Since my initial bullish write-up on Crestwood Equity (NYSE:CEQP) back in mid-February, the stock hasn’t done much of anything. Let’s take a closer look at what’s been going on with the name.

Q1 Results

CEQP reported its Q1 results back in early May. The midstream operator saw an 11% increase in adjusted EBITDA to $192.6 million from $172.8 million a year earlier.

Its distributable cash flow for the quarter came in at $103.6 million. It paid out a quarterly distribution of 65.5 cents, resulting in a coverage ratio of 1.5x.

Free cash flow was $45.7 million after it spent $57.9 million on growth Capex in the quarter. FCF after distribution was an outflow of -$23.3 million.

The company ended the quarter with 4.2x leverage, or 4.0x after the sale of its 50% stake in Tres Palacios to Brookfield Infrastructure for $178 million.

Looking at its segments, Gathering and Processing North recorded EBITDA of $132.8 million versus $133.3 million a year ago. The company saw a 1% increase in crude gathering on its systems. However, natural gas gathering volumes fell -7%, natural gas processing volume slipped -8%, and produced water gathering volumes edged -1% lower. Powder River Basin natural gas gather volumes fell -2%, while processing volumes were 1% lower.

On its Q1 call, CEO Robert Phillips said:

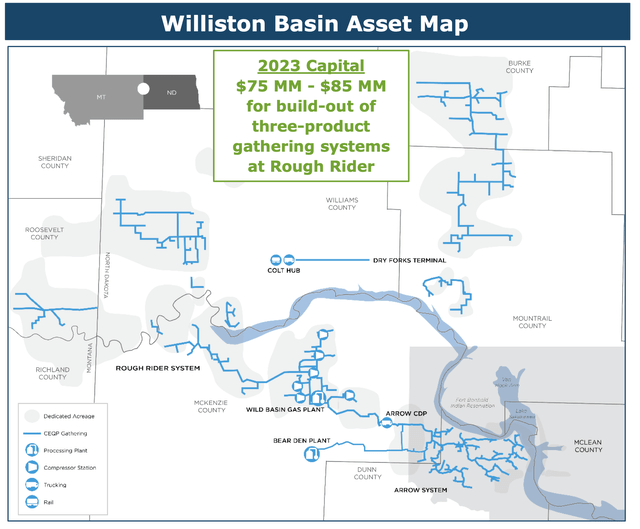

“In the Williston. We’re seeing the Arrow system slowly catch up the last year’s volumes as we expect to connect more than double the new wells in 2023 than we connected last year. Our key producers, Devon, Exxon and Enerplus are maintaining active new drilling or DUC completion programs, and they have a number of work-over rigs coming back in the field, bringing weather-related shut-in production back online. So a lot of activity around Arrow. On the Rough Rider system, Chord is spot on their 2023 development schedule, and we just placed the very important city of Williston 3-product gathering project in service last week and this is critical infrastructure to support Chord’s 2023 and ’24 drilling program in the Western acreage dedicated to us. And let me finally say that our Williston operations team continues to do a great job in reducing operating costs, continuing to find integration synergies and mitigating winter weather disruptions that we’ve experienced in the fourth quarter and the first quarter of this year.”

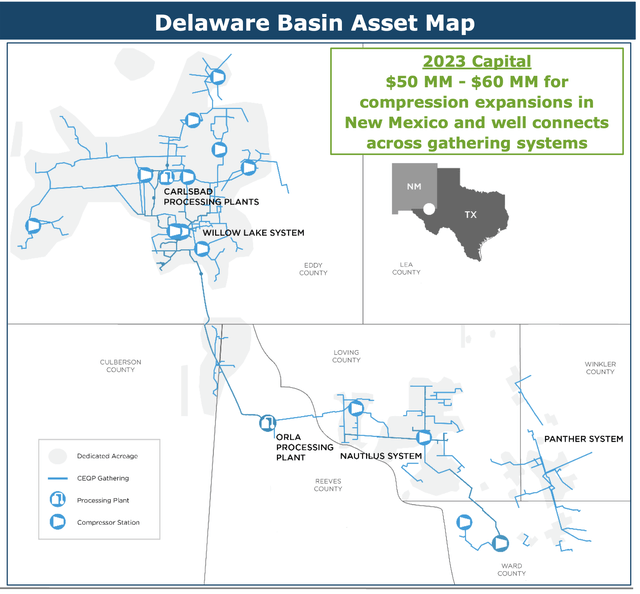

Gathering & Processing South EBITDA climbed 50% year over year to $41.0 million from $27.4 million a year ago. Natural gas gathering and natural gas processing volumes increased surged by 111% and 244%, respectively, due to the acquisition of Sendero Midstream and significant volume growth on its Willow Lake system. Crude volumes rose 11%, while produced water volumes climbed 36%.

CEQP Storage & Logistics segments saw its EBITDA climb 55% to $32.8 million from $21.2 million a year earlier. The segment benefited from increased demand due to winter weather in the Midwest and East Coast.

One of the bigger risks I talked about when first looking at CEQP was its ties to the Bakken, and the severe winters the area sometimes sees. This past winter was particularly harsh, which disrupted drilling and well connections in the basin. While E&Ps will eventually catch up with their drilling plans, and many are looking to connect the majority of their wells in Q2 and Q3, this does have a flow through impact when it comes to volumes.

Oil wells decline, and the largest declines come from new wells. CEQP and its producer customers need a certain number of new wells to come online each year just to maintain volumes, then anything above that is growth. While the long-term attractiveness of CEQP’s position is unchanged, the lack of volume growth in the Bakken should not be surprising given the past winter weather.

CEQP’s Permian assets, meanwhile, performed well, and its logistics unit took advantage of some arbitrage opportunities from the weather in the quarter.

Outlook

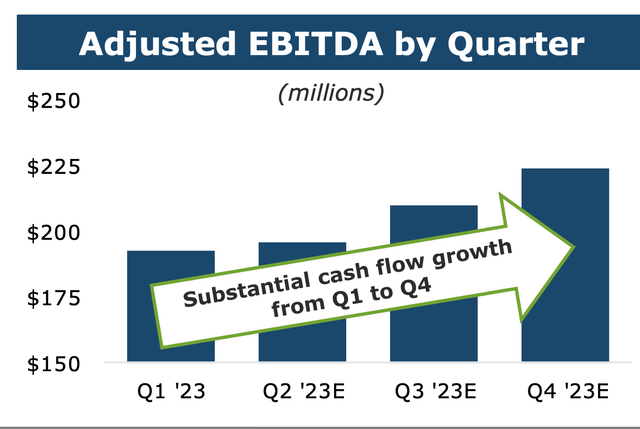

For 2023, CEQP is looking for adjusted EBITDA of between $780-860 million. That’s an 8% year-over-year increase at the midpoint.

Company Presentation

DCF is projected to come in at between $430-510 million. The company expects to spend between $135-155 million on growth Capex and $25-30 million on maintenance Capex.

Half of its growth Capex is centered on the western expansion of its Rough Rider system, along with some incremental expansions on its Arrow system. CEQP is projecting between 115-125 well connects this year for its Bakken assets.

Company Presentation

In the PRB, the company said it has been in talks with Continental to support their drilling in the area. The company notes that it has excess gathering, compression, and processing capacity on the system.

About 40% of its Capex will go towards the Delaware, with a focus on well connects, system expansions and compression additions in New Mexico. It expects 120-130 well connects for the year.

Company Presentation

FCF after distributions is forecast to be between $10-90 million, with year-end leverage of between 3.7-4.1x. It expects its distribution to remain flat this year at $2.62, with a coverage ratio of between 1.6-1.8x.

CEQP’s 2023 outlook remained unchanged, and with producers like Chord (CHRD) looking to do the bulk of their Bakken completions in Q2 and Q3, the company should have a pretty clear sight. The company should see some nice growth in the basin after it completes its expansion to support CHRD, while the PRB also offers some upside as Continental looks to expand in the area. The Permian, meanwhile, remains the premier oil basin in the U.S., and all players should benefit when the basin sees increased gas takeaway come online later this year.

Valuation

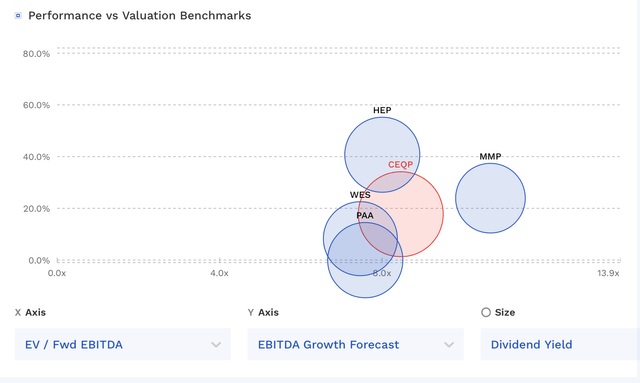

CEQP trades at 8.4x the 2023 EBITDA consensus of $823.1 million. For 2024, it trades at 7.8x the 2024 EBITDA consensus of $883.1 million.

It trades at about 5.7x P/DCF of $470 million, and has a 2023 FCF yield of over 12%.

The stock currently yields 10.4% with a solid 1.7x coverage ratio projected for the year.

The stock trades at a similar valuation to other midstream companies, although it has one of the highest yields.

CEQP Valuation Vs Peers (FinBox)

Conclusion

There probably isn’t a stock I know better than CEQP. At my old firm, CEQP was twice the top-contributing position for the fund, and I was the lead analyst on the company. When we initially took a position, it was one of the most reviled stocks out there, and no one wanted to touch it will a 10-foot poll. I later helped author a presentation called the Crestwood Comeback that we sent to management and made public.

Where CEQP stands today versus when my old firm took that position is quite remarkable, and a lot of credit as to go to Bob Phillips and Robert Halpin and the CEQP team. When my old firm owned it, the company went from CEQP 1.0 to CEQP 2.0, as it fixed its balance sheet, right sized its distribution, and sold some non-core assets. Today, this is CEQP version 3.0, where the company has gotten rid of most of its legacy assets to concentrate on its core Bakken and Permian midstream assets.

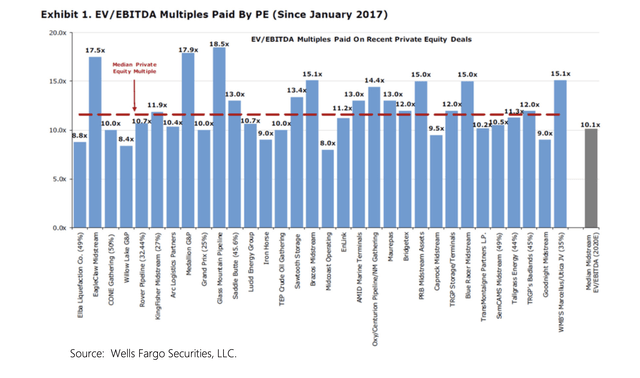

While there may be some noise due to earlier Bakken weather, CEQP remains in good shape and the stock looks undervalued at current levels. In general, I think much of the midstream space is undervalued. Typically, before the pandemic, midstream companies would be valued around 12x in the private markets and over 10x in the public markets. Valuations were even higher a few years back. Notably, most of these companies are in better financial shape today (better balance sheets, no IDRs), but trade at lower valuations than they did several years ago.

Wells Fargo

The over 10% yield is attractive for income investors, and its coverage is strong. Interested investors can also check out its preferred shares (CEQP.P), which also offer a good value. The preferred shares yield 9.4% and have much less volatility compared to the common.

I continue to rate the stock a “Buy.”

Read the full article here