It has been three months since my latest update on The Walt Disney Company (NYSE:DIS) when I highlighted a number of reasons why the company is finally in a good position to deliver on its bottom line figures.

Seeking Alpha

Unfortunately for DIS shareholders, Q2 results failed to impress as more visibility on the company’s turnaround plan and DTC profitability was needed.

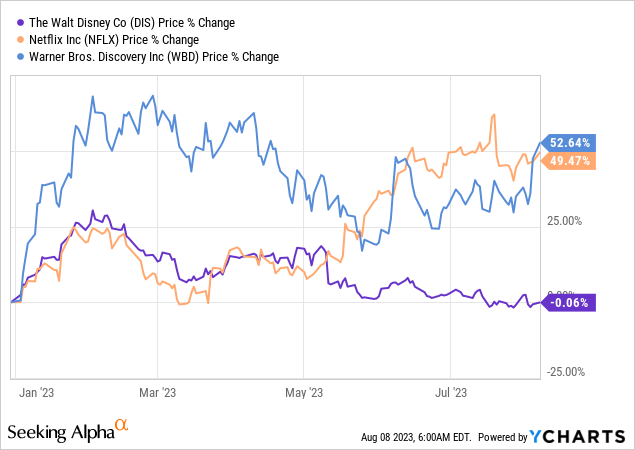

Thus after calling the initial top in DIS share price in late 2019 and then again in 2021, when excess liquidity brought the share price to unsustainable levels once again, Disney continues to be a bitter disappointment for investors with flat to slightly negative year-to-date returns (see below).

At the same time, key competitors, such as Netflix (NFLX) and Warner Bros. Discovery (WBD), both delivered roughly 50% return since the start of the year.

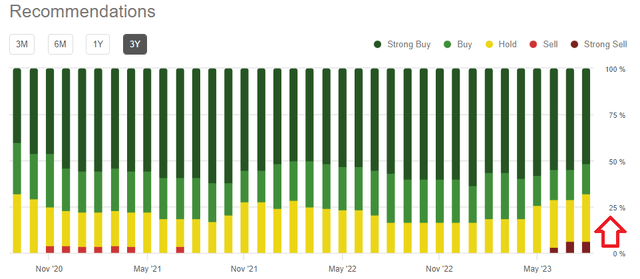

With that performance in mind, the expectations for the upcoming third quarter results later this week are high. That’s why even the usually optimistic sell-side analysts are now growing weary of the company’s prospects and consequently “sell” ratings begin to creep up.

Seeking Alpha

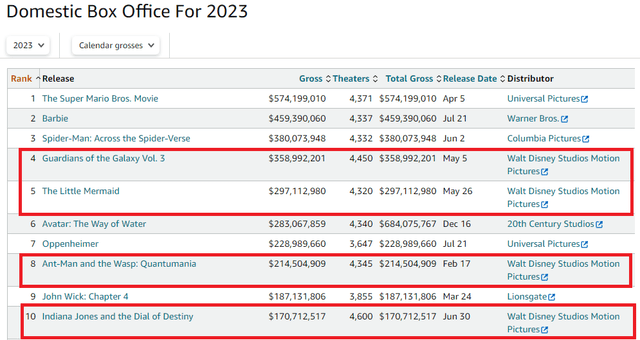

Gone are the days when Disney absolutely dominated at the box office, and it seems that the company still depends heavily on sequels and remakes of popular intellectual property.

www.boxofficemojo.com

Although Disney’s current problems would not be solved overnight, I still believe that the company is making the right move toward de-emphasizing quantity of released content at the expense of quality. Even more importantly for anyone considering buying Disney at current levels, the stock is now significantly less risky than it was a few years back.

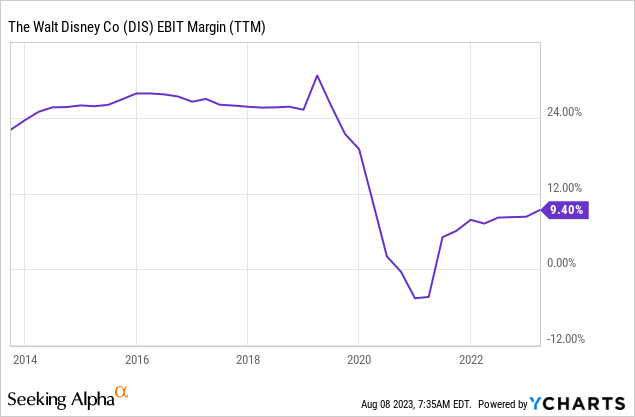

Cost Cutting Measured and Margins

As I warned about four years ago, the largest risk factor for Disney’s share price has been the uncertainty around the company’s operating margin as the business model shifted toward direct-to-consumer.

Management is now trying to tame skyrocketing production costs and has pledged to reduce the ballooning quantity of new content. The ambitious plan is targeting roughly $5.5bn of cost savings and it appears that the Q3 of 2023 would see the highest amount of severance charges.

(…) we are making excellent progress on our cost-cutting initiatives and are on track to meet or exceed the efficiency targets we outlined last quarter. During Q2, we took a restructuring charge over approximately $150 million, primarily related to severance. While we are continuing to refine our estimates, we currently expect to record additional severance charges of approximately $180 million over the remainder of this fiscal year with the bulk of that additional charge expected in the third quarter.

Source: Disney Q2 2023 Earnings Transcript

The progress made on this initiative is good news for long-term shareholders, but in the more immediate term, a larger than expected restructuring charges could easily lead to more downside.

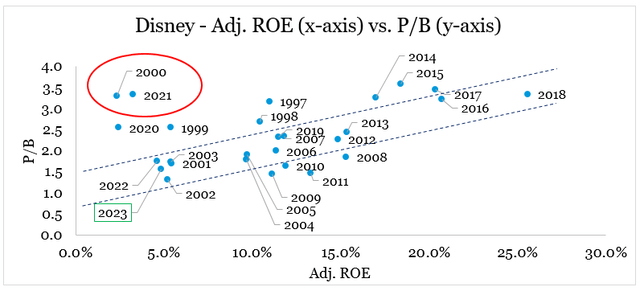

This downside risk, however, is largely limited due to Disney’s stock now being in a far better position when compared to 2021 period. What I mean by that is that the current price results a price-to-book ratio that’s in line with the company’s current adjusted return on equity (adjusted for restructuring charges and other income/expense). This is in stark contrast with 2021, when the share price was trading at levels far above those implied by the company’s ROE.

prepared by the author, using data from SEC Filings and Seeking Alpha

As we see above in fiscal year 2021, Disney stock was in a similar risk category to the 2000 period, which led to the dot.com bubble.

In hindsight, this is now obvious but at the time, most investors had a hard time believing that DIS could fall by nearly 50%.

Seeking Alpha

Nevertheless, this dynamic now results in Disney’s share price being less prone to a sharp fall, if the company fails to meet consensus estimates.

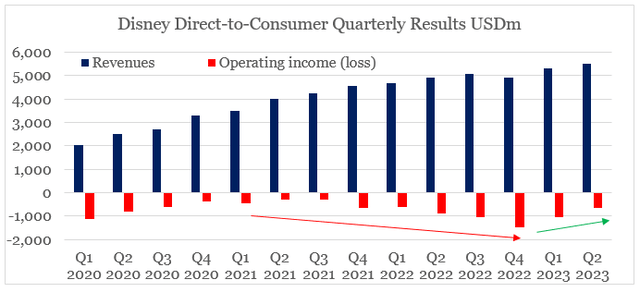

Progress Made In Direct-To-Consumer

On the surface, it appears that the Direct-to-Consumer segment is on track to achieve profitability in fiscal year 2024.

prepared by the author, using data from SEC Filings and Earnings Releases

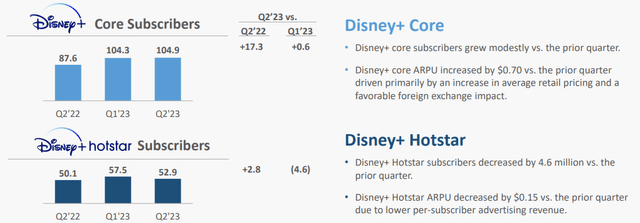

In that regard, the upcoming quarter will be very important for the progress being made on that front. Most importantly, since “core subscribers” growth has cooled off significantly during the previous quarter and Disney+ Hotstar saw a large drop.

Disney Investor Presentation

Average revenue per user (ARPU) would also be a key area to watch as in Q3 of 2023 there will be no favourable impact on ARPU from foreign exchange which make the quarter less susceptible to noise from macroeconomic factors.

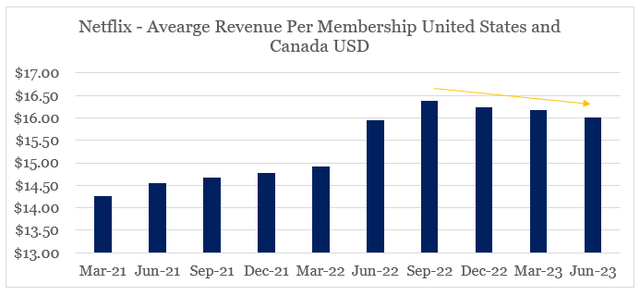

Judging by the latest results at Netflix (NFLX), Disney is not in a good position to meaningfully improve its ARPU and a more aggressive pricing approach would likely lead to loss of subscribers.

prepared by the author, using data from Earnings Releases

Any hint of more aggressive on advertising on Disney+ also would be perceived as a positive sign that the company is capable of breaking-even in the DTC segment as subscriber growth cools off.

The truth is we have only just begun to scratch the surface of what we can do with advertising on Disney+. And I’m incredibly bullish on our longer term advertising positioning.

Source: Disney Q2 2023 Earnings Transcript

Although quarterly trends often contain lots of noises and forecasts are hard to make, the upcoming quarter will be of paramount importance on how Disney is progressing in terms of achieving profitability in its DTC segment. In a similar fashion to parks (as we’ll see below), investors also should keep in mind that the macroeconomic environment remains supportive for now but it could quickly change in following quarters.

Is Momentum In Parks Fading?

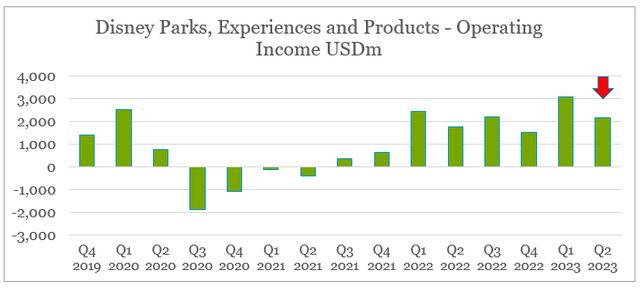

Disney’s Parks, Experiences and Products segment has been a bright spot on the company’s income statement as demand remained strong and the price increases took place.

That’s why earlier in the fiscal year, Disney’s management was very optimistic about retaining the record-high margins. Then Q2 came with a disappointing drop in profitability that brought operating margin down from 35% in Q1 to 28%.

prepared by the author, using data from SEC Filings and Earnings Releases

During the last quarter, Disney’s management blamed wage increases and costs associated with new guest offerings for the profitability drop in domestic parks, while international parks benefited both from the weaker dollar and higher attendance.

Moving on to Parks, Experiences, and Products, operating income increased by over 20% vs. the prior year to $2.2 billion, with increases at both international and domestic parks and experiences partially offset by lower merchandise licensing results at consumer products. Our international parks were a bright spot this quarter, with strong year-over-year operating income growth driven by higher attendance and improved financial results

Source: Disney Q2 2023 Earnings Transcript

Investors should look carefully for the dynamic between international and domestic parks as the latter would continue to suffer from higher cost pressures.

(…) inflationary cost pressures, including from a new union agreement, is expected to drive a modest adverse impact to domestic parks and experiences operating margins in the third quarter compared to the prior year.

Source: Disney Q2 2023 Earnings Transcript

As long as the economy remains strong and discretionary spending increases, Disney is in a good position to see its Parks, Experiences and Products segment flourish due to high attendance and pricing initiatives taking place. In a similar fashion to the DTC segment, however, results that are in-line or worse than expectations could be perceived as a negative signal due to the high risk of an economic slowdown in the coming months.

Conclusion

The long-lasting problems at Disney are unlikely to go away overnight. The recent pivot away from its quantity over quality strategy, however, is encouraging and investors would be looking for more details on the cost-cutting initiatives, progress being made in the DTC segment and sustainability of margins in the Parks, Experiences and Products segment. At the same time, the share price response to a slight miss in consensus estimates is likely to be muted as Disney now trades more in-line with its business fundamentals.

Read the full article here