CTO Realty Growth, Inc. (NYSE:CTO) has become highly opportunistic as the stock dropped 7% on excellent earnings. This article will detail why the drop happened and show that as we dig in further, the underlying data and fundamentals portend a strong future for CTO.

The drop – headline number weakness

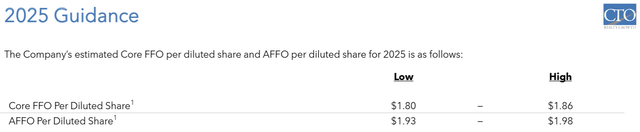

Consensus estimates called for CTO to earn $2.01 of AFFO/share in 2025.

S&P Global Market Intelligence

Despite strong earnings in the fourth quarter of 2024, CTO issued 2025 AFFO guidance at $1.93 to $1.98.

CTO

That’s a 6 cent miss at the midpoint and represents negative growth in 2025.

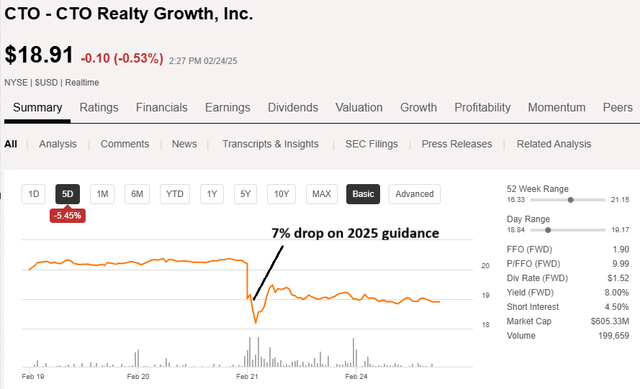

REITs are overwhelmingly traded on AFFO/share and AFFO/share growth. As such, a miss of this magnitude was not received well, with the stock trading down 7% on the report.

SA

The algorithms that can execute trades within moments of a report hitting the news are excellent at detecting beats or misses on headline numbers, so the price drop was immediate.

These algorithms, however, are not as good at analyzing the underlying fundamentals.

The fundamentals tell a different story – one of strength and growth.

Beyond the headlines

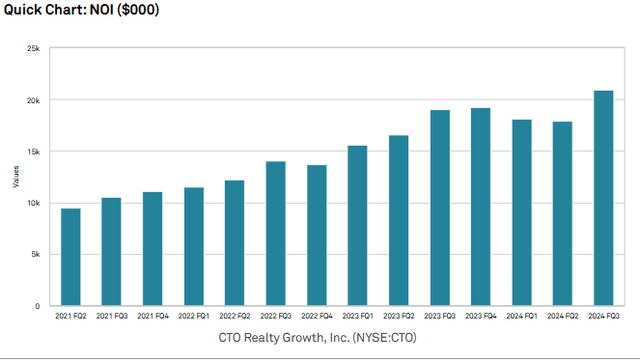

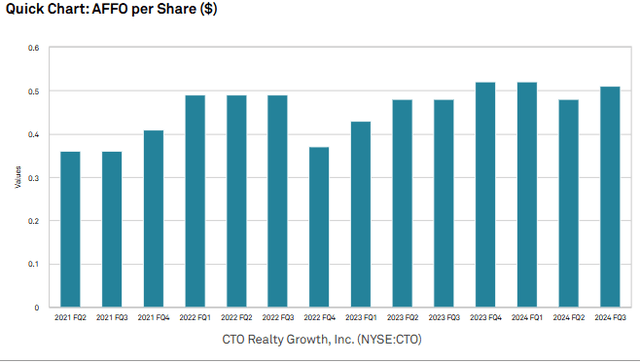

CTO has been growing nicely, with increases in net operating income flowing through to solid AFFO/share gains.

S&P Global Market Intelligence

S&P Global Market Intelligence

While the charts above are up and to the right, there are some lumps due to timing.

Retail leases take a while to commence. Permits need to be obtained. Stores need to be reconfigured. Tenants need to move in.

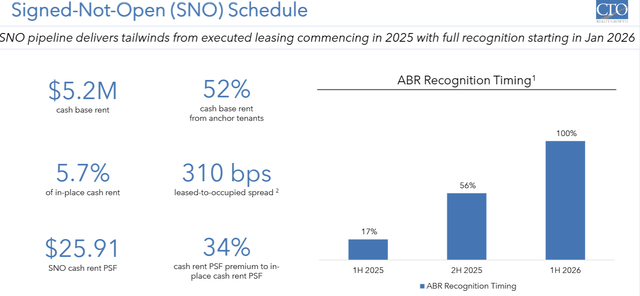

Thus, there is often a three-to-12-month gap between lease signing and commencement. CTO currently has $5.2 million annual base rent in contracts that are signed but not yet open, otherwise known as SNO leases.

CTO

As there are 31.84 million shares outstanding, SNO leases represent 16 cents per share in AFFO accretion. These 16 cents per share will start to kick in throughout 2025, but primarily hit earnings in 2026 and beyond. Since only 17% of it is in the first half of 2025, weighted average earnings for the year will largely not include the SNO leases.

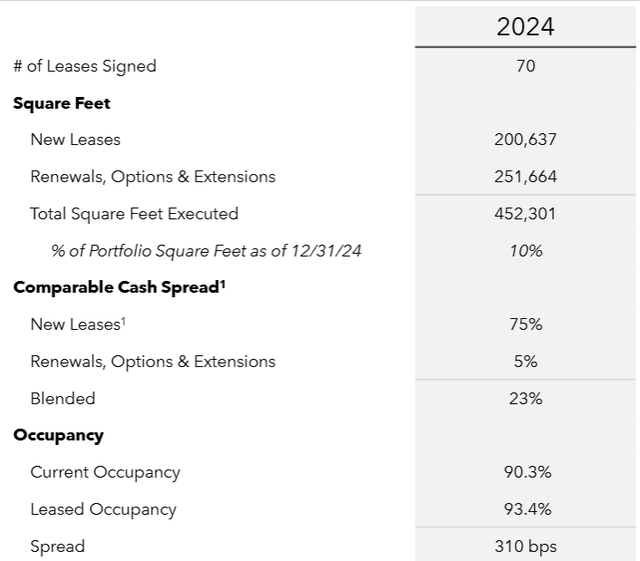

This SNO lease timing issue has been present with CTO for a while. It tends to roll. In 2024, many formerly SNO leases commenced while new leases were signed. Specifically, 70 leases were signed in 2024 encompassing 452K square feet.

CTO

Notably, new leases were signed at 75% higher rent than expiring leases. Blended leasing spreads were pulled down by renewal options which allowed tenants to extend their leases at an average roll-up of just 5%. Overall spreads came in at 23%-plus.

Keep in mind that such renewal options are a relic of a time when retail lease negotiations were tenant-favored. Following the Financial Crisis, retail real estate was oversupplied, so landlords just needed tenants to keep their space open. This allowed tenants to negotiate favorable terms such as renewal options at only minor roll-ups.

Today, retail real estate is undersupplied, so negotiations are more landlord-favored. Tenants generally do not get renewal options of this kind anymore. So going forward, a higher percentage of leases should be signed at the full markup to market rental rates.

Beyond the typical SNO leasing, 2025 features another substantial timing issue: the replacement of bankrupt tenants.

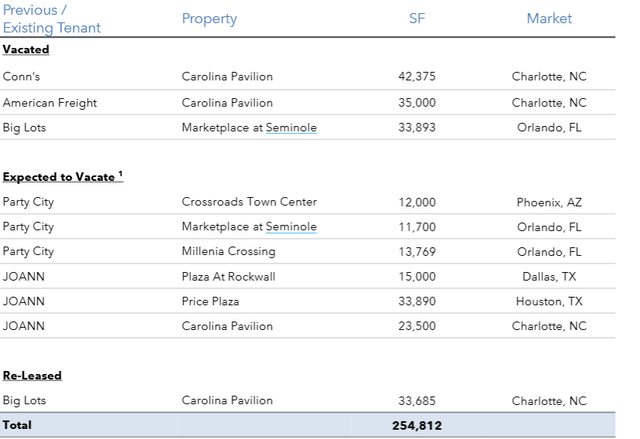

CTO lost the following tenants to bankruptcy:

CTO

In a recent article, we discussed extensively how the bankruptcy of retail tenants is actually favorable for landlords in the present environment as long as the properties involved are well positioned.

The basic idea is that rental rates on existing leases are well below market rates such that bankruptcy of the tenant affords an opportunity to re-lease at the much higher market rate well in advance of the initial lease’s expiry.

John Albright, CTO’s CEO, discussed the tenant bankruptcies on the 4Q24 earnings call:

“Moving to recently announced retailer bankruptcies. Given that all of our impacted leases were for spaces with meaningfully below market rents and embedded value, we have been proactive in working to quickly regain them. Late in the fourth quarter, we successfully worked through the court process and regained four spaces that were occupied by our two Big Lots, one Conn’s, and an American Freight. Furthermore, we are now working on agreements to get possession of our three Party City spaces and three JOANN spaces early in 2025. Notably, we already have LOIs or are negotiating leases with tenants for a majority of these spaces.”

Rather than trying to force the bankrupt tenants to honor the leases and pay rent, CTO is kicking them out as fast as they can to be able to lease the space to new tenants. New leases on this space are likely to be about 50% higher rent per foot. Albright continues:

“Based on current lease negotiations, we currently estimate that potential re-leasing spread for these spaces could be between 40% and 60%. While we are making rapid progress on leases with new tenants, it simply takes time for tenants to obtain permits, complete their build-out and open. Accordingly, we expect rent from new tenants to commence during 2026.”

The former leases of bankrupt tenants listed above paid $2.8 million ABR. That represents about 9 cents per share in lost revenue. Since these properties are to be vacant for the majority of 2025, this resulted in the light 2025 guidance.

I think the market is seeing this as lost revenue. I see it as a timing issue.

Based on negotiations, CTO anticipates signing replacement tenants for these spaces at $4.0-$4.5 million ABR. So, upon stabilization, CTO’s ABR should be about $1.2 to $1.7 million higher than it was with these tenants in place.

CTO guidance assumes the properties are recaptured from tenants in the first quarter, so it’s counting almost no rent from former tenants of these properties in 2025. Guidance assumes new leases commence in 2026, so it is assuming no rent from future tenants in 2025.

Stabilized run-rate AFFO/share (beats consensus by 13 cents)

There are two significant portions of earnings that should be present in 2026 and beyond but not 2025.

- SNO leases – $5.2 million ABR.

- Replacement tenants for kicked-out tenants $4.25 million ABR.

In combination, that suggests that stabilized ABR should be $9.45 million higher than 2025 ABR. That’s 29 cents per share.

As such, we calculated CTO’s stabilized run rate AFFO/share at $2.24. This is well above 2026 consensus estimates of $2.11.

The higher stabilized AFFO is enabled by CTO’s stellar leasing activity in 2024 and the ongoing leasing activity at market rates.

Why are market rents so high for CTO’s properties?

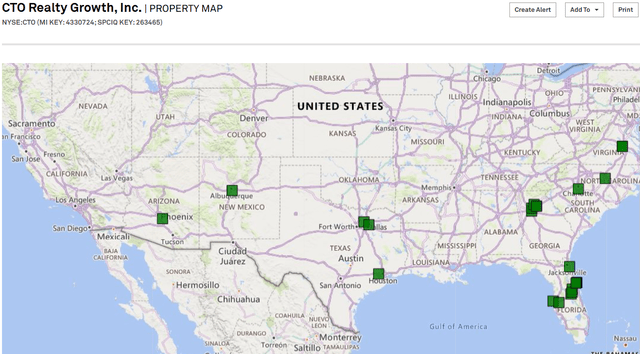

CTO’s shopping centers are in Atlanta, Phoenix, Dallas, Tampa, Daytona Beach and other high-growth Sunbelt markets.

S&P Global Market Intelligence

For other types of real estate, these markets are high growth and high supply.

Multifamily rents, for example, are expected to come in roughly flat in 2025 for these markets because the rapid job and population growth is being balanced out by a large wave of newly constructed apartments. The same could be said for industrial properties.

Shopping centers benefit from the same demand drivers of population and job growth, but have uniquely low supply. There has been virtually no new net supply of shopping centers in the U.S. since 2009.

As such, the sector has higher demand with minimal supply growth resulting in higher occupancy and higher rental rates.

CTO’s five-mile catchment areas average 203,000 people and $143,000 average household income. Retailers want access to densely populated affluence, so they’re paying premiums to locate in CTO’s centers.

Willing to wait

Given the timing of lease commencements, it will likely take until mid-2026 for CTO’s run rate AFFO/share to hit $2.24.

With a market price of $18.85 that’s an extremely cheap valuation, and with an 8% dividend yield, I’m happy to wait for the contracted ABR to kick in. Just as CTO sold off when the headline AFFO came in weak, I suspect the price will rise when AFFO grows on lease commencement.

Read the full article here