While the S&P 500 (SPY) and Nasdaq Composite (COMPQ) are off to their strongest H1 performances in years with year-to-date returns of 14% and 30%, respectively, we’ve seen bifurcated returns across the market. This is evidenced by sectors like Financials (XLF) and Energy (XLE) being taken to the woodshed while several mega-cap tech names have continued to march higher. Fortunately, the restaurant group has evaded the rough start to 2023 that we’ve seen from the Retail Sector (XRT), and Darden (NYSE:DRI) has been one of the top performers, making a new 52-week high and all-time high earlier this month. However, while the stock may have momentum at its back, its lukewarm FY2024 guidance may not be enough to maintain the stock’s bullish momentum, and while it’s been a clear outperformer, it’s hard to argue that there’s any meaningful margin of safety in the stock here. Let’s look at the fiscal Q4 and FY2023 results below:

Olive Garden Menu (Company Website)

Q4 & FY2023 Results

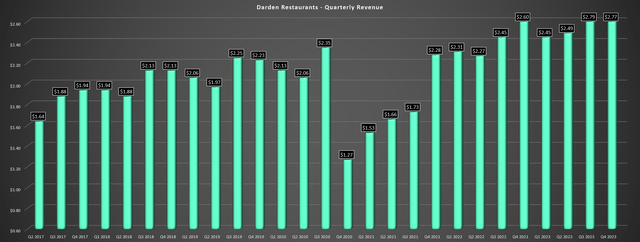

Darden released its fiscal Q4 and FY2023 results this week, reporting quarterly revenue of ~$2.77 billion, a 6% increase from the year-ago period. The near-record sales figure was driven by mid single-digit same-restaurant sales growth (4.0%) and the addition of 47 net new restaurants. And while this figure may not appear that impressive, Darden was lapping record revenue and 14% sales growth from the year-ago period, making it challenging to deliver double-digit revenue growth given the difficult comparisons combined with a more difficult macro environment and a tougher competitive landscape as some brands were more promotional to offset the softer traffic figures. Plus, Darden outperformed the industry benchmark according to same-restaurant sales and traffic according to Black Box Intelligence, helped by strong sales growth from LongHorn Steakhouse and Olive Garden which made up for a slower fiscal Q4 for its Fine Dining and Other segment (Cheddar’s, Yard House, Bahama Breeze, Seasons 52).

Darden – Quarterly Revenue (Company Filings, Author’s Chart)

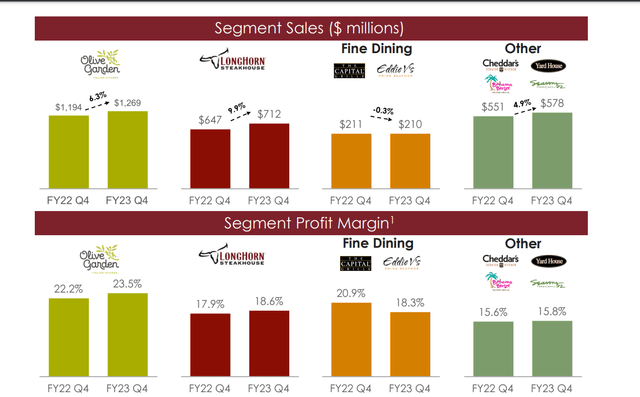

Regarding the marginal year-over-year decline in sales for its Fine Dining segment (The Capital Grille, Eddie V’s), Darden noted that this was partially because of difficult comparisons as it lapped a huge fiscal Q4 (quarter ended March 29th, 2022) following the Omicron surge in early 2022, with Fine Dining up 34.5% year-over-year to ~$210 million in sales. And while we could see another soft quarter in fiscal Q1 2024 as the company laps 107% retention year-over-year (traffic measured by average number of entrees sold per operating week), Darden noted it expects traffic to “stabilize” for the rest of the year. The company also reiterated that it’s not seeing anything concerning from a consumer standpoint even if there was some check management at some of its high-end brands, which could simply be attributed to normalization after some excess in the year-ago period.

Darden – Segment Sales & Margins (Company Presentation)

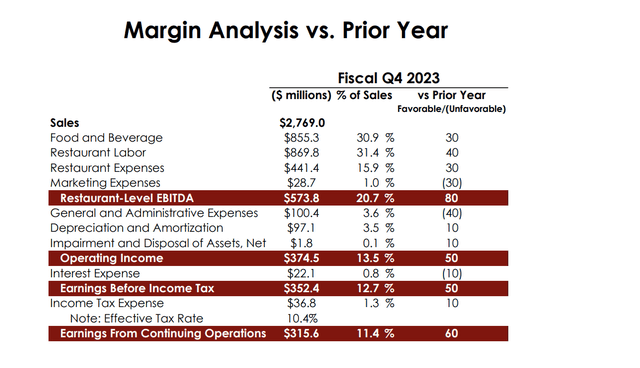

Looking at the results on a full-year basis, Darden reported record revenue of ~$10.5 billion, a 9% increase year-over-year, attributed to 6.8% same-restaurant sales growth and unit growth, ending the period with over 1,900 restaurants. Once again, LongHorn Steakhouse (~29% of total restaurants) was an outperformer with ~7.4% same-restaurant sales growth, with Olive Garden and its Other segment coming in just behind at 6.7% an 7.0% same-restaurant sales growth, respectively. Meanwhile, from a profitability standpoint, Olive Garden and LongHorn Steakhouse both saw a meaningful step up in margins in the period with a 130 basis point and 70 basis point improvement, respectively. This statistic is certainly encouraging amid another quarter of elevated (albeit moderating inflation), with total inflation coming in at 4.4%, down from 7.1% in fiscal Q3 2022.

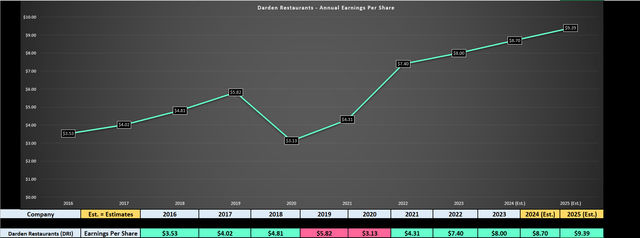

Darden Restaurants – Annual Earnings Per Share (Company Filings, Author’s Chart)

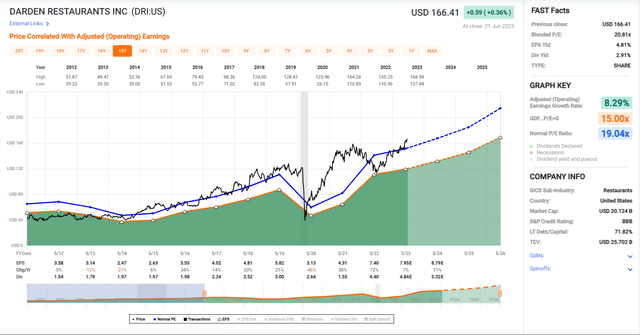

Finally, looking at earnings growth, the company did not see the benefit of its Ruth’s Hospitality Group acquisition in the period given that the deal just closed, but still finished a tough year with rising rates and elevated inflation by delivering above the top end of its revenue guidance (~$10.5 billion vs. $10.4 billion), and hitting the top end of its annual EPS guidance of $7.40 to $8.00. This resulted in just shy of 9% annual EPS growth in FY2023, and the company is guiding for annual EPS of $8.70 at the midpoint in FY2024. And while this will be a record if met, it implies a slight deceleration in annual EPS growth from previous years when including the addition of its recent acquisition, which was completed for cash at a value of ~$700 million. So, although Darden beat sales guidance and met the top end of annual EPS guidance, the outlook was a tad underwhelming.

Industry Wide Trends

Digging into the slightly softer guide, it’s possible that Darden is being a little conservative given that the macro environment remains challenging, and the company certainly has a habit of over-delivering on its promises regarding previous guidance ranges. And while the company will get a benefit from the addition of 154 slightly higher-margin restaurants being added to its system (80 company-owned restaurants / 74 franchised restaurants), we have seen clear evidence of traffic slowing in recent months. In fact, Black Box Intelligence reported that same-store sales and traffic fell for a third consecutive month in April with same-store sales growth of just 1.3%, implying softer traffic and limited check growth when balanced against mid to high single-digit pricing industry-wide. The good news is that Darden continues to outperform despite the tough environment, so while it can’t predict how industry traffic and sales will look, it is confident that it can outperform its category peers.

During FY2023, Darden noted it outperformed its peers by 510 basis points on a same-restaurant traffic basis and 410 basis points from a same-restaurant sales basis.

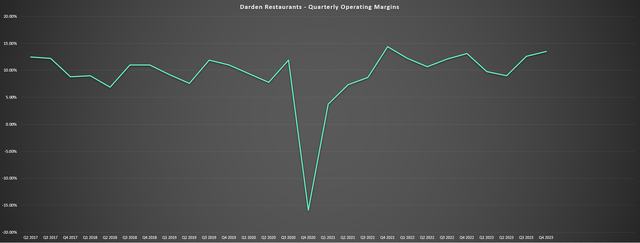

Darden – Quarterly Operating Margins (Company Filings, Author’s Chart)

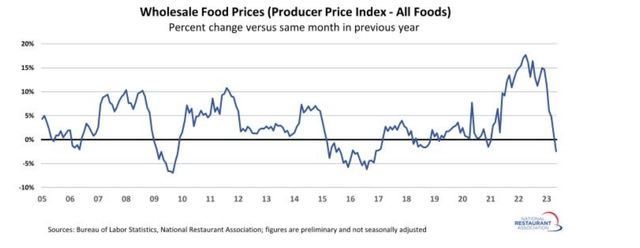

Moving over to inflation, Darden has guided for inflation of 3.5% at the midpoint in FY2024, a material improvement from FY2023 levels. And the industry can finally breathe a sigh of relief after two unprecedented years from a commodity inflation standpoint. In fact, Darden’s fiscal Q4 results benefited from deflation in chicken and seafood and productivity improvements that helped to offset beef inflation. The result was that margins were up year-over-year despite the company pricing conservatively to maintain its value proposition and not turn off consumers that are already dealing with higher costs nearly everywhere they look. And just as importantly, the same was true on a full-year basis, with operating margins up meaningfully vs. pre-COVID-19 levels even with meaningful wage and commodity inflation, helped by G&A efficiencies and reduced restaurant and marketing expenses. And given its Employer of Choice awards at Olive Garden, The Capital Grille and Seasons 52, investors shouldn’t have any issues from a retention standpoint.

Fiscal Q4 2023 vs. Prior Year Margins (Company Presentation)

Digging into the FY2024 outlook, the good news for Darden is that while food & beverage costs rose 380 basis points year-over-year due, the company beat its FY2023 sales guidance in a competitive environment even with lower marketing expenses as a percentage of sales year-over-year, and commodity inflation appears to be heading in the direction. The evidence is in the below chart which shows that wholesale food prices fell for the fifth month out of the past six, a material improvement from persistently worsening inflation last year that made it difficult for many brands when making pricing decisions. Unfortunately, beef prices remained elevated, which affects brands like LongHorn Steakhouse, but it’s an improvement from widespread double-digit inflation. So, while the consumer is arguably weaker as we head into FY2024 with two years of elevated grocery costs, investors can take solace for two reasons:

- Darden is bucking the industry-wide trend, does not plan to be promotional and is sticking to its strategy to not follow other brands regarding material discounting to get traffic in the door

- Commodity inflation should be below 3.5% this year which should take some pressure off Darden’s need to price at well over 5.0% to cover inflationary pressures, which should lead to a slightly more satisfied guest overall if they aren’t having to sit down to noticeable price increases every other occasion yet are still getting the quality food/service they’ve come to appreciate at Darden’s restaurants

Wholesale Food Prices (National Restaurant Association)

The last point worth noting is that although consumers aren’t seeing much relief regarding grocery costs, rent/mortgage costs and overall expenses, we continue to see relief at the pump, with national average gas prices down nearly 30% from $4.96/gallon to $3.58/gallon. And while this may not make up that large of a portion of one’s monthly budget, it is a small and needed win after what’s been a couple of rough years for most consumers. So, if gas prices can remain below $3.60/gallon, this could buoy same-restaurant sales growth for casual dining brands as overall consumer sentiment may not be as bad as it was last summer when the average consumer was getting hit from all angles. That said, even if traffic improves, check management is a real possibility, and it’s this difficult outlook that explains why Darden may have taken a more cautious stance on its FY2024 guidance.

So, is the unpredictable macro outlook priced into the stock?

Valuation & Technical Picture

Based on ~122 million shares and a share price of $163.00, Darden trades at a market cap of ~$19.9 billion and an enterprise value of ~$22.4 billion. This has left Darden trading at a sub 5.0% free cash flow yield relative to FY2024 estimates (~$1.08 billion), and when mixed with high single-digit revenue growth, it’s hard to argue that the stock is materially undervalued after its recent rally. In fact, the best time to buy the stock has been when it’s traded at closer to a 6% EV/FCF yield, which is where I highlighted that the stock would become attractive if it were to slide below $124.70 per share per my Q4 2021 update. And while its brands have continued to outperform the industry and peers with a further boost from the recent acquisition of Ruth’s Hospitality at an attractive price, we’ve seen other names become more undervalued as Darden has rallied, making DRI less attractive from an absolute and relative value standpoint.

Darden – Historical Earnings Multiple (FASTGraphs.com)

Moving over to Darden’s earnings, FY2024 guidance calls for annual EPS of $8.70 at the mid-point, pointing to a deceleration in annual EPS growth when including the ~$0.11 benefit from the RUTH acquisition. And while this will translate to record annual EPS for Darden, which is more than can be said for many of its casual dining peers that continue to struggle, the stock is trading at ~18.7x FY2024 annual EPS estimates at a share price of $163.00, only marginally below its 15-year average earnings multiple of 19.0. So, even if we apply a premium multiple to Darden of 20.9 (10% premium to 15-year average) because of its diversified portfolio of iconic brands and ability to outperform from a traffic standpoint, this would still only translate to a fair value of $181.80.

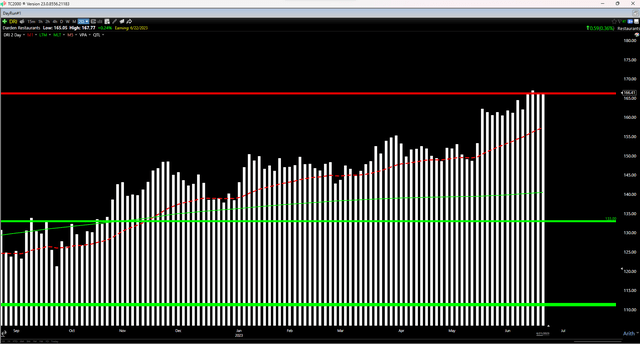

DRI 1-Year Chart (TC2000.com)

While this fair value estimate points to moderate upside, I prefer a large margin of safety baked in to justify buying new positions, with a required 25% discount to fair value for large-cap stocks. If we apply this discount to Darden’s estimated fair value, the stock’s ideal buy zone would come in $136.40 or lower, suggesting the stock is nowhere near a low-risk buy point currently. And if we look at the technical picture, it corroborates the less attractive reward/risk profile, with Darden sitting in the upper portion of its support/resistance range of $133.00 to $166.00, with a current reward/risk ratio of 0.10 to 1.0. So, while the stock may offer an attractive dividend yield (~3.3%) and it may be much better positioned than some of its weaker peers like Cracker Barrel (CBRL) and BJ’s Restaurants (BJRI), I don’t see any way to justify paying up for the stock here above $163.00.

Summary

Darden put together a solid year in FY2023 despite a difficult macro environment and has been rewarded for its efforts, massively outperforming the restaurant industry with a ~17% year-to-date return and new all-time highs. However, with the stock now trading at over 20.0x forward EV/FCF and hugging short-term resistance at $166.00, I see far more attractive opportunities elsewhere in the market today. One example is Capri Holdings (CPRI) which trades at barely 10.5x forward EV/FCF, with another attractively valued name being Pan American Silver (PAAS) which is trading at barely 11x free cash flow coming off a transformative acquisition. So, if I were looking to put new capital to work in the market today, I see better opportunities, and I would view any rallies above $169.50 for DRI before August as profit-taking opportunities.

Read the full article here