Recently, a cash-flows focused ETF – Pacer US Cash Cows 100 ETF (BATS:COWZ) caught my attention. As someone who prefers cash-flow positive companies, I decided to take a look at this instrument as it may offer just that in a single instrument, which could save time and resources in stock picking.

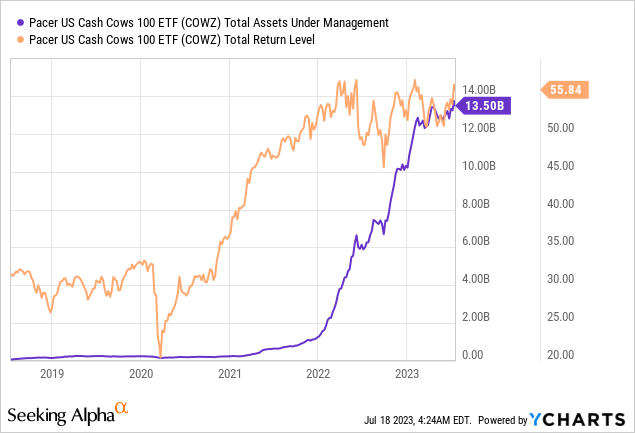

Following an impressive 2021, when COWZ yielded more than 42.5% of total return, it caught the attention of many investors, as evident from the rapid growth of the fund’s AUM. However, I worry that these new investors may be late to the party as a repeat of the strong 2021 is not very likely. The historical track record shows that COWZ is indeed a solid instrument and its performance is on par with the Russell 1000 and the S&P500, but it comes with additional risk. Overall, it looks like a good instrument to play economic cyclicality.

COWZ Overview

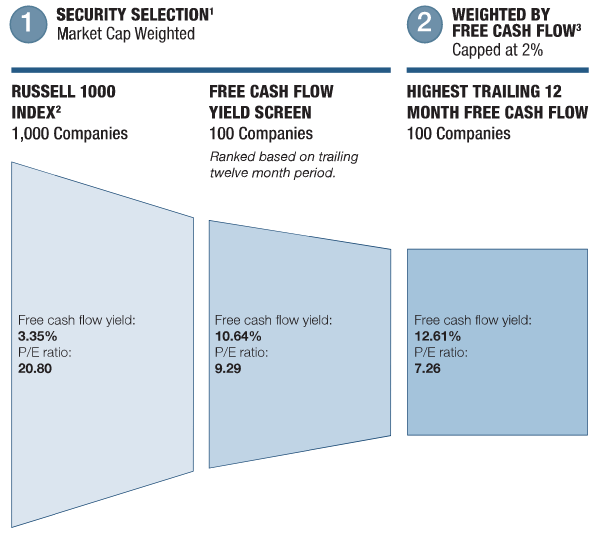

According to its prospectus, COWZ is designed to track the performance of the Pacer US Cash Cows 100 Index. The index itself is using Russell 1000 Index as the universe and ranks its constituents by their respective cash flow yields. Then, the 100 companies with the highest cash flow yield are included in the Pacer US Cash Cows 100 Index. The latter index uses quarterly rebalancing and weights its components by their TTM free cash flow. However, individual weights are capped at 2%. In theory, this should result in quite good diversification. In reality, though, at different times of the economic cycle, cash flow generation may be concentrated into a few sectors.

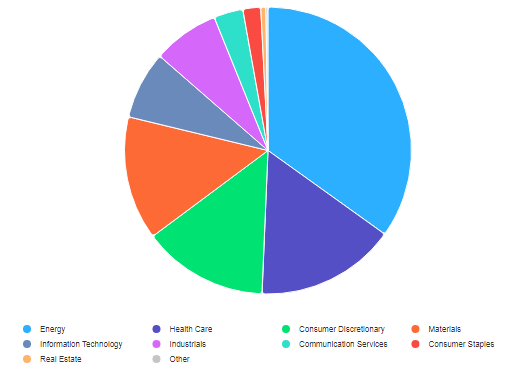

COWZ sector breakdown (Pacer ETFs)

Such is the case now, as Energy has been a cash flow machine in the last two years, hence it has a weight of nearly 35% in COWZ. The second sector by weighting is Healthcare (15.8%), followed closely by Consumer Discretionary (14.1%) and Materials (14.0%), both of which are quite cyclical. When also considering the weight of Industrials (7.5%), it’s evident that more than 70% of COWZ is invested in sectors that are quite sensitive to the state of the economy.

COWZ key characteristics (Pacer ETFs)

However, these cyclical sectors were big winners of the economic upswing, fuelled by government stimulus, related to the pandemic. As a result, COWZ achieved strong performance and as of the end of Q1’23 had single-digit P/E ratio and double-digit free cash flow yield, which is quite impressive for an ETF.

Historical Track Record

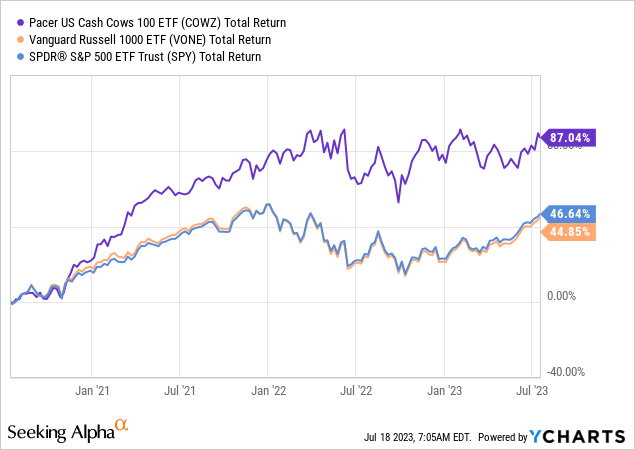

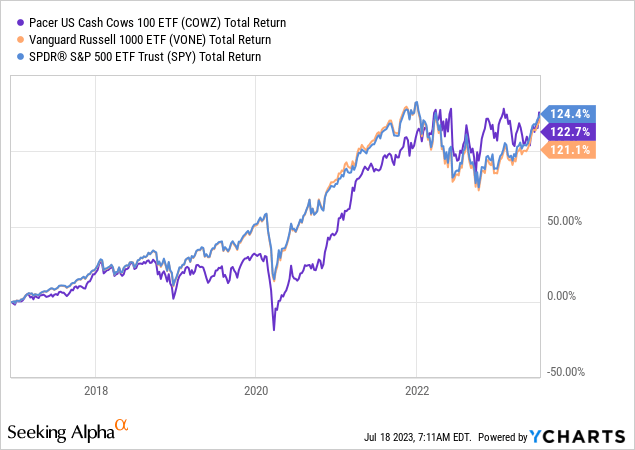

While the last three years were quite good for COWZ as it outperformed both the universe of the Pacer US Cash Cows 100 Index – Russell 1000 and the notorious S&P500, this has not always been the case. Since its inception in 2016, COWZ has been lagging behind the broad market for most of the time and was able to catch up recently, due to the favourable market environment.

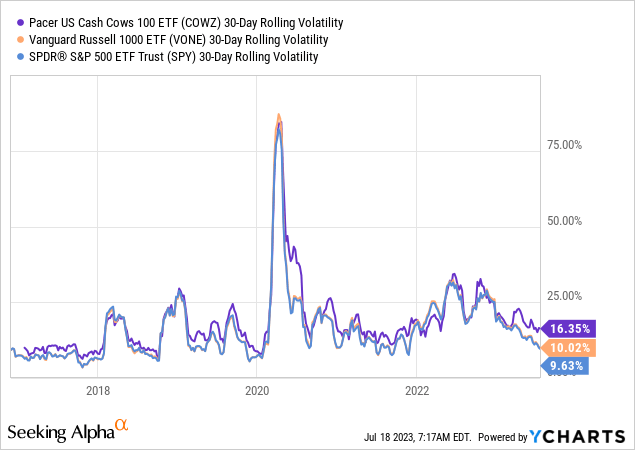

Speaking in absolute terms, since its inception, COWZ is pretty much on par with the broad market. One more important factor is the risk that comes with that return. In the case of COWZ it’s more volatile by both the Russell 1000 and the S&P500, making it inferior in that dimension.

Risks

In light of its high tilt towards cyclical sectors, COWZ bears significant risk in the event of a recession. Recession expectations have been prominent in the beginning of the year, however, they are fading away lately. Still, I don’t think that the economic growth of 2021-2022 will be repeated again, especially in light of the more restrictive monetary policy. Such an environment of negative or low economic growth should not be supportive of cyclical industries, like the ones dominating COWZ’s portfolio.

Conclusion

Despite its amazing performance in the past three years, COWZ is unlikely to keep the same level of returns in the future. Its portfolio is dominated by cyclical industries, which could be a source of risk, especially in an environment of global economic slowdown. The historical track record indicates that COWZ is on par with the broad market in terms of performance, but with considerably higher volatility.

Read the full article here