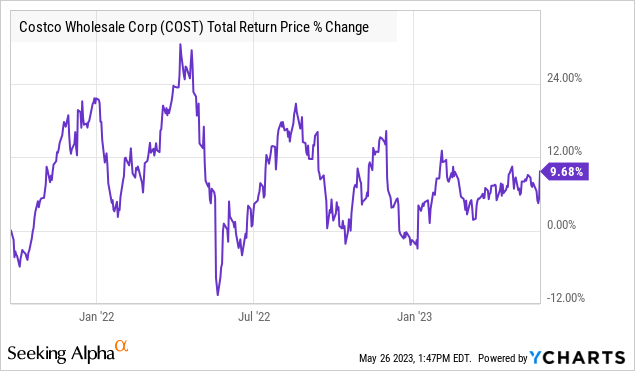

Costco Wholesale Inc (NASDAQ:COST) reported fiscal Q3 earnings with the headline net sales missing expectations while EPS came in a bit stronger than expected. The stock rallied on the news and is up about 11% this year, yet still well below the highs from 2022.

We covered COST last year citing what we viewed as a messy outlook. Indeed, that’s been the case with the latest quarterly report sending more mixed signals which we discuss below. The market continues to reward Costco for its ability to support margins and drive earnings despite slower growth and the challenging macro backdrop.

While COST commands a premium as a retail leader with blue-chip fundamentals, its pricey valuation is why we remain on the sidelines. We see limited upside in the stock over the near term with risks tilted to the downside.

COST Q3 Earnings Recap

COST Q3 adjusted EPS of $3.43 was $0.12 ahead of the consensus estimate, and also up 8% from Q2 2022. This was accomplished even as revenue of $53.65 billion, up 2% y/y, missed expectations by $900 million.

The gross margin climbed modestly with management citing gains in core categories like food, reflective of stabilizing inflationary cost pressures compared to last year. Similarly, the operating income is up by 5% benefiting from declining shipping and freight rates.

Operationally, traffic at stores has been strong but balanced by a decline in average transaction value. Costco is seeing weakness in bigger ticket items that are typically more discretionary. These were themes discussed during the earnings conference call:

In terms of third quarter comp sales metrics, traffic or shopping frequency remains pretty good, increasing 4.8% worldwide and 3.5% in the U.S. during the quarter. Our average daily transaction or ticket was down 4.2% worldwide and down 3.5% in the U.S., impacted in large part from weakness in bigger ticket non-foods discretionary items.

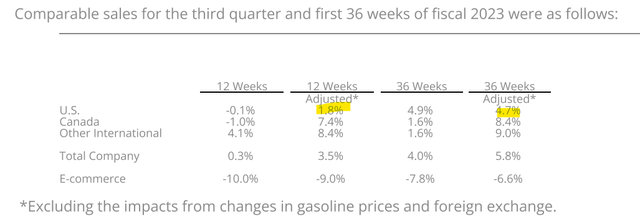

The adjusted comp sales increase of 1.8% in the U.S. slowed from 5.8% in Q2 suggesting still resilient consumer spending considering the environment of high-interest rates and stubborn inflation, but also slower momentum. The total company’s 3.5% increase in comp sales captured stronger growth trends internationally.

source: company IR

What’s Next For COST

While Costco is not offering financial targets or formal guidance, management comments suggested some optimism focusing on the positive points. The company benefits from long-term growth drivers which starts with its ongoing global expansion. The company has opened 17 new locations in fiscal 2023 with a target of hitting 23 by year-end.

Those stores help drive the growth in paid membership, reaching 124.7 million cardholders in Q3, up 7% y/y. Considering strong renewal rates, this dynamic supports a runway for long-term earnings growth and climbing cash flows which is the allure of the stock.

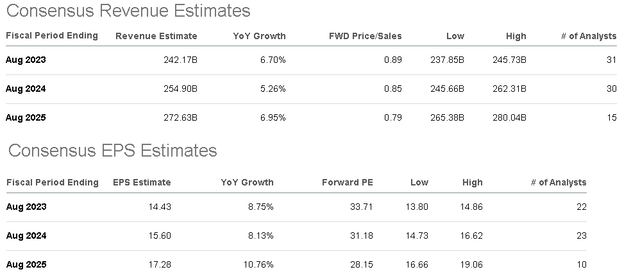

According to the current consensus, Costco is expected to average annual top-line growth in the mid-single digits through 2025. The outlook for EPS is higher, closer to 10% over the period with some margin expansion.

Taking these figures as reasonable, we would also argue that it would take a stronger global macro backdrop evolving sooner rather than later for COST to materially outperform these estimates. The assumptions here are based on the membership trends and at least modest comparable store sales gains.

Seeking Alpha

On the other hand, the main risk to consider would be for economic conditions to further deteriorate, hitting consumer spending demand directly. As it relates to the U.S. economy, stubborn inflation, and high-interest rates will continue to pressure the economy over the next several quarters.

While there are certain advantages of the membership model and the ability to offer customers low prices for staple items, it remains to be seen how discretionary categories will evolve. The weakness in e-commerce with sales down 10% in Q3, for example, is concerning. While this remains a smaller part of the overall business, the strategy has likely lagged behind more ambitious goals of higher penetration.

Other major retail names including Walmart Inc. (WMT) took a more cautious tone during their latest messages to investors, and it’s clear to us that Costco faces many of the same challenges.

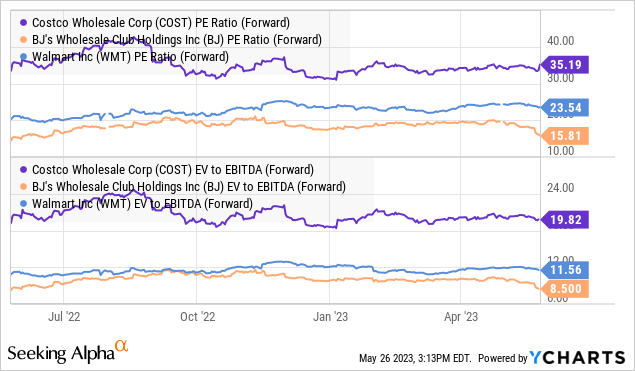

These aspects highlight the divergence in terms of valuation where Costco trades at a premium to peers including Walmart and BJ’s Wholesale Club (BJ). COST trading at a 35x forward P/E multiple or 20x on an EV to forward EBITDA basis is nearly double the average multiple between WMT and BJ.

In our view, it becomes more difficult to justify COST’s spread considering the latest financial trends for all three companies leave a lot to be desired. The argument that COST is overvalued holds merit in our opinion, but likely not enough to justify a sell assuming the spread can continue.

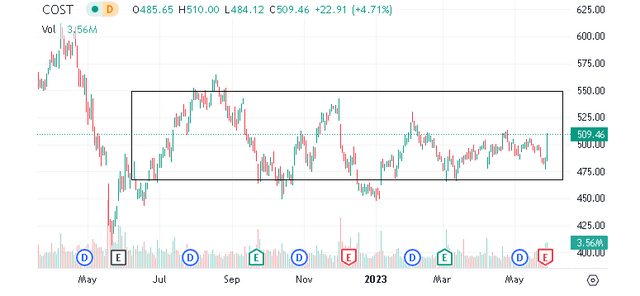

COST Stock Price Forecast

We rate COST as a hold, balancing a positive long-term outlook and solid fundamentals against what we view as a pricey valuation and ongoing macro uncertainties.

Simply put, we don’t see a catalyst for shares to break out higher, while more of the status quo would likely also limit the downside in the near term. Looking ahead to the next quarterly report, comparable store sales and margin trends will be the key monitoring points.

Seeking Alpha

Read the full article here