German manufacturing survived severe challenges last year amid energy disruptions from the Russia-Ukraine conflict. But recent economic releases point to light emerging at the end of the tunnel. At first glance, Germany falling into a technical recession over the winter (the second consecutive GDP decline in Q1) was concerning, particularly for the industrials-heavy Global X DAX Germany ETF (NASDAQ:DAX). Yet, investments positively contributed to the GDP print (+3% QoQ), led by equipment and construction, despite the energy headwinds and tighter credit conditions. Similarly, recent German industrial production (excluding construction and energy) accelerated in May, led by motor vehicle production (up ~5% MoM) and manufacturing orders (up ~6% MoM).

In essence, German manufacturing companies appear to be more than capable of funding their capital expenditure needs from existing resources, which bodes well ahead of an extended monetary tightening cycle. While DAX has been hit by rate concerns following the strong US jobs report last week, I am sticking with my constructive view (see prior coverage here) given the undemanding ~11x P/E (vs. consensus high-teens EPS growth estimates).

Fund Overview – Access German Blue Chips at an Ultra Low-Cost

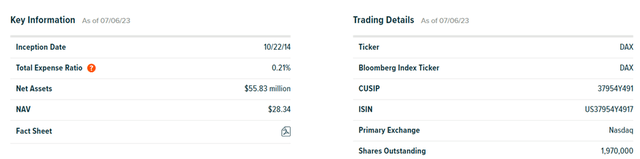

The US-listed Global X DAX Germany ETF, which tracks the total return performance of the 40 largest Frankfurt Stock Exchange-listed German stocks (i.e., the German DAX index), has seen its net asset base decline to ~$56m (down from ~$59m prior) following the drawdown over the last month. Yet, the fund maintains a 0.2% expense ratio, making it the most cost-effective vehicle to gain exposure to German large-caps. By comparison, the iShares MSCI Germany ETF (EWG) charges 0.5% for access to a similar portfolio.

Global X

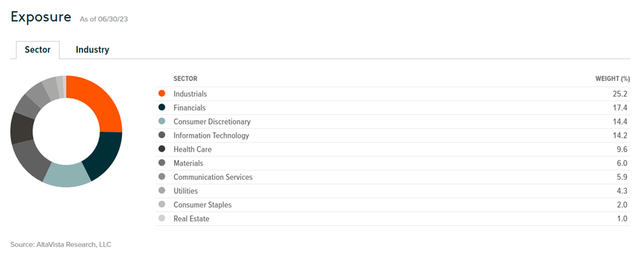

In line with the German DAX index, the fund has 40 stocks in its portfolio (EWG runs a larger 59-stock book), with Industrials leading the sector breakdown at 25.2% (up from 24.0% prior). Financials remain the second-largest sector holding at 17.4% (unchanged), while Consumer Discretionary has replaced Information Technology in third at 14.4% of the portfolio. With the top five sectors still contributing an outsized ~81% of the total portfolio, DAX comes with relatively high sector concentration vs other single-country Euro ETFs. The portfolio beta also runs above comparable Euro area options at 1.24 to the MSCI EAFE (EFA), a measure of equity performance for developed markets ex-North America, by virtue of its cyclical industrials exposure.

Global X

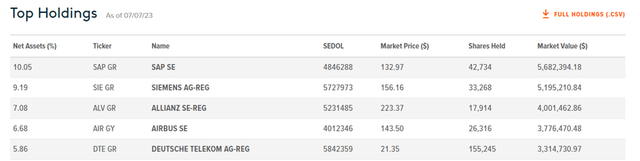

The DAX single-stock allocation has been largely consistent with prior reporting, with the only notable change to the fund’s top-five list being the decreased weighting for Deutsche Telekom (OTCQX:DTEGY) at 5.9% (down from 6.6% prior) in place of aerospace multinational Airbus SE (OTCPK:EADSF) at 6.7% (up from 6.2%). Elsewhere, the top holdings remain German software company SAP SE (SAP) at 10.1% of net assets (unchanged) and industrial conglomerate Siemens (OTCPK:SIEGY) at 9.2% (slightly above the 8.9% prior). At ~39% of the overall portfolio, the concentration of the five largest DAX holdings is unchanged as well. The underlying portfolio has, however, been de-rated slightly to ~11x earnings and ~1.2x book, screening attractively relative to the unchanged ~12% return on equity profile.

Global X

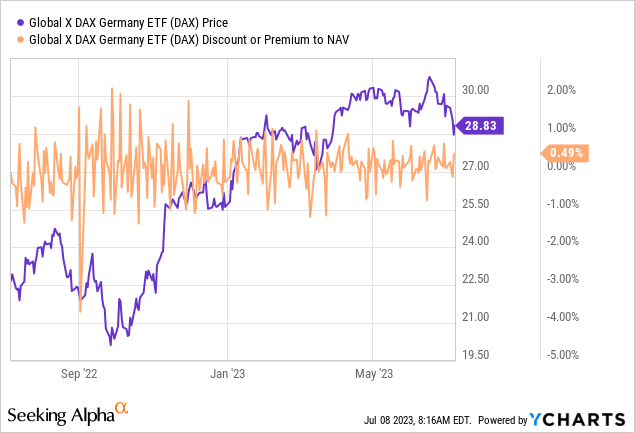

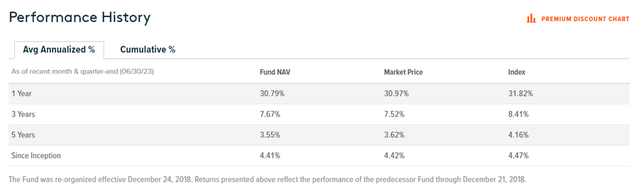

Fund Performance – Strong Capital Appreciation Track Record Intact

Despite the underperformance over the last month, DAX has still appreciated by a solid 10.9% on a YTD basis. Zooming out, the fund has also compounded at a solid 4.2% in market price and NAV terms since inception in 2014. The industrials-focused portfolio isn’t for the faint-hearted, though, given the volatility – last year’s double-digit % drawdown in H1 and subsequent H2 recovery (on China reopening hopes) being case in point.

Global X

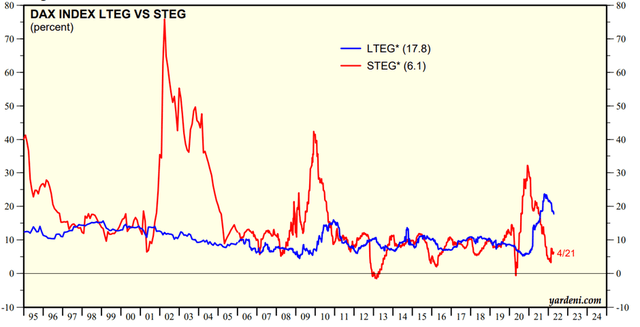

That said, the consistent distribution, supported by the fund’s strongly cash-generative stock holdings, will appeal to income investors. At current levels, the 30-day SEC yield is up to 3.2%, boosted by the valuation de-rating over the last month. Yet, DAX’s consensus earnings growth estimates stand at +6.1% short-term (+17.8% long-term), so I would expect further yield upside as the earnings recovery continues.

Yardeni

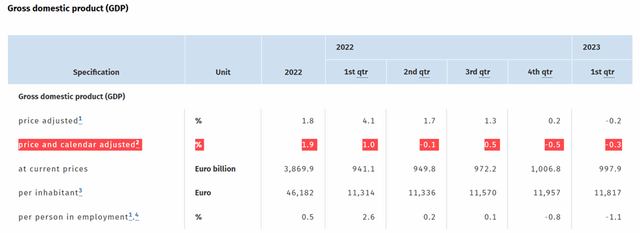

Positive Industrial Read-Throughs Despite the Technical Recession

Last year’s one-two punch of higher energy prices and wage growth pressures was a test German manufacturing appears to have passed. Yes, German GDP is on the decline (down 0.3% QoQ in Q1 2023 after a down 0.5% print in Q4 2022), but a closer look suggests a more benign outlook for manufacturing given the positive contributions from net exports and investments. So even in the likely scenario that the German government maintains lower public spending, in turn, weighing on growth this year, DAX’s industrials-led portfolio could prove more resilient than the market expects.

German Statistics Office

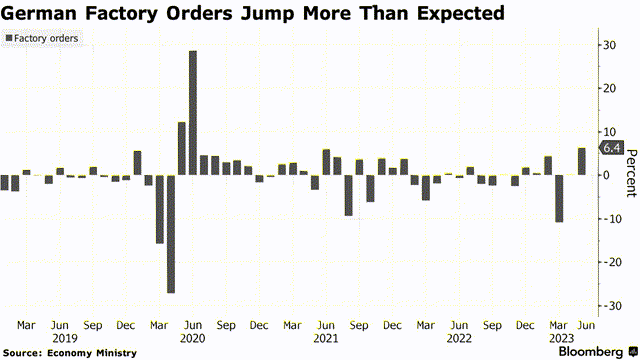

To be clear, there remain major hurdles on the horizon, including tighter credit conditions in a ‘higher for longer’ rate backdrop, as well as slower export growth amid the external slowdown. But at ~11x P/E (vs. high-teens long-term EPS growth), I suspect the negatives have been priced in. In contrast, Q2 economic releases have offered positive read-throughs for the DAX. Take the German industrial production data, for instance, which showed a headline 0.2% MoM decline in May. Dig deeper, however, and you’ll find that motor vehicle production was up ~5% MoM (note Mercedes-Benz (OTCPK:MBGAF) and BMW (OTCPK:BMWYY) are major holdings). Manufacturing orders also saw a strong rebound at +6.4% MoM, mostly driven by large capital goods orders (up low-teens % MoM) – again a positive read-through for the likes of key holdings Siemens and Airbus. Given these large caps are adequately funded as well, the resilience of DAX portfolio companies’ earnings could well surprise to the upside despite a challenging backdrop.

Bloomberg

Still an Inexpensively Priced Play on the Resilience of German Large-Caps

German capital goods names tend to correlate with manufacturing data, so given the well-documented challenges in recent months, the DAX underperformance is somewhat understandable. But silver linings are emerging from recent economic releases out of Germany, with motor vehicle production and manufacturing orders accelerating on a sequential basis. This validates the investment-driven strength in Q1 GDP, which despite confirming a technical recession (albeit a shallow one), showed investment in equipment and construction surprising to the upside.

To be clear, I’m not underwriting a major rebound anytime soon – the current backdrop of tightened credit conditions is likely to continue with more ECB tightening on the horizon. But German industrials seem well-equipped to fund their capex needs, with most large-caps in the DAX maintaining high cash balances and profits. At the current ~11x P/E (PEG Ratio of 0.7x), the market seems too bearish on German equities; continued P&L resilience through the near-term turbulence should re-rate the portfolio over time.

Read the full article here