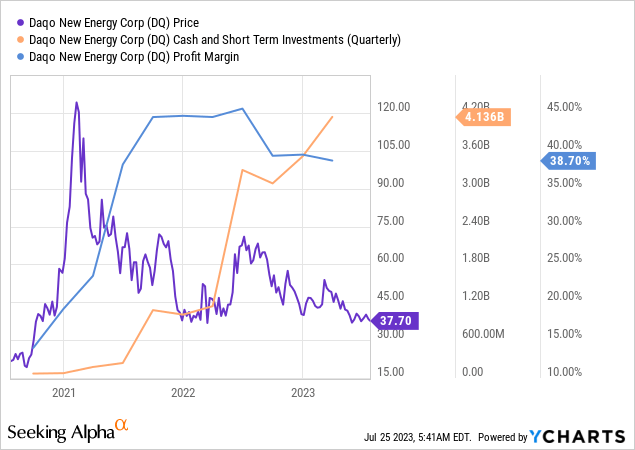

Daqo New Energy (NYSE:DQ) has been trading sideways for the last two years. Back in 2021, investors thought that polysilicon prices hit the top of the cycle and started to sell their quick earned profits. Little did they know that polysilicon prices could remain resilient till the beginning of 2023. The company’s profit margins were extremely high and the cash and short term investments have now exceeded the market cap of the stock, even when subtracting all liabilities.

In the last few months polysilicon prices have been crashing close to all-time lows. As a result, more selling pressure has been put on the stock as investors fear lower profit margins. However, Daqo New Energy’s balance sheet has never been so strong. The windfall period made it possible to expand capacity without taking on massive debt. The next few months might be period where Daqo can regain market share as new entrants quit and small players exit their expansion plans in polysilicon business.

Polysilicon Prices

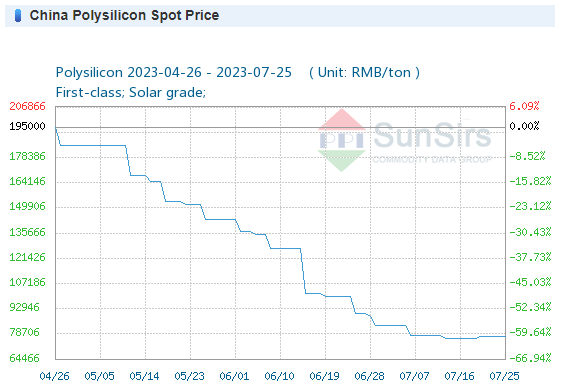

Polysilicon prices have dropped for a combination of reasons. First reason is the capacity expansion of multiple polysilicon manufacturers, that has created more supply than demand. Further, wafer manufacturers had an inventory glut of polysilicon, due to limited supply of high-purity quartz, leading to even less demand. Lastly, Daqo New Energy mentioned in the latest earnings call that they would decrease their stacked inventory, what probably flooded the market and had effect on the prices.

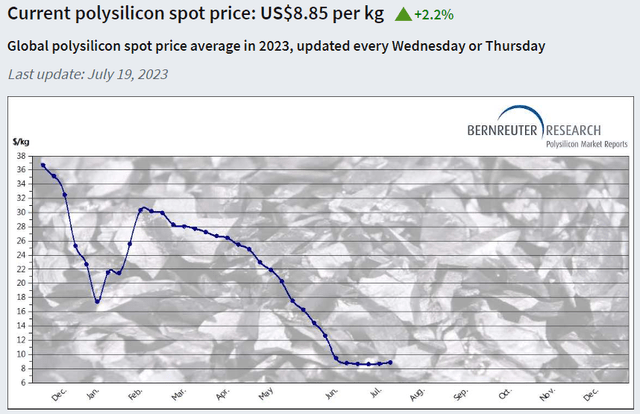

However, prices are stabilizing and could regain positive momentum towards to end of the year. Decreases in polysilicon prices will eventually lead to lower solar panel prices and consequently could stimulate to more demand for solar panels. Solar panel makers have a lot of expansion plans running creating again more demand for polysilicon. Additionally, two polysilicon manufacturers have already stalled their expansion plans: Dongli PV in Inner Mongolia (48,000 MT) and a new entrant Baofeng Silicon in Gansu province (50,000 MT). Further, Bernreuter mentioned:

Three Chinese manufacturers with high production costs have already suspended operation due to losses, and even leading suppliers are said to have stopped shipments now.

Keep in mind that the graph of Bernreuter does not exclude the currency exchange. Daqo sells most polysilicon in China, so the prices do not need to be converted to USD. Therefore, I like the graph from SunSirs more, which shows the first slight gain in polysilicon prices happened only since last week.

Bernreuter SunSirs

Q2 Earnings Preview

Daqo New Energy will report earnings on August 3 for the second quarter of 2023 ended June 30. I expect Daqo to remain highly profitable for Q2. April saw prices of polysilicon between $22-27/kg, May $9-22 and June $9. The average total production cost last quarter was $7.55/kg.

To estimate bear and bull cases we have to look at the polysilicon volume the company is planning to sell. Daqo is planning to reduce inventory to 5,000 MT, meaning shipments need to be around 60,000 MT.

For the bear case I will take an average selling price of $12/kg and assume total production cost has remained the same. This would result into revenue of $720 million ($12 * 60,000,000) and earnings of $267 million (($12/kg – $7.55/kg) * 60,000,000).

For the bull case I will take an average selling price of $18/kg and assume total production cost has remained the same. This would result into revenue of $1.08 billion ($18 * 60,000,000) and earnings of $627 million (($18/kg – $7.55/kg) * 60,000,000).

The bear case would result in a slight decrease in net income compared to Q1 and a slight increase in revenue. The bull case would lead to a large increase in net income compared to Q1 and a decent increase in revenue QoQ.

Since 20,000 MT of the polysilicon was already signed in contracts in April I think we are far from the bear case and might even exceed the bull case. Also, considering that Daqo sells more higher quality N-type polysilicon the difference in spot prices we see on the graphs can differ from the prices Daqo is selling polysilicon at. In both cases, the company is highly profitable and will further increase their cash balance sheet.

Valuation

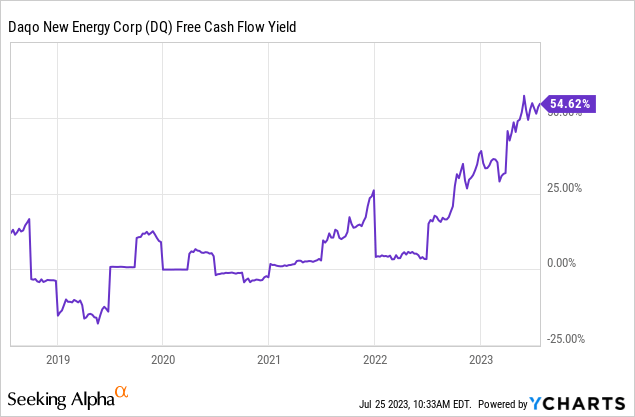

At the current prices, you can buy Daqo New Energy for an unheard of free cash flow yield of 54%. This showcases the high profitability the company is carrying.

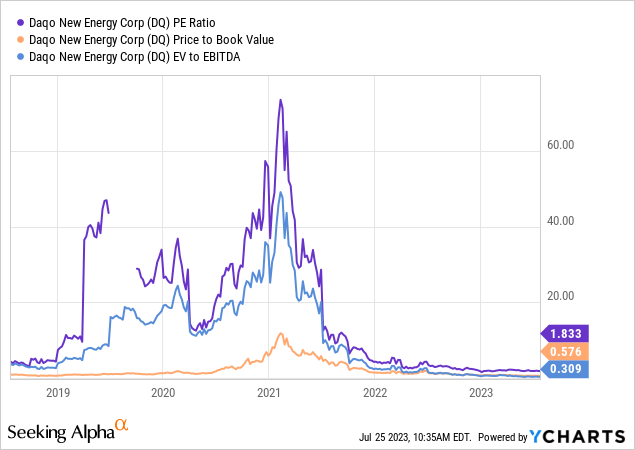

Historically, the company is trading at all-time low valuations with a price-to-earnings ratio of 1.8, a price-to-book value of 0.57 and an enterprise value-to-EBITDA of 0.309.

Of course, profitability will take some hits in the coming quarters, but not as much as investors are assuming in my opinion.

Balance Sheet

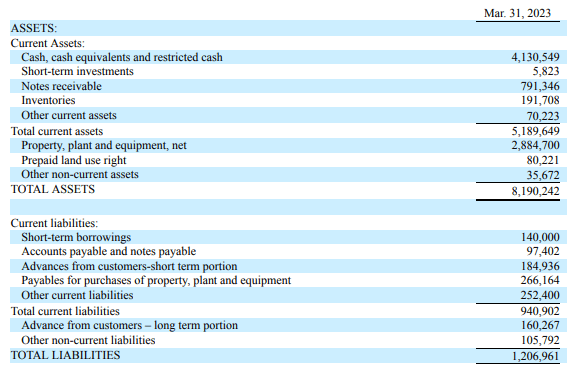

The balance sheet is a fortress and the strongest I have seen so far in my investing journey. Cash and cash equivalents are at $4.1 billion, which is more than the stock is currently trading at (market cap: $2.9 billion). Daqo has an exceptional current ratio of 5.52. This could be even higher if we exclude the advances from customers that are temporarily seen as a liability.

SEC filing

The company started a buyback program of $700 million and has still $615 million left for buybacks. I do not think we are half way the buyback program yet, considering the not so great momentum in the stock. Q2 will reveal more information on this.

Takeaway

The energy transition to renewables is not slowing down at all. The international energy agency goes as far as calling out that annual solar PV capacity additions will increase every year for the next five years. Lower solar module prices will re-accelerate demand downstream and could lead to more positive momentum in polysilicon prices. More so, a slowdown in capacity expansion for polysilicon and further expansion for vertically integrated solar panel makers is a good thing.

In this downward cycle of polysilicon it is important to understand that only the strongest players will survive. Daqo is one of them and can profit from this situation to keep investing heavily in further innovation, cost reduction and higher quality polysilicon. On the other hand, high cost producer and new entrants in the business can only think about survive. Market share gains are definitely a possibility.

Daqo New Energy is still very profitable in both the bear and bull case for Q2. The management is aware of undervaluation and will support stock prices with share repurchases. I still rate the stock a “Strong Buy” and I have added some more shares to my position.

Nevertheless, investor need to keep in mind that Daqo New Energy has been identified by the SEC under the Holding Foreign Companies Accountable Act. This means the company will be delisted by 2024, if they do not show the right auditing under the rules of the United States.

Interested in more? Check out my other articles on DQ:

Daqo New Energy: Underappreciated, Despite Strong Business And Undervaluation

Daqo New Energy: Momentum Is Building Up As Polysilicon Prices Rebound

Daqo New Energy: 18% Share Buyback Should Boost This Net-Net Deal

Read the full article here