The Company

Core Molding Technologies, Inc. (NYSE:CMT) is a $245-million market cap firm that is engaged in the manufacturing of thermoplastic and thermoset structural products, utilizing various processes such as compression molding, resin transfer molding, liquid molding, and more. They cater to a wide range of industries including trucking, automotive, power sports, construction, agriculture, and building products, both domestically and internationally.

CMT’s IR materials [August 2023]![CMT's IR materials [August 2023]](https://indebta.com/wp-content/uploads/2023/10/49513514-16961546277261832.png)

In Q2 FY2023 Core Molding Technologies exhibited a robust financial performance. While net sales remained relatively stable at $97.7 million, the firm saw a noteworthy 2.6% increase in product sales – that was primarily driven by customer pricing adjustments aimed at recovering changes in raw material costs, highlighting the company’s responsiveness to market dynamics.

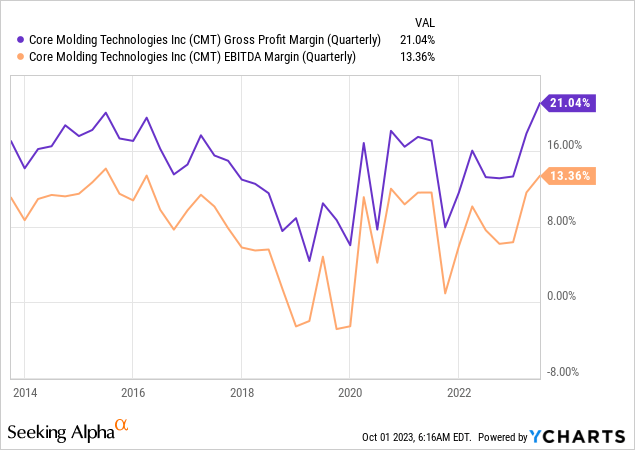

One of the standout achievements in Q2 was the remarkable improvement in gross margin, reaching 21%, the highest in over a decade. This substantial margin expansion, representing a 320-basis-point increase from the previous quarter and a remarkable 780-basis-point increase YoY, was attributed to production efficiencies and customer pricing enhancements, the executives noted during the latest earnings call.

Furthermore, Core Molding Technologies reported a doubling of its operating income, reaching $10.1 million for the quarter, with operating income margins improving by 590 b.p. YoY, standing at 10.3% [EBITDA margin now stands at 13.36%].

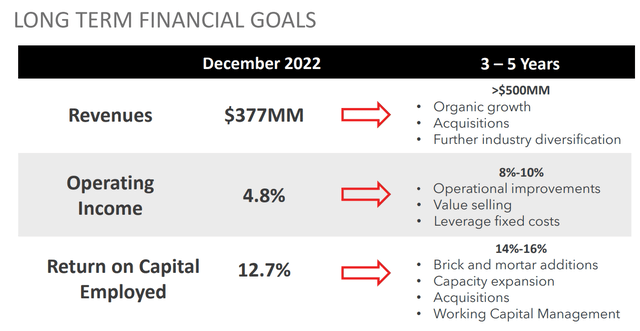

The company’s net income for the quarter was $7.9 million, or $0.91 per diluted share, marking a remarkable increase of over 250% compared to the previous year’s EPS. Moreover, management clearly has no intention of stopping there and plans to expand further through acquisitions and organic growth in its end markets. The long-term goal is to reach over $500 million in sales in a matter of a few years while also boosting the ROCE to the range of 14-16%.

CMT’s IR materials

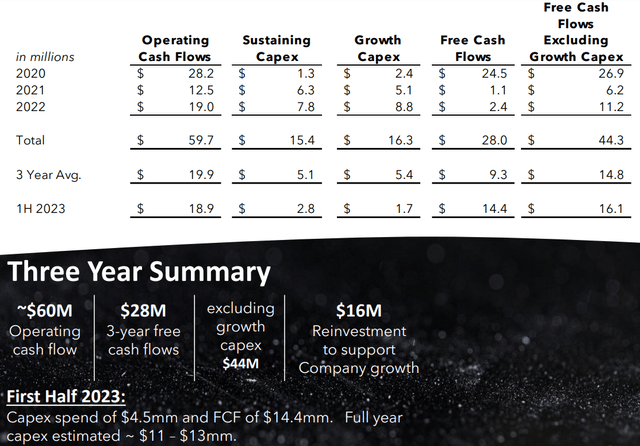

I like that the company started generating significantly more cash in 2023 compared to its recent past. In fact, the operating cash flow of $18.9 million for H1 2023 is roughly in line with the full-year average of the past 3 years. At the same time, 1H 2023 free cash flow exceeds the 3-year average free cash flow by 54.8%:

CMT’s IR materials

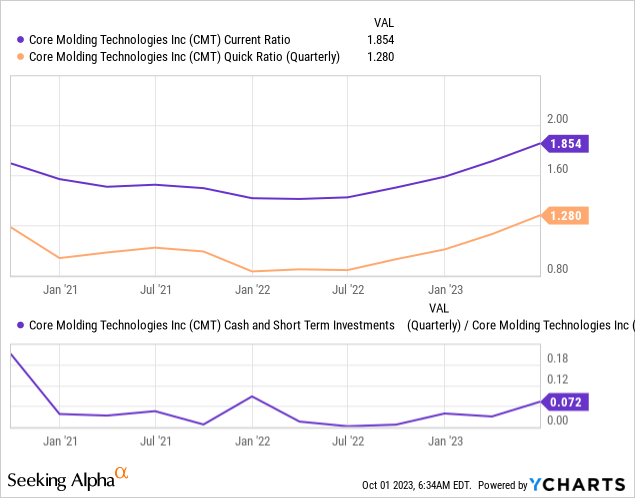

СMT’s term loan costs are fixed at 4.95%, which looks very good against the backdrop of rising rates today. The firm’s debt-leverage ratio stands at 0.6, which, I assume, is much better than that of CMT’s peers.

Also, I didn’t observe any liquidity issues: both the current and quick ratios are above 1, and the ratio of cash on the balance sheet to market capitalization exceeds 7%. This is particularly impressive considering the recent significant growth in CMT’s market capitalization.

In my opinion, global trends indicate that CMT will continue to grow and develop in the coming years. First, the company has been able to diversify quite a bit in recent years. In 2015, 100% of its revenue came from thermosets and more than 80% of that revenue was coming from the Trucks segment. Now CMT’s sales are almost evenly split between thermosets and thermoplastics, and the Truck segment’s share of revenue has dropped to 44%. If 8 years ago CMT generated 68% of its revenue in the U.S., today another market has been added (Canada), and the revenue structure is now much more diverse (U.S. holds only 38%). This suggests that the company is more resilient and has much greater growth opportunities than before. Second, CMT is a direct beneficiary of the deglobalization processes. Having succeeded in expanding into the Canadian and Mexican markets, CMT should serve the needs of various U.S. industrial sectors, having a positive impact on its order backlog and ultimately on its financial performance.

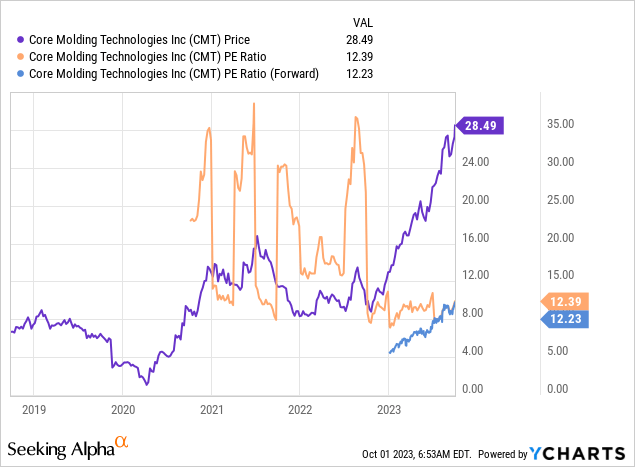

However, considering that CMT stock is up >117% year-to-date, does it make sense to buy it at current levels?

The Valuation & Expectations

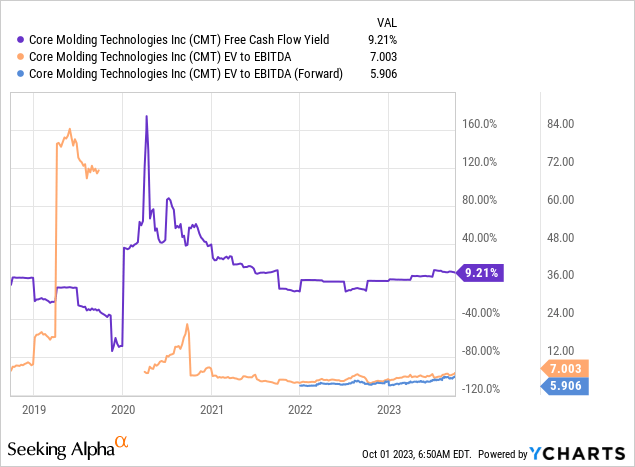

When I think about the company outperforming its 3-year full-year average FCF in 1H FY2023, I realize that the 9.23% FCF yield we see today looks very attractive. At the same time, the EV/EBITDA ratios – both TTM and forward – are still at very low levels, which confirms my findings:

The next year’s 12x price-to-earnings ratio, which is 15% below the median for the Materials sector, also looks good – but only if we see continued EPS growth in the near future.

In the short term, however, CMT may have some difficulties.

Looking forward, based on industry analyst projections and customers’ forecasts, the Company expects revenues for the second half of 2023 to decrease 5-10% when compared to the second half of 2022.

Source: CMT’s 10-Q [MD&A section], author’s emphasis added

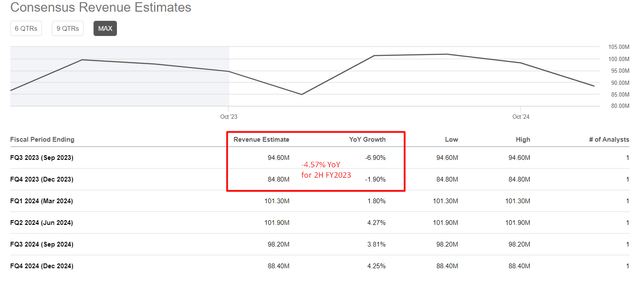

Temporary difficulties are absolutely normal, especially in the industry in which CMT operates. However, the consensus is blind to the management’s forecast of a 5-10% decline in revenue in H2 2023: 1 analyst covering CMT forecasts a year-over-year revenue decline of -4.57%, which is much better than the mid-range guidance of -7.5%.

Seeking Alpha, author’s notes

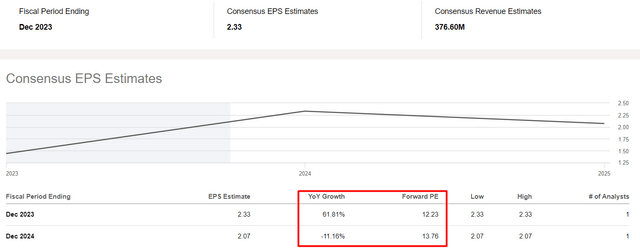

Therefore, even if margins improve slightly from here, the subsequent consensus EPS forecast is also questioned. However, in FY2024, Wall Street expects EPS to decline ~11% YoY, which will not make the company less attractive from a fundamental perspective (the implied P/E FY2024 will be somewhat >13.7x if this forecast materializes).

Seeking Alpha, author’s notes

The Bottom Line

I like Core Molding Technologies in many ways: development strategy, potential demand growth in source markets, tailwind from global trends, innovation, etc. However, I get the impression that the market is slightly underestimating the potential magnitude of the sales decline in the second half of 2023, which could come back to haunt CMT after such a rapid increase in its market cap recently.

TrendSpider Software, CMT

I expect CMT stock to cool off a bit after Q3 results [expected Nov. 6, 2023], which would be an ideal time to buy. But right now, I think it’s too risky to buy at the very top. Therefore, I recommend waiting for the Q3 results and keeping CMT on the watchlist.

Thanks for reading!

Read the full article here