A Quick Take On Couchbase

Couchbase, Inc. (NASDAQ:BASE) reported its FQ2 2024 financial results on September 8, 2023, beating both revenue and consensus earnings estimates.

The firm provides various database technologies that operate across public, private and hybrid cloud environments.

I previously wrote about Couchbase with a Hold outlook.

Compared to MongoDB’s (MDB) products, Couchbase may be less able to take full advantage of AI-related workloads, so I remain Neutral [Hold] on my outlook for BASE.

Couchbase Overview And Market

Santa Clara, California-based Couchbase provides various database configurations within a single subscription service-based platform, including public clouds, hybrid environments and distributed structures.

Management is headed by president and CEO Matthew M. Cain, who has been with the firm since April 2017 and was previously president of Worldwide Field Operations for Veritas Technologies.

The firm pursues a typical “land and expand” sales and marketing approach focused on medium and large-sized enterprises via its direct sales and marketing efforts and through ecosystem partners.

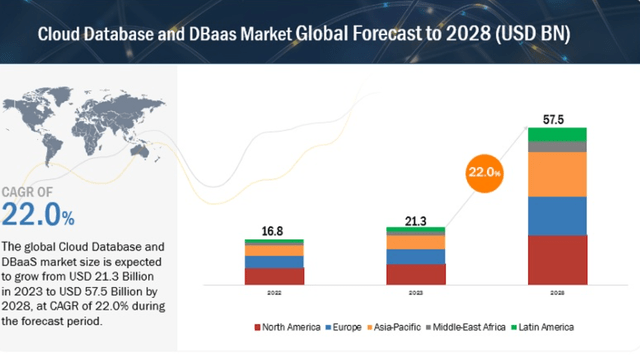

According to a 2023 market research report by MarketsAndMarkets, the global cloud database and DBaaS market was an estimated $21.3 billion in 2023 and is forecast to reach $57.5 billion by 2028.

This represents a forecast CAGR of 22.0% from 2023 to 2028, growing at a faster rate than the previous forecast report in 2018.

The main drivers for this expected growth are rising demand for structured data, ease of use in deploying cloud database functionalities, and a pay-as-you-go revenue model.

Also, the consumer goods and related retail sector is expected to lead the demand for DBaaS services due to the need to process a large number of invoices, improve their business continuity, and the need for increasing competitiveness.

Below is a chart showing the projected industry growth by global region:

MarketsAndMarkets

Major competitive or other industry participants include:

- Oracle

- IBM

- Microsoft

- Amazon

- MongoDB

- SAP

- EnterpriseDB

- Redis Labs

- Neo4j

- DataStax

- MariaDB

- MemSQL

- Others.

Couchbase’s Recent Financial Trends

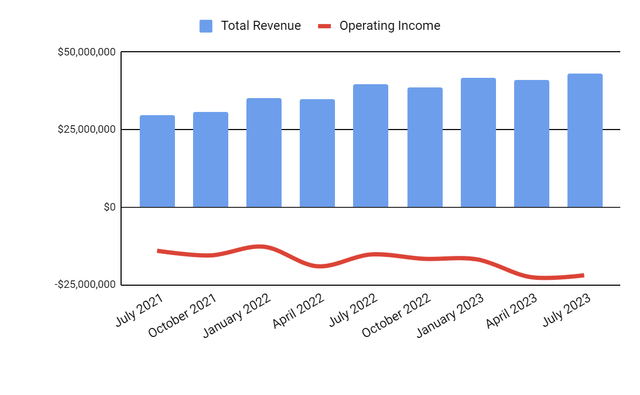

- Total revenue by quarter has continued to trend higher; Operating income by quarter has worsened further into negative territory due to higher SG&A costs and lower gross profit margins:

Seeking Alpha

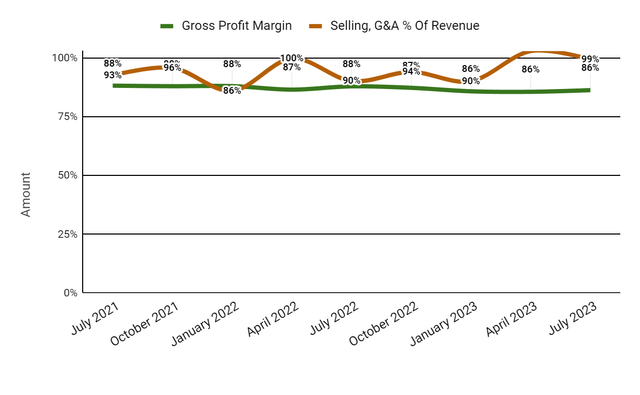

- Gross profit margin by quarter has trended lower; Selling and G&A expenses as a percentage of total revenue by quarter have remained extremely high, as the chart shows below:

Seeking Alpha

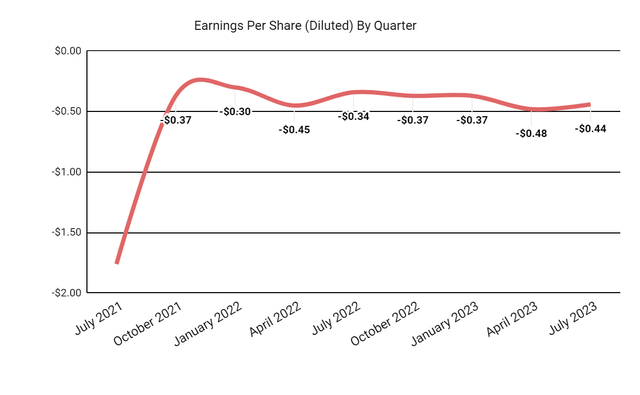

- Earnings per share (Diluted) have remained heavily negative, deteriorating further in recent quarters:

Seeking Alpha

(All data in the above charts is GAAP.)

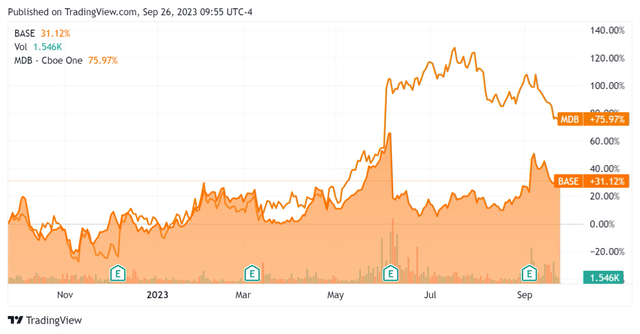

In the past 12 months, BASE’s stock price has risen 31.12% vs. that of MongoDB’s rise of 75.97%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $165.8 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash used was ($27.1 million), during which capital expenditures were $5.5 million. The company paid $35.0 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Couchbase

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.0 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

4.9 |

|

Revenue Growth Rate |

16.9% |

|

Net Income Margin |

-46.1% |

|

EBITDA % |

-46.8% |

|

Market Capitalization |

$821,450,000 |

|

Enterprise Value |

$661,910,000 |

|

Operating Cash Flow |

-$32,620,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.66 |

(Source – Seeking Alpha.)

BASE’s most recent unadjusted Rule of 40 calculation worsened to negative (29.9%) as of FQ2 2024’s results, so the firm continues to perform poorly in this regard, per the table below:

|

Rule of 40 Performance (Unadjusted) |

FQ1 2024 |

FQ2 2024 |

|

Revenue Growth % |

23.4% |

16.9% |

|

EBITDA % |

-43.6% |

-46.8% |

|

Total |

-20.2% |

-29.9% |

(Source – Seeking Alpha.)

Sentiment Analysis

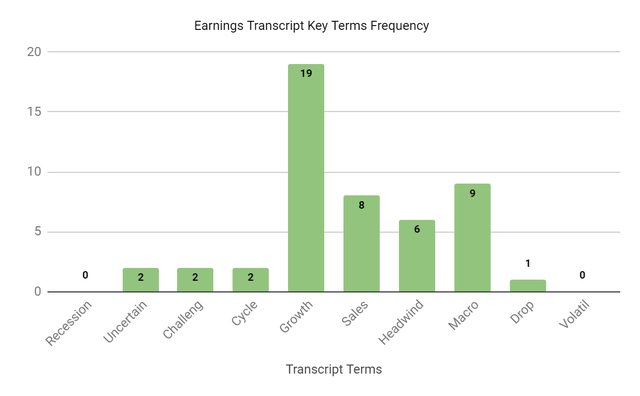

I prepared the chart below illustrating the frequency of certain keywords in management’s most recent conference call with analysts.

Seeking Alpha

The chart indicates the firm and its clients are experiencing a variety of difficult business conditions that present headwinds on IT spending by customers.

Analysts questioned leadership about how it was going to capitalize on demand for AI functions with Capella.

Management responded that Capella iQ will be part of the overall offering and will be monetized via increased consumption and expanded usage.

The team was asked about the divergence between slowing revenue growth and stable ARR growth.

Leadership said that revenue growth slowed due to negative macro effects on services, but subscription revenue has remained steady.

Commentary On Couchbase

In its last earnings call (Source – Seeking Alpha), covering FQ2 2024’s results, management’s prepared remarks highlighted beating previous guidance across major metrics.

Management believes that AI applications represent “the next great catalyst for modern applications.”

So, the firm has launched a private preview of “Capella iQ,” which adds generative AI capabilities to its Capella system.

Management also recently launched its Couchbase AI Accelerate Partner Program to “make it easier for customers to build AI applications with Capella.”

The dollar-based retention rate was 115%, indicating steady improvement, which management pins on its Capella system and larger enterprise customer demand.

Total revenue for Q2 2023 rose 8.3% YoY, while gross profit margin fell 1.6% due to increasing changing mix from customer adoption of Capella.

Selling and G&A expenses as a percentage of revenue increased by 9.1% year-over-year due to higher sales costs, and operating losses worsened by 44.1%.

The company’s financial position is reasonably solid, with ample liquidity and no debt. Free cash used was a manageable $27 million in the past four quarters.

BASE’s Rule of 40 performance has been poor and worsening sequentially due to very high losses.

Looking ahead, management guided fiscal 2024 revenue growth to approximately 12.0%.

If achieved, this would represent a significant decline in revenue growth rate versus 2022’s growth rate of 25.3% over 2021.

In the past twelve months, the firm’s EV/Sales valuation multiple has risen by around 33%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include stronger-than-expected demand for its Capella system and AI-related initiatives.

However, the company continues to experience lengthening sales cycles and downward pressure on IT spending as clients and prospects exert greater scrutiny on deals and terms.

Also, compared to MongoDB’s products, which some analysts believe are more directly suited to AI workloads, I’m cautious about Couchbase’s ability to take full advantage of this new demand sector.

My outlook on BASE, therefore, remains Neutral [Hold] for the near term.

Read the full article here