Introduction

Since the beginning of 2023 Costco (NASDAQ:COST) has been on a tear. I’m a member and frequent shopper, normally once or twice a week to buy essentials. Although I mostly buy food there, they’re literally a one-stop shop for everything. From food, household necessities, clothing items, furniture, tires, travel, appliances, water filtration, vision services, gasoline, a pharmacy, and insurance, I can go on and on. They have it all. I’ve always heard good things about Costco, from the way they treat their employees to the quality of their products. But I’ve never decided to look or do an analysis on the stock until now. I’ve always kept an eye out for it, especially now with so much uncertainty in the economy. When sentiment is low, consumer staple stocks typically go higher as investors look for a safe place to park their cash. Then there was the recent news of the company selling gold bars at their stores. So I decided to do an analysis and see if Costco is a great dividend stock to add to an investor’s portfolio right now.

Business Overview

The company was founded in 1976 and is headquartered out of Washington State. They operate membership warehouses all over the world including not only the U.S., but U.K., Mexico, Japan, China, Australia, and Spain to name a few. In short, Costco offers members “low prices on a limited selection of nationally-branded and private-label products in a wide range of categories”. Members can also shop for Costco’s private label brand Kirkland, which is designed to be of equal, or better quality than national brands. Additionally, they offer better prices and values to their members, which come in three different tiers: Executive, Business, and Gold Star Memberships.

Their executive members have access to additional savings on items such as auto and home insurance. One way the company is able to achieve cheaper prices is by eliminating many costs associated with other wholesalers & retailers. These include salespeople, delivery, and billing & accounts receivable. Costco prides itself on running a tight ship with low overhead, which enables them to pass savings to their members. The company has been public since 1985 and didn’t start paying a dividend until almost 20 years later in 2004.

Strong Growth & Recent Earnings

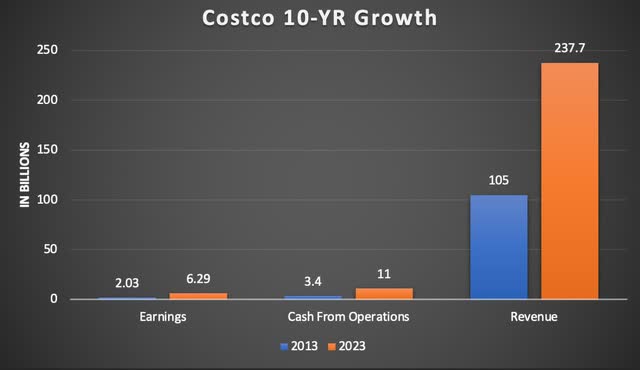

There haven’t been many wholesalers that have posted the growth Costco has over the last decade. Even compared to its largest peer, Walmart (WMT), Costco has outperformed the retail giant over a 10-year period. As seen below, revenue has grown by 126% from $105 billion to $237.7 billion at the end of fiscal year ’23. Earnings tripled from $2.03 billion to $6.29 billion, while cash from operations almost quadrupled over the same period from $3.4 billion to $11 billion.

Author creation

WMT outperformed COST when it came to revenue, growing theirs by almost 137% from $472 billion to $630.79 billion. They grew cash from operations by almost 50% from $25.24 billion to $37.80 billion over a 10-year period. One thing to note is that WMT’s earnings did decline over the same period by 17.6% from $17 billion to $14 billion. So, while WMT remains the larger of the two, the latter has outperformed the giant over the last decade and I expect this to continue going forward.

The company reported Q4 earnings last week and also posted some strong growth for the end of the year as well. Net income grew almost 16% from $1.86 billion to $2.16 billion year-over-year. Memberships per household also grew to 71 million, up 7.6% over the same period. Additionally, COST also beat analysts’ expectations on revenue as well, with $78.94 billion in the quarter. Sales were also up year-over-year.

Special Dividends & Buybacks

Another thing that has impressed me about COST is how fast they’ve managed to grow the dividend. They last raised the dividend earlier this year by 13% from $0.90 to $1.02. A huge difference in Costco’s dividend from most retailers is the special dividends the wholesaler pays out on occasion. Since 2012 the company has rewarded its shareholders with four special dividends. One in 2012, 2015, 2017, and 2020. Although they haven’t rewarded shareholders with one since the pandemic, they have grown the dividend by almost 46% over the same period.

Additionally, the company announced earlier this year the reauthorization of its buyback program of $4 billion, which is expected to be over the next four years. This replaced the program initiated in 2019 which was expected to expire in April of this year. Essentially, shares outstanding have increased over the last decade, but not by much. So, this announcement was great news for investors as COST looks to return cash to its shareholders over the next few years. In Q4, they repurchased 433,000 shares outstanding for a total of $230 million.

Future Outlook

COST is expected to continue on its path to growth over the next 3 years. One important note. The company recently announced the sale of gold bars, which I think was a genius move. Investors typically look to gold as a hedge against inflation. Due to the rapid rise in interest rates to battle this, this turned out to be a significant gain for COST. Their 1-ounce gold bars have been selling out online within a few hours, so fast that the company had to limit them to two per member.

One aspect I like to look at when potentially investing in a company is its future growth outlook. What does this look like over the next 2, or 3 years? Is it expected to decline? COST is expecting growth, albeit slowly. Like most wholesalers, growth is never expected to be rapid. That’s one reason why consumer staples like this are normally priced at a high valuation during economic uncertainty. They’re dependable and somewhat recession-resistant. Although sales slow during these times, everyone has to continue paying for their needs, whether it be food or gas.

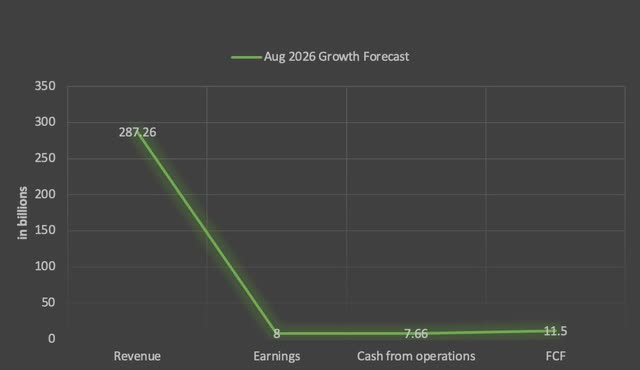

Analysts are expecting revenue growth of roughly 21% over the next three years, while earnings and free cash flow are also expected to post double-digit growth of 27% and 13% respectively. Cash from operations is expected to be slower at 4%. While this growth is not eye-popping, I’m expecting COST to exceed expectations unless the economy goes into a deep recession in the next couple of months.

Author creation

Valuation

The one dislike I have with COST is their valuation. The price is up double-digits over the last 6 months. Even since the beginning of 2023, the share price has gone up over $100. Currently, the stock offers little upside to its average price target of $597 and is trading less than $1 from its 52-week high. The stock’s current P/E is also higher than peers WMT and Target (TGT), who both have a ratio of 30x and 15x at the time of writing. This is a further testament to the financial strength and business model of the company.

Tipranks

For my fair valuation, I decided to use the discounted cash-flow model or DCF. Costco’s historical FCF growth is 17% over the last decade. I assumed the company would continue growing its FCF at this rate through sales, membership growth, and expansion. Then assuming this growth slows to 10% and adding in their current book value per share and an expected 15% ROR, this brought me to a fair valuation of $366. But this is if investors are expecting a 15% rate of return, which is what the great Warren Buffett looks for. This also happens to be one of Charlie Munger’s, Buffett’s right-hand man, favorite stocks. But honestly, I don’t expect the stock to drop that low, even in a recession. I caution investors looking to add to wait for any slow-downs or share price weakness before adding. If you have a longer-term outlook for the stock, then now may be a good time for dollar-cost averaging.

Risks

If we do enter into a recession, I think the biggest risk Costco will face is a slowdown in spending. The company has seen growth over the last few years, but a recession would most likely have a negative impact as consumer spending becomes tighter, which will affect net income. During the GFC, the company saw a 15% drop in net income. Another risk, although I think this is a longer-term one, is the company’s exposure to the State of California. Even with being the most populous state, California has seen an outflow of residents migrating to other states in search of cheaper housing and taxes. The company has quadrupled the amount of stores in California, with 134 stores currently. Texas is the next state with the most at 38. Furthermore, the company struggled particularly in California in the 2008-2009 recession when unemployment reached above 12%.

Then there are high interest rates, which will continue affecting the company as well. If interest rates are held or the FED decides to hike in the near future, COST could potentially see a huge rise in interest expenses next year. Over the course of the year, interest expenses rose $8 million from $48 to $56 million. Interest income was also higher in the 4th quarter by $171 million, for a total of $238 million annually. This was a 255% increase from 2022. So investors and shareholders should definitely keep a close eye on this going forward.

Investor Takeaway

COST is a strong stock that has posted some impressive growth over the last decade. They also are very shareholder-friendly and recently announced the reauthorization of their share buyback program earlier this year. Over the last 6 and 12-month period, the stock price has risen by double digits, causing it to become overvalued in my opinion. If the country does enter into a recession, the company will most likely see a decline in net income, similar to the GFC. This coupled with a higher interest rate environment could lead to negative investor sentiment in the stock. If this happens, they could see a price decline in the near-future. Due to their current valuation and limited upside to their average price target, I rate Costco a hold, and investors looking to add should wait for any signs of share price weakness.

Read the full article here