After several years of poor business results and daunting stock price performance, TechnipFMC (NYSE:FTI) has begun to enjoy accelerated business momentum this year. Even better, the oilfield services provider has promising growth prospects for the next several years. As a result, the stock has rallied 98% over the last 12 months. Such a steep rally may lead some investors to think that the stock has become overvalued. However, TechnipFMC remains reasonably valued.

Business overview

TechnipFMC, which is based in the United Kingdom, offers products, technologies, and services to oil and gas producers in Europe, Central Asia, North and Latin America, the Asia Pacific, Africa, and the Middle East.

Shale oil production in the U.S. has been booming for nearly a decade. It temporarily decreased in 2020 due to the coronavirus crisis, which caused a collapse in global oil consumption and the price of oil. However, as soon as the global economy reopened, U.S. shale oil production returned to growth mode.

On the other hand, shale oil production is expected to have declined in September, for the second month in a row. In addition, there are concerns that U.S. shale oil production may peak in the near future, partly due to high exploration and production costs, which have rendered many wells uneconomical. TechnipFMC is well protected from this potential threat, as it generates more than 90% of its revenue and its orders outside the North American land market.

Moreover, TechnipFMC currently enjoys positive business momentum. In the second quarter, the company grew its revenue by 14.5% over the prior year’s quarter. Even better, its subsea segment received orders of $4.1 billion, which represented a book-to-bill ratio of 2.5. As a result, subsea backlog grew 29% sequentially, to $12.1 billion, of which 81% will be converted into revenue from next year. The company grew its total backlog 25% sequentially, to $13.3 billion. This amount is essentially twice as much as the total revenue of the company in 2022 ($6.7 billion). It is thus evident that TechnipFMC is securing its future sales at a fast pace.

TechnipFMC earned many important contracts during the second quarter. It was awarded its fifth consecutive contract by Exxon Mobil (XOM) in Guyana, one of the most exciting growth projects in the entire oil industry. The company also signed a 20-year contract with Chevron (CVX). According to this contract, TechnipFMC will provide subsea production systems for the development of offshore gas fields in Australia.

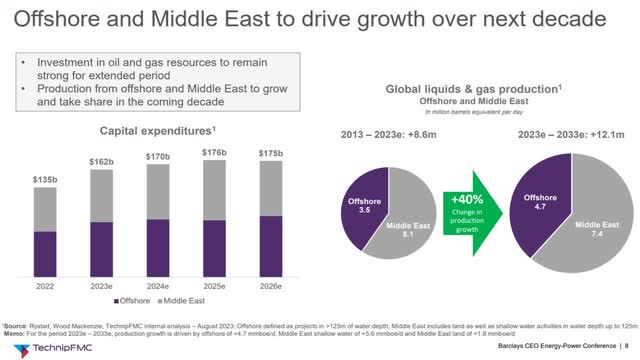

It is also important to note that TechnipFMC has a multi-year growth runway ahead.

Growth Potential of TechnipFMC (Investor Presentation)

Source: Investor Presentation

Global oil and gas production increased by 8.6 million barrels per day between 2013 and 2023. Even better for oilfield services providers, global oil and gas production is expected to grow by 12.1 million barrels per day over the next decade. As a result, global capital expenditures are expected to grow approximately 30% from 2022 to 2026. This trend will certainly be a major growth driver for TechnipFMC.

Analysts seem to agree on the exciting growth prospects of TechnipFMC. They expect the technology and services provider to grow its earnings per share from $0.45 this year to $2.14 in 2026. If the company meets the analysts’ estimates in 2026, it will achieve its best performance since 2016.

Risks

Everything seems rosy for TechnipFMC right now, as the company seems to have ample room for growth for the next several years. On the other hand, investors should always keep in mind the dramatic cyclicality of the oil and gas industry.

The performance record of TechnipFMC is a testament to the risks related to the high cyclicality of its business. The company has failed to post a meaningful profit for five consecutive years. Even worse, it has incurred aggregate losses per share of -$17.14 over the last five years. This amount of losses is 90% of the market capitalization of the stock and hence it is excessive.

Due to the daunting business performance, the stock dramatically underperformed the broad market over the 4-year period leading to October 2022. During that period, the stock plunged 55% whereas the S&P 500 and the Energy Select Sector SPDR Fund ETF (XLE) gained 32% and 6%, respectively. The vast underperformance of TechnipFMC vs. the S&P 500 should be expected whenever the energy market faces its next downturn. This is a risk that should not be undermined by investors.

There is another risk as well, namely the accelerated shift of most countries from fossil fuels to renewable energy sources. The sales of electric vehicles are growing exponentially while there is a record number of green energy projects that are in their development phase. When all these projects begin to generate energy, they will probably take their toll on global oil production. Nevertheless, this is most likely a long-term threat to the business of TechnipFMC. As the fierce global energy crisis proved last year, the transition from oil products to clean energy is harder than initially anticipated and hence global oil production is not likely to peak anytime soon.

Valuation

TechnipFMC is currently trading at a forward price-to-earnings ratio of 42.5x, which seems excessive on the surface. However, as mentioned above, the company is expected to more than quadruple its earnings per share, from $0.45 this year to $2.14 in 2026. This means that the stock is trading at 9.0x times its expected earnings in 2026. This earnings multiple may seem too low to some investors but it is important to keep in mind the high cyclicality of this business and its aforementioned risks. Overall, TechnipFMC seems to be reasonably valued right now.

Final thoughts

After five consecutive years of poor business performance, TechnipFMC finally enjoys strong business momentum. It also has exciting growth potential over the next decade, as oil and gas producers will have to significantly increase their capital expenses in order to grow their output and make up for the lack of investments over the last four years. Nevertheless, given the risks related to the high cyclicality of the oil and gas industry, the stock appears fairly valued.

Read the full article here