Curtiss-Wright Corporation (NYSE:CW) expects double digit FCF growth for the year 2023. I am optimistic about the impressive M&A strategy, the diversification of the activities, and market expectations. In my view, further new long-term contractual relationships signed by Curtiss-Wright will most likely drive investors’ interests, which may draw the attention of more investors. I did identify risks from dependency on government agencies and perhaps lack of technological innovation, however I believe that the stock price could trade at a higher price mark.

Curtiss-Wright: Diversified Activities And Significant International Exposure

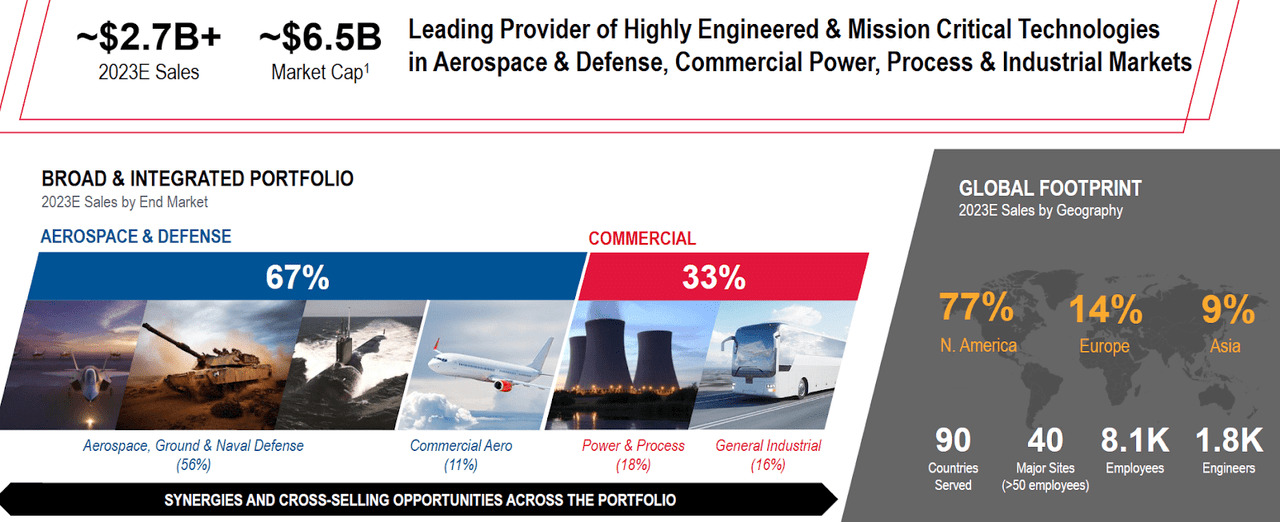

Curtiss-Wright is an international business that provides its customers with highly engineered solutions, products, and related services. The clients belong mainly to the field of the aerospace and defense industry as well as other markets with complex technological needs. At present, the company is devoting energy to achieving portfolio diversification that allows it to adapt to economic cycles.

Source: Investor Presentation

The presence of the company is determined by making strategic decisions to preserve and increase the company’s position in the market as well as to sustain recognition for its trajectory. Curtiss-Wright was part of some crucial innovations in different industries, such as still being with the name of Wright Brothers of the first manned flight in history, having a presence in the development of the first nuclear warship, and participating in the construction of the first power plant of its kind in the United States.

With these precedents and a current moment characterized by the change in business perspectives given by technological development and innovation, the company has its forces to achieve highly effective and safe products for very specific niches as well as to continue the commercial relationship with the original manufacturers of the aerospace and power generation industries.

The company’s operations are divided into three business segments: aerospace and industrial, defense electronics, and power and nuclear power. For this, it has several manufacturing facilities in the United States and some facilities in the international field in Mexico, Canada, and the United Kingdom.

The first of these segments has, as its main clients, companies from the aerospace trade and in some cases from the defense industry. Among the products we can find special devices and devices for driving airplanes as well as electronic products such as sensors, regulators, automators of flight conditions, and technological surfaces.

Even having long commercial relationships with leading companies in the commercial sector, this segment is highly dependent on the conditions of the economy in general, due to the consumption of the population destined for this industry, and the needs of companies to review or expand their fleets as well as to carry out investments in this regard.

The defense electronics segment is mainly oriented to the US defense industry and to a lesser extent to the aerospace trade. Products include in-flight communication technologies, highly complex integrated systems, instruments for test flights, and stabilizers among others. The flow of operations in this segment is highly linked to government decisions regarding investment or needs in the aerospace industry. In this sense, Curtiss-Wright has managed to maintain relations and agreements with certain institutions that allow it to maintain an active presence in some platforms with specific purposes, such as land or air vehicle platforms, or both nuclear and non-nuclear submarines. In the past 10 years, the company has actively participated in more than 320 platforms, taking part in more than 3,000 development or equipment programs. Sales are typically carried out through contractual obligations with government entities as opposed to the common sales channels through which their prior segment profits are earned.

Lastly, the nuclear and non-nuclear energy generation segment markets mainly with the naval defense industry and the energy market. The company manufactures, develops, and sells turbines, high-density engines, valves, and related services in ship repair. It also offers integrated modulation or ventilation systems as well as application-specific technological developments on specific products.

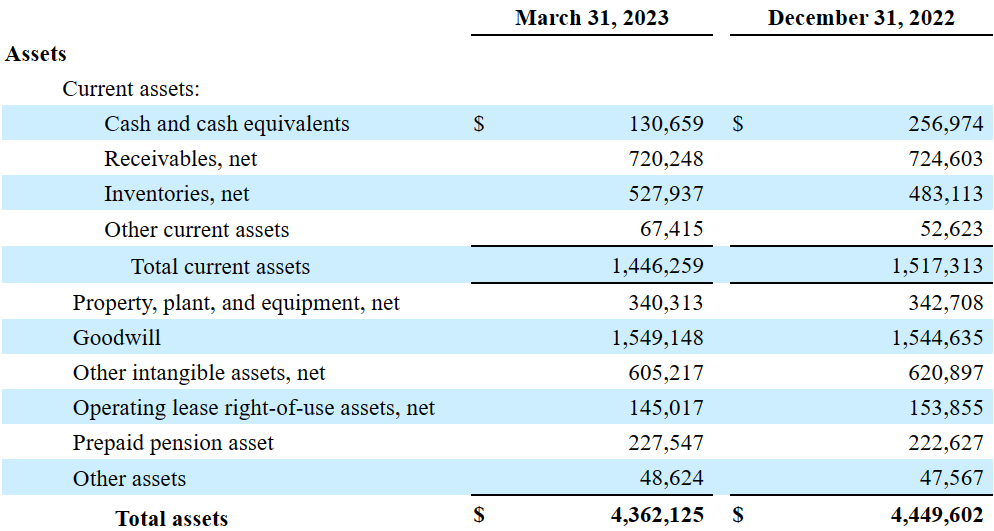

Balance Sheet

The last quarterly report included a small reduction in the total amount of assets and liabilities driven by reductions in cash, operating lease-right of use assets, and accounts receivable. The list of liabilities also decreased due to reductions in deferred revenue, deferred tax liabilities, and accrued expenses. I do not think that the evolution of the balance sheet would be appreciated by investors.

As of March 31, 2023, the company reported cash and cash equivalents worth $130 million, accounts receivables of $720 million, inventories worth $527 million, and total current assets of about $1.446 billion. Also, with property, plant, and equipment of $340 million, goodwill close to $1.549 billion, and prepaid pension asset of $227 million, total assets stand at $4.362 billion.

Source: 10-Q

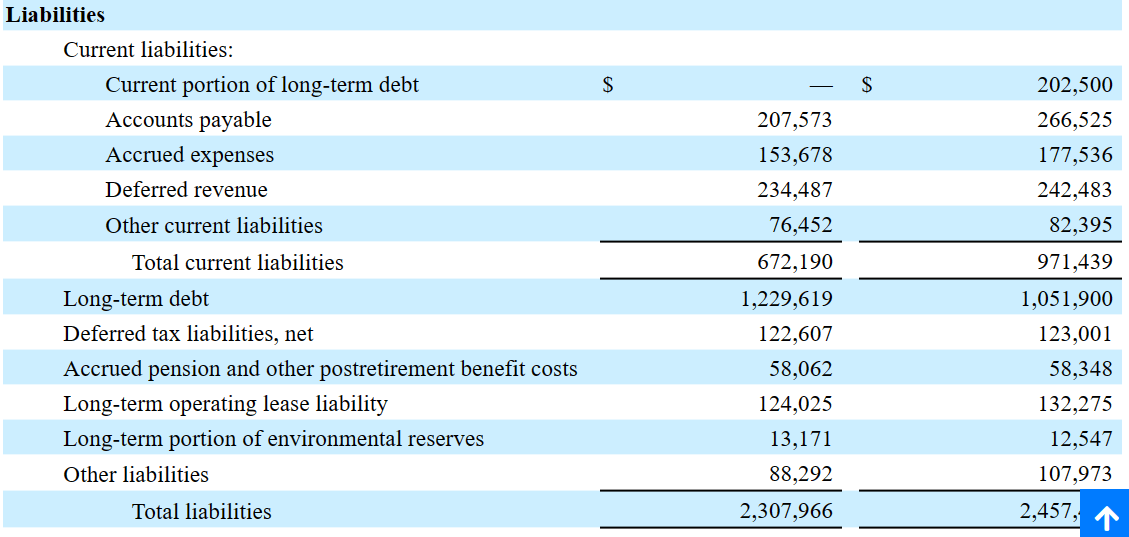

Also, with accounts payable of about $207 million, accrued expenses worth $153 million, and deferred revenue of $234 million, total current liabilities stood at $672 million. The balance sheet also included long-term debt of $1.229 billion, accrued pension and other postretirement benefit costs of $58 million, and long-term operating lease liabilities close to $124 million. Total liabilities would be close to $2.307 billion.

Source: 10-Q

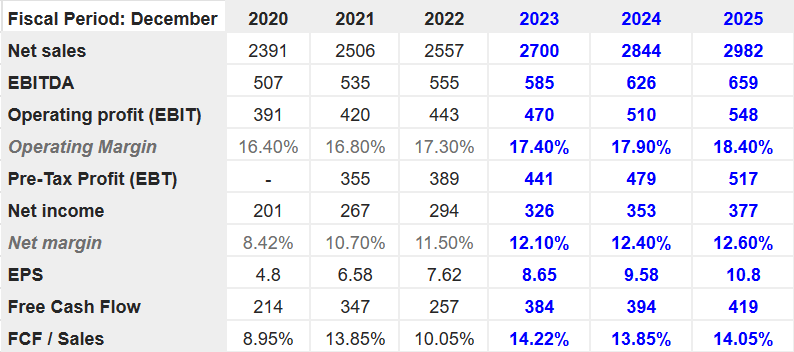

Market Expectations

I believe that readers will be interested in having a look at the expectations of other analysts. In this case, I think that the expectations are beneficial as they include net sales growth, operating profit growth, and net income growth.

Market expectations include 2025 net sales close to $2.982 billion, 2025 EBITDA of $659 million, operating profit of $548 million, and operating margin of about 18.4%. 2025 net income would stand at $377 million, with an EPS of $10.8 million, 2025 FCF of $419 million, and FCF/sales of 14%.

Source: Marketscreener.com

My Financial Model

Under the assumptions in my financial model, I assumed that revenue growth and FCF margin stability would most likely come from diversification of its product portfolio as well as the long-term contractual relationship Curtiss-Wright maintains with its customers.

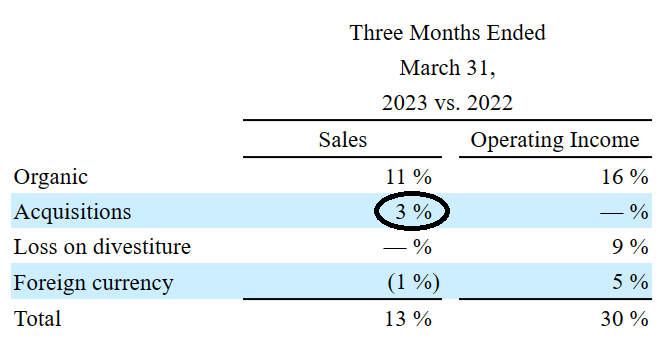

I also believe that shareholders will enjoy the growth in the short term driven by both organic and inorganic sales and the acceleration of these through more direct channels with its customers. Besides, I assumed that the recent success in its operating platform will most likely allow allocation of significant resources to research and development and perhaps new future acquisitions. In this regard, I would draw the attention to the inorganic growth reported in the last quarterly report. The company seems to obtain inorganic net sales growth in most quarters.

Source: 10-Q

In my view, if investors believe that new cash from sale of assets will be coming to the balance sheet, they may buy more shares. As a result, the cost of capital may decrease, which may have a positive impact on the stock valuation. In the last quarterly report, we saw one sale of assets in Germany.

In January 2022, the Corporation completed the sale of its industrial valve business in Germany for gross cash proceeds of $3 million. The Corporation recorded a loss of $5 million upon sale closing during the first quarter of 2022. Source: 10-Q

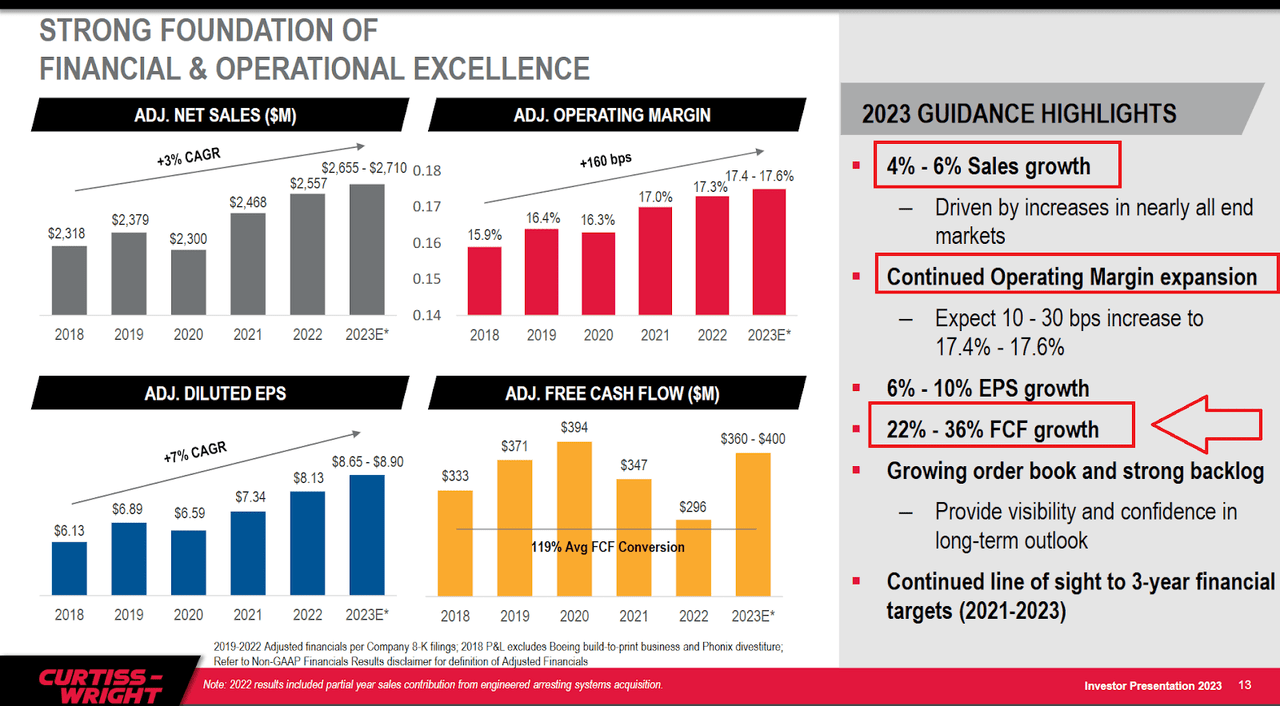

Under my DCF model, I also assumed that future sales growth would be approximately close to what the company reported in its 2023 guidance. I am referring to 4%-6% sales growth and 6%-10% EPS growth. It is also worth noting that management believes that 22%-36% FCF growth could be achievable. In my view, further order book growth and backlog growth would serve as the drivers of future business expansion.

Source: Investor Presentation

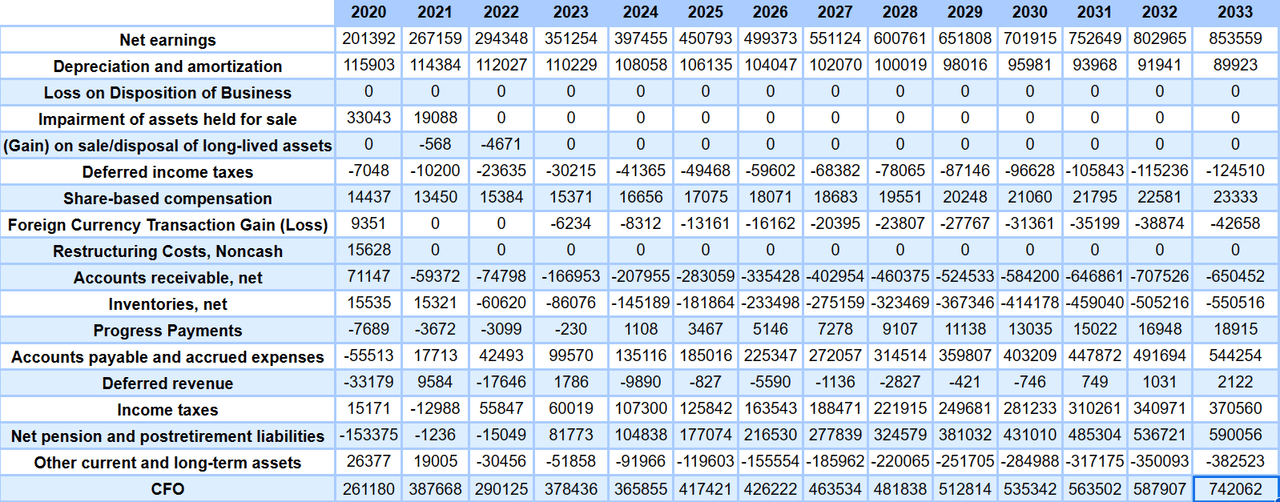

My financial model would include net income growth, CFO growth, and FCF growth. I did not take into account the calculation of the FCF gains from disposition of assets, goodwill impairments, or restructuring costs.

2033 net earnings would stand at $853 million, with depreciation and amortization worth $89 million, deferred income taxes of about -$125 million, and share-based compensation close to $23 million.

Also, with 2033 changes in accounts receivable of about -$651 million, 2033 changes in inventories of -$551 million, changes in accounts payable and accrued expenses close to $544 million, and changes in the net pension and postretirement liabilities of about $590 million, 2033 CFO would be $742 million. If we assume 2033 capex of -$5 million, 2033 FCF would be $737 million.

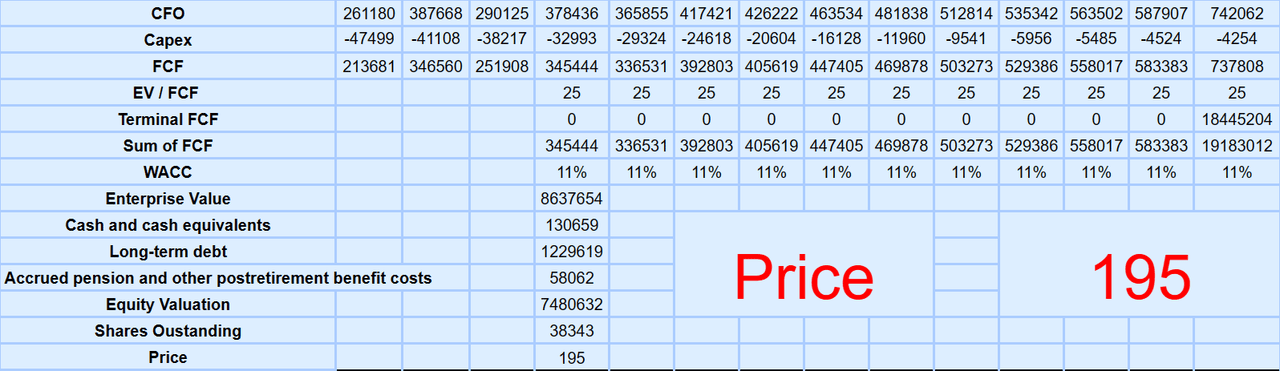

Source: DCF Model

If we assume an EV/FCF close to 25x and a WACC of 10.5%-11%, the enterprise value would stand at $8.63755 billion. Besides, if we add cash and cash equivalents worth $130 million, and subtract long-term debt of about $1.229 billion and accrued pension and other postretirement benefit costs close to $58 million, the equity valuation would be $7.4855 billion. Finally, the fair price would be close to $195.55 per share.

Source: DCF Model

Competitors

Curtiss-Wright maintains commercial relations with state agencies, and some of these contracts are secured in the long term. With that, the negotiation of other contracts sometimes includes other companies in the sector, which are not numerous and maintain great access to resources and infrastructure capacity. Competitors with more resources may have more advantages than Curtiss-Wright when signing new contracts.

I also believe that the development of technology for increasingly specific products opens the door for new companies to participate with low conditions in the markets. This also applies to the segment for the aerospace industry. The company also lives with the eventual sufficiency that some companies or agencies have to cover their own manufacturing or repair demand.

Risks

In addition to the logical operational risks that exist for Curtiss-Wright due to the nature of its business, we must highlight that for all its segments, the ability to scale or expand sales and activities depends on the success of its customers and their demand for growth. This factor, added to its great dependence on sales with the United States government agencies, is one of the points where I think it is necessary to stop to take a perspective of the real growth capacities towards the future. Although the relationship with these agencies undoubtedly provides a consistent channel of activities, it can eventually become a limitation in the event that the company fails to conduct its investigations with the technological standards of private markets.

I would also be afraid that the inability to maintain the technological standard and functionality of its products could have great consequences with regards to future contract assignments and the attraction of new clients. To this dependency on government agencies must be added the dependency on companies in the commercial aerospace sector and, ultimately, the dependency on the development of this sector, which in turn is conditioned by the global economic situation.

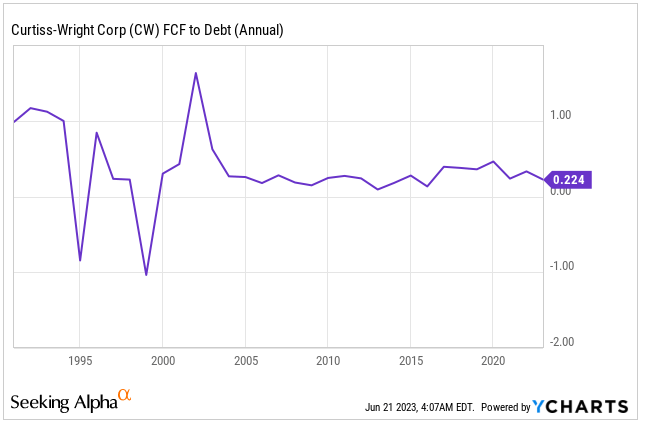

Considering the stability of the industries in which Curtiss-Wright operates and its long term business history, I am not really afraid of the risks from the debt. With that, I think that many investors out there would be a bit afraid of the total amount of debt.

Source: YCharts

My Takeaway

Curtiss-Wright presents great credibility in its track record, maintaining top-of-the-line quality and safety standards, and a sustained business activity that is focused today on delivering immediate returns to its shareholders. I believe that the recent sale of assets in the last quarter, the impressive guidance given for 2023, new acquisitions, and FCF expectations would be enough to justify a position in the stock. I see several risks from competition, dependency on government agencies, and lack of technological innovation. With that, I believe that Curtiss-Wright stock could trade at a higher mark.

Read the full article here