Earlier this year, a rather interesting transaction was completed whereby Crane Company (NYSE:CR) was essentially split into two separate enterprises. One of these retained the name Crane Company, while the other was named Crane NXT (CXT). The latter of these centers around the production of things like bank notes and technologies associated with them. In a previous article, I performed a deep dive into that enterprise and discussed whether or not it made sense for investors to consider it an attractive opportunity at this time. But now that that job is completed, I have decided to dig into the more boring, but larger and more diverse, Crane Company. Based on all the data provided by management, the company does seem to offer attractive growth potential over the next few years. However, given where shares are priced, I do think that it is more or less fairly valued until we start to see that growth taking place. After all, the devil is in the details when it comes to acquisition activities.

A New Crane Company

There is a tremendous amount to be gained when companies become more operationally diverse. The extra revenue that they produce has the potential to open up the door to further operational synergies that should create additional value for investors in the long run. The diversity also usually results in stability during times when one part of a business is suffering but the others might not be. On the other hand, when operations become too diverse and when it becomes difficult to place the proper emphasis needed on the needs of each portion of the business, a better approach might involve splitting those assets off into separate entities. This was in the move decided by Crane Company last year. And earlier this year, that move finally was completed.

Crane Company

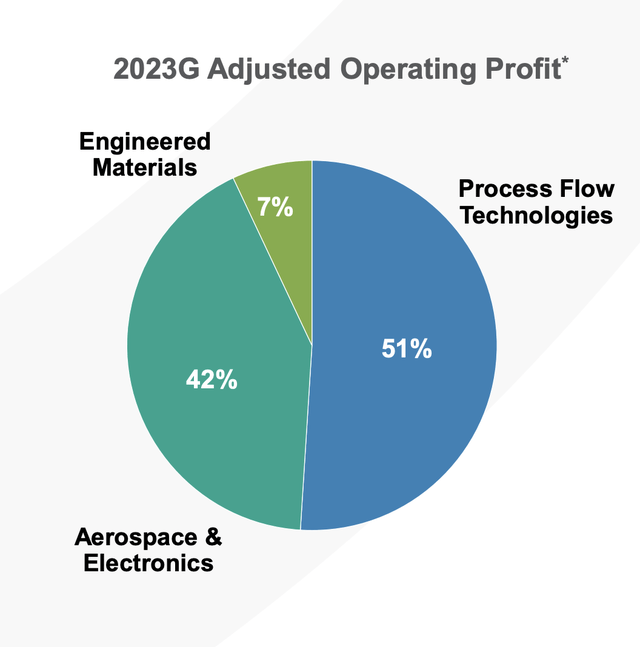

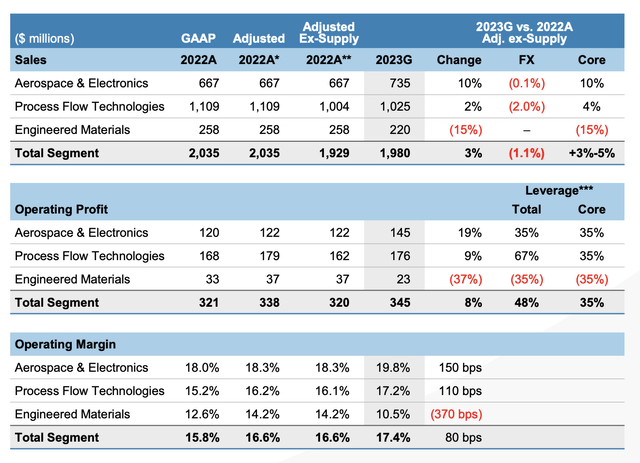

The purpose of this article is to focus entirely on the enterprise that’s currently known as Crane Company. This involves the Aerospace & Electronics, as well as the Process Flow Technologies operations that the original combined company had. Using estimates for the 2023 fiscal year, about 51% of the firm’s profits come from the Process Flow Technologies unit. Through this unit, the company produces and sells process valves and related products such as lined pipe, fittings and hoses, pumps, and more. It’s also responsible for the production of pumps and systems that are used for water and wastewater applications. Plus it is a manufacturer of commercial valves. The Aerospace & Electronics segment of the company, meanwhile, is responsible for about 42% of profits. Through this, the company produces A variety of solutions such as sensing systems, fluid and thermal management technologies, landing systems, and more. And finally, the last portion of the company is referred to as Engineered Materials. It is responsible for about 7% of profits. And through it, the company produces fiberglass reinforced plastic panels and coils that are largely used in the production of recreational vehicles, as well as other related technologies.

Although the Aerospace & Electronics portion of the business currently accounts for less thing in half of the firms’ overall profits, it is the portion of the company that management believes has the greatest growth potential. Over the next decade, for instance, management expects this unit to generate annualized sales growth of between 7% and 9%. At first glance, this may seem odd. After all, 72% of the company’s revenue goes to OEMs (Original Equipment Manufacturers) and 43% of its revenue is made out to military customers. You wouldn’t expect this kind of application or this kind of market to see such tremendous growth.

Crane Company

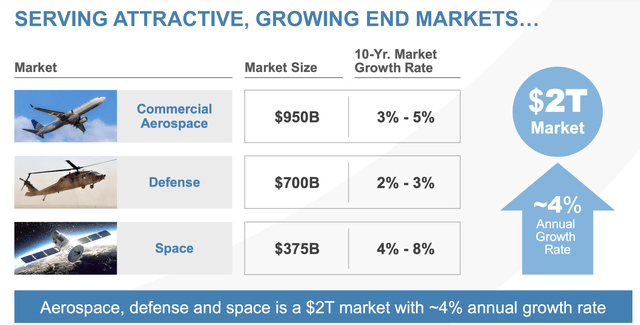

More likely than not, though, the company is banking less on rapid industry sales growth and more on its ability to capture a larger share of the market. For instance, during 2022, the Aerospace & Electronics segment was responsible for only $667 million in revenue. That number should climb to around $735 million this year. By comparison, the industry that it plays in is massive. Yes, the defense market is only growing at a rate of about 2% to 3% per year. But its current market size is about $700 billion. The commercial aerospace market is growing slightly more rapidly, with revenue expansion of between 3% and 5% per year. But it’s a $950 billion market. The company also has exposure to the space market that it estimates is worth $375 billion. It is forecasted to grow at a rate of between 4% and 8% per annum. Capturing even a little bit of market share along the way could go a long way toward helping the company achieve its targeted growth.

Crane Company

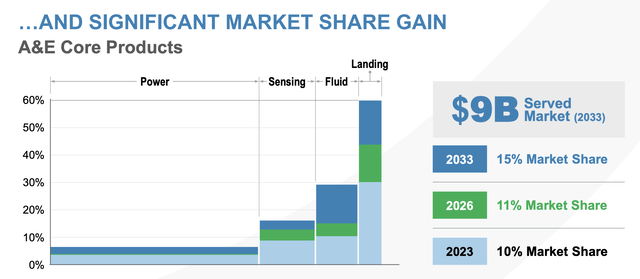

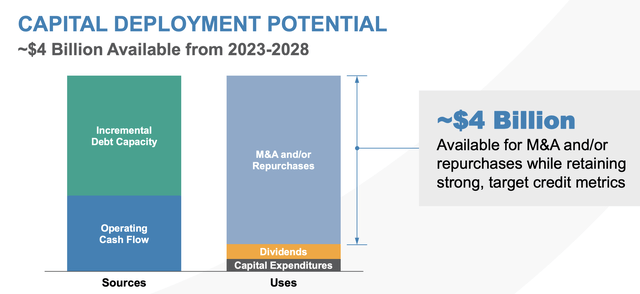

It is worth noting that the specific niches Crane Company plays in when it comes to this space has a total served market of only about $7 billion. However, there is the very real possibility of the company expanding into other verticals in this space. After all, one of the main reasons why the enterprise restructured in the way that it did is so that it could have additional fuel in order to grow. Though I expect this fuel to be allocated to more than just the Aerospace & Electronics segment, it likely will be the primary focus by management. Total capacity for mergers and acquisitions today stands at around $1 billion according to management. Between now and the end of 2028, the company anticipates this number growing to as much as $4 billion.

Crane Company

Meanwhile, the Process Flow Technologies business is considerably larger, accounting for over $1 billion in revenue during 2022 and with that number expected to grow to $1.03 billion this year. Considering this is a $17 billion addressable market for the company, it’s easy to conclude that the firm is a major player in this space. 52% of the revenue for this segment comes from the Americas, with another 28% coming from Europe. A whopping 46% of revenue comes from valves, with 19% coming from instrumentation and sensing technologies. And the main customers for the company include chemical firms, pharmaceutical companies, and general industrial businesses. If it’s all combined, these account for 62% of the segment’s sales.

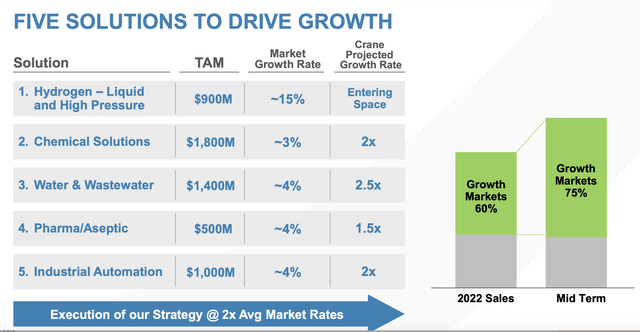

Unfortunately, this is a slower growing opportunity for the company, with its core market expected to expand by between 3% and 5% per year. But just like is the case with the Aerospace & Electronics space, management is dedicated to growing into other verticals. They have so far identified five different markets that they believe they can do well in. Combined, these were increased the total addressable market for the segment from $17 billion to $22.6 billion. The fastest growing piece of this that management is focused on is the hydrogen category, namely centered around liquid and high pressure solutions. This is only a $900 million market. But management expects it to continue to grow at a rate of about 15% per year.

Crane Company

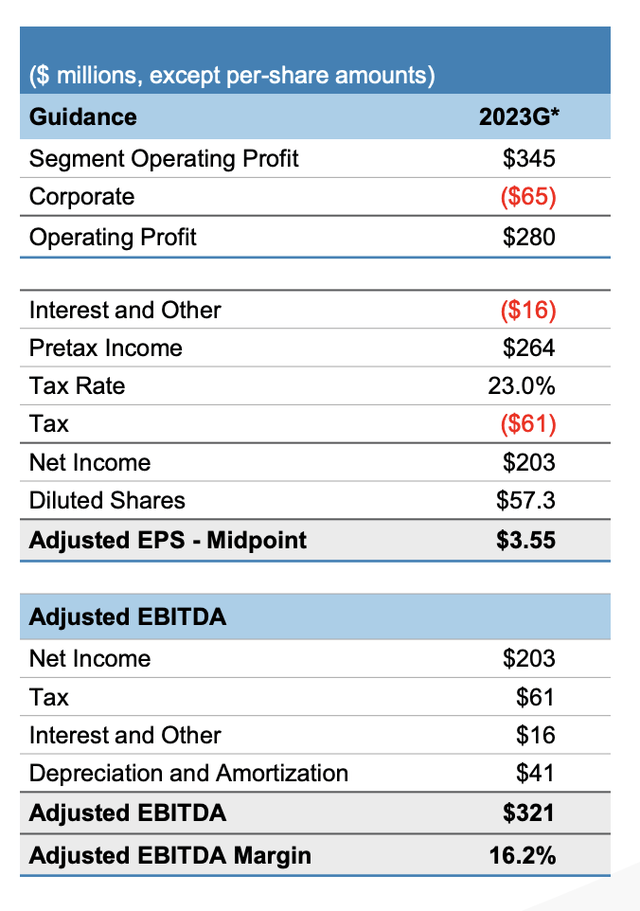

Management has been fairly generous when it comes to guidance for the enterprise. They currently believe that net income will come in at around $203 million for the year. Meanwhile, EBITDA is forecasted to be around $321 million. No estimates were provided when it came to operating cash flow. But I backed out certain aspects of EBITDA to give us a good approximation of $244 million. Given where shares of the company are right now, this would imply a price to earnings multiple of 22.2. The price to operating cash flow multiple would be 18.5, while the EV to EBITDA multiple would come in at 14.4. In one of its investor presentations, the firm did provide a comparative analysis using the EV to EBITDA approach and looking at similar firms on this basis. Those companies currently have an average EV to EBITDA multiple of 15. That would mean that, in theory, Crane Company is quite close to fair value.

Crane Company Crane Company

Takeaway

Fundamentally speaking, Crane Company is in solid shape right now. With net debt of no more than $150 million following the completion of its spin-off, and some robust operations under its belt, I do like its odds for the long haul. However, shares do look to be more or less fairly valued at this moment. Because of that, I have no choice but to rate it a ‘hold’. But in the event that management starts to deliver on its growth promises, or if shares fall from here, my stance could change.

Read the full article here