Background

The housing market has, for the last two years, largely confounded investors and economists with its resilience. It was largely thought that a rising interest rate environment would dampen housing prices: that hasn’t happened. It was thought that rising inflation would eat away at demand for homes as Americans delayed moving: that also hasn’t happened.

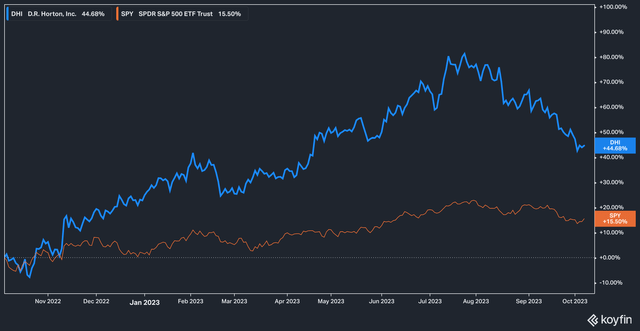

Indeed, it seems that almost every emerging macro trend has made home builders stronger, rather than weaker. Consider the chart for home building giant D.R. Horton (NYSE:DHI):

DHI vs SPY, 1 year (Koyfin)

Over the past year the stock has handily beaten the S&P 500 (SPY) on a total return basis, generating a 44% return for investors. From its peak on July 25th, however, the stock has fallen roughly 20% as fears of higher-for-longer interest rates and the general sense among investors that consumers won’t be able to keep up their frenetic pace of buying bubble to the surface.

We contend, however, that this recent drop presents a buying opportunity, and that the structure of the market at the most basic supply/demand level are long term positives for D.R. Horton. Let’s dive in!

Homes For Sale

On the supply side of the housing market, the biggest problem is that, well, there isn’t much supply. Sales of existing homes have slowed to a snail’s pace, and it isn’t difficult to understand why. Here are two of the largest reasons for lower supply levels in the used-housing market:

- The majority of homeowners today are sitting on lower interest rate mortgages. Moving would mean finding a new home and (presumably) getting a new mortgage at a much higher rate. This is obviously unattractive unless someone has to move.

- Members of the Baby Boomer generation are opting for starter houses or staying in their current homes longer in an effort to stave off having to live in retirement homes or communities. Given the larger share of wealth held by Boomers as opposed to younger home buyers (Millenials and Gen-X, mainly), this is a powerful market force.

With used houses being difficult to come by, new homes are the obvious alternative, and D.R. Horton is the largest homebuilder by volume available for this pool of buyers.

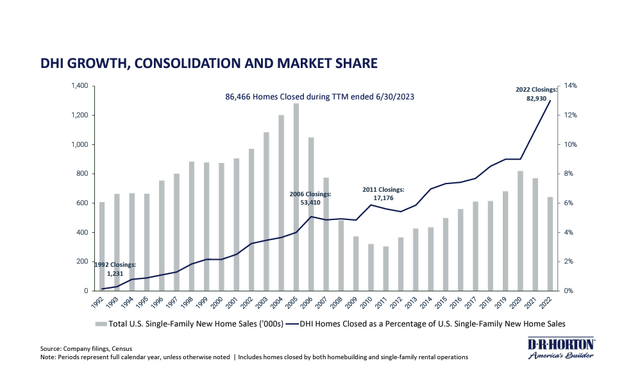

DHI Market Share (Investor Presentation)

It’s not difficult to see how dominant D.R. Horton is in a fractured marketplace. The above chart, which goes back to 1992, shows that the company’s management has adroitly managed the company’s growth: D.R. Horton didn’t even experience a drop off in a percentage of closings against all home sales during the housing bubble of 2008 (the absolute number fell between 2006 and 2011, of course, but this was due to macro issues outside of the company’s control), and the company is now responsible for roughly 13% of all new family home sales nationally as of 2022.

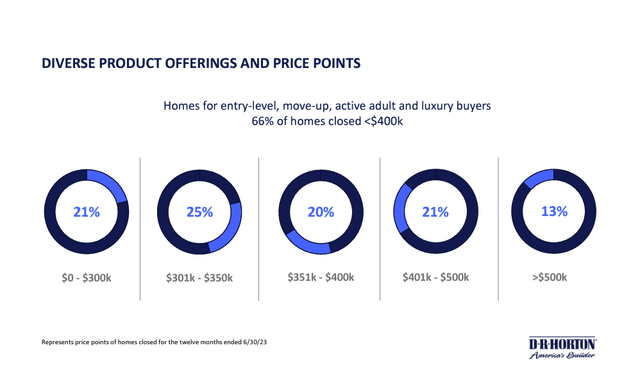

D.R. Horton Price Points (Investor Presentation)

The company has also done a good job of staying attuned to the pricing attitudes of the market. As interest rates rise, buyers can afford less home. 66% of D.R. Horton’s new homes list for under $400,000 (seen above).

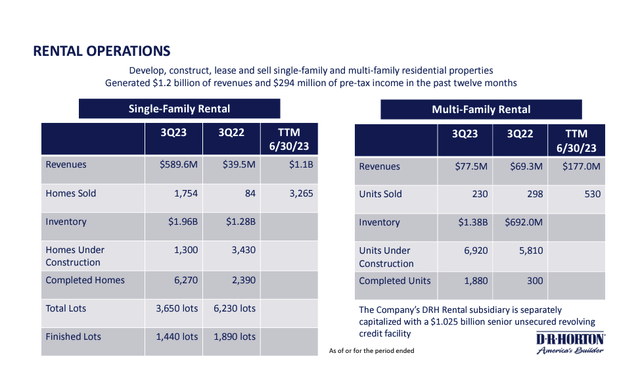

The company has also managed to tap into another pool of buyers with deep pockets: institutions who buy homes en-masse to rent them.

D.R. Horton Rental Operations (Investor Presentation)

In the twelve months ending the third quarter of 2023, the company reported $589 million in revenue from its rental operations, which is tremendously larger than its twelve-month revenue ending the third quarter 2022 of $39 million, but remains only a fraction of the company’s overall trailing twelve-month revenue of $34.6 billion. Management acknowledged in the latest conference call that rental margins are expected to be down in the near-term, but this is not surprising given the combination of higher interest rates and inflation. We think that the expansion of D.R. Horton’s rental business is likely to provide a buffer in the future against difficult times, and also showcases the nimbleness of management and willingness to explore new ways for the company to generate revenue.

Valuation

Homebuilders, taking part in a cyclical business, have never enjoyed premium valuations.

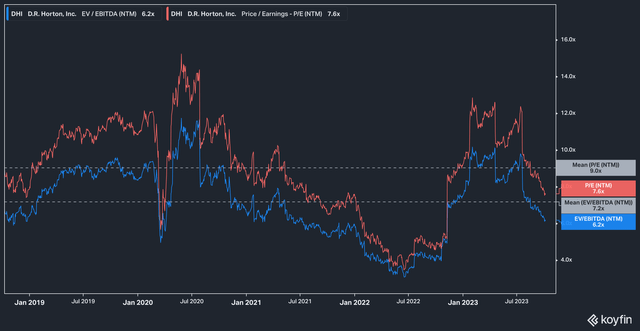

DHI Forward EV/EBITDA and P/E (Koyfin)

On a forward basis, the stock currently trades at 7.6x price to earnings and 6.2x EV/EBITDA. This is below the stock’s five year average of 9x and 7.2x, respectively, which is a positive sign to us in that the run-up in price (and recent pullback) has not pulled the stock into the upper bounds of historic valuation.

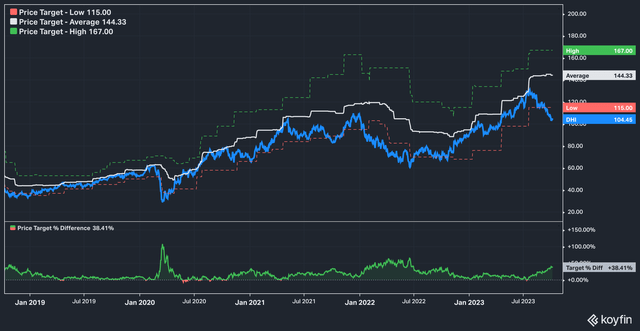

DHI Analyst Price Target (Koyfin)

Analysts price targets are also comfortably above current levels, with no downward revisions to targets since 2022. As it stands, today’s current price sits 38% below the median price target of $144.33.

The Bottom Line

While it is not surprising that D.R. Horton’s stock has tumbled in the last three months, we think that the headwinds it faces are largely temporary, and the fact that valuations remain below five-year averages supports the idea that the stock may have room to resume its upward momentum when they pass. Risks to our thesis include a stronger-than-expected U.S. recession, as well as further extensions of higher-for-longer interest rates.

Read the full article here