Investment Thesis

Docebo Inc. (NASDAQ:DCBO) offers a cloud-based Learning Management System (‘LMS’) that helps organizations manage the training needs of their internal employees, customers, and partners. The company has grown its subscription revenue at a 42% CAGR over the last four years and is well-positioned to continue capitalizing on favorable market trends. According to a recent report, the corporate e-learning market was valued at $39.1 billion last year and is expected to grow at a 15% CAGR from 2024 to 2032.

Revenue growth in recent quarters has decelerated and is expected to slow down further in upcoming quarters. Management highlighted multiple growth drivers that will likely have a positive impact on growth next year. Meanwhile, margins have expanded substantially showcasing the inherent operating leverage in the business. Shares are valued at 32 times FCF which appears attractive given the improving margins and the promising outlook for the next year as the company approaches the “Rule of 40” milestone. However, the significant deceleration implied in management’s guidance for this year keeps me on the sidelines until there is clearer evidence of a potential growth reacceleration.

Financial Highlights

Q1 Investor Presentation

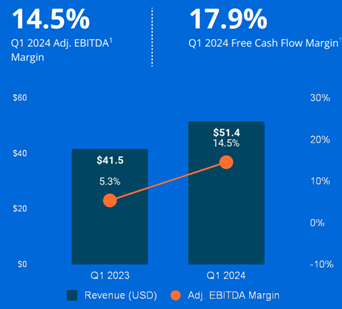

Q1 Revenue was up 24% year over year, which was a slight deceleration versus the 26% growth in Q4 2023. Macroeconomic headwinds that specifically impacted its SMB and lower mid-market customers were cited as a reason for the growth slowdown. Additionally, there was a negative impact from reduced usage by a large customer adopting in-house LMS. Margins however were very strong as the company demonstrated its inherent operating leverage with adjusted EBITDA and FCF margins reaching 14.5% and 17.9% respectively, as shown above.

Management guidance however was considerably weak, and the main reason behind the selloff in my opinion. Q2 revenue guidance of $52.3 million at the midpoint implies year-over-year growth is expected to be around 20%. Management’s full year guidance of 18% revenue growth implies that revenue growth in the second half of 2024 will be just 15% year over year. Despite the revenue deceleration that is implied in its guidance owing to the continued macro-economic weakness, my understanding is that management still expects a solid contribution from its enterprise and government segment as implied by its CEO stating:

Almost 50% of our ARR in quarter one came from enterprise and government segments. And then 50% of our pipeline is enterprise and external hybrid use case, which, by design is what we want more for better unit economics. So we remain very, very optimistic about the trend moving forward on the basis of this.

Expectations Going Forward

Multiple drivers for growth from late Q4 onwards

Management pointed out several initiatives which should support organic growth. One of them is related to price increases that will be implemented on new deals from April onwards. The benefits from this on the company’s financials are not expected to be seen until late 2024 or early 2025. Another growth driver is on the government side which is expected to bring in large contracts once the FedRAMP certification is received later this year. Again, the revenue impact from this is likely to be seen only next year. Lastly, management expects new products that will start rolling out in the second half of the year to also contribute towards next year’s revenue.

Given this backdrop, I do not expect to see evidence of any re-acceleration of growth in Q2 and Q3, though I will look out for certain aspects on the respective earnings calls that I will discuss later. I feel more confident that the company will see a re-acceleration in growth exiting Q4. Given the underlying dynamics and facing easier comps, I expect revenue growth to be closer to 20% from Q1 2025 onwards. Commentary from its CEO gives me further confidence in my expectations as he emphasized reaching the target of “Rule of 40”. He said:

And as you think about the growth of the business still at what we delivered this quarter, at 23%, the natural operating leverage from G&A will get us to a position where this company, as we look through 2024 2025 cycle is more of a balanced rule of 40 where EBITDA free cash flow naturally is getting closer and closer to the 20% mark.

Solid FCF margins

Q1 Investor Presentation

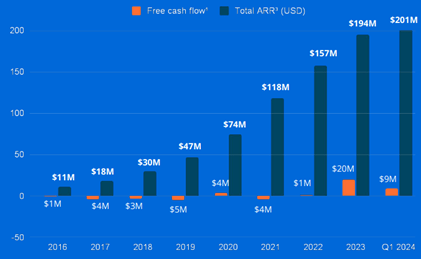

The company has grown revenue drastically since 2016 with minimal cash burn as highlighted above. Going forward management expects adjusted EBITDA to be around 15% this year while approaching 20% in the next couple of years. Likewise, FCF is expected to be robust and higher than adjusted EBITDA as explained by its CFO as he stated:

Generally, I would say free cash flow on — if you look at on trailing 12 months basis, would be 1% or 2% higher relative to our EBITDA. That’s kind of the rule of thumb in our world.

Given the growth slowdown expected this year, I expect management will keep expenses under control which should drive operating margins higher, given its high gross margins (>80%) and largely fixed cost base. Given management’s target to reach 20% margins by the end of 2025, my expectations are for this year’s EBITDA to end up above the upper range of management’s guidance.

Capital allocation strategy

The company has an NCIB in place, which gives management the option to return capital to shareholders through buybacks. The company’s substantial issuer course bid in November last year resulted in the purchase of 5.7% of its shares outstanding for $100 million. Its CEO has, however, stated that investments in growth initiatives, either organic or inorganic, are presently of higher strategic importance. Given that shares currently trade significantly below the value where the substantial issuer course bid was carried out, I do expect management to step up its share repurchase activity though, barring any M&A.

Valuation

I estimate the company’s revenue for FY24 to be approximately $214 million, which implies a year-over-year growth above 18%. This is on the higher end of management’s guidance but largely in line with analyst estimates. Similarly, adjusted EBITDA should be close to $33 million at a margin of 15%. I estimate FCF to be slightly higher as discussed previously, ending up near $36 million.

At today’s share price of $38 and considering the company’s net cash position of $80 million, it has an enterprise value of $1.07 billion, based on 30.2 million shares outstanding. Shares are currently trading at an EV-to-adjusted EBITDA multiple of 32 and a price-to-free cash flow FCF multiple of approximately the same value. Since the company currently has no direct peers in the LMS space that are public, I chose to compare its valuation against other B2B SaaS companies that have similar size growth rates and financial health. Shares of AvePoint, Inc. (AVPT) and PROS Holdings, Inc. (PRO) have price-to-FCF multiples close to 50 with the former growing at 25% and the latter just above 10%. In comparison, a multiple of 32 does appear attractive for Docebo which has historically grown at rates well above 20% and has room for margin expansion. However, the decelerating growth expected in upcoming quarters leads me to conclude that shares appear to be close to fully valued.

Risks

I believe the ongoing macroeconomic headwinds affecting the company’s SMB and lower mid-market customers pose a substantial risk to near-term organic growth. Another risk to consider is the increased competition in the LMS sector from diverse players across various verticals as described in its Annual Report. Additionally, some of the company’s customers may also aim to develop an in-house solution, though Docebo has tried to mitigate this risk by offering a range of additional features and a high degree of customization to enhance its platform’s appeal.

Key aspects that investors should look out for in its Q2 earnings

Though growth is expected to be weak on its topline, one of the key underlying metrics to track the health of the business is the Average Contract Value. This value was up 11.7% in Q1 versus the same period last year. This value should remain at this level as management focuses more on enterprise and government deals. Profit margins should continue to improve from levels seen in Q1 as I mentioned previously, and I consider it to be further evidence of the operating leverage in this business. Investors should also look for any further commentary from management on the progress regarding the growth drivers and whether the initial timelines are still expected to be met, especially regarding the launch of new products.

Conclusion

The company has historically demonstrated an attractive profile of strong organic growth and improving margins. However, management’s guidance suggests a significant slowdown in growth in the upcoming quarters, posing a notable near-term risk. Despite finding the valuation compelling, I rate the shares as a Hold for now.

Read the full article here