Investing in actively managed fund almost always comes with a much higher expenses, compared to a passive one. For that reason, it would make sense for an actively managed fund to generate alpha, in order to justify the higher costs that it brings to investors. However, this is not the case many times. Such seems to be the case with Cornerstone Total Return Fund (NYSE:CRF). The fund has been focusing on paying high dividends, despite income generation being its secondary objective. Unfortunately, the distributions are not made entirely from income from investments, but also include realizing capital gains, hence unwinding the portfolio. What’s worse, it seems like there’s much overlap with the S&P500, raising questions about potential closet indexing. Still, over a long period of time, CRF has underperformed the broad market. Despite all that, shares of CRF are trading at considerable premium to their NAV. For all these reasons, I think that CRF investors may want to consider switching it for SPY.

CRF Overview

The Cornerstone Total Return Fund has a long history as it was established in 1973. In terms of style, the fund claims to be diversified in nature, aiming to employ a balanced approach between growth and value. Regarding the investment objectives of CRF, its prospectus highlights capital appreciation as a primary objective, while income generation has a secondary role. Despite this, the dividend history indicates that the fund has been making quite substantial distributions to its shareholders on a monthly basis throughout the years.

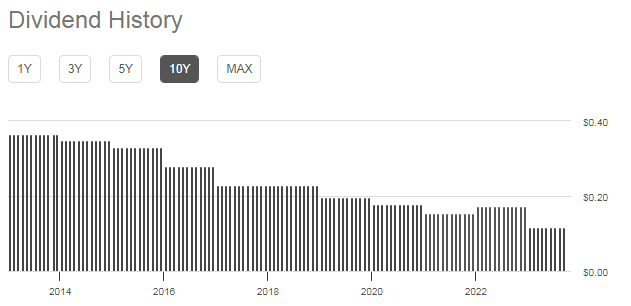

CRF’s dividend distributions (Seeking Alpha)

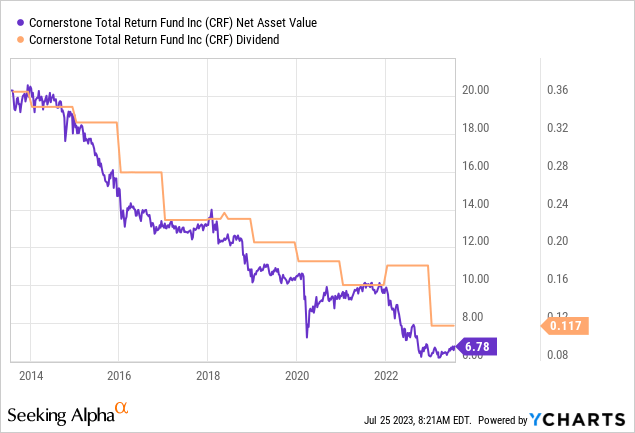

Annualizing this year’s monthly dividend of US$0.1173/share results in a dividend yield of over 17% to the last share price of US$8.19. Also, it’s easily noticeable that the dividend has been shrinking for most of the last 10 years. Such a trend, combined with the high dividend yield could be an indication that the fund is using not only the regular income that it receives from its investments, but is also distributing realized capital gains. However, the total size of the portfolio has not being falling, due to the annual rights offerings that the fund is doing. To me, this seems quite contrary to the primary objective of capital appreciation. Looking at the NAV erosion alongside dividend distributions is reaffirming the unsustainable nature of the dividends.

Portfolio holdings

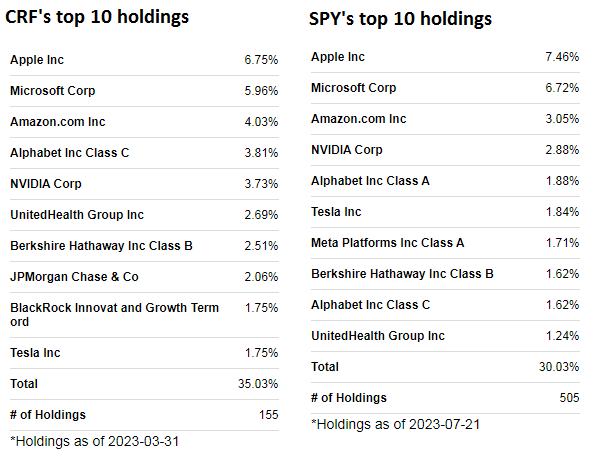

CRF comes with an expense ratio of 1.15% for 2022, which although not a lot for an actively managed fund, is much higher than the overwhelming majority of passive ETFs. However, speaking about active management, the overlap between the top 10 holdings of CRF and SPY, which tracks the S&P500 and has an expense ratio of only 0.09% is quite concerning.

CRF and SPY top 10 holdings (Seeking Alpha)

Although the dates are not identical, as CRF reports its holdings on a quarterly basis, the comparison demonstrates that top 3 positions are virtually identical, while 8/10 positions in the portfolios are the same with some slight difference in weighting. This might be an indication of closet indexing.

Performance track record

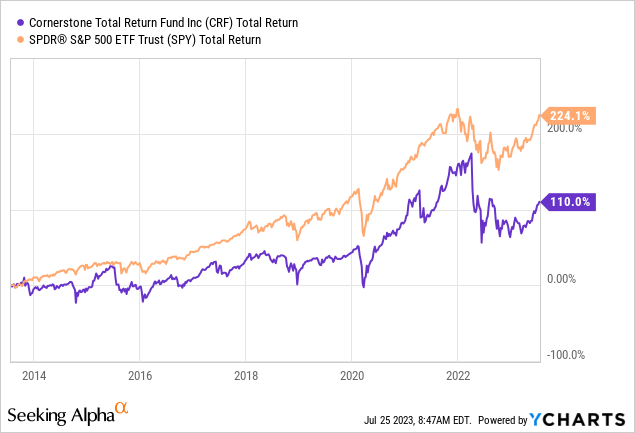

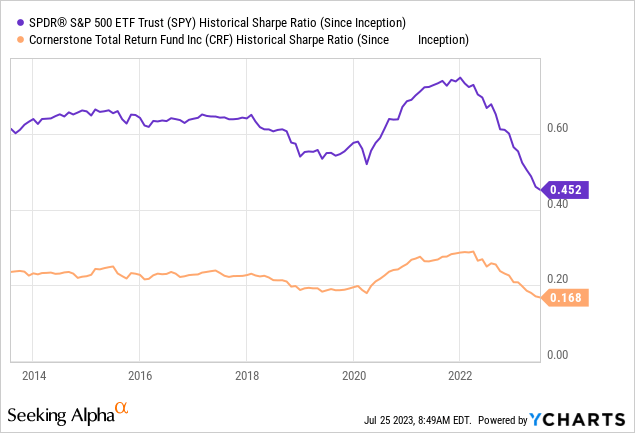

Although the prospectus of CRF doesn’t explicitly state a benchmark, I think it’s fair to compare it to the S&P500 as it has quite an overlap in top positions and the investment style of the fund is “diversified” just as the broad market.

It turns out that over a long 10-year period investing in CRF has yielded less than half of what the SPY (as an ETF tracking S&P500) yielded. Not only that, but SPY seems to be superior in terms of risk also, as it has a much higher Sharpe ratio.

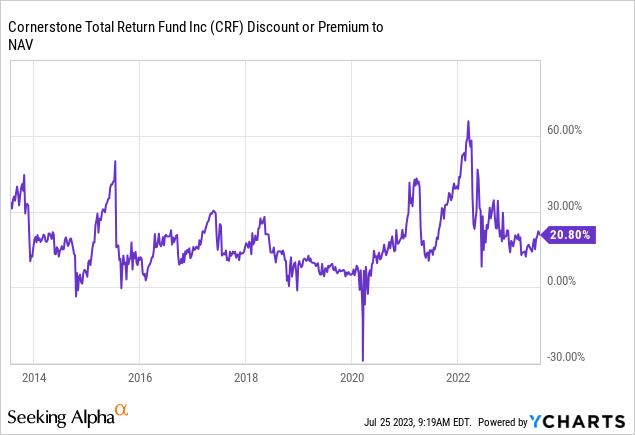

Despite all this, shares of CRF are trading at a pretty large premium to its NAV. In my opinion, this makes the investment case for CRF even worse as investors should be paying approximately 20% more for a portfolio, which is not that far from the broad market in terms of composition and despite this underperforms in the long run.

Tax considerations

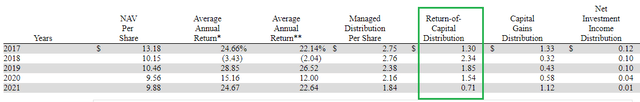

Going back to the distributions, there are important tax implications, based on the way the dividend is formed. As already established, alongside income from investment, CRF is using capital gains to boost up dividends. However, the fund is also including return-of-capital in the payment, which is not taxable, reducing the effective tax rate on the dividend.

CRF’s distributions structure (CRF’s prospectus)

However, this also reduces the cost basis of investors, resulting in higher capital gains once they decide to liquidate their position. For example, if someone bought the stock for US$10.00 some time ago and in the meantime received dividends, including US$1.00 of return-of-capital, the cost basis will drop to US$9.00, resulting in a capital gain of US$0.50 if the share is sold for US$9.50.

Conclusion

Investors should not fall for the seemingly high dividend of CRF as the majority of it consists of capital gains and return of paid-in capital, while actual income from investments is a smaller part. This appears contrary to the primary objective of the fund – capital appreciation. To make matters worse, there seems to be quite a significant overlap between CRF and S&P500, judging by the top 10 positions of the fund and SPY, which tracks the broad market index. In terms of performance, over a 10-year period CRF has underperformed SPY considerably and has an inferior risk profile, based on its lower Sharpe ratio. For that reason, I don’t think CRF is a good investment and existing CRF shareholders may want to consider switching to the lower cost SPY.

Read the full article here