Investment thesis

Deere & Company (NYSE:DE) stock was a safe harbor in a challenging 2022. During market turmoils, investors are seeking defensive stocks, and Deere’s long-term stability suggests that it is indeed defensive. But, this year, the stock substantially underperformed the broad market, and my valuation analysis suggests it was fair. The stock still looks overvalued at the current price level. That is why I assign the stock a “Hold” rating.

Company information

Deere & Co. was founded in 1837 and is headquartered in Moline, Illinois. The company is a multinational corporation that specializes in manufacturing machinery for different end markets. The company’s flagship line of business is the production of agricultural machinery.

The company uses a 52/53-week fiscal year ending on the last Sunday in the reporting period, which generally occurs near the end of October. Deere is managed through the following operating segments: production and precision agriculture [PPA], small agriculture and turf [SAT], construction and forestry [CF], and financial services [FS].

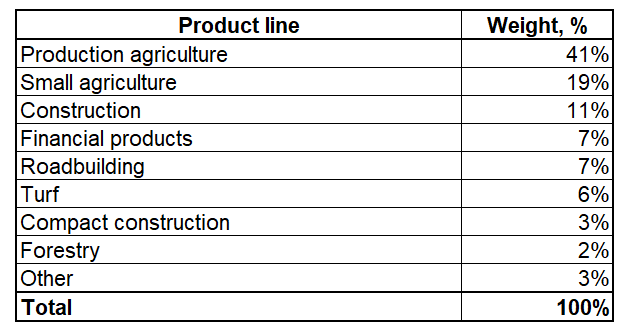

Deere disaggregates its sales by geography and by product lines. About 60% of the company’s revenues are generated in North America. The company’s product line looks diversified; production agriculture represents about 41% of the total.

Compiled by the author based on the latest 10-K report

The shares are a component of the S&P 500.

Financials

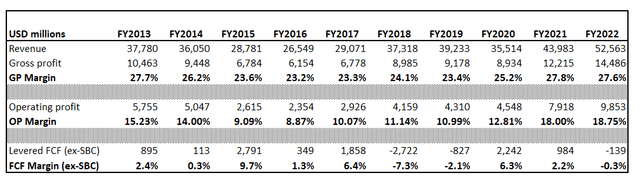

Deere’s financial performance has been stellar over the past decade. The company delivered a 3.7% revenue CAGR and gross margin was stable within a narrow range between 23% and 28%. I like that the company improved its operating profitability from 15% to 19%. Deere operates in a highly capital-extensive business, meaning free cash flow [FCF] margins are narrow. The peak FCF without stock-based compensation [SBC] was 6.4% almost seven years ago.

Author’s calculations

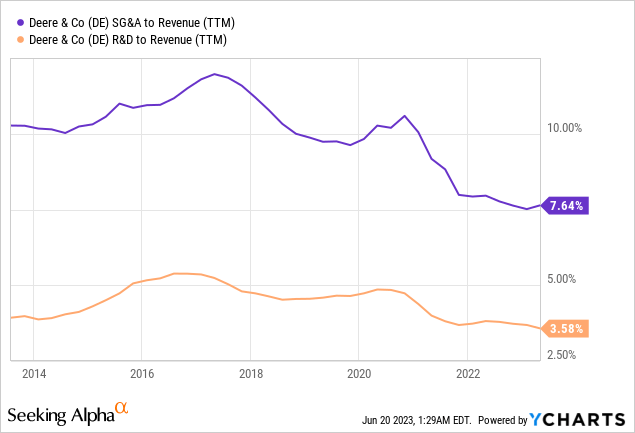

I like the SG&A to revenue dynamics which is declining steadily as the business grows. Being attentive to costs is crucial for a business with narrow FCF margins and the management succeeded in cost control, based on the trendline. The company invests substantial amounts in R&D. Deere invested about $15 billion in innovation over the past decade. Looks impressive for an agricultural business.

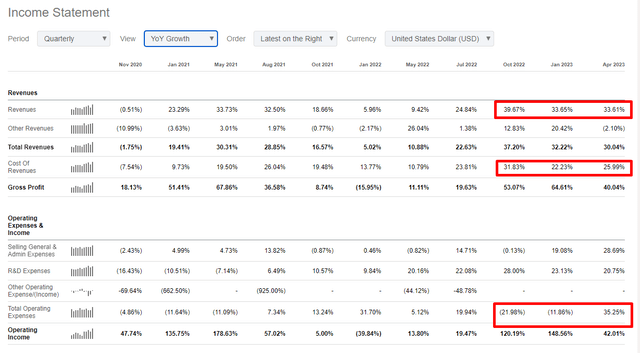

Now let me narrow down my financial analysis to a quarterly level. Revenue growth demonstrates robust momentum with a 30% YoY growth in the last three quarters. I also like that the topline grew much faster than expenses, allowing profitability metrics to expand significantly. It is a good indicator that the management is executing exceptionally, especially considering the harsh environment of high inflation and tight credit.

Seeking Alpha

The upcoming quarter’s revenue growth is expected to decelerate, though. For Q3 FY 2023, consensus expects revenue at $14.1 billion, which is 8% higher YoY. Thus, revenue growth is expected to decelerate substantially. On the other hand, the company will continue to improve profitability since the adjusted EPS is expected to increase notably from $6.16 to $8.21. The upcoming quarter’s earnings release is expected closer to late August.

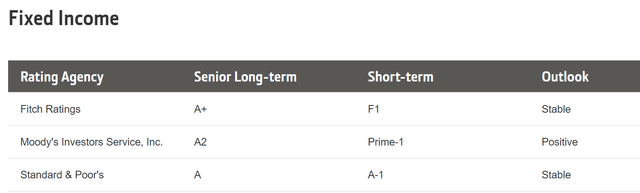

The company’s balance sheet is in good shape, with $3.6 billion in cash and very sound liquidity ratios. Deere’s leverage level is inherently high because of its financing segment. The company’s debt has a high investment-grade credit rating from leading agencies.

Deere’s official website

Valuation

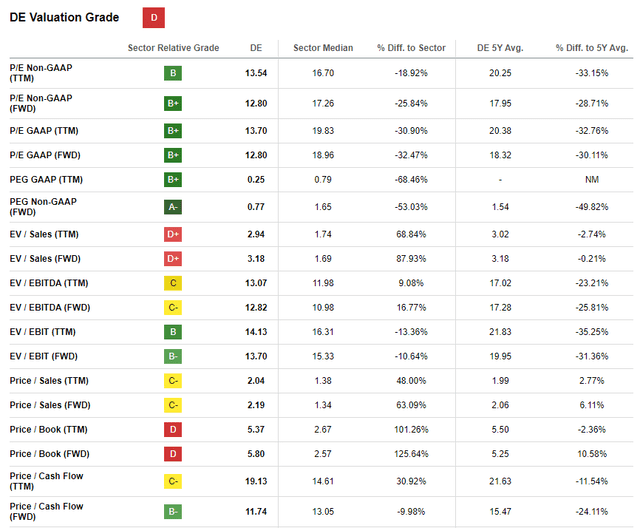

Deere stock significantly underperformed the broad market this year. DE declined about 4% year-to-date. On the other hand, the stock was a safe harbor in a turbulent 2022 with a 24% stock price appreciation. DE has a low “D” valuation rating from Seeking Alpha Quant. This is primarily because of very high price-to-sales and price-to-book metrics.

Seeking Alpha

But the company is a global leader in its industry. Therefore, the premium might be fair. To figure out whether a premium to the current stock price is fair let me exercise additional valuation approaches.

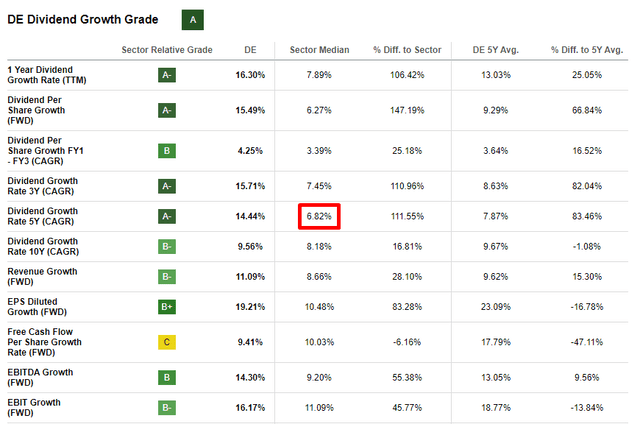

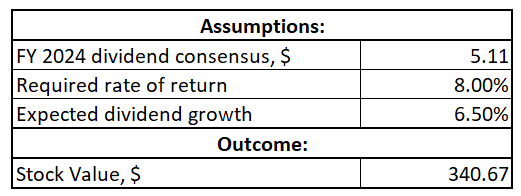

Deere has a solid dividend history with 33 consecutive years of dividend payouts. Therefore, I will start with the dividend discount model [DDM]. GuruFocus suggests that the WACC for Deere is about 8%, and I use it as a required rate of return. I have dividend consensus estimates, which project a $5.11 dividend for FY 2024. The dividend growth rate is always tricky because the data is usually very mixed in different time horizons. To be conservative, I round down to 6.5% the sector median 5-year dividend CAGR.

Seeking Alpha

Incorporating all the assumptions into the DDM formula returns a fair stock price of about $341. It means the stock price has about 16% downside potential from the current level.

Author’s calculations

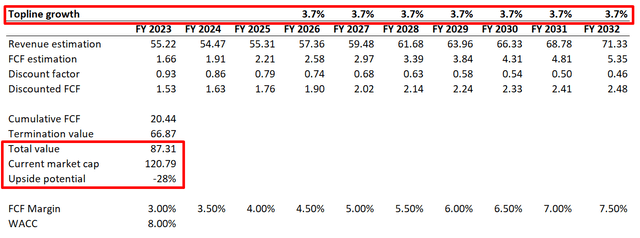

To get more evidence, I also want to simulate a discounted cash flow [DCF] approach. For future revenues, I mix consensus estimates with my professional judgment. I do so because forecasts from analysts are available only up to FY 2025. For the years beyond, I expect revenue growth to sustain a 3.7% CAGR, which the company delivered over the past decade. I use TTM metrics ex-SBC for the FCF margin, which is at 3%. I use the same 8% discount rate as I did for the DDM.

Author’s calculations

As you can see, based on the above assumptions, the stock looks about 30% overvalued. I realize that premium for market leaders like Deere is common, but I think I am not ready to pay a 30% premium even for a market leader.

Risks to consider

Apart from the apparent risks of the harsh environment with potential recession and looming credit crunch, Deere investors also face several other risks.

For example, the company’s sales are heavily reliant on company-financed sales. This means high exposure to interest rates and credit risks. Unfavorable changes in interest rates will affect borrowing costs and the ability of customers to afford financing. Lower financing affordability means the demand for Deere’s offerings is highly likely to be adversely affected. Credit risk means a high potential for customers to default on their obligations leading to more debt impairment, which will be recorded in the company’s P&L.

The company also faces regulatory risks. Reductions in agricultural subsidies or the imposition of tariffs and trade restrictions may impact agricultural markets and affect farmers’ purchasing power and investment decisions. Changes in government policies and regulations related to agriculture and trade may create uncertainty and potentially disrupt Deere’s business.

As a global company, Deere also faces significant risks related to trade policies, tariffs, foreign exchange rates, and commodity prices. Unfavorable changes in fluctuations in these aspects, which are outside of the company’s control, may undermine the company’s financial performance.

Bottom line

Overall, the stock is substantially overvalued. The company is an undisputed leader in manufacturing agricultural machinery, and people will always need something to eat. The financial performance has been stellar over the long term, but I am not ready to pay more than a 20% premium, even for a market leader like Deere. Moreover, the dividend yield below 2% is insignificant and is not worth the risk. Therefore, DE is an apparent “Hold” for me.

Read the full article here