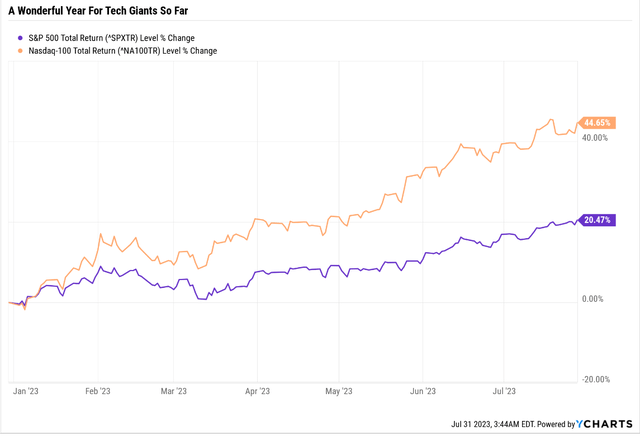

Wall Street is partying, celebrating what is increasingly looking like a soft landing, kind of.

YCharts

Is there news to justify this? Yes, in a way. The economy is proving more resilient than expected, with Q2 GDP just benign revised up from 2% to 2.6%.

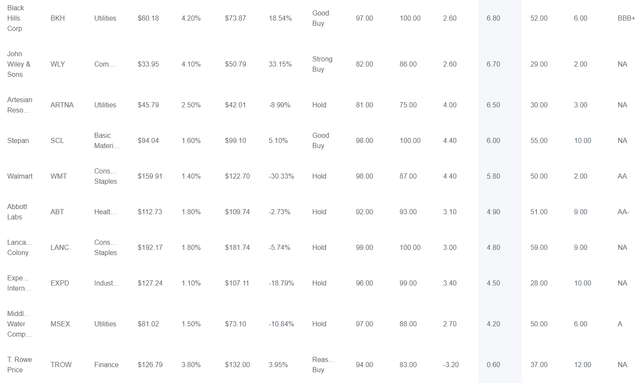

Daily Shot

The economy is growing so strongly that the soft-landing dreams are back on the table. Some economists at JPMorgan think that, for the first time in history, the Fed will be able to bring down inflation from above 5% without a recession.

But here’s the problem…

The S&P Was Pricing In A Soft Landing 10% Ago

I’m not denying that the economic news has been pretty good, steadily pushing back the most anticipated historical recession. While the data still points to a mild 2024 recession, with the bond market saying a 100% chance by July 31st, 2024, here is what Wall Street is missing.

| Weekly Decline In S&P EPS Consensus | Last Week’s EPS Consensus | Year | EPS Consensus | YOY Growth | Forward PE |

| 0.00% | $206.58 | 2021 | $206.58 | 50.43% | 22.2 |

| -0.06% | $215.93 | 2022 | $215.80 | 4.46% | 21.2 |

| -0.52% | $219.09 | 2023 | $217.94 | 0.99% | 21.0 |

| -0.11% | $245.20 | 2024 | $244.93 | 12.38% | 18.7 |

| 0.20% | $274.26 | 2025 | $274.82 | 12.20% | 16.7 |

| 2024 Recession-Adjusted Forward PE | Historical 2024 EPS (Including Recession) | 12-Month forward EPS | 12-Month Forward PE | Historical Overvaluation | |

| 21.50 | $213.09 | $234.03 | 19.580 | 16.34% |

(Source: DK S&P 500 Valuation Tool, FactSet.)

If there is a 2024 recession, the 13% historical EPS decline (from current expectations) would make the S&P 500 (SP500) trading at 21.5X forward earnings.

- 22X January 4th, 2022, before stocks fell 28% in 9 months.

What if we have the first soft landing when inflation started above 5%? Then stocks are “only” 19.6X forward earnings, a 16% historical premium.

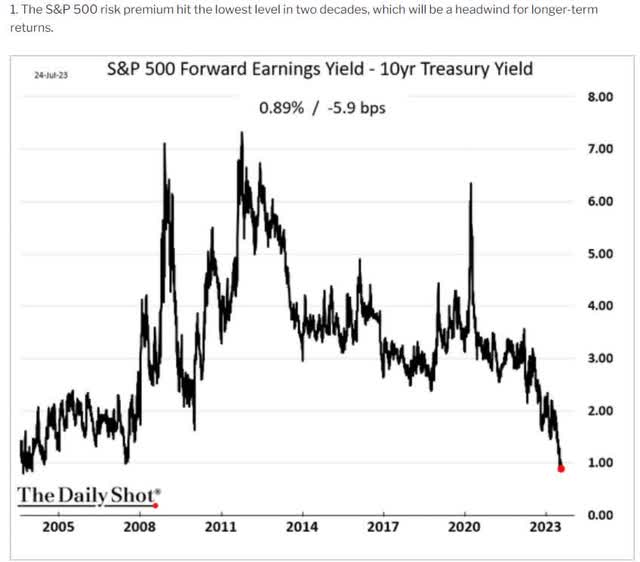

That would be high even if interest rates were zero, but they aren’t zero; the Fed just raised rates for the 11th time to a 22-year high.

Daily Shot

And that’s why, compared to bonds, it’s the worst time in 20 years to buy the S&P 500.

Can valuation be used to time the market? Nope, not at all.

Does it tell you anything about future returns? Absolutely.

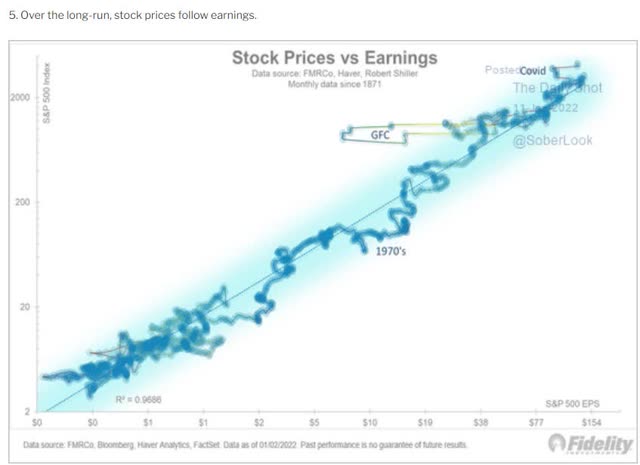

Fidelity

Over ten years, 90% of stock returns are explained by valuation alone: over 20 years, 91%; and over 30+ years, 97%.

What percent of stock returns are explained by valuations over 12 months? The time frame of the infamous “analyst recommendation”? According to JPMorgan, it’s 5%.

In the short-term, momentum and sentiment (luck) are 20X more powerful than fundamentals.

But in the long-term, fundamentals are 33X as powerful as luck.

In the short term, stock prices are vanity, a crapshoot in the Wall Street casino.

In the long-term, stock prices are fundamentals-driven destiny, and the Wall Street Casino is the House that always wins.

Long-term investors owning the world’s best companies are the House; they always win unless the world ends.

And I can personally promise you the world isn’t going to end. If it does, we’ll be too dead to care that I was wrong;)

There Is Always Something Smart To Buy, Even In Stupid Markets

Are there economists who are still bullish on the S&P even today? Sure. Tom Lee at Fundstrat has a 4,800 end-of-year target, and his bullish case is 5,000.

But even the most bullish economists admit that valuations today are so stretched that they expect long-term returns for the market to be rather uninspiring…to say the least.

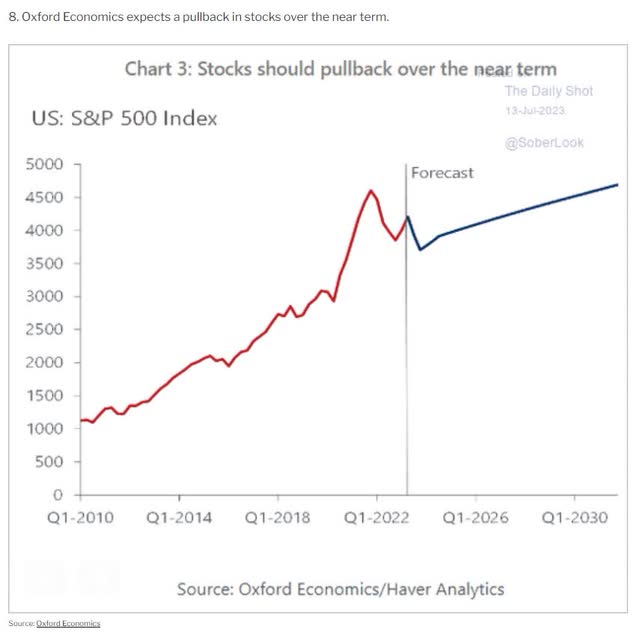

1.4% Annual Returns For S&P 500 Through 2030: Oxford Economics

Daily Shot

Oxford’s economists expect a shark correction soon followed by a lost decade for the market over the next six years. What about AI? Isn’t that going to boost productivity? Drive earnings growth higher? Save the market and keep us partying like its 1999 forever?

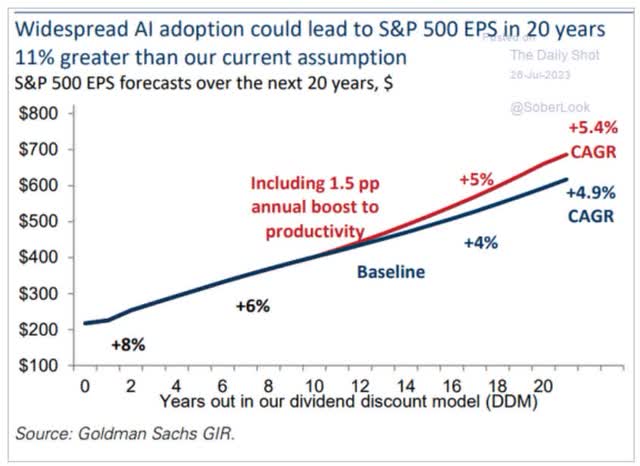

Daily Shot

Goldman’s base case is a 1.5% boost to productivity over the next two decades.

Which they believe will translate into 11% better earnings over the next two decades. Not per year, but just 11% higher 20 years from now. That’s just 5.4% annual earnings growth.

- 10.2% from 2009 through 2022.

Why is Goldman so bearish on earnings growth in the coming decades? For the same reasons, the Fed thinks earnings will be much slower.

- End of an Era: The Coming Long-Run Slowdown in Corporate Profit Growth and Stock Returns.

For 40 years, corporate earnings benefited from several key tailwinds that have become headwinds.

- 40 years of falling interest rates

- 40 years of falling corporate taxes

- 40 years of globalization lowering costs and expanding markets

- 40 years of historically high immigration.

Now all that has stopped or gone into reverse, and that’s why some economists, like Goldman and Oxford, expect stock returns to suck in the coming decade.

Goldman’s forecast for the next 20 years should humble anyone planning to use index funds to retire.

| Metric | Goldman Base-Case Forecast | Total Return Over 20 Years |

| Yield | 1.4% | 32% |

| Growth With AI Boost | 5.4% | 187% |

| Growth Without AI Boost | 4.9% | 160% |

| Valuation Drag | -0.7% | -17% |

| Total Return With AI Boost | 6.1% | 224% |

| Total Return Without AI Boost | 5.6% | 195% |

| 20-Year Bond Market Inflation Forecast | 2.5% | 63% |

| Inflation-Adjusted Total Return With AI Boost | 3.6% | 102% |

| Inflation-Adjusted Total Return Without AI Boost | 3.1% | 83% |

(Source: Goldman Sachs.)

Goldman’s base case is that stocks will return 3.6% real returns over the next 20 years, doubling your buying power in two decades. The S&P’s historical inflation-adjusted return is 7% for the last ten years, 25 years, 50 years, 100 years, and even 217 years, according to BlackRock.

- 287% is the S&P’s historical inflation-adjusted 20-year return

- Goldman thinks S&P’s 20-year returns will be 65% below the historical norm.

Two-thirds weaker stock market returns…there is only one thing that could be worse. And that’s if investors attempted to time the market so poorly, they achieved 65% worse returns than the market.

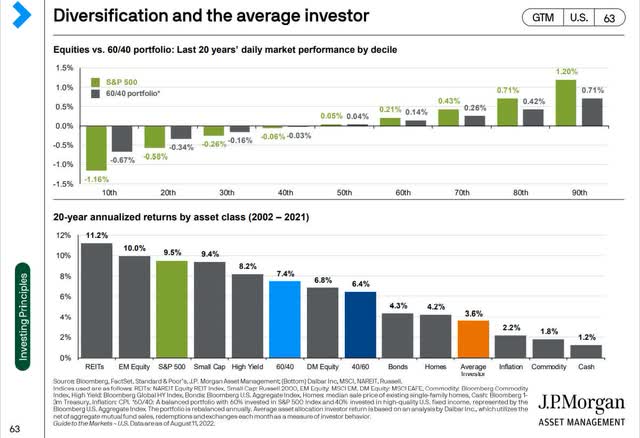

JPMorgan Asset Management

Which is exactly what happened over the last 20 years.

When billionaire hedge fund managers can’t time the market, what hope do regular folks have? The hope of lottery ticket math, it seems. And that’s about how much sense market timing makes.

- 6.1% Goldman 20-year S&P base case return

- historically expects average investors to achieve 2.3%

- adjusted for inflation: -0.2% for the average investors investing in S&P 500 through market timing…for 20 years.

Oxford Economics thinks investors are in for a lost decade. Goldman thinks the average investor could be in for a lost two decades.

And guess what? I have the solution to help you overcome the market’s insane valuations! Here is a wonderful and sane way to help you maximize your chances of retiring rich and staying rich in retirement.

High Total Return Dividend Aristocrats: The Smart Solution To Our Stupid Market

- dividend aristocrat: S&P company with a 25+ year dividend growth streak

- dividend champion: any company with a 25+ year dividend growth streak

- dividend king: any company with a 50+ year dividend growth streak.

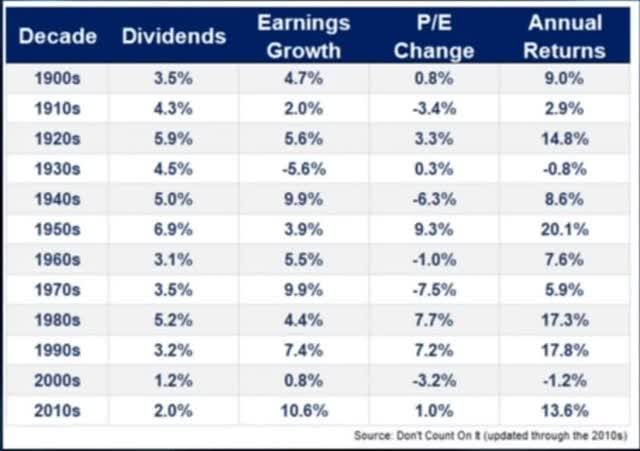

For about 70 years, most of Wall Street has been using the Gordon Dividend Growth Model for forecasting long-term returns.

- Vanguard

- Fidelity

- Schwab

- Brookfield

- Oaktree

- JPMorgan

- Bank of America

- the hedge fund industry

- private equity.

The Physics Of Finance: Fundamentals Driven Destiny

Ritholtz Wealth Management

Yield, growth, and valuation changes, nothing else actually matters. Or, more specifically, nothing will directly drive returns.

- Quality will protect you from owning one of the 44% of stocks that falls 70+% and never recovers.

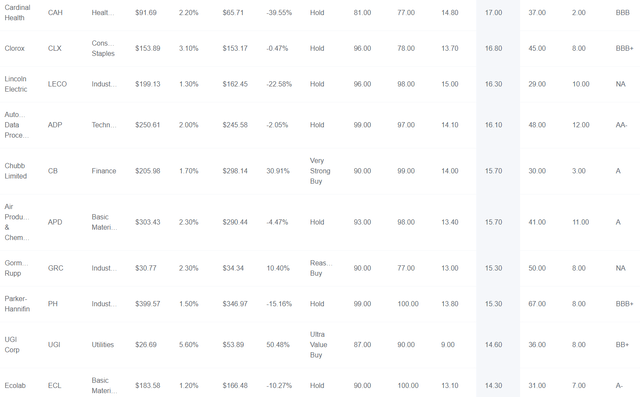

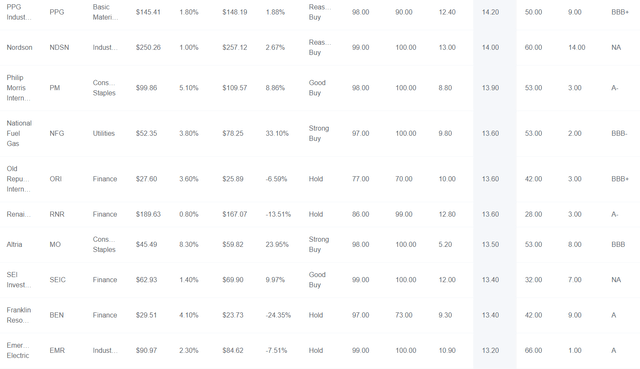

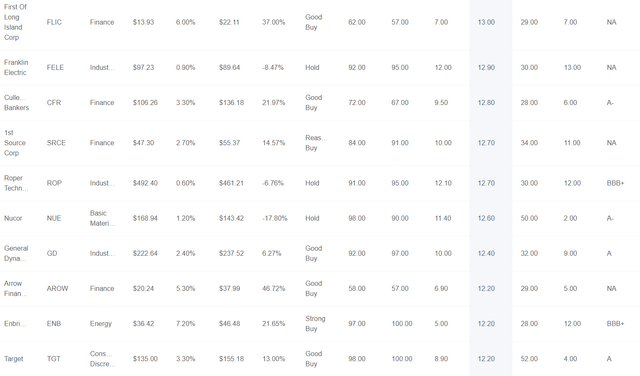

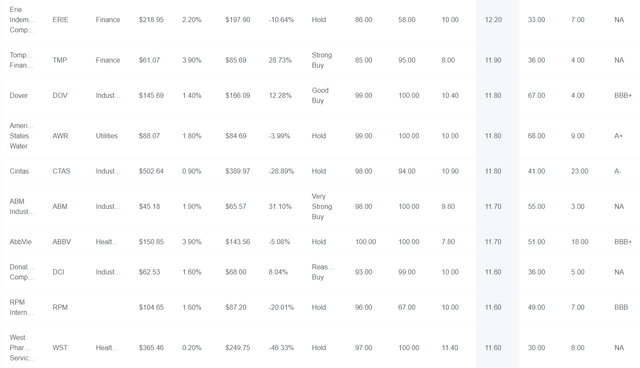

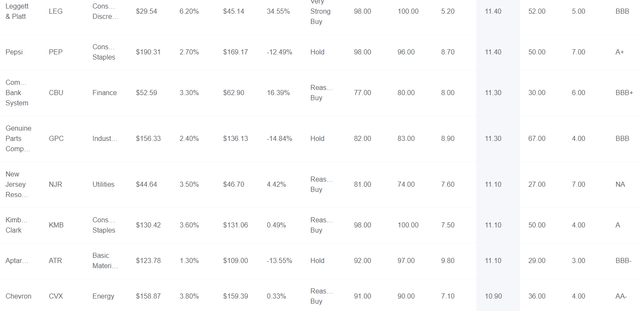

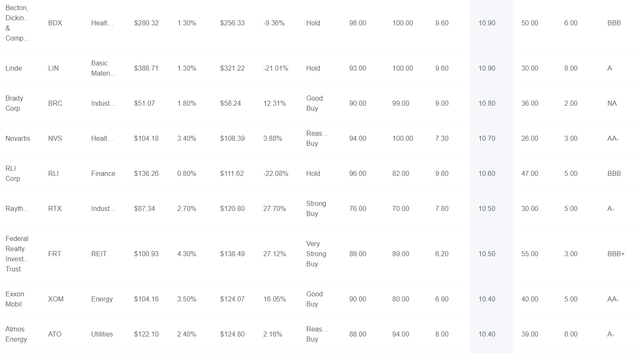

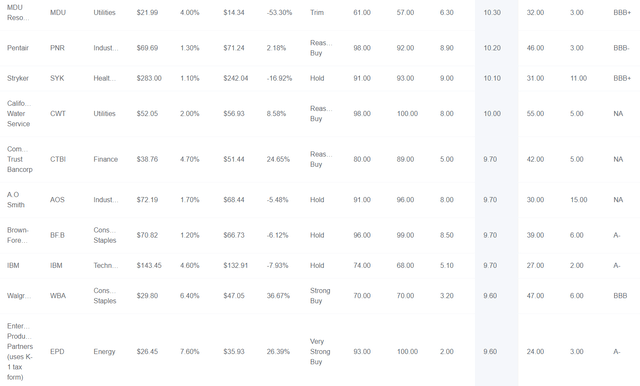

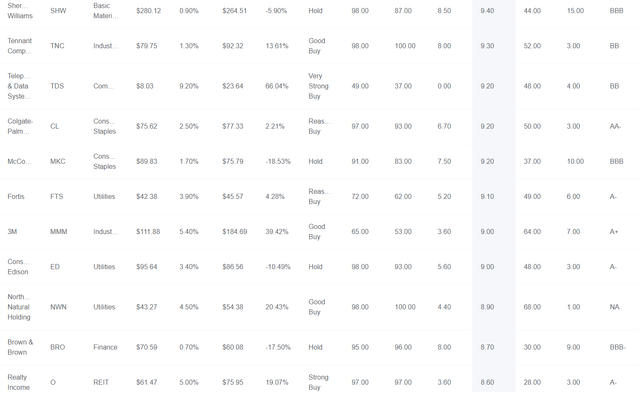

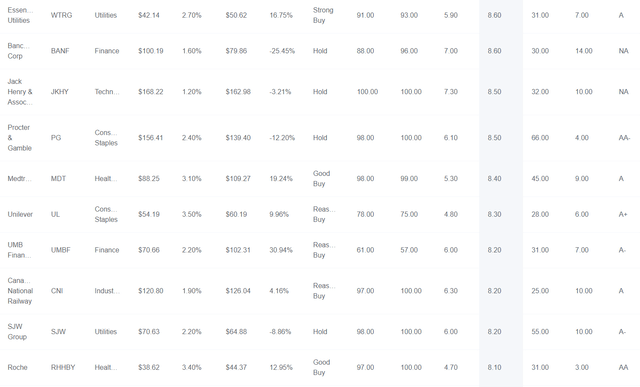

So let’s look at all the dividend aristocrats, champions, and kings and rank them by their long-term consensus total return potential, yield + long-term growth consensus (valuation cancels out over 30+ years).

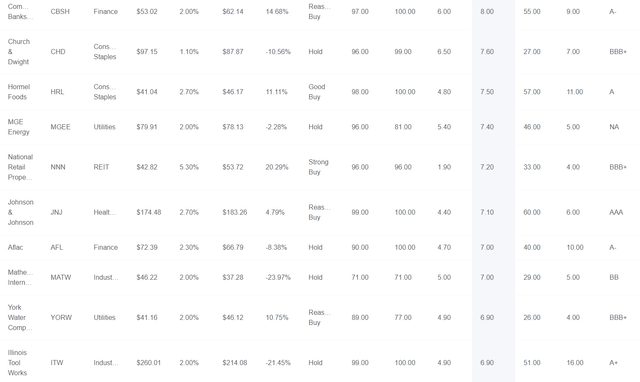

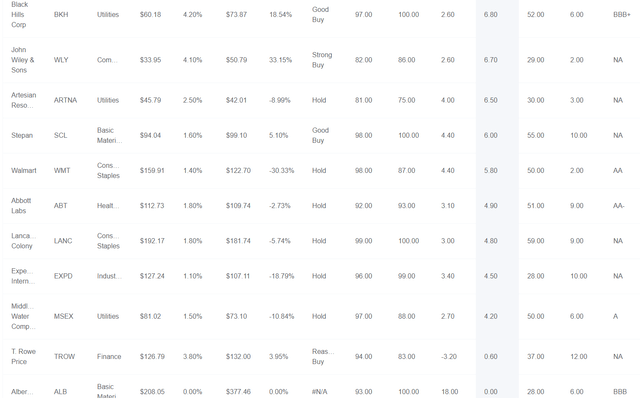

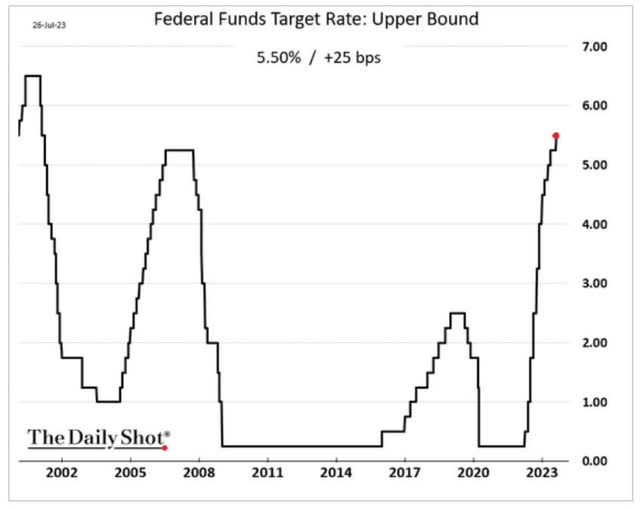

Dividend Aristocrat Ranked By Long-Term Total Return Potential

- we’re ignoring valuations in this article

- DO NOT BUY OVERVALUED Aristocrats

DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal DK Zen Research Terminal

Bottom Line: Choose Smart Stocks So You Can Sleep Well At Night In Stupid Markets

Valuations seldom matter in the short term and almost always matter in the long term. In the long term, they are the only thing that matters.

Today the market is objectively stupid. 20X forward earnings have never made sense, not even when rates were zero, much less the highest interest rate in 22 years.

So This Is Why Relative Valuations Are At 20-Year Highs?

Daily Shot

But it’s always and forever a market of stocks, not a stock market.

The butcher’s bill is about to come due after a decade when any index fund investor could kick back and enjoy 16% annual returns, on par with the greatest investors in history.

Things will likely be much harder unless the most optimistic AI scenarios come true.

Fortunately, as we’ve just seen, there are plenty of high total return potential dividend aristocrats to choose from—the world’s best companies with the best return potentials.

In my next article, I’ll show you how to build the ultimate dividend aristocrat retirement portfolio for anyone worried about a potential lost decade or two!

Read the full article here