Introduction

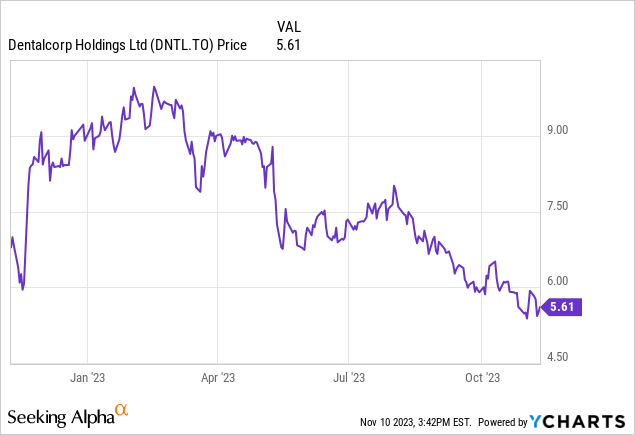

In my previous articles, I started to turn positive on dentalcorp (TSX:DNTL:CA) (OTCPK:DNTCF) as the cash flow results were improving and the M&A pace was slowing down. This would and should allow the company to reduce its gross debt and net debt levels and that would obviously have an immediate and noticeable impact on the interest expenses and thus the underlying free cash flows. I argued the company was pretty close to “peak interest payments” as I expect the interest payments to top out pretty soon.

In this article I will refer to the company website where applicable. The financial statements can be found on the SEDAR+ website.

A net loss in the third quarter

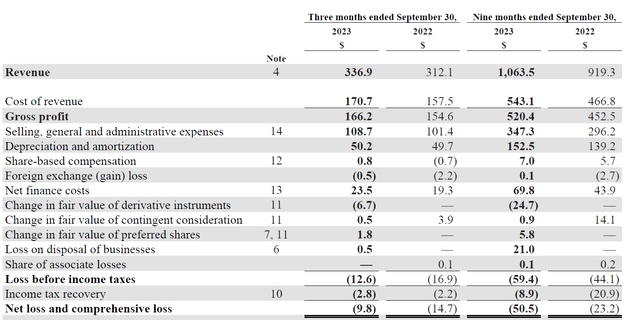

Total revenue in the third quarter increased to C$337M from C$312M in the third quarter of last year, and this resulted in an 8% higher gross profit, which jumped to C$166.2M.

Dentalcorp Investor Relations

Of course Dentalcorp also had to deal with higher SG&A expenses which increased by approximately 7% while the net finance costs increased by almost a quarter to C$23.5M. As you can see in the image above, this resulted in a pre-tax loss of C$12.6M and a net loss of C$9.8M or 5 cents per share.

There are a few elements impacting the results. First of all, there was a positive impact of C$6.7M in the value of derivative instruments. These are interest rate swaps as the company correctly hedged its interest rate exposure in 2022 as it entered into a long-term C$500M interest rate swap contract. As interest rates on the financial markets increase, these hedges become more valuable and that’s how the company was able to record a C$6.7M gain in Q3 and a gain of almost C$25M in the first nine months of the year.

But if we look at the net finance expenses of C$23.5M, it’s now indeed starting to look like we have reached the top. Not only is Dentalcorp now generating some interest income thanks to the higher interest rates, there was no noticeable increase compared to the first half of the year, and although the hedging income was lower than in the first half of the year, the net finance expenses after hedging indeed seem to have reached a plateau.

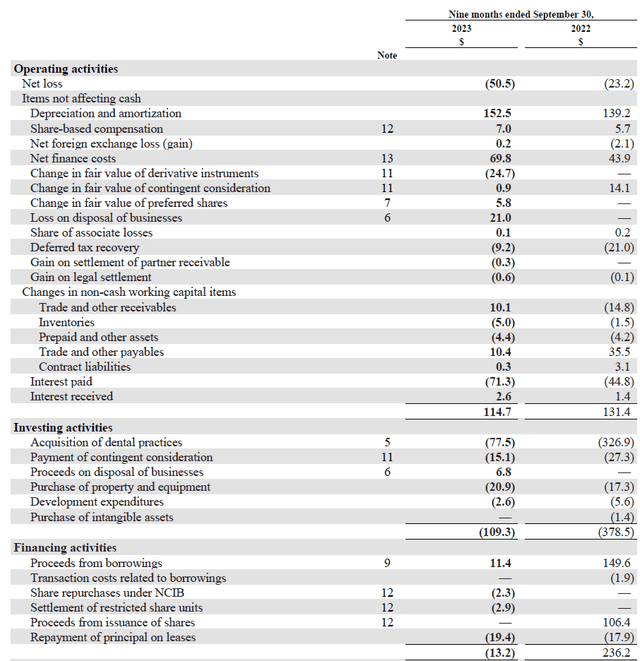

In my previous articles, I focused on Dentalcorp’s cash flow results. The reason for this was quite straightforward: as the income statement is severely impacted by the high depreciation and amortization expenses while the sustaining capex and lease expenses are pretty minimal. As you can see in the image below, the total amount of depreciation and amortization expenses was C$152.5M in the first nine months of the year while total capex was just C$23.5M with an additional C$19.4M in lease payments for a total of just C$43M. That’s a massive difference due to the high sunk costs related to the M&A activities where after some of the intangibles are amortized.

Dentalcorp Investor Relations

As the cash flow statement shows, the company generated almost C$115M in operating cash flow, but after deducting the C$11M in contributions from working capital changes and the C$19.4M in lease payments, the underlying operating cash flow was approximately C$84.5M. As the total capex was almost exactly C$23.5M, the company generated a positive free cash flow result of roughly C$61M. That cash was used to complete the acquisition of new practices and the payment of the contingent consideration of previous deals. But if no M&A would occur at this moment and if you would exclude the contingent consideration payments (as those are per definition finite), the company is definitely free cash flow positive. C$61M represents a free cash flow result per share of just over C$0.32, and while that’s not spectacular, it’s a decent result. After comparing the 9M 2023 results with the H1 results, the net free cash flow result in the third quarter was approximately C$21M.

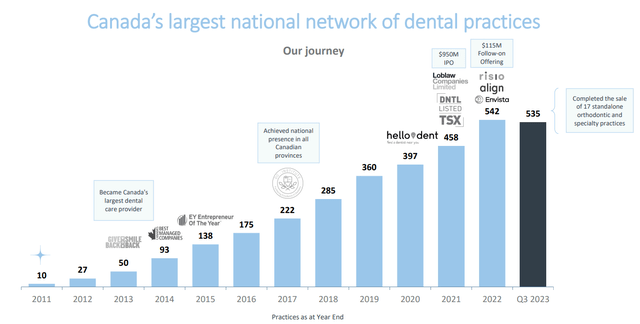

That being said, I would really prefer the company to focus on reducing its net debt rather than pursuing additional M&A. Don’t get me wrong, I’m not against adding practices, especially if that can be arranged at a lower valuation than what Dentalcorp is trading at. During the third quarter, Dentalcorp acquired three practices at an EBITDA multiple of 5.9. Meanwhile, the company is trading at approximately 9.5 times the EBITDA adjusted for lease amortization.

Dentalcorp Investor Relations

As of the end of September, Dentalcorp had a net financial debt of approximately C$970M (again excluding lease liabilities) which results in a debt ratio of just over 4 times the EBITDA. That’s relatively high but fortunately operating dental practices should result in “sticky” customers who are loyal to their dentist.

Investment thesis

Dentalcorp’s current valuation is not outrageous but the market would probably like to see debt management before pursuing additional growth. Subsequent to the end of the third quarter, Dentalcorp acquired another two practices for a total consideration of C$15.9M and I would expect Dentalcorp to have paid approximately the same multiple as the transactions it closed during the third quarter.

The stock is not expensive but this is a market that rewards financial prudence over pursuing growth. The stock is currently trading at a 7.6% free cash flow yield (on an underlying basis) and I expect this to increase as the company either reduces its debt and thus will see lower interest expenses. Or it continues to grow its free cash flow through M&A (preferably at a moderate pace).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here