Investment Thesis

Datadog, Inc. (NASDAQ:DDOG) is an observability and security platform integrating various monitoring and automation tools for applications. It facilitates real-time insights into infrastructure, application performance, and security, aiding organizations in streamlining their operations and driving high ROI in their digital journey.

Datadog’s business has hit a rough spot, seeing their customer adoption curve start to peter out.

As you’ll soon see, Datadog faces a problem, one that afflicts growth companies in the process of evolving from hypergrowth to more moderate growth.

When growth companies start to slow down, there’s a period of shareholder rotation. Where the growth investors sell and move on to the next fastest-growing business, but where value investors are still not interested as they only focus on the company’s bottom line, and they steadfastly refuse to pay up for growth. No matter how alluring the story.

And that’s where Datadog finds itself, in no man’s land. Here I’ll describe some positive and negative aspects to help readers think through this investment.

Datadog’s Near-Term Prospects

Datadog is an observability and security platform, offering comprehensive monitoring and automation for cloud applications. With a strong emphasis on breaking down silos between development and operations (DevOps) teams, Datadog enables the adoption of DevOps practices, aiding organizations in their digital transformation and cloud migration.

Its unified platform integrates metrics, traces, logs, and data from over 600 integrations, providing real-time insights into application performance. Notably, Datadog’s key strengths lie in its cloud-agnostic design and extensive integration capabilities. The platform’s primary benefits include reduced time to problem resolution, improved operational agility, and enhanced efficiency.

Recently, Datadog has demonstrated reasonably solid fundamentals, driven by a surge in new product innovations and comprehensive product development. With a keen focus on providing holistic platform solutions, Datadog has introduced a range of new products and features that cater to diverse customer needs. These offerings, including AI-driven observability tools, security management capabilities, and enhanced cloud optimization features, demonstrate Datadog’s strategic vision to serve as a one-stop solution for businesses navigating the complexities of cloud migration and digital transformation. The company’s dedication to integrating cutting-edge technologies and expanding its product capabilities underscores its position as a leader in the observability and cloud management space.

However, despite its positive trajectory, Datadog faces near-term challenges. The company has observed a slowdown in the growth of existing customer usage, particularly among those engaged in cloud optimization activities.

Allow me to provide some context by focusing on customer growth rates spending more than $100K of annualized:

- Q3 2022: +44%

- Q4 2022: +38%

- Q1 2023: +29%

- Q2 2023: +24%.

As you can see, Datadog’s customer adoption curve has meaningfully slowed down. And what happens if Q3 sees its customer adoption curve decelerate further? That would further cement the view that this business’ best days are now in the rearview mirror.

What’s more, recently many companies in the IT sector have noted the challenges they are facing in cloud optimization. Readers may consider seeing my analysis of PagerDuty, Inc. (PD), although it should be noted that this matter has been widely disseminated through many other DevOps companies’ commentary.

Ultimately, Datadog faces the task of sustaining its growing customer base amidst increased scrutiny of customers’ IT costs. To sum this up, it’s no different from other IT and DevOps peers to Datadog, who are discussing how customers now seek cost-effective solutions and are exploring various options, to get more value, higher customer ROI, while getting seamless integration across their different platforms.

Datadog Needs to Re-Establish Itself as a Growth Story

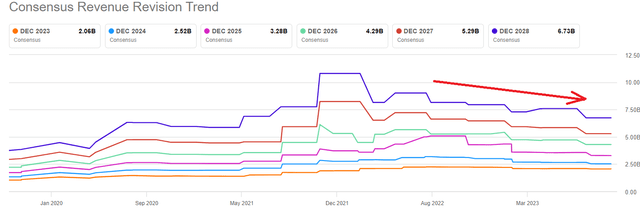

SA Premium

I’ve made it clear to followers of my work, that you don’t want to invest in battleground stocks. Investing is difficult enough by itself. You don’t want to invest in a company where the sell-side is in the process of downwards revising their financial models.

Those investments are difficult to make and the stock becomes very volatile.

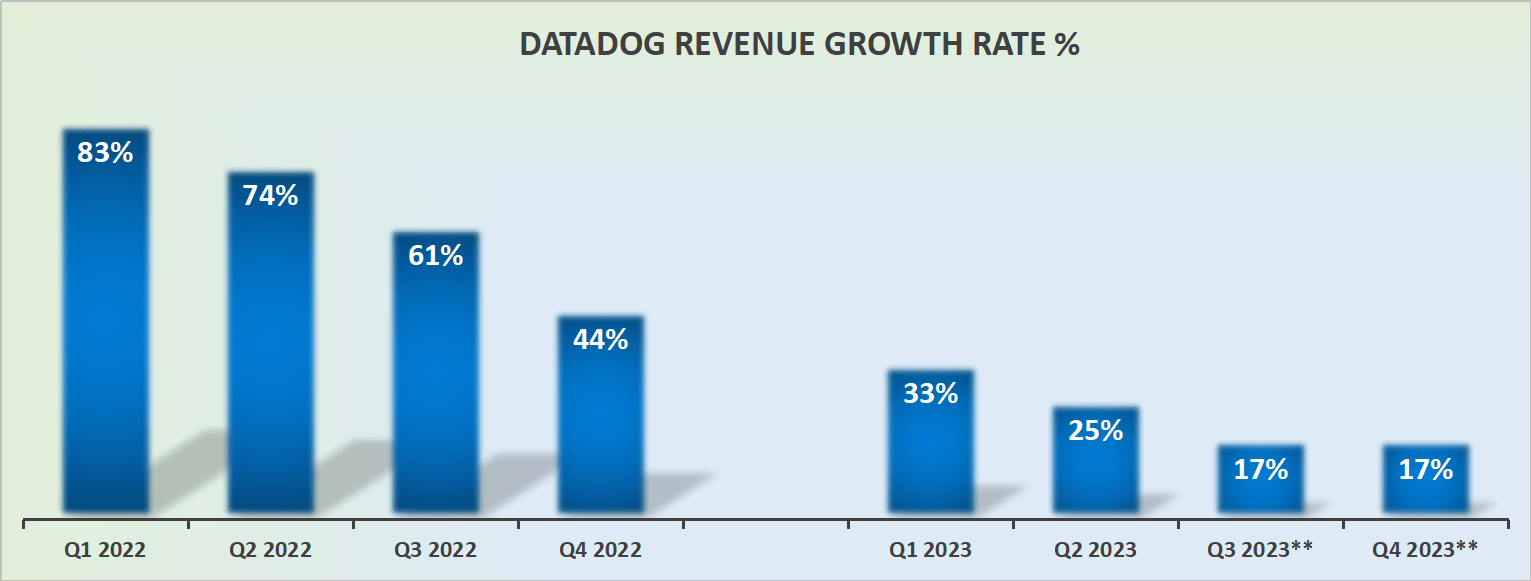

DDOG revenue growth rates

Consider this matter. Datadog’s comparables are undoubtedly becoming easier from this point forward. But unless Datadog dramatically increases its Q4 guidance together with its Q3 results, this will mean that despite the easier comparables, in the best-case scenario, Datadog will exit 2023 growing at 25% CAGR.

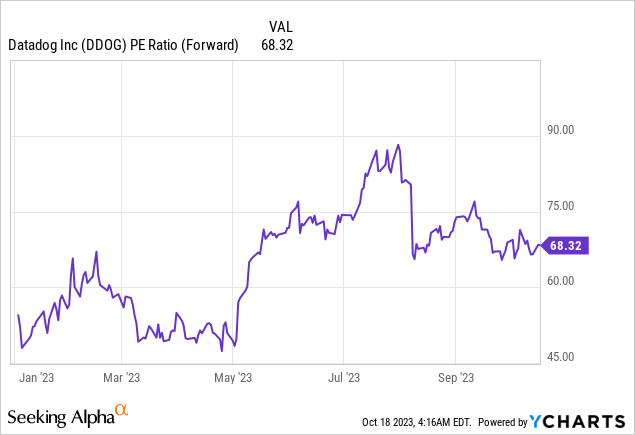

On the one hand, that would be a positive, since its current guidance points to less than 20% CAGR. But on the other hand, I wonder if Datadog as a 25% CAGR business is enough for investors to be willing to pay such a high premium for its stock?

To be clear, I’m not arguing that Datadog is highly overpriced. My assertion is only that Datadog, Inc. stock at 68x forward earnings already carries a high premium and that investors should not expect to see much of a premium expansion on this stock, particularly if the business is in the process of delivering more moderate growth rates.

The Bottom Line

In evaluating Datadog, Inc. stock, it’s evident that the company, known for its comprehensive monitoring and automation tools, is currently encountering a plateau in its growth trajectory. Despite its strong fundamentals and continuous product innovation, the recent deceleration in customer adoption rates raises uncertainties about its future outlook. Amidst the backdrop of intensified scrutiny on customers’ IT expenses and the evolving trends in the IT sector, I find myself questioning the current valuation of Datadog. At 68x forward earnings, the stock already carries a substantial premium, and it remains unclear if its anticipated 25% CAGR is sufficient to justify such a high valuation. With investors expecting more robust growth, Datadog needs to strategize how to reignite its growth story to warrant the current premium and maintain investor confidence, given the volatile nature of the market.

Read the full article here