull Case: Wish’s Balance Sheet

In my previous analysis, I said,

I fail to believe that Wish will succeed with [its] capital allocation strategy.

I argued that Wish wanted to grab investors’ attention with the announcement of a buyback program, to signal to investors it has a very strong balance sheet with ample cash position and no debt.

More specifically, Wish wants investors to buy into its bull case, that the business is priced at close to $150 million market cap, while it holds more than 3x this sum in cash on its balance sheet.

However, I urge investors to think about management’s incentives. If the company was to return all the capital back to its shareholders, this would mean that the business wouldn’t be a publicly traded company.

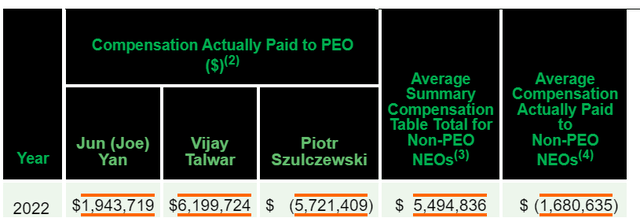

And as a consequence, management wouldn’t be getting publicly traded-executive-like compensation, see below.

WISH, Principle Executive Officer (PEO)

Meaning that the incentive for Wish is to exist and not return excess capital back to shareholders.

The Bottom Line

As I delve into the intricacies of ContextLogic Inc., I acknowledge the multifaceted challenges this company grapples with.

While I am mindful of the structural issues and ongoing concerns surrounding Wish, I also recognize that the complete bear case, including potential liquidation, can unfold over a considerable time frame.

Thus, while I stand by the belief that the long-term outlook is unfavorable, the short-term landscape might be punctuated by bouts of turbulence and short-term action.

Hence, issuing a sell rating now doesn’t present a compelling risk-reward proposition. Nonetheless, this reality doesn’t alter the sobering truth that Wish’s long-term prospects are not promising.

Read the full article here