Back in April I initiated coverage on Corsa Coal (CSO.V) (OTCQX:CRSXF), a small Pennsylvania coal miner that had come back from the brink of solvency and looked poised for a strong 2023. Well, the situation got significantly better on Friday, when Corsa announced a settlement with PennDOT over a dispute dating back to 2010 and 2011. The settlement provides for $35m of gross proceeds to Corsa, who expects to receive $23.3m net of contingent legal fees in Q4 (all figures in USD).

So What?

This development is tremendous for Corsa. When halted Friday at $0.42/share, Corsa’s market cap stood at about $45m. This payment therefore represents a 50% windfall to Corsa. Even better, Corsa ended Q2 with $19m of net debt, an amount fully covered by the settlement. With the precarious financial shape Corsa has been in for the last several years, this significantly de-risks the equity.

Operational Update

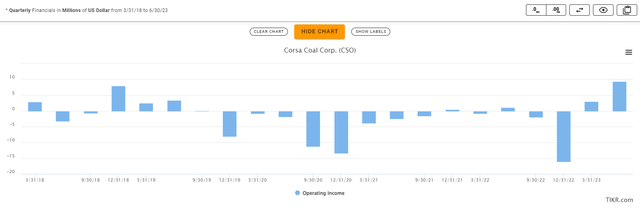

This settlement comes on the heels of Corsa’s best financial quarter in a long while. Corsa hadn’t had a quarter with $9m of operating income since 2017:

Corsa Operating Income (TIKR.com)

The majority of the cash for the quarter was used to normalize working capital balances, but Corsa guided to a continued increase in production and cash costs at the lowest levels in multiple years. For a company that was on the brink less than a year ago, this is a welcome turn of events.

With two more quarters of ~$175/ton coal contracts, Corsa may be able to generate $30m of cash from operations before 2023 is over. When coupled with their settlement payout, Corsa should have the capital to pay off their outstanding debt and fully fund the $20-24m of CapEx required to being their new Keyser mine online in Boswell. With an additional 570k tons of estimated annual production, this mine should be able to pay itself off very quickly, perhaps in less than a year if Corsa can maintain their cash margins near $60/ton.

My biggest concern with Corsa was their relatively high cost of operations, producing coal last year for over $130/ton. This puts them in the most expensive quartile of producers, not a good place to be for a commodity business. However, Corsa has been able to increase production from their access into North Mine, helping bring costs down to $114/ton in Q2 and guiding similar for Q3. With over 1m tons now contacted for FY23 and increased tonnage available at Keyser, Corsa could exceed 1.5m annual tons of production in the near future, and making them less dependent on one mine for earnings.

Valuation

With Low-vol met coal trading around $210/ton currently, Corsa should be able to contract FY24 tons for at least $160/ton. If production remained 1m tons/year and costs rebound to $120/ton, even with maintenance CapEx and corporate costs this should be enough to generate $20m of FCF. If costs can stay closer to $115, sales hit $170, and production gets closer to 1.2m (Q2 run rate), Corsa could earn $40-50m of FCF, before any future Keyser contribution.

I think it’s reasonable to expect Corsa to trade for a $100m enterprise value given this profile, and with no net debt expected by the end of the year, that would push Corsa to $1/share. If Keyser progresses well, one could argue for more.

Risks

Corsa has generic commodity producer risks: volatile price exposure, inflated raw material costs, and vulnerability in a recession. Their lack of scale exacerbates these risks if one of their mines experiences a significant issue. Corsa trades over the counter in the US and fairly thinly on the TSX Venture Exchange, which subjects shareholders to volatility and illiquidity.

Conclusion

After a long time on life support, Corsa Coal appears to have turned a corner, both operationally and financially. With good contracts in hand and prospects for another adequate contracting cycle into 2024, Corsa should be able to make further progress strengthening their operations. I think it’s reasonable to expect Corsa to trade near $1 on this settlement and improved operational performance, with further upside if Keyser can be brought to production as anticipated.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here