Introduction

Copper holds an indispensable role in the transition towards cleaner and more sustainable energy solutions that many governments across the world have committed to. This red metal will be essential to meet these goals and take the centre stage underpinning the growth of electric vehicles and energy infrastructure.

However, copper does not just appear out of nowhere. While its necessity in the future is known, the world is confronting a daunting chasm between copper’s supply and demand. This chasm poses a threat to the goals governments have committed to and with an impending scarcity of this crucial resource looking likely, the price of copper looks only set to increase.

Investors looking to capitalize on the burgeoning demand for copper, can turn their gaze to the Global X Copper Miners ETF (NYSEARCA:COPX). COPX allows investors to gain exposure to companies engaged in the mining of copper, offering exposure to a commodity set for surging future demand.

Within this article, I would like to explore why the demand for copper is only set to grow in the future and what I believe is the investment potential of the COPX ETF.

Explosive Demand Growth

In many ways copper has seen surging demand before. In around 3000 BC, humans discovered copper could be mixed with tin to form bronze helping kick off the bronze age. This led to increasing demand for copper to make bronze for use in weapons, tools and household items.

What kickstarted coppers modern demand, was a discovery in the 1820’s which would change the world. It was found that copper was not only a great conductor of heat but also of electricity. With the invention of the telegraph, copper wires were needed to transfer the electrical signals across long distances. With further development, copper wiring became ubiquitous across the developed world for transporting electricity and used in many devices.

When contemplating the ongoing energy transition, the spotlight often gravitates toward batteries and the critical battery metals like lithium, cobalt, and nickel. These elements are undoubtedly essential components of the shift toward cleaner and more sustainable energy solutions. However, in this energy revolution, it’s imperative not to overlook a metal that has been a linchpin in our energy infrastructure for decades: copper.

Cars already take up 10% of global copper demand, but electric vehicles use up to 2.5 times as much copper. With the UK banning the sale of non-electric vehicles from 2030, a 2035 ban set to be put in place in the EU and with nine US States having bans set for 2035, demand for coppers use in cars is only set to grow.

Electrification requires copper, with solar cells and wind turbines needing huge amounts of copper to be made. These renewable sources of energy however are often located in remote areas away from major cities, necessitating extensive transmission lines to deliver the electricity where it is needed. The infrastructure to transport this electricity uses huge amounts of copper.

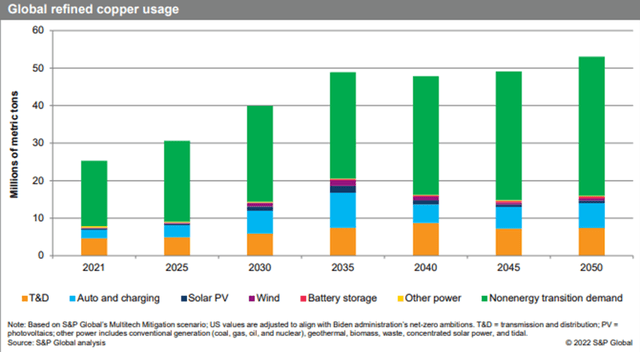

Current estimates suggest that copper consumption is expected to grow from 25 million metric tons in 2020 to almost 50 million metric tons in 2035. Although greater efficiencies and technological development may reduce that number slightly, it will still be a large increase in demand for copper.

S&P Global: The Future of Copper Report

The Looming Shortfall

With this surge in demand for copper comes the question of where we will get it from. Currently copper production in 2023 is set to be 23 million metric tons. Although this implies a surplus for this year of 250,000 metric tons, this remains far below the copper demand 2035 scenario.

As such, copper mining will have to ramp up significantly. According to the “Rocky Road Scenario” in the S&P Global: The Future of Copper Report, on current projections based on existing mining capacity, copper recycling and continuation of current mine development trends, there will be a shortfall of 9.9 million metric tons a year.

Even in the high ambition scenario where copper mining and recycling is seriously ramped up there is still a shortfall of 1.6 million metric tons. Is this scenario more mines are needed, but mines are expensive, take 15 years to develop on average and are prevented in many developed and developing countries due to their environmental impact.

Recycling has been proposed to offer a solution and does currently contribute to 17% of the world’s refined copper supply. Recycling though is no substitute for the vast amount of copper needed. To incentivise more and improved recycling, and the opening of mines with lower grade ore, to meet the supply deficit in copper, it seems inevitable that higher copper prices will be required.

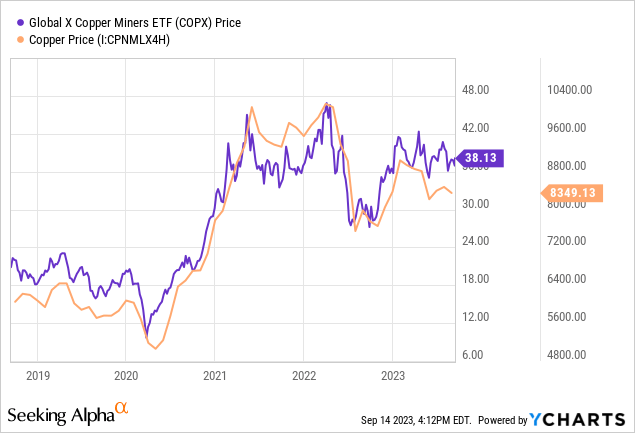

Understanding COPX

The Global X Copper Miners ETF, trading as COPX, is an ETF that aims to offer investors exposure to a carefully selected basket of copper mining companies across the world. As such it offers exposure to the price of copper due to the price of the miners showing strong correlation with the copper price. I prefer exposure to the miners over the pure copper price due to the ability of miners to generate vastly greater profit and returns when the price of copper goes up, and the exposure to new mines as they come online.

Currently the top 10 holdings of the ETF is, Southern Copper Corp. (SCCO), First Quantum Minerals (OTCPK:FQVLF), Lundin Mining (OTCPK:LUNMF), Ivanhoe Mines (OTCQX:IVPAF), Teck Resources (TECK), Freeport-McMoRan (FCX), Grupo Mexico (OTCPK:GMBXF), BHP Group (BHP), Antofagasta (OTC:ANFGF) and Glencore (OTCPK:GLCNF). There are a total of 38 holdings, with no holding exceeding 5.51% and the top 10 holdings representing 52.3% of assets. Although some of these miners engage in mining not just copper but other commodities, all their copper mining operations are of significant size that they are exposed to the price of copper. By investing in a diversified ETF, it allows for greater global reach across a larger number of mines and provides mitigation of risk if a particular company runs into problems by diversification.

Above I explained why I am bullish on copper in the long-term, and investing in COPX allows exposure to the price of copper as all the companies in the ETF are integral to the supply of copper. Hence, I rate COPX a strong buy for the long term.

Risks

Investing in COPX and copper mining in general is not without its risks. Three main risks I think investors should consider is the copper price, geopolitics and the risk of a reversal of the energy transition.

Firstly, copper prices. Although I am bullish for the copper price in the longer term due to the supply deficit, in the short term the copper supply is forecast to be in surplus which could hold down the price of copper and hence the share price of miners. In the long term, based on current forecasts it looks set that the copper price will rise.

Secondly geopolitical factors. Copper mining is subject to various geopolitical and regulatory risk. Change in government policy, trade tensions and legal challenges can disrupt the development of mines impacting miners operations. Additionally, if the copper price does rise we could see existing mines hit with windfall taxes on the so called ‘windfall’ profits of miners. These would be hard to avoid as if a company has spent millions developing a mine, stopping mining could cause costlier.

Finally, could we see the unlikely scenario of a reversal of governments net zero goals? Already in Europe we are starting to see pushback against net zero policies, with Germany trying to block a full combustion energy ban and some states pushing back against legislation they see as threatening their core industries. A reversal of many of these green policies will reduce demand for copper.

Conclusion

As the metal of electrification, copper plays an important role in facilitating an electric future. With strong demand and tight supply predicted it seems inevitable that the copper price increases. For investors seeking exposure to this crucial commodity, the COPX ETF emerges as a compelling choice. By investing in a diversified portfolio of copper miners, COPX allows exposure to capitalize on potential growth and opportunities in the sector, and to the copper price that drives many miners share prices. As the world moves forward, copper remains resolute, and the COPX ETF looks set to only increase in price.

Read the full article here