Investment action

Dell Technologies Inc (NYSE:DELL) has consistently demonstrated its ability to navigate a fluctuating market landscape with agility and strategic depth. Even amidst challenges, the firm has managed to register growth, a testament to its robust operational strategies. The increase in demand, which is a result of favorable macroeconomic conditions and strong performances in crucial regions, further highlights Dell’s market knowledge. Their focus on AI, evident in their product innovations and their roadmap for GenAI, signals their commitment to staying ahead of technological curves.

Dell’s Analyst Day provided a glimpse into their visionary approach towards the burgeoning AI sector. Their proactive stance on the future of AI, coupled with strategic decisions like pivoting from cloud-centric to edge-centric solutions, indicates their adaptability. Additionally, their accomplishments in the storage sector, particularly the popularity of PowerFlex, demonstrate their capacity to lead and innovate. Given this backdrop, Dell appears to be a compelling investment choice, well-equipped to harness the potential of AI-centric market shifts and upcoming growth avenues.

Basic information

Dell is a leading global technology company recognized for its pioneering direct-to-consumer sales model. Dell began as a personal computer manufacturer. Over time, the company expanded its offerings beyond just PCs. Today, Dell provides a comprehensive suite of IT solutions, including servers, storage devices, networking products, and software. Catering to a diverse clientele, from individual consumers to large enterprises and public institutions, Dell customizes its solutions to address specific customer needs. With a steadfast commitment to innovation and a customer-centric approach, Dell remains a significant force in the global technology landscape.

Over the past half-decade, Dell’s financial trajectory has been tumultuous. The COVID-19 pandemic significantly impacted its 2020 performance, with a pronounced dip in server and storage product sales. This downturn was a direct result of businesses curbing IT expenditures amidst the global crisis. In 2021, the revenue trended downward, settling at $86.7 billion. This was influenced by a waning demand for conventional PCs, as the work-from-home paradigm shift saw many opting for mobile devices. Additionally, intensified competition from other tech behemoths posed challenges. These competitors, with their diverse IT offerings and the advantage of scale, could afford to undercut prices. Yet, from 2022 onward, there was a notable upswing, with 2023 revenues surpassing previous years, indicating a robust revival in the PC industry. This resurgence can be attributed to economies rebounding and the gradual return to traditional office work environments.

Review

Dell’s financial performance in the current quarter showcased revenue of $22.9 billion. While this marked a 13% decrease year-over-year, it represented 10% sequential growth. The company’s gross margin stood at $5.5 billion, making up 24.1% of the total revenue. This figure saw an uplift of 2.7%, a result of reduced input costs and a disciplined approach to pricing. The operating income for the quarter was $2 billion, and the diluted EPS came in at $1.74. Diving deeper into specific segments, commercial revenue experienced sequential growth, reaching $10.2 billion. On the other hand, the consumer segment reported revenue of $2.4 billion. The Consumer Systems Group had a particularly strong quarter in terms of profitability, recording an operating income of $1 billion, which is 7.5% of its revenue. This was a notable increase of 120 basis points from previous figures. Lastly, Dell Financial Services reported second-quarter originations of $2.3 billion, marking 1% growth.

Starting the quarter, Dell approached with caution due to their previous quarter performance. Yet, the quarter brought positive surprises as demand surged, particularly in June and July. Despite a year-over-year decline in revenue, the uptick in demand combined with Dell’s effective strategies yielded impressive current quarter results. On a broader economic scale, Dell identified encouraging trends as they transitioned into the second half of the year. The U.S. market demonstrated a stronger demand foundation, and performance in the EMEA region surpassed Dell’s expectations. There was also a noticeable increase in demand from the government and SMB sectors, with transactional demand gaining momentum as the quarter unfolded. AI’s rise has been a significant factor in the surge of product demand, shaping the landscape of data and computational requirements. Dell emphasized the expanding impact of AI, especially in domains like workstations and PCs. Demonstrating this upward trend is Dell’s PowerEdge XE9680, an AI-enhanced solution. Its standout performance in the second quarter established it as Dell’s fastest-growing new release.

“We are encouraged with some of the signs we are seeing in the macro environment as we move into the second half” “While revenue was down year-over-year, a better demand environment and strong execution enabled extraordinary Q2 results” 2Q24 call

During their Analyst Day, Dell accentuated the opportunities presented by GenAI, illustrating their industry-leading position in AI infrastructure products and services. They perceive the shift towards Gen AI as a defining transition. With interest spanning from cloud providers to traditional enterprises and a variety of applications, Dell is poised as the preferred partner for businesses navigating digital evolution. They project the AI market’s Total Addressable Market [TAM] to grow at an 18% annual rate, touching $124 billion by 2027. Dell also pointed out the evolving landscape of AI, transitioning from cloud-centric to edge-centric. They noted that nearly half of GPU server investments are projected to be on-premises or edge-based. Considering that 83% of all data is stored on-premises and about 75% of businesses are increasing their AI investments, Dell is strategically positioned to leverage this burgeoning market. It’s essential to mention, however, that while the AI sector promises expansive growth, it currently operates on slim margins. As Dell expands its footprint in this domain and rolls out additional services, it aims to offset these cost challenges.

Beyond their achievements in AI and PC sales, Dell’s success in the storage market can be largely attributed to their expertise in HCI. A cornerstone of this success is their unique software-defined storage solution, PowerFlex. PowerFlex’s rising popularity in the market stems from its capability to autonomously adjust both compute and storage, meeting the needs of high-demand applications. Remarkably, PowerFlex has witnessed consistent growth over eight successive quarters. In the recent quarter, its growth rate surged into triple digits, more than doubling its previous performance. This undeniably positions PowerFlex as a standout offering in Dell’s storage portfolio.

Valuation

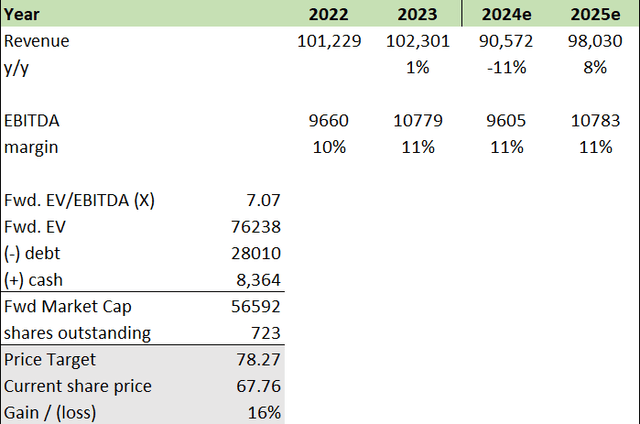

I believe DELL will grow at a rate of negative 11% in FY24, but this trend will reverse with an anticipated 8% growth in FY25. My projection for FY24 is rooted in the guidance provided by the management. Their outlook for FY24 is influenced by a few key factors. To start, Dell faced heightened pricing pressures in the second quarter, which is impacting their top line. In the Infrastructure Solutions Group segment, the company envisions consistent performance on a sequential basis. Although there’s a positive outlook for servers, particularly those integrated with GPUs, there’s a tempered expectation for the broader server portfolio. On top of that, a seasonal downturn in storage performance is predicted for the next quarter. Transitioning to FY25, my 8% growth estimate is in line with market consensus. The growing opportunities in GenAI, coupled with the increasing adoption of AI that’s currently propelling PC demand, are set to be significant drivers for Dell’s revenue in FY25 as the benefit slowly bears fruit. Given the large TAM of the AI market and its expected double-digit growth, I’m optimistic about AI solidifying its role as a revenue driver for Dell in the forthcoming years.

Author’s work

DELL is presently trading at approximately 7x its forward EV/EBITDA, while its peers have a median of 8x. A closer examination reveals that Dell’s EBITDA margin stands at 9%, surpassing the peer median of 6%. However, its expected 1-year revenue growth rate projection is a decline of 1%, contrasting with the peer median growth of 4%. This negative revenue growth outlook, despite the superior margin, likely contributes to its lower forward EV/EBITDA valuation, as the market often views declining growth prospects with caution, even when offset by better operational efficiency.

My price target for DELL is approximately $78, indicating a potential upside of 16%. My recommendation leans towards a buy, as Dell’s current market price is below my target. While the company grapples with pricing challenges, broader market trends, especially the rising adoption of AI, are promising. This surge in AI interest is fueling PC demand, and with Dell’s strategic pivot towards this expansive AI market, they are well-positioned for future revenue growth. A deeper dive into DELL’s strategies and initiatives underscores their proactive approach to technological advancements, always seeking growth avenues rather than settling for the status quo.

Risk and final thoughts

A potential downside to my buy recommendation is the possibility that the optimism regarding AI adoption, the size of the AI TAM, and its projected CAGR might be overly ambitious. Should AI not meet these lofty expectations, it could result in a share price drop for Dell.

Additionally, broader macroeconomic concerns, such as inflation and supply chain disruptions due to geopolitical conflicts, pose risks. An uptick in inflation or an exacerbation of supply chain issues could exert additional strain on Dell’s revenue and profit margins.

Dell’s recent financial performance showcased resilience and strategic adaptability. Despite facing challenges, the company reported sequential growth, underpinned by robust margins and operational efficiency. Entering the quarter with caution due to past performance, Dell was buoyed by a surge in demand. The company’s focus on AI, as evidenced by the success of products like PowerEdge, highlights its commitment to innovation. Dell’s Analyst Day emphasized their leadership in AI infrastructure. Their vision for GenAI and the AI market’s projected growth showcases their forward-thinking approach. The strategic shift from cloud to edge in the AI landscape further solidifies Dell’s market position. Moreover, Dell’s prowess in the storage market is commendable. Given these factors, I recommend a buy rating for Dell. While immediate challenges persist, broader AI-driven market trends and Dell’s strategic realignments position the company for a promising future.

Read the full article here