Introduction

The last and only time I wrote about The Walt Disney Company (NYSE:DIS) was in July 2023, when I argued that the stock needed a catalyst to finally turn around and move away from its long-term downtrend.

Seeking Alpha, my past coverage of DIS

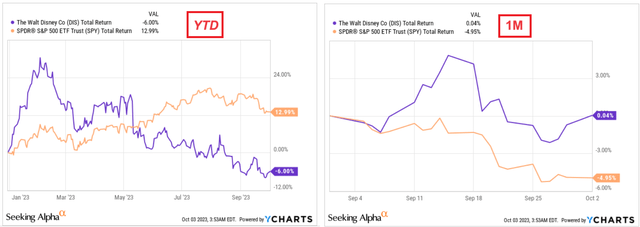

Since the beginning of this year, shares of DIS have significantly underperformed the broader market [by ~19%]. But over the past month, as the S&P 500 Index (SPY) (SPX) experienced a correction, DIS stock has remained stagnant:

YCharts, author’s notes

Has the stock received the catalyst it needed during this time and is finally ready for a turnaround? Let’s find out together.

The Recent Financial Performance

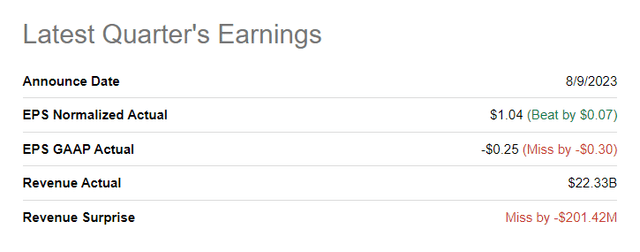

Disney reported its fiscal 3Q23 results on August 9th, revealing mixed performance. While the company exceeded EPS estimates by $0.04, it fell short of revenue expectations by $180 million.

Seeking Alpha, DIS

As a reminder, in February 2023, Disney implemented a corporate restructuring, including layoffs and expense cuts, intending to reduce expenses by $5.5 billion, including $3 billion in content spending cuts. The company also reorganized its management structure, returning to a structure similar to that during Bob Iger’s previous tenure as CEO.

In Q2, DIS continued its restructuring efforts, incurring a substantial $2.44 billion charge related to content impairment and a $210 million charge for severance during the quarter. These charges were excluded from adjusted and segment results.

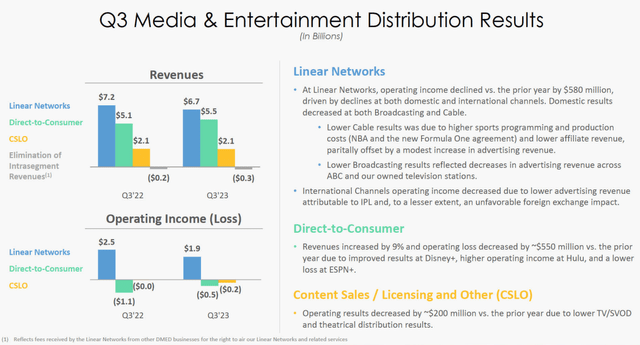

The fiscal 3Q revenue reached $22.3 billion, a 4% increase from the previous year, driven mainly by the Parks, Experiences, and Products division, which saw a 13% revenue increase. This growth was primarily due to international parks rebounding from COVID-related closures. The Media and Entertainment Distribution division experienced a 1% decline in revenue, with direct-to-consumer video streaming revenue rising 9% but offset by declines in linear networks and content sales.

The consolidated segment operating income remained flat at $3.6 billion. Disney’s direct-to-consumer business reported an operating loss of $512 million, narrowing from previous losses, thanks to restructuring efforts.

Disney’s IR materials

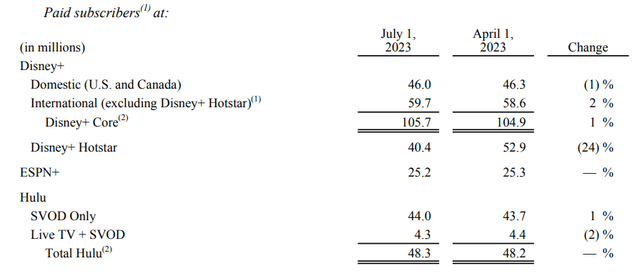

Disney+ lost 12 million net subscribers in fiscal 3Q, including domestic and international losses, though partially offset by an increase in standalone Disney+ international subscribers. Disney ended the quarter with 146.1 million Disney+ subscribers, down 6% from the previous year, and 219.5 million total subscribers across all streaming services, down 1%.

Disney’s 10-Q

To boost profitability, Disney announced price increases for its direct-to-consumer services, including Disney+ and Hulu. They also planned a password-sharing crackdown in 2024, following Netflix’s lead.

Disney faced challenges with strikes by the Writers Guild of America and SAG-AFTRA, affecting content production and promotion. The strikes posed both short-term margin benefits and long-term content creation challenges. Why? The benefit in the short term comes from cost savings as production expenses, including salaries and wages for actors, writers, and crew, are reduced or eliminated during the strike period. In the meantime, Disney can continue to generate revenue from content already produced and distributed, which increases short-term margins and cash flow.

However prolonged strikes can lead to significant content gaps in Disney’s production pipeline. The lack of new content may lead to a decline in viewership and audience engagement, particularly on linear broadcast and cable channels, which may have a long-term negative impact on the company’s viewership and advertising revenues.

All this leads me to quite mixed feelings: In my opinion, the accumulated problems of DIS are far from solved, even after the return of the old CEO, no matter what anyone says. Maybe something has changed on the street expectations or valuation?

Valuation & Expectations

Last time, I did a comparative analysis with Disney’s major competitors to see how undervalued or overvalued the stock was at the time. Here are the peer companies I’ll compare DIS to today:

-

Comcast Corporation (CMCSA): a global media and technology company that owns NBCUniversal that operates television networks, movie studios, theme parks, and cable networks;

-

Netflix Inc.: a leading streaming service that offers a vast library of TV shows, movies, and original content;

-

AT&T Inc. (T): owns WarnerMedia, which includes Warner Bros. Studios, HBO, and various television networks;

-

Sony Group Corporation (OTCPK:SNEJF): owns Sony Pictures Entertainment, a major movie studio, and also operates television networks and other entertainment businesses;

-

Amazon.com Inc. (AMZN): a global technology and e-commerce company that owns Amazon Prime Video, a popular streaming service;

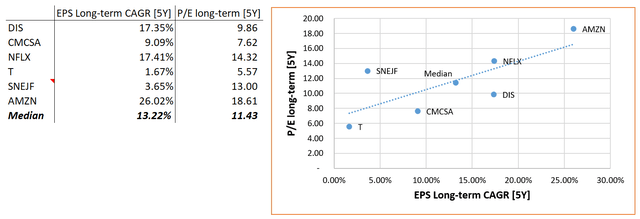

I suggest looking not at TTM multiples, as they’re skewed based on past results that no longer matter, but at forward earnings and their growth rates. And let’s not look just at the next year, but 5 years ahead for more clarity [Sony is an outlier here as I have data only for the next 4 years instead of 5]:

Seeking Alpha data, author’s calculations

Moreover, DIS is the only stock on the entire list whose EPS and implied P/E declined simultaneously in the most recent quarter. For both FY2023 and FY2027, EPS estimates were mostly positively revised, with implied P/Es falling by 10-15% in some cases.

| DIS | EPS down, PE down |

| CMCSA | EPS up, PE down |

| NFLX | EPS up, PE down |

| T | EPS up, PE down |

| SNEJF | EPS mixed, PE down |

| AMZN | EPS up, PE down |

Source: Author’s work

What conclusion can we draw from this? The stock of DIS is comparatively undervalued versus all its peers so far because, in the chart above, the DIS point is under the trend line with a long-term forecast for EPS growth at the level of Netflix. But this EPS forecast for DIS is declining, while NFLX’s is growing, which is not at all in favor of DIS.

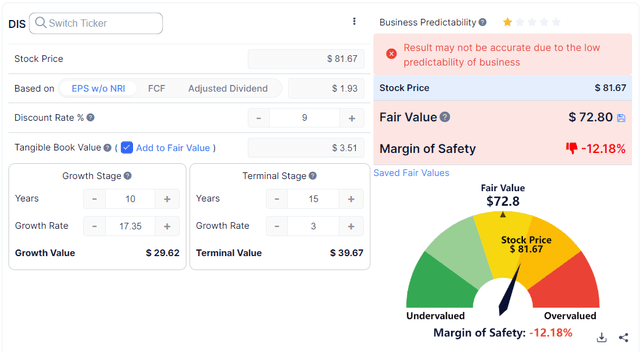

But what about intrinsic value? Let’s assume that the TTM EPS [$1.93] will grow at a current implied growth rate of +17.35% for 10 years rather than 5, and the terminal value will see a 3% YoY growth in the post-forecast period for a 15-year period. Then with a WACC of 9%, the DIS share is a bit overvalued today:

GuruFocus, author’s inputs

The Verdict

Based on the results of the analysis conducted today, I could not find any significant qualitative and quantitative changes that would favor a rapid recovery of DIS stock. Maybe I missed something – let me know in the comments below. However, in my opinion, DIS is still far from being called a “Buy” – this mouse [or dog] still needs a catalyst to gain that status. Therefore, I recommend avoiding DIS until such a catalyst emerges.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here