French banks, which generally run diversified lending/asset management business models, are great places to be ahead of a monetary policy pivot. Of the three majors, Credit Agricole (OTCPK:CRARY) screens most favorably due to its outsized insurance and asset-gathering fee income contribution vs. net interest income from retail and corporate banking. But the upside potential for Credit Agricole is hindered by its leaner capital position; this keeps the return on tangible equity relatively high but also reduces the scope for buyback-driven EPS upside. Credit Agricole has also favored deploying excess capital into M&A over shareholder returns historically, though its mixed track record has weighed on investors’ willingness to assign a higher valuation multiple.

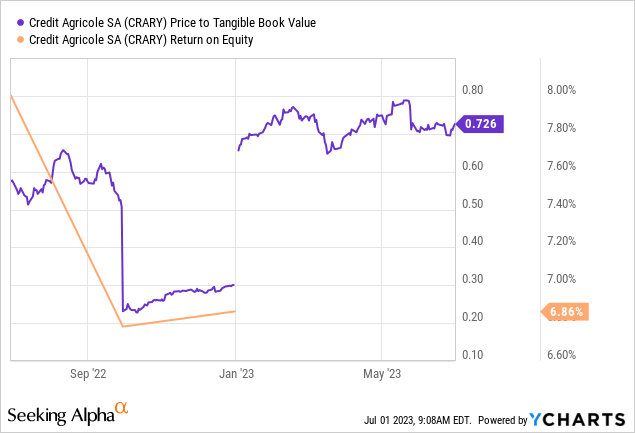

The domestic regulatory backdrop is hardly favorable either – in addition to rate hikes on regulated savings products (e.g., the 100bps Livret A hike in January), lawmakers’ push for bank windfall taxes or ‘climate investment’ mandates could weigh on shareholder value creation. And given the structurally higher cost of equity environment for EU banks post-Credit Suisse (CS) AT1 default, Credit Agricole likely won’t be running much of an equity spread (i.e., the difference between its return and cost of equity) for the foreseeable future. Net, the equity seems fairly priced at the current ~30% discount to tangible book; I see no compelling reason to own the stock ahead of Q2 results.

Unique Business Model Underpins Robust Through-Cycle Fundamentals

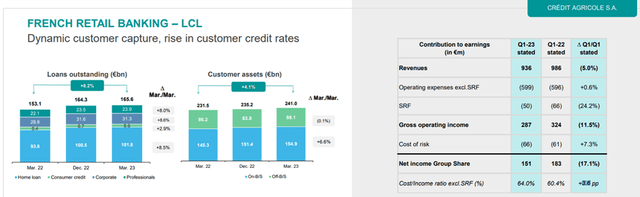

Of the three major French banks (the others being BNP Paribas (OTCQX:BNPQY) and Societe Generale (OTCPK:SCGLY)), Credit Agricole has seen the highest growth in key metrics such as loan growth and deposits at its French retail banking unit LCL. In contrast, its net interest margin has underperformed YoY, reflecting its focus on growth via customer acquisition (+100k new customers and +4% YoY customer asset growth in Q1 2023). Given its larger asset gathering and insurance presence, optimizing for cross-selling opportunities over retail banking NIMs makes sense. Management also deserves credit for its operating cost discipline, as the bank’s industry-leading retail jaws performance (i.e., the ratio of income increases to corresponding expense growth) has kept the P&L robust through the turbulence of recent months.

Credit Agricole

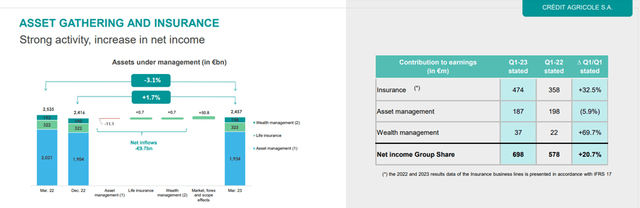

Perhaps more importantly, Credit Agricole’s asset-gathering and insurance income has provided a valuable offset to any net interest margin pressure. While assets under management were slightly down YoY (but up sequentially) due to market conditions, retail fee growth (mainly payment and services) has shined through low-margin institutional outflows. As the rate cycle turns and boosts the broader markets, Credit Agricole should also benefit from inflows to a greater extent vs. its peers. But even with the tangible book positioned for steady growth over the next year, the capital return potential is limited here. For one, the dividend payout is already at the upper limit of ~50%. And though there is a strong case for buyback accretion with shares trading at a discount to tangible book, Credit Agricole’s leaner equity base means there isn’t a lot of excess capital available to deploy.

Credit Agricole

CS AT1 Wipeout Paves the Way for a Higher Cost of Capital Regime

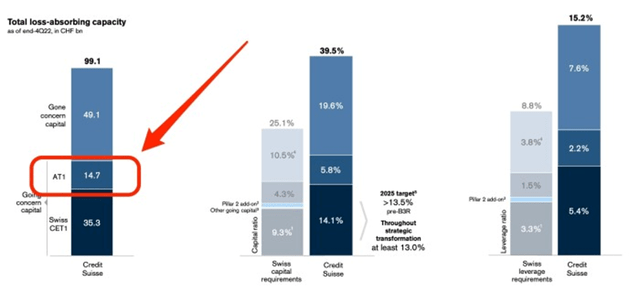

On the one hand, the landmark Credit Suisse deal this year underlined the implicit regulatory ‘put option’ underlying EU banks (recall the SNB offered UBS (UBS) liquidity assistance and a Swiss government guarantee to assume potential losses from CS assets post-merger), effectively capping the banking sector’s equity risk premia. More significant, however, was the long-term implication of writing down CS AT1s (i.e., ‘additional tier 1’ contingent convertible claims) despite the equity salvaging value from the transaction.

FT

Given the scale of AT1s outstanding from European banks and the increasingly crucial role these securities have played in their funding structures over the years (Credit Agricole included), investors demanding higher yields would have profound implications for wholesale funding costs. Credit Agricole has generally placed its AT1s well below its cost of equity in the high-single-digit % range (e.g., its EUR1.25bn issuance in March came at an initial 7.25% rate), so yields closer to the low-teens could significantly weigh on the group’s overall cost of capital and by extension, its ability to create shareholder value.

Additional Funding Pressure Ahead at the French Retail Bank

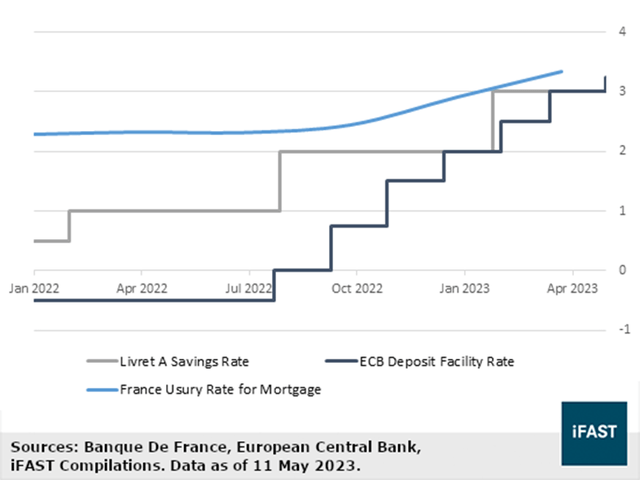

Compounding the prospect of a higher EU-wide funding cost regime are potential headwinds from steep hikes on French-regulated savings products in the coming months. Retail banks are already contending with two successive 100bp rate increases for Livret A or ‘instant access savings accounts’ (now at 3% or the highest rate in fifteen years). With inflation still elevated in France and unlikely to ease before the next revision due in July this year, expect more hikes down the line. In the likely event that higher regulated rates translate into higher unregulated product yields as well, French banks look set for a material headwind to their net interest income growth path. Of the three major banks, Credit Agricole could come off worst given its relatively lower net interest margins and limited scope for cost cuts to offset the impact.

iFAST

Not Cheap Enough

As appealing as Credit Agricole’s relatively lower rate sensitivity might seem ahead of a neutral/looser monetary policy environment, there are simply too many potential headwinds on the horizon. Besides its lower shareholder return headroom, a result of its leaner capital base, the bank’s track record of value creation (organically and inorganically) hasn’t been particularly impressive. With limited upside potential to the high-single-digits % structural ROTE in a higher cost of capital environment post-banking troubles in the US/EU, the bank could see its equity spread further compress (if not turn negative). Potential regulatory headwinds are an added source of downside, most notably from the further hikes to regulated domestic savings products like Livret A. Add in tail risks like a potential French bank windfall tax, and the seemingly cheap ~0.7x tangible book valuation doesn’t screen so cheaply anymore.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here