The potential Exxon Mobil (XOM) deal to acquire Pioneer Natural Resources (PXD) should make Devon Energy (NYSE:DVN) even more appealing. The independent energy company trades at yearly lows while a deal for Pioneer would be for a stock valuation at all-time highs. My investment thesis remains ultra-Bullish on Devon Energy trading at a discount to the other energy stocks on the market.

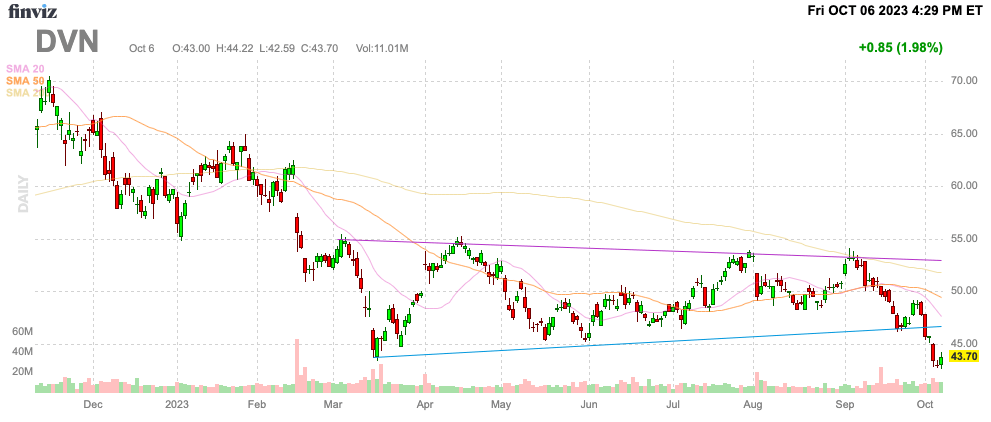

Source: Finviz

Odd Dip

Devon Energy was oddly left out of the recent rally in oil. The stock now trades at multi-year lows, even despite the big potential merger in the energy space and oil prices that spiked to $90/bbl.

Exxon Mobil is potentially bidding for Pioneer Natural Resources in a move to boost oil production from the Permian Basin. Exxon Mobil actually hit an all-time high right prior to news of the deal leaked late last week and the stock has reversed over $15 from the highs along with the corresponding dip in oil prices.

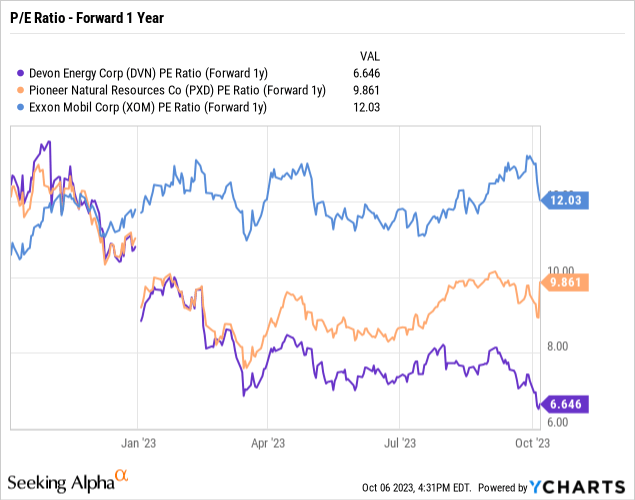

While the details of a potential $60 billion merger are unknown and might not even happen, the interesting aspect is the valuation disconnect between Devon and Pioneer here. Devon trades at only 6.6x forward EPS estimates while Pioneer trades at 9.9x EPS targets and Exxon Mobil is rumored as willing to pay another 10% premium for Pioneer on top of the rally on Friday.

Even Exxon Mobil now trades at 12.0x forward EPS targets. The stock market is oddly favoring the energy giant over the independent producers, hence one reason the company is probably targeting Pioneer. The deal could be very accretive with the use of cash, though shareholders are unlikely to want Exxon Mobil to pile on a bunch of debt again.

Booming Oil Production

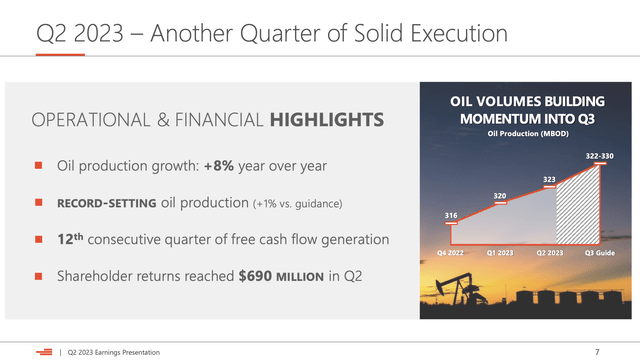

Devon Energy continues to boost oil production with guidance for Q3 production reaching 322K b/d to 330K b/d, up from 323K b/d back in Q2. Oil production growth reached 8% YoY and total production hit 662K boe/d.

Source: Devon Energy Q2’23 presentation

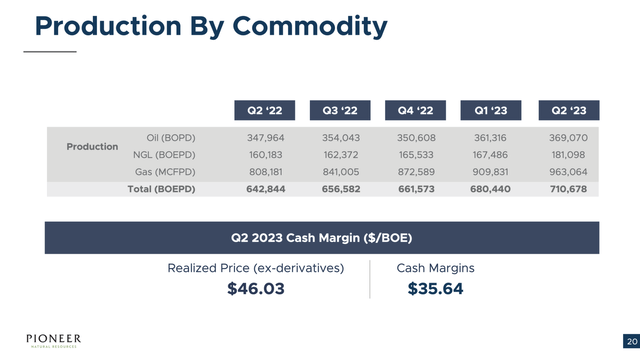

The odd part here is that Pioneer Resources only produced 369K b/d of oil during Q2 with total production at 710K boe/d. The independent energy company had oil production at 52% of total production, slightly above the 49% oil production levels at Devon.

Source: Pioneer Q2’23 presentation

One has to really question the valuation discrepancy between Pioneer with a potential offer for $60 billion and Devon Energy trading with a current market cap of only $28 billion. The issue really isn’t the valuation for Pioneer at $60 billion with forecasts for annual free cash flow topping $5 billion annually with WTI prices at $80/bbl.

Devon now offers investors a massive dividend opportunity. The energy company pays a fixed $0.20 quarterly dividend amounting to a 1.8% dividend yield while the variable amount hit $0.29 during Q2 and the higher oil prices are likely to help boost this amount.

Based on a consistent $0.49 quarterly dividend, Devon would pay a $1.96 annual dividend offering a 4.5% dividend yield. On top of these dividend payouts, the company repurchased 3.8 million shares for $200 million during Q2 and the current stock weakness along with oil prices rallying to $90 provides an ideal opportunity to buy very cheap shares.

Takeaway

The key investor takeaway is that Devon Energy just appears an ignored energy stock despite strong profits and capital returns. Exxon Mobil might be chasing Pioneer due to Permian Basis resources and a CEO looking to retire making a deal more possible, but Devon Energy is the much cheaper play here.

Investors in Pioneer Natural Resources should use any offer from Exxon Mobil to flip the investment into Devon Energy. One can sell Pioneer at all-time highs and flip that investment into Devon at multi-year lows.

Read the full article here