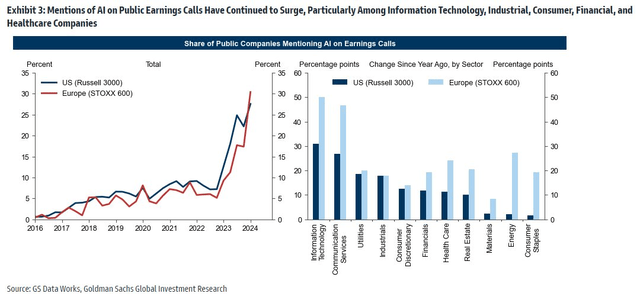

As we head into the heart of the first quarter earnings season, executives in C-suites around the world remain focused on the potential of artificial intelligence (“AI”). AI has indeed helped lift markets in the last year, particularly among Info Tech stocks, but we’ve seen volatility tick up lately. All eyes will now be on large-cap tech firms to see what their profitability pictures paint in terms of the current corporate enterprise-tech investment environment.

I have a hold rating on Dell Technologies Inc. (NYSE:DELL). I see the stock as near fair value following a sharp rise as this old-school legacy tech firm has reshaped itself into an AI play.

AI Mentions Remain on the Rise, Tech Focused

Goldman Sachs

According to Bank of America Global Research, Dell operates two primary business units: Infrastructure Solutions Group (ISG, provides servers, storage, hyper-converged infrastructure, and networking), and Client Solutions Group (CSG, provides desktops, notebooks, workstations, and displays). It also reports revenues derived from the external VMWare commercial partnership under ‘Other’ revenues.

Back in February, DELL posted a strong set of Q4 2024 results. Non-GAAP EPS of $2.20 beat the street estimate by $0.48 while revenue of $22.3 billion was a modest beat. The firm announced a strong 20% increase in its cash dividend, and it now yields close to what the broad market pays. Shares surged nearly 32% in the following session as the market interpreted the quarter and call as a turning point in DELL’s evolution from a tech hardware company into one that has AI exposure.

But getting into the actual numbers, the company’s Infrastructure Solutions Group (ISG) particularly benefited from AI-related growth – its server orders backlog doubled to $2.9 billion as of the end of the quarter. The management team raised FY 2025 EPS guidance, which was also above analyst estimates. ISG guided to a mid-to-high teens revenue growth rate for the year ahead on the heels of AI demand, while free cash flow was strong.

Then, on March 26, DELL announced it was cutting staff in a cost-reduction effort – shares rose in the days after that news.

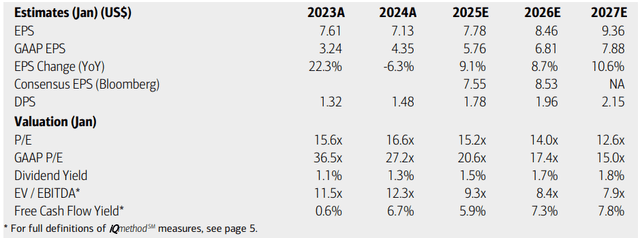

On valuation, analysts at BofA see earnings climbing at a healthy and steady pace over the coming years. 2025 operating EPS is seen just shy of $8 while more than $9 of per-share non-GAAP profits could come about by 2027. The current Seeking Alpha consensus figures are about in line with what BofA sees.

Dividends, meanwhile, are forecast to rise at a likewise fast clip over the quarters ahead, so there could be a growing yield component here, too. Valuation multiples appear cheap, but DELL has historically traded at soft valuations, though the firm is materially different today (after its 2019 IPO) compared to the firm of the 2010s and early to mid-2010s. Still, its free cash flow yield is solid, currently at 7%.

Dell Technologies: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

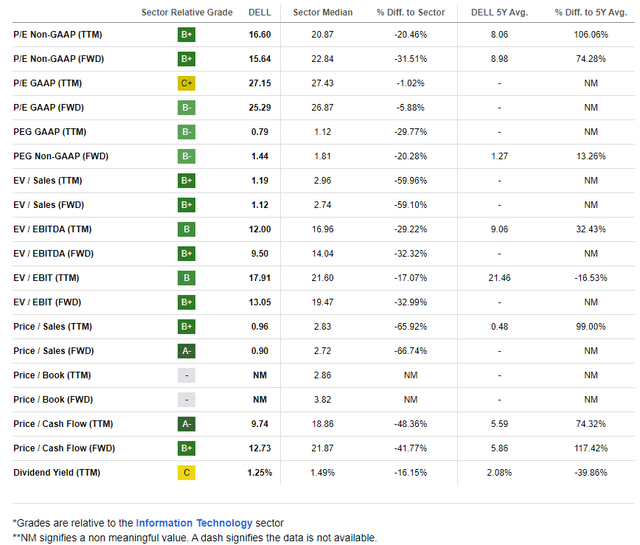

DELL’s current P/E is nearly seven turns higher than its 5-year average. AI pixie dust has clearly been poured into the stock, and solid EPS growth through the out years warrants a better earnings multiple compared to the high-single-digit level the company had so many years ago when it was primarily a hardware firm.

If we assume a 15x P/E, materially above its historical norm, and $7.80 of operating EPS over the next 12 months, then shares should trade near $117, which is about where the stock trades today. Also, keep in mind that a 15 P/E is only about a 1.4 non-GAAP forward PEG ratio – below that of the broad market. So there could even be room for multiple expansion if DELL proves itself over the next few reporting periods.

DELL: Reasonable Valuation Multiples, A Re-Rating Vs. History

Seeking Alpha

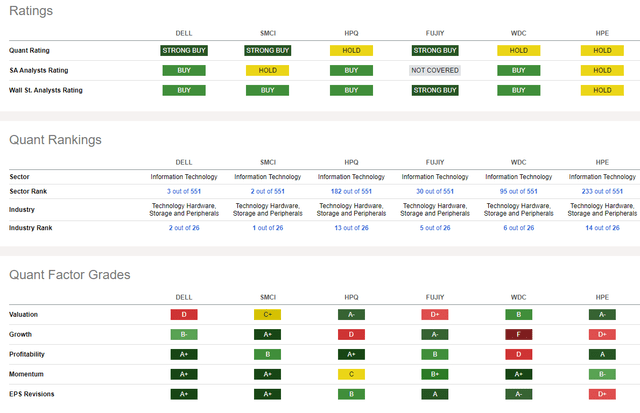

Compared to peers, DELL features a weak valuation grade, but I see the multiples in the above graph as actually attractive for the reasons I previously laid out. Moreover, DELL’s growth trajectory is impressive while current profitability trends are robust.

With industry-leading share-price momentum, there are concerns on the chart that I will detail later in the article. Finally, EPS revisions have been on the good side (16 up, 0 down) in the last 90 days ahead of its May Q1 reporting date.

Competitor Analysis

Seeking Alpha

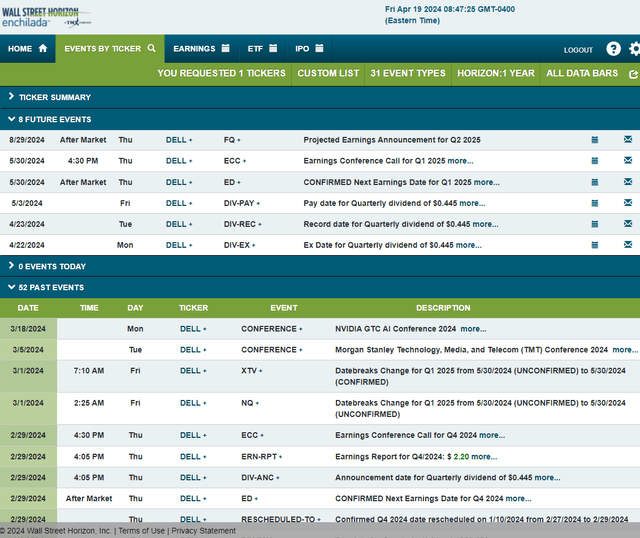

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2025 earnings date of Thursday, May 30 AMC with a conference call immediately after the results hit the tape. You can listen live here. Shares trade ex a $0.445 dividend on April 22.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

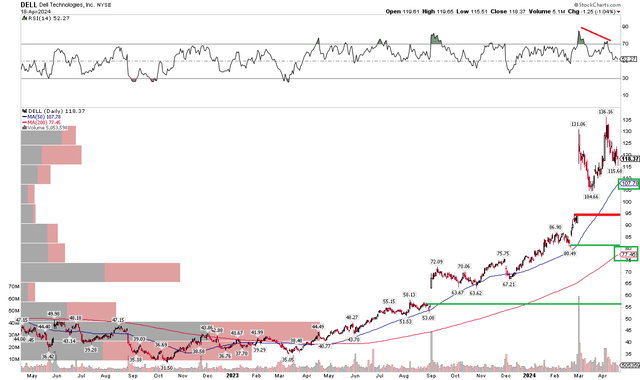

DELL shares are up nearly 170% (total return) in the past year. Notice in the chart below that the stock chart has featured a few price gaps – which are commonly important according to technicians. But there are different types of gaps. The first, a breakaway gap, is often never filled as it indicates the lift-off of a new trend. In DELL’s case, the gap following the Q2 2024 results released last summer could be one of that ilk – it would require a significant decline for DELL to fill the September 1, 2023, gap way down at $55.

What catches my eye is the lingering “runaway” gap just below the $95 mark. I could certainly see that being filled over the months ahead. Buttressing that assertion is that there has been a bearish RSI divergence – evidenced by a lower high in the RSI momentum oscillator at the top of the chart. Moreover, the rising 50-day moving average will be key to watch. DELL shares have historically straddled that trend-line indicator, dating back to the second quarter of last year. The long-term 200dma does not come into play until way down near the February 21 low around $80.

Overall, buying DELL on a dip into the mid-$90s could be a favorable risk/reward idea.

DELL: Runaway Gap Fill In Play, Rising 50dma Offers Some Support, Bearish RSI Divergence

StockCharts.com

The Bottom Line

I have a hold rating on DELL. Shares are about fairly valued given the solid growth outlook and reasonable multiple, though the company still must show itself worthy of a premium valuation over the quarters ahead. I do see risks on the chart, however.

Read the full article here