Introduction

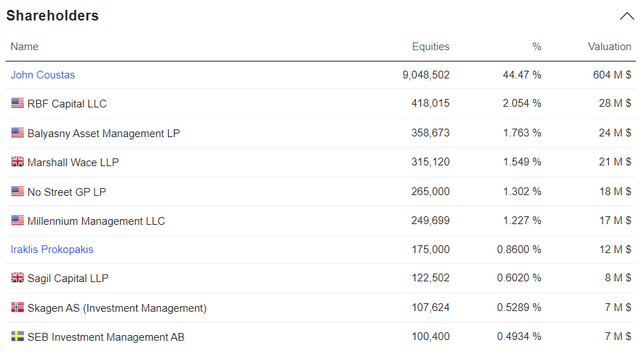

Danaos Corporation (NYSE: NYSE:DAC) is an ocean freight company that owns and operates container vessels. The company is Cyprus-based with a fleet of 68 container vessels ranging in size from 2,200 TEU to 13,100 TEU. Danaos has a long history in ocean freight operations since 1963 and one could call the company a family business as the largest shareholder, with 44.47% ownership, is the son of the original founder of the company. To understand the size of the company the balance sheet stands on a 5-year average of approximately $3 billion and revenue on a 5-year average of $610 million. However, revenue is volatile as freight rates for the whole industry change drastically on an annual basis.

Danaos ownership structure (Marketscreener.com)

Investment thesis

The investment thesis for Danaos Corporation stands on low leverage and high dividend. Low leverage decreases risks and high revenue backlog increases the chance for dividends in the future. In addition, the company stock price has been in positive momentum over the last 6 months, which increases potential return.

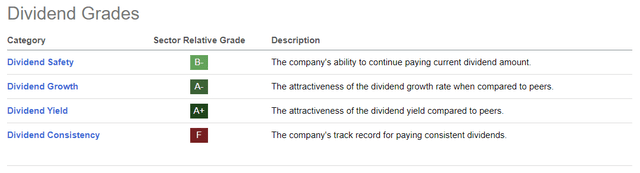

Let’s discuss dividends first. The overall Seeking Alpha dividend grade for Danaos Corporation is a bit two-sided. Dividend growth and yield are relatively good while dividend consistency is not so great. Trailing 12-month dividend growth stands at 20.00% and the TTM dividend yield is at 4.39%. The dividend consistency is rated F because the company started continuous dividend payments only in mid-2021. There is no guarantee that the company will continue the dividend payments on a current cycle.

Danaos Corporation dividend grades (Seeking Alpha)

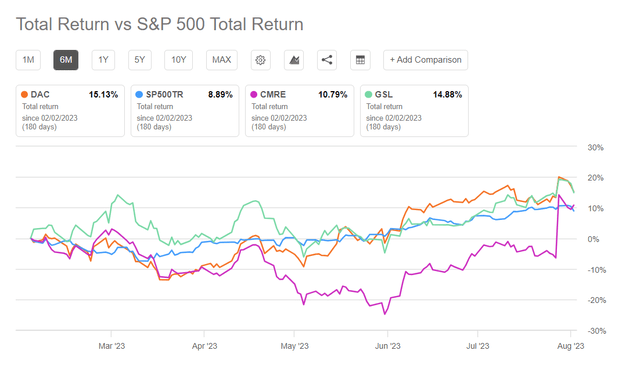

Secondly, let’s discuss the momentum behind Danaos’ stock price. Seeking Alpha’s Quant gives B- rating for Danaos price momentum. In my opinion, this is still relatively good and price development indicates an uptrend. The stock price has increased by 15.13% over the last 6 months which exceeds the return on SP500 and two main competitors. Good momentum may continue with the bull market.

Total return vs competitors (Seeking Alpha)

Leverage

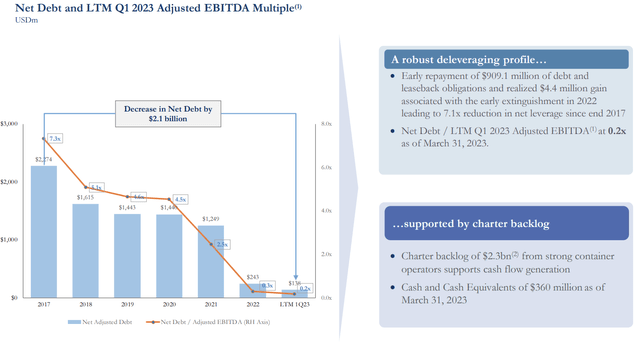

Danaos leverage (Danaos Corporate presentation)

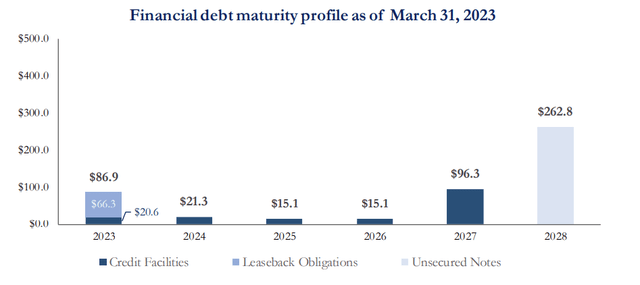

Danaos Corporation has been successfully deleveraging its balance sheet since 2017. These efforts decrease investors’ risks related to the company’s ability to pay dividends. Overall the company has paid back loans by $2.1 billion since 2017 and net leverage stands at 0.2x at the end of Q1 2023. A major takeaway for Danaos investors is the company’s ability to allocate future excess cash flow to dividends because cushions for debt payments are not needed. I think The maturity profile for debt is also good from a dividend investor perspective. The next major debt repayment will be as late as 2027, which improves the company’s ability to pay dividends.

Debt maturity profile (Danaos Corporation presentation)

Revenue Backlog

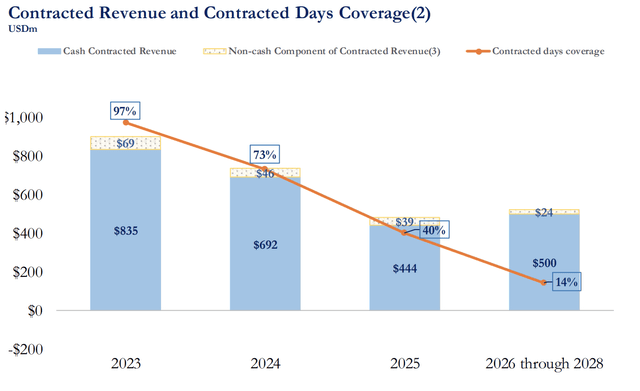

Contracted revenue (Danaos Corporation presentation)

Danaos has a strong overall revenue backlog standing at $2.3 billion. For 2023 the majority of days (97%) have been contracted as of March 31st, with expected cash revenue of $835 million. Also, 73% of 2024 days are signed with expected revenue of $692 million. If Danaos is able to contract 2024 with similar charter rates that it has done for now, investors can expect revenue to stand at $947 million for 2024. However, it is extremely challenging to estimate what kind of charter rates the company will be able to close. From the development of charter rates for container ships, we can see that the major decline in freight rates has stopped and a gradual increase has begun. Price development may indicate that Danaos could be able to negotiate freight rates at similar levels which are already closed for 2024. The main takeaway from the strong revenue backlog for investors is that the company has already closed a significant portion of its future topline. This creates a safety cushion for investors and decreases risk related to future revenues.

Valuation

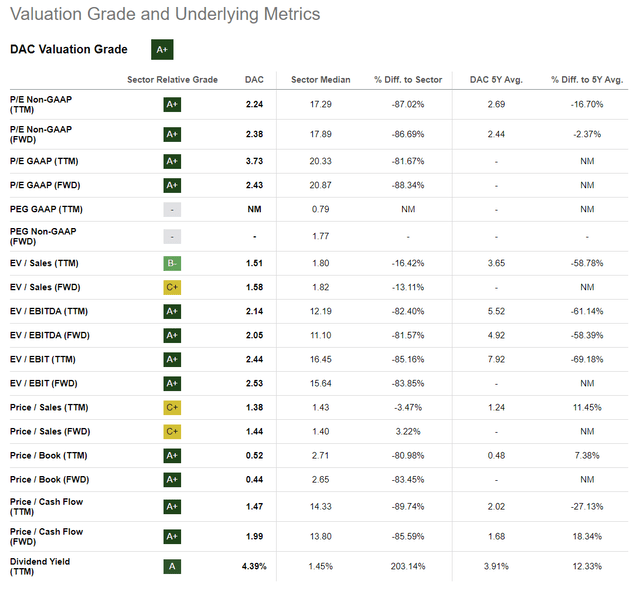

Danaos Corporation valuation grade (Seeking Alpha)

From a valuation perspective, Danaos Corporation looks cheap. Seeking Alpha’s Quant gives an overall valuation grade of A+ for Danaos Corporation. The price-to-book ratio stands at 0.52 which means that the market capitalization of the company is only 52% of the total balance sheet value of the company. The total market value for Danaos stands currently approximately at $1.39 billion and as of 31st of March 2023, the total book value for its vessels was $2.70 billion.

From an income statement perspective, Danaos’ profitability is also on an attractive level. The trailing 12-month price-to-earnings ratio is at 2.24. This means that the company is able to make profits to cover the whole market value only in approximately two financial years. Overall valuation seems attractive for investors interested in container vessel owners. However, investors must remind that container shippers and other ocean vessel owners have enjoyed one of the most profitable years in 2021 and 2022 since the great financial crisis. These inflated profits potentially shift traditional valuation ratios to look better than they really are.

Risks

Investors must take into account multiple risks while evaluating Danaos Corporation as an investment. We highlight major risks below but investors must remain that the risks are not limited to these.

The first challenge for Danaos is to keep up its profitability and free cash flow. As mentioned earlier, container ship owners have enjoyed periods of extremely high charter rates that enabled significant profitability for the whole sector. It is not guaranteed that the company will be able to continue similar profitability in the next couple of years.

Topline development for Danaos is driven by the demand for container shipping, which is correlated with global GDP development. Luckily OECD estimates that the global GDP will be growing between 2023 and 2024 which potentially helps Danaos to maintain its revenue.

The profitability is driven by the development of operating expenses. High-inflation environment pushes operating expenses higher which makes it harder to maintain profitability in the future. According to OECD, global inflation would slow in 2024 but remains still above 4%. This means that the cost structure of Danaos will still remain under pressure.

Global geopolitical tensions also create uncertainty for Danaos’ operations. Especially relationships between the West (US and EU) and China are important for container vessel owners. The US-China relationship has been developing positively lately but the direction may change which is a potential issue for Danaos.

Conclusion

In conclusion, Danaos Corporation is a company with low leverage and a strong contracted revenue basis for 2023 and 2024. Investors looking for exposure in container vessel owner that has strong potential for strong dividend payments may find a good candidate out of Danaos Corporation. Positive price momentum, low leverage, and strong operational history make Danaos Corporation a strong buy for medium- to long-term hold.

Read the full article here