Intro

We wrote about Donaldson Company, Inc. (NYSE:DCI) back in May of this year when we attempted to stamp a price on the dividend aristocrat using the dividend discount model. Although $90 a share came to be the result of the dividend discount calculation at the time, shares of Donaldson have failed to move towards this target as the stock has moved down roughly 3.5% since our most previous commentary to currently sit just under the $62 level.

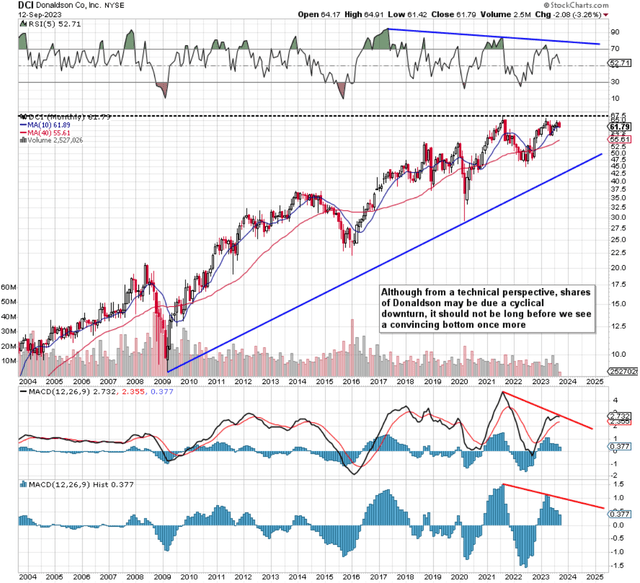

From reviewing the company’s recent fiscal Q4-2023 earnings report, we still believe Donaldson will get to that target ($90+) although investors may have to wait sometime before the next significant up move can begin in earnest. The reason being is that we have a sizable bearish MACD divergence on the long-term chart monthly chart, which may be pointing to a market top. Donaldson’s histogram also demonstrates how Donaldson’s latest upmove has been weakening. Investors looking to sell into this potential down move should wait for Donaldson’s monthly histogram to move into negative territory. This signal would coincide with a MACD bearish crossover and would confirm a likely trend change.

Technically, though, Donaldson remains in a long-term bull market as the industrial player continues to print long-term higher lows and higher highs. In fact, we would need to see a technical break below the multi-year trend line depicted below to denote a fresh bear market in this play. Given the impressive fundamentals in Donaldson which were on full show in the company’s recent Q4 earnings report and the fact that stocks in bull markets, many times surprise to the upside, the play here is to hold existing positions and only add when a clear buying signal presents itself once more.

Donaldson Long-Term Technicals (StockCharts.com)

Profitability – Gross Margin Strength

Gross margin in the most recent fourth quarter (34.28%) outpaced the fiscal 2023 number of 33.91% which in turn comes in ahead of the company’s 5-year average of 33.55%. The sector median comes in at 30.3% on average over the past 12 months. Donaldson was able to drive its gross margin higher in fiscal 2023 primarily through higher pricing. With inflation on the rise again, it remains crucial that Donaldson will continue to have the wherewithal to protect its income statement from rising costs going forward.

To this point, it is evident that Donaldson is not behind the eight-ball in terms of competitiveness compared to its competition. Not only is Donaldson’s gross margin increasing, but it is also starting from a higher level over what the sector is trading at presently. This ensures Donaldson’s bottom-line earnings curve remains protected, which is what Wall Street wants to see.

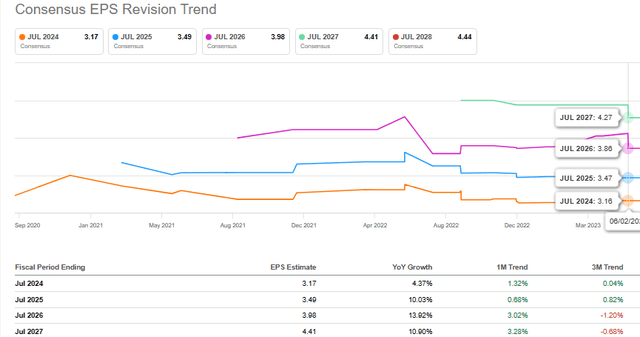

Projected Forward-Looking Earnings Growth

In fact, Donaldson’s fourth-quarter earnings and margin trends have boosted forward-looking EPS estimates, as we see below. The company’s current fiscal 2024 bottom-line estimate of $3.17 per share has already increased by $0.04 per share already, with the upward trend likely to continue going forward. Mobile Solutions looks set to take advantage of favorable trading conditions, where aftermarket strength is also expected to drive sales forward in fiscal 2024. Industrial Solutions is expected to report mid-digit percentage growth, with the expected decline in Aerospace and defense projected to be well covered by growth across multiple Industrial businesses. In Life Sciences, the 20% expected top-line growth is really only the tip of the iceberg when one considers the heavy investment Donaldson continues to make in this segment. Sustained investments in staff, R&D, multiple acquisitions and a new bioprocessing technical center should all meaningfully add to the ‘value proposition’ in Life Sciences Donaldson will bring to the table over time.

Donaldson Consensus EPS Revisions (Seeking Alpha)

Value Is Tied To The Dividend

Being a dividend aristocrat (where the payout continues to be well covered by free cash flow), we would expect investors to step in on the long side if indeed Donaldson’s dividend yield were to trade well above normal. Presently, Donaldson’s forward dividend yield of approximately 1.61% is right in line with the stock’s 5-year average for this metric. If a drop to the $50 level were to ensue as the technicals may be implying, Donaldson’s trailing sales multiple would drop to 1.76% and the dividend would quickly jump to the 2% mark. Both of these numbers (trailing sales multiple and dividend yield) look very attractive when compared to historic averages in DCI, which is why we believe any potential downward trend will not gain any type of significant traction.

Conclusion

To sum up, although Donaldson’s technicals seem to be pricing in a near-term down move, the company’s recent Q4 earnings report and guidance for fiscal 2024 point to both margin and earnings growth. Let’s see how Q1-2024 earnings fare out. We look forward to continued coverage.

Read the full article here