DigitalOcean (NYSE:DOCN) has stumbled after briefly taking part in the broader recovery in growth stocks. DOCN has seen its revenue growth rate decelerate rapidly as existing customers pulled back growth ambitions. With growth rates now roughly in-line with larger mega-cap cloud titans, investors may be wondering if the stock remains compelling given the highly leveraged balance sheet. While it is likely that DOCN may always operate at some disadvantage relative to larger peers, the stock trades at very cheap valuations. I expect growth rates to pick up once the macro environment improves, helping to both ease leverage concerns as well as highlight the undervaluation in the stock. I reiterate my strong buy rating as DOCN is still a deep value play in tech.

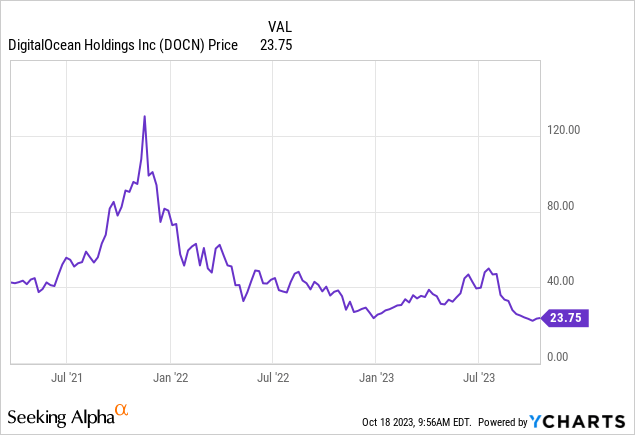

DOCN Stock Price

DOCN at one point soared triple-digits since the start of the year, but has since given up almost all of its gains.

I last covered DOCN in July where I reiterated my strong buy rating. The stock is down heavily since then – what went wrong? I did not expect growth rates to implode so rapidly, as DOCN’s smaller size seemed to indicate an ability to sustain solid growth rates relative to larger peers (a hypothesis which has since proven incorrect). While we may be running the risk of throwing good money after bad, I am of the view that DOCN continues to have a niche serving smaller enterprises in the cloud space.

DOCN Stock Key Metrics

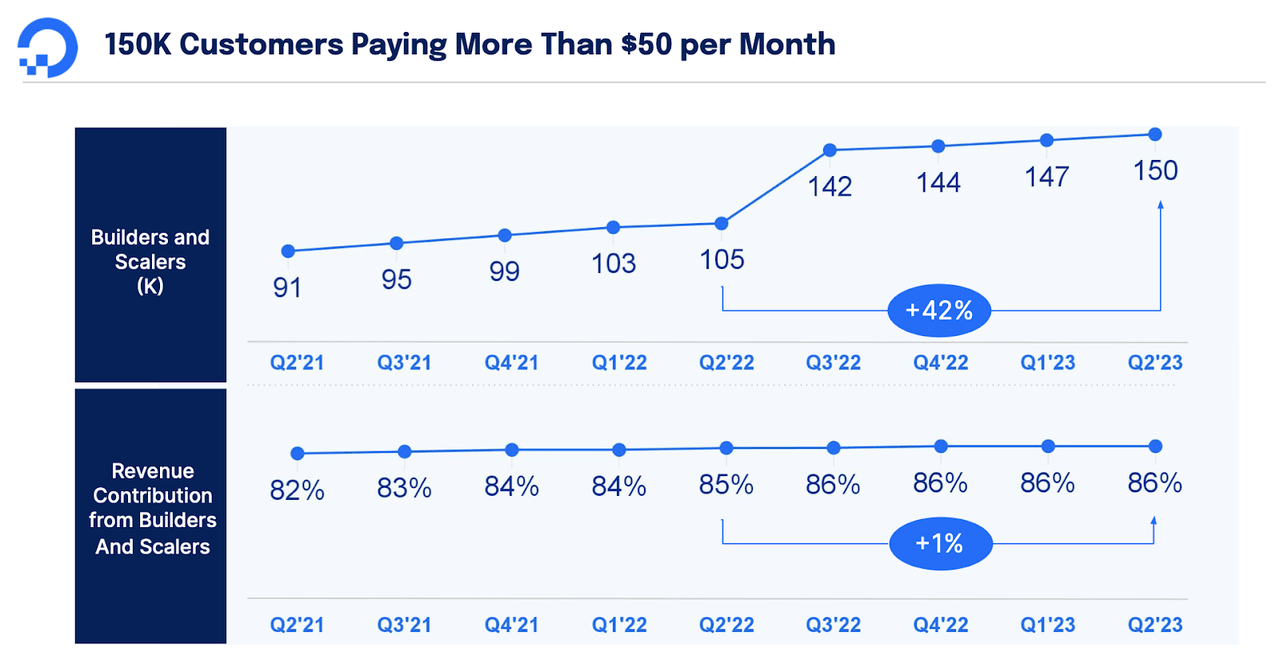

In its most recent quarter, DOCN delivered just $169.8 million in revenue, falling short of guidance for $170.5 million. After seeing a one-time boost in large customers due to a pricing increase last year, DOCN has seen customer growth stall sequentially.

2023 Q2 Presentation

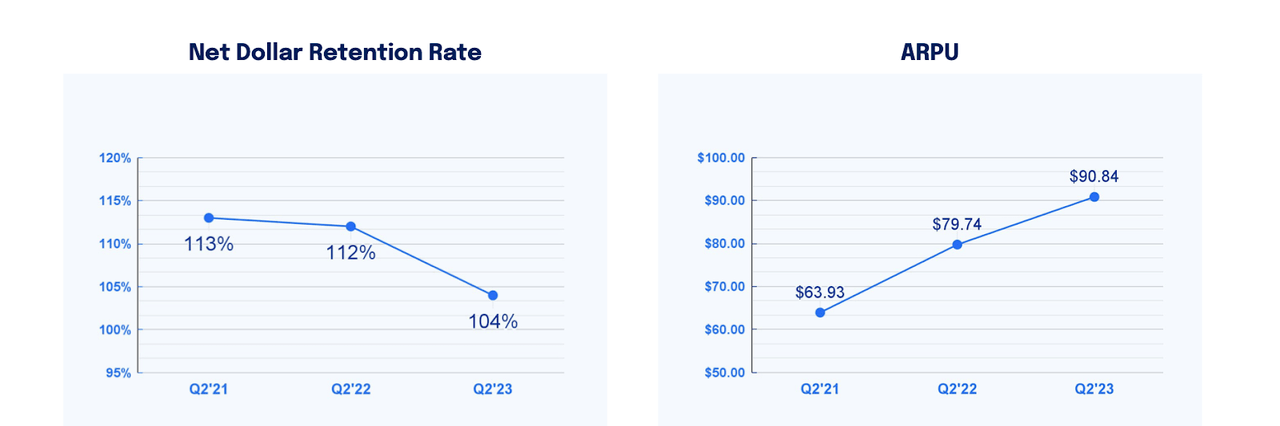

Those headwinds come at a time when the net dollar retention rate from existing customers continues to fall, ending up at 104% in the quarter. Average revenue per user (‘ARPU’) grew solidly YoY, but that was due to the aforementioned pricing increase. I expect ARPU growth to moderate in the third quarter as that would be the first time the company laps the price increase.

2023 Q2 Presentation

The lone bright spot was that DOCN continued to generate cash. Adjusted EBITDA stood at $72.2 million, or 43% of revenue, and free cash flow stood at $45.1 million, or 27% of revenue. DOCN ended the quarter with $550 million of cash versus $1.5 billion of debt, which inclusive of the $111 million in cash spent on the Paperspace acquisition, nets out to just over $1 billion in net debt. That is a sizable leverage position of around 4x debt to EBITDA. Leverage runs high here due to the company’s acquisition spree over the past several years. I expect leverage to come down as the company realizes operating leverage. DOCN repurchased 2.78 million shares for $103 million in the quarter, bringing its year-to-date repurchase total to $369 million.

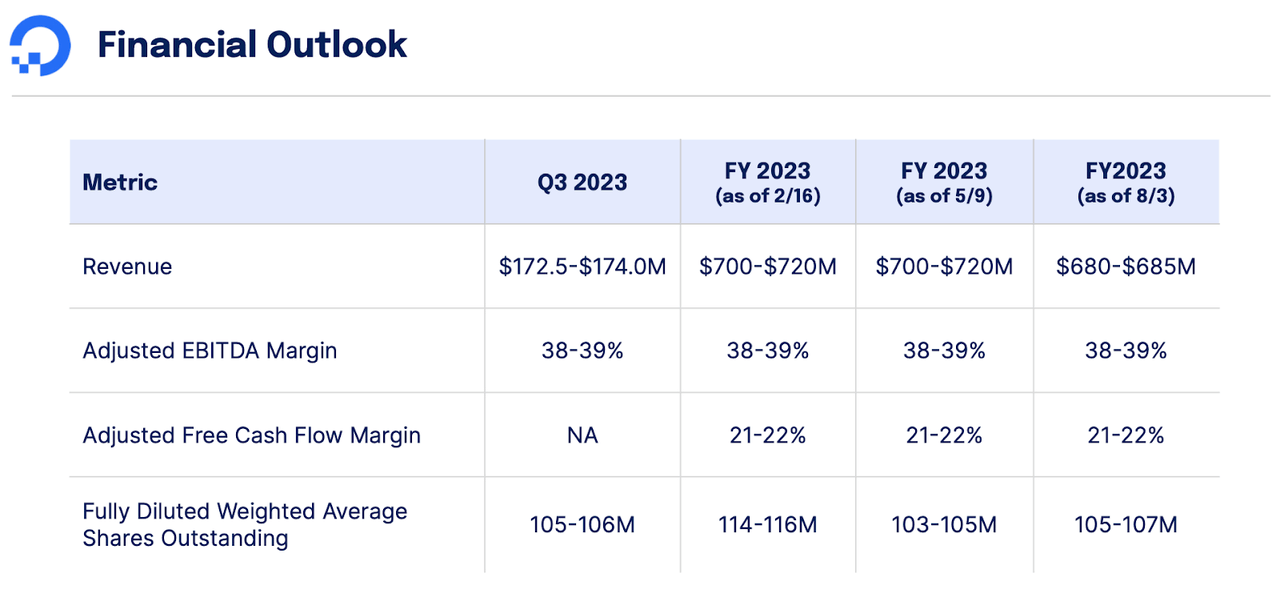

Looking ahead, management reduced full-year revenue guidance to just $685 million at the high end, implying 14% YoY growth. That growth rate trails that of the mega-cap cloud titans and may imply that generative AI or the macro environment are causing the company to lose market share.

2023 Q2 Presentation

On the conference call, management touted the Paperspace acquisition as helping to fill the void in the company’s AI offerings. It is good to see management recognizing the competitive risks, but I am doubtful that this acquisition offers a quick and easy fix. Management noted that Paperspace had a triple-digit-growth rate and may contribute a couple percentage points to overall company growth in 2024.

Management noted that they had not seen a bottom in growth deceleration given that customers remain “much more disciplined about managing their cloud storage.” Adding insult to injury, the company disclosed accounting errors in the first quarter report, specifically related to the calculation of income tax expense. Management expects the restatement to have an immaterial impact to adjusted EBITDA.

Cloudways, which they acquired last year, grew at a 45% YoY rate. Management expects Cloudways to become a larger and larger percentage of their revenue mix and thus a more meaningful contributor to overall growth. That said, skeptics may note that this fact may simply be adding fuel to the bearish thesis, namely that the company has been juicing growth rates through M&A.

Management noted that they intend to slow down their pace of share repurchases due to the “significant opportunity” for growth. In my view, that decision is more likely due to the fact that leverage is running quite high.

Subsequent to the end of the quarter, the company announced that they had begun a search for a new CEO. That sent the stock falling even further, as this is increasingly looking like a company losing focus amidst a tough macro environment.

Is DOCN Stock A Buy, Sell, or Hold?

While the fundamental picture continues to deteriorate, DOCN is trading cheaply. The stock recently traded hands at around 3x sales, an arguably cheap multiple given consensus estimates for healthy double-digit revenue growth over the long term. The stock looks cheap even if the company never returns to management’s prior guidance of 30% growth.

Seeking Alpha

DOCN has significant leverage, a negative given that most tech stocks have net cash balance sheets. But DOCN makes up for that with higher profit margins, with the stock recently trading at less than 20x this year’s earnings estimates.

Seeking Alpha

The presence of the large debt load elevates the risks here. If revenue growth continues to decelerate, and fails to accelerate upon a macro recovery (indicating disruption by the cloud titans), then the stock looks expensive as it may need to trade down to a single-digit multiple of earnings at that point. But if DOCN can continue to operate in its niche of serving smaller and medium sized enterprises, making up for a more modest product offering with stronger customer service, then the company might be able to sustain double-digit top-line growth over the long term, benefiting from the secular growth drivers of cloud and data. As the company generates increasing cash flows, the leverage ratio should moderate and thus support a higher multiple. Even at a modest valuation of 6x-7x sales the stock offers around triple-digit upside.

What are the key risks? I have already highlighted the competitive risks. Generative AI may have exacerbated this issue as even smaller enterprises may view generative AI as being a critical product offering from cloud providers. It is possible that DOCN is unable to innovate fast enough to bridge the competitive gap. We must also not ignore the fact that management allowed leverage to get this high through aggressive M&A.

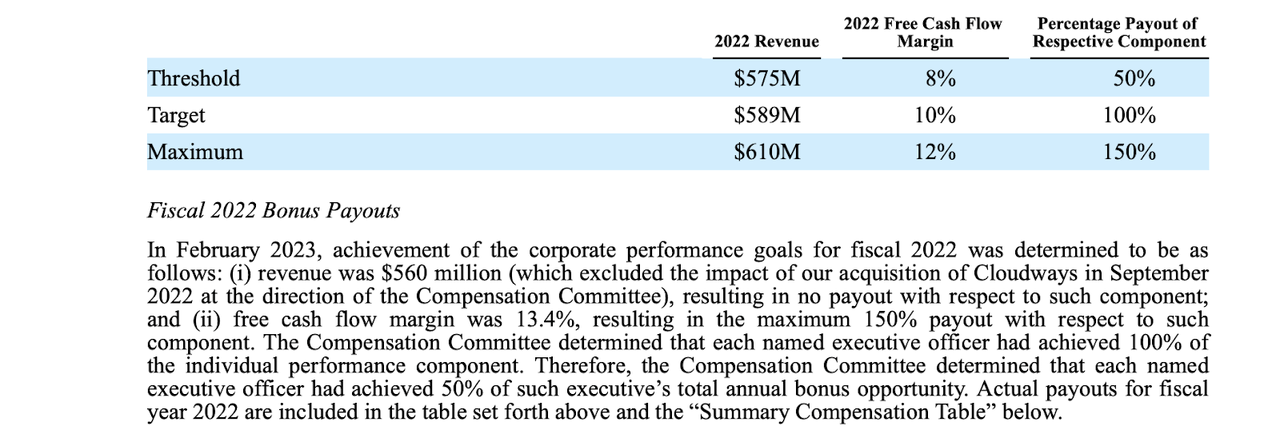

One may be wondering why the company has been so acquisitive – the answer lies in their compensation plan. As stated in their proxy, bonus compensation is paid out in large part based on revenue targets.

2023 DEF14A

This kind of incentive structure may present elevated risk as management may seek to further acquire to increase company size, at the risk of the balance sheet.

Because I expect a significant recovery in growth rates upon an improvement in macro conditions, I reiterate my strong buy rating for the stock but caution that the optimism is mainly based on the valuation as balance sheet and competitive risks loom large here.

Read the full article here