Introduction

As a person who is all for autonomy and freedom, I love this vision as articulated on the company’s website,

Dorman gives repair professionals and vehicle owners greater freedom to fix cars and trucks by focusing on solutions first. For over 100 years, we have been one of the automotive aftermarket industry’s pioneering problem solvers, releasing tens of thousands of replacement products engineered to save time and money and increase convenience and reliability.

Founded in 1978, the company supplies replacement and upgrade parts in the motor vehicle aftermarket industry. Dorman Products (NASDAQ:DORM) serves passenger cars, light-, medium-, and heavy-duty trucks, as well as specialty vehicles, including utility terrain vehicles (UTVs) and all-terrain vehicles. Much of the 129,000 distinct parts marketed by DORM were designed and engineered by DORM.

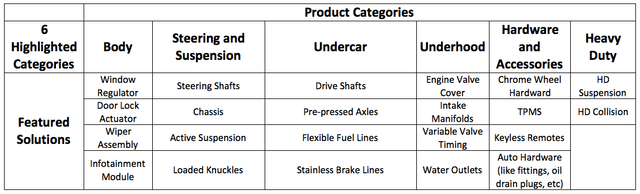

The following highlights the product offerings in six major categories. To be clear, DORM has 365 product categories and 129,000 products, so the table below merely serves to illustrate its best and most popular products.

Dorman Product Website

Five Reasons Why I Like DORM

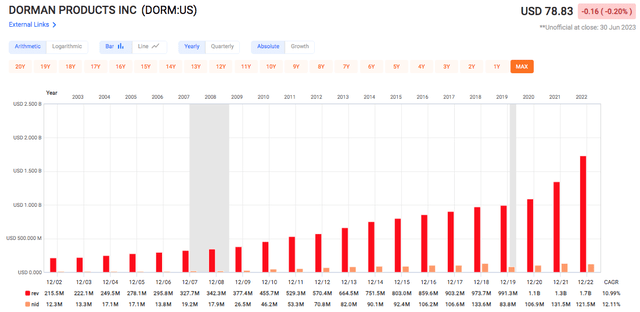

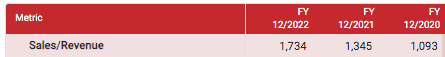

1. DORM Has Increasing Revenue and Net Income

I like a business that can grow its revenue and net income, and DORM has done just that. Over the past twenty years, it grew revenue by a CAGR of 10.99% to $1.7 billion in 2022, and net income grew even more CAGR of 12.11% to $121.5 million in 2022.

Fast Graph DORM 20-year Revenue and Net Income

2. DORM Is Back By Strong Tailwinds

The number of cars on American roads has been increasing steadily, from 272 million in Q1 of 2018 to 286 million in Q1 of 2023. The average age of light trucks increased from 10.9 years in 2011 to 12.2 years in 2022. The trend of older cars staying on the roads continued in 2021 and 2022. In 2021, it was a case of a lower supply of new cars due to shortages in semiconductor chips, and following that in 2022 came higher inflation and higher car prices across virtually all the major manufacturers. These two factors contribute to more Americans keeping their current cars rather than buying new cars.

As noted in the 2022 10K,

The Company’s products are primarily purchased and installed on a subsegment of the passenger and light-duty vehicles in operation in the United States (“VIO”), specifically weighted towards vehicles aged 8 to 13 years old. Each year, the United States seasonally adjusted annual rate (“US SAAR”) of new vehicles purchased adds a new year to the VIO. According to data from the Auto Care Association (“Auto Care”), the US SAAR experienced a decline from 2008 to 2011 as consumers purchased fewer new vehicles as a result of the Great Recession of 2008. We believe that the declining US SAAR during that period resulted in a follow-on decline in our primary VIO subsegment (8 to 13-year-old vehicles) commencing in 2016. However, following 2011 and the impact of the Great Recession of 2008, U.S. consumers began to increase their purchases of new vehicles which over time caused the US SAAR to recover and return to more historical levels. Consequently, we expect the VIO for vehicles aged 8 to 13 years old to continue to recover over the next several years. Additionally, during 2023, we expect fewer new vehicles to be purchased in the near term, benefiting demand for aftermarket parts, given the lack of availability of new vehicles and increased interest rates.

With a greater number of aging cars requires owners to perform the necessary repairs and maintenance to keep these vehicles well-maintained and safe to operate.

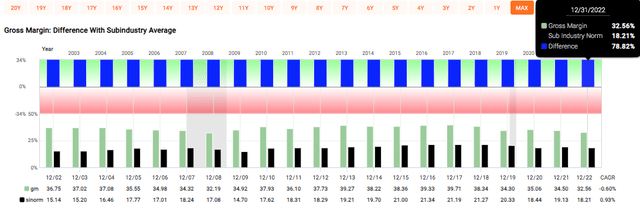

3. DORM Has Industry Leading Margins

Since the trade war tariffs started in July 2018 (more on this later), DORM’s gross margins fell from 38-39% to around 34% in 2019. And in 2022, margins were further compressed due to supply chain issues and delays.

Gross Margins

Despite these challenges, DORM still outperformed industry peers with gross margins exceeding the industry average by 78.82%.

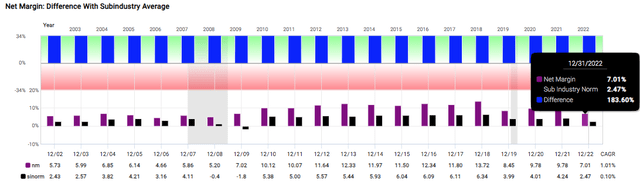

A similar situation happened to DORM’s net margins after the 2018 tariff war ensued. From 2010 to 2018, DORM’s net margin consistently hovers between 10% to 12%, more than twice the industry’s average of 5% to 6%. After the 2018 tariffs, the whole industry was affected, and DORM was no exception.

Net Margin

Its net margin from 2019 to 2022 has been around 8.45% to 9.78% (versus the industry’s (3.99% to 4.24%). The well-documented supply chain and higher cost issues in 2022 brought the net margin down to 7.01% in 2022 which was still almost three times the industry’s average of 2.47%.

4. DORM Is An Understated Growth Stock

The article is titled Dorman Products: The Growth Stock That Nobody Knew, and here is why.

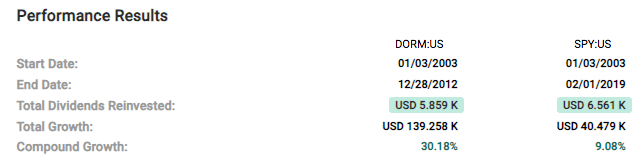

Before the 2018 tariffs kicked in, from the period of 2002 to 2018, DORM simply crushed the S&P 500’s 9.08%, turning a $10,000 investment into $139,258, a 30.18% CAGR that best the returns of legendary investors like Peter Lynch (29% in 13 years) and Seth Klarman (20% over 30 years).

Fast Graph

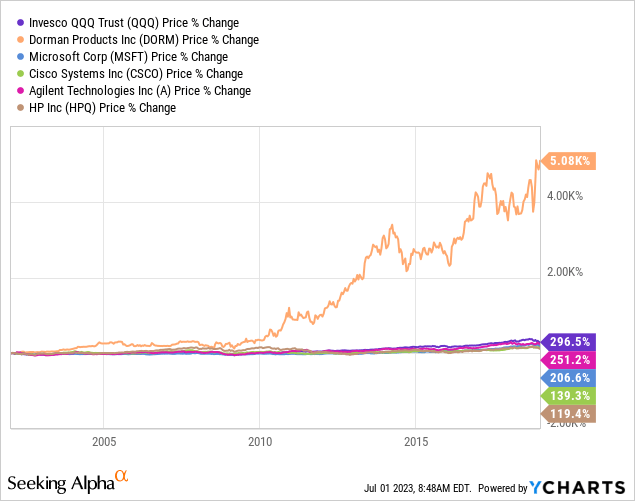

This little company that makes and sells unsexy car parts even outperformed technology-heavy QQQ. From January 2002 to January 2019, DORM rewarded its long-term investors with an astounding return of 5080%, besting QQQ’s respectable 296%, and leaving legacy technology companies like Microsoft (MSFT), CISCO (CSCO), Agilent Technologies (A), and HP (HPQ) its wake.

5. DORM Seemed To Be Currently Undervalued While Expecting To Keep Growing Earnings And Revenue At Double-Digit Rates

With the global economy normalizing and previously high costs due to the supply chain back to almost pre-pandemic levels, sales, and earnings are expected to continue to grow in this post-pandemic era.

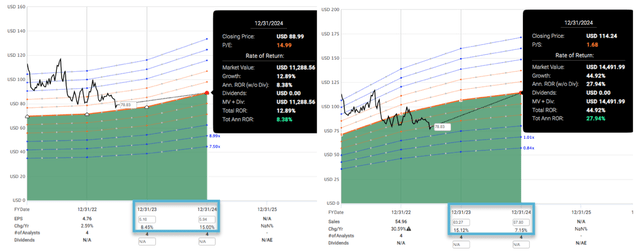

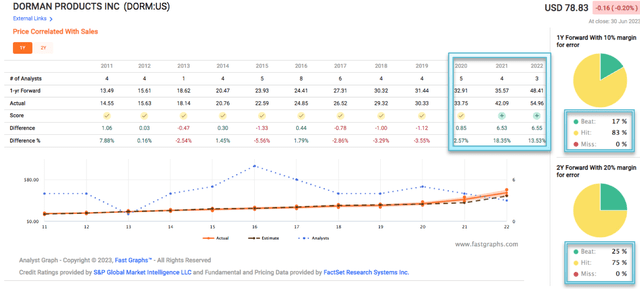

It seemed that Wallstreet likes DORM. Analysts that report to Yahoo Finance forecast growth to be at an annual rate of 15% for the next 5 years. FactSet analysts forecast a yearly average adjusted operating earnings growth for the next two years of 11.72% on the back of 11.13% revenue growth. This is a far cry from the earlier mentioned 30% CAGR but 11% is still a respectable growth figure.

And if DORM trades back up to its normal P/E of around 15 or to its normal P/S of around 1.68, it could potentially offer capital gains in 18 months ranging from 12.89% to 44.92%.

Fast Graph

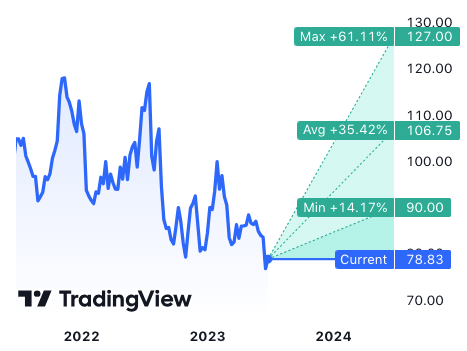

It seemed that Wallstreet likes DORM. According to TradingView, 4 analysts gave 1-year price targets ranging from $90 to $127, representing upside of 14.17% and 61.1% respectively.

TradingView

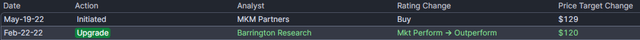

It received two positive ratings from analysts in 2022, with price targets of $120 and $129.

Finviz

So Why Did DORM Crash From 2022 to 2023?

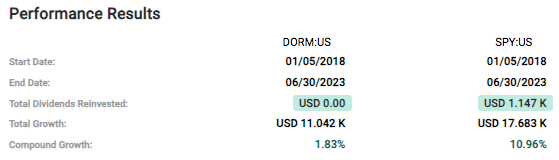

From 5 January 2018 till 30 June 2023, DORM severely underperformed the S&P 500.

Fast Graph

That period of underperformance was to be expected, with the global lockdown in 2020, with factories closed and movement restrictions, plus the resulting supply chain issues, the adjusted operating earnings crashed by 37% in 2020. The decline in 2020 was not unusual, and with the vaccine successfully concocted and released to the world, the adjusted operating earnings rebounded strongly in 2021 and 2022 by 30% and 34% respectively.

And despite the challenges in 2021 and 2022, DORM’s exceeded analysts’ 1-year revenue forecast for 2021 and 2022 by 18.35% and 13.52% respectively.

Fast Graph DORM Exceeded Revenue Forecasts for 2021 and 2022

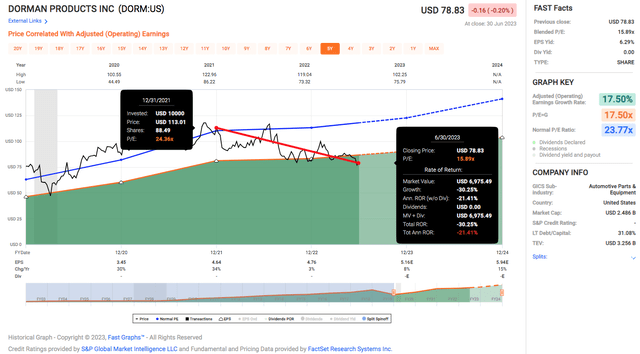

Yet, for the past one and a half year, DORM’s share price collapsed 30%.

Fast Graph DORM 31 December 2021 to 30 June 2023

I believe it is due to the increased debt load that DORM took on with two major acquisitions. And with that, let’s discuss the risks.

Risks

High Debt

According to the 2022 10K,

We market our products under the Dorman , Dayton Parts and SuperATV names, along with several sub-brands, which identify products that address specific segments of the motor vehicle aftermarket industry.

2022 10K

Dayton Parts and SuperATV are recent acquisitions; Dayton Parts was acquired in 2021, while Super ATV was acquired in 2022. The Dayton Parts was acquired for a total cash of around $338 million, financed with $100 million from cash on hand and the rest financed from borrowings under the DORM’s new $600 million revolving credit facility with the Bank of America. And the acquisition of Super ATV cost DORM $490 million in cash at closing, plus an earn-out of up to $100 million in the aggregate payable over two years subject to certain performance targets being achieved in 2023 and 2024, according to the company’s press release.

The two acquisitions definitely boosted the revenue ending 2021 and 2022.

Fast Graph Dorm Financials

There is nothing wrong with companies buying revenue and earnings through value-accretive acquisitions. However, since this is the first time in the past 20 years that it has done acquisitions, and it is doing it on such a magnitude, there will be concerns regarding the management’s (lack of) experience in ensuring a successful integration of not two but three businesses.

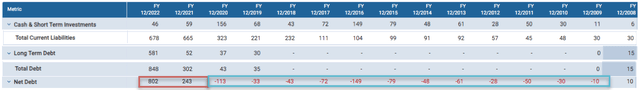

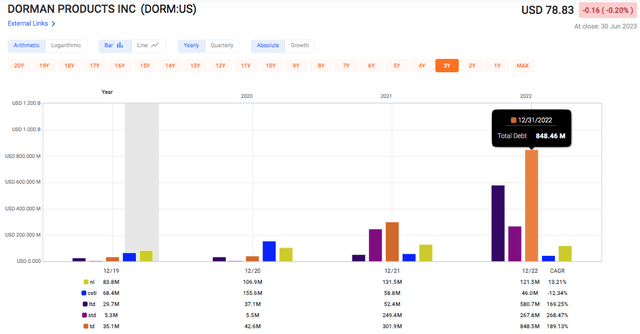

Fast Graph

From 2009 to 2020, the company has been in an enviable negative net debt situation (which means DORM had more cash than total debt). Then, as a result of the two acquisitions, the total debt skyrocketed from $35.08 million in 2019 (which was very manageable with its net income of $83.76 million or the $63.35 million in cash and cash equivalents) to $848.46 million in 2022 (on the back of just $121.55 million in net income and $46.03 million in cash and cash equivalents).

DORM High Debt Compared to Net Income and Cash

Pages 34 and 35 of the 2020 10K states the due date for the maturity of the loans,

On August 10, 2021, in connection with the acquisition of Dayton Parts, we entered into a credit agreement that provided for a $600.0 million revolving credit facility, including a letter of credit sub-facility of up to $60 million (the “2021 Facility”). The 2021 Facility replaced our previous $100.0 million revolving credit facility. The 2021 Facility was scheduled to mature on August 10, 2026…

On October 4, 2022, Dorman entered into an amendment and restatement of the 2021 Facility (as amended and restated, the “New Facility”) by and among Dorman, the lenders from time to time party thereto, and the administrative agent. In addition to including the existing $600.0 million revolving facility, the New Facility includes a $500.0 million term loan, which was used to fund the SuperATV acquisition. The New Facility (including the revolving portion of the New Facility) matures on October 4, 2027…

As a result of this massive undertaking, free cash flow per share plummet from $4.22 per share in 2020 prior to the acquisitions to just $0.12 per share as of 2022. This leaves DORM with very little wiggle room for error. For the next 4.5 years, DORM will have to be laser-focused on repaying the loan, leaving little working capital for more capital expenditures, stock repurchases, and R&D expenditures or acquisitions.

And what I also meant by little wiggle room is this: What if DORM’s customers were to delay payments for goods receivable, or worse, go out of business?

From 2022 10K, the company reveals that most of its revenue is concentrated in four customers. Three of them account for approximately 49% of net sales. DORM’s four largest customers accounted for 69% and 71% of net accounts receivable as of December 31, 2022, and December 25, 2021, respectively, and it seems that there is little the company can do about this state of affairs.

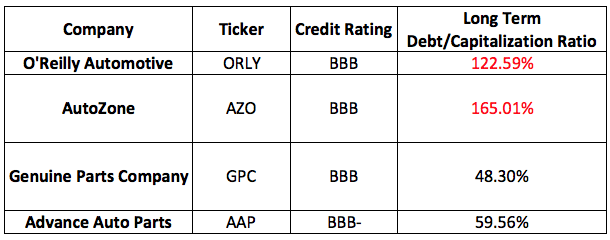

Who could these automotive retailers be? Details are not found in the 10K nor the investor presentation slides, so to hazard a guess, I listed the major automotive retailers in the United States in the table below.

Possibly DORM’s 4 Largest Customers

All of these companies have credit ratings ranging from BBB- to BBB, so the chances of them defaulting are relatively low. However, as investors, we should always weigh the risks versus rewards, and in a relatively high inflation environment when compared to the previous decade, with relatively high-interest rates, it is not impossible for these investment-grade companies to get into trouble that may require them to stretch their repayment period, which in turn can cause DORM grief.

China

Most of DORM’s products are purchased from China, and other than currency exchange fluctuations that can cause changes in the cost of these products, trade tariffs enacted by the US Government also added to the cost of the products that are made in China.

In fiscal 2022, approximately 64% of our products were purchased from suppliers in a variety of non-U.S. countries, with the largest portion of our overseas purchases being made in China.

In the third quarter of 2018, the Office of the United States Trade Representative (USTR) began imposing additional tariffs on products imported from China, including many of our products, ranging from 7.5% to 25%. The tariffs enacted to date increase the cost of many of the products that are manufactured for us in China. We have taken several actions to mitigate the impact of the tariffs including, but not limited to, price increases to our customers and cost concessions from our suppliers. We expect to continue mitigating the impact of tariffs primarily through selling price increases to offset the higher tariffs incurred. Tariffs are not expected to have a material impact on our net income but are expected to increase net sales and lower our gross and operating profit margins.

The company has been derisking this aspect, decreasing the dependence on China by decreasing the procurement from 74% in 2021 to 64% in 2022. The company’s move to diversify the sources of its production is in the right direction though 64% is still a concerning figure.

Valuation Again

Earlier, I wrote that DORM seems to be undervalued. FactSet analysts think that DORM can generate $5.94 per share of adjusted operating earnings in 2024. Assuming that the market priced in the risks above and the company does not trade back to its 10-year normal P/E of 21 but instead trades between a P/E of 12 to 15, the shares could be worth between $71.28 to $ 89.10 per share. That means DORM shares could be fairly valued now with a possible 13% upside in 18 months.

Considering the execution risks from the management, and the geopolitical risk associated with an increase in tension between the United States and China, which is only likely to increase further with further rhetoric as the 2024 presidential election approaches, the current price does not seem to provide a sufficient margin of safety.

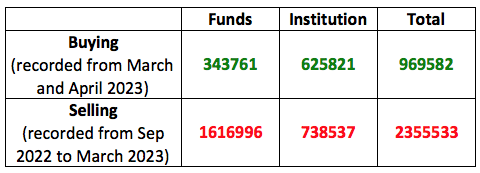

“Smart money” agrees, with the majority of them exiting or reducing their DORM positions compared to those who bought or increased.

Data from Morningstar

Conclusion

I like Dorman Products (DORM) a lot. Its past performance prior to 2019 was impressive, beating even the performance of legendary investors like Seth Klarman and Peter Lynch. The business is backed by strong tailwinds with more aging cars on the roads owners need to spend more on maintenance and repairs. It is a leader in its industry with much higher margins than the industry average. It is expected to keep growing earnings and revenue, especially after the acquisitions of Dayton Parts and SuperATV.

However, it is operating in a new reality now, one with tighter margins thanks to the tariff war, higher inflation, and higher cost of doing business. DORM has much more debt now and its free cash flow has declined precipitously to just $0.12 per share in 2022 from $4.22 in 2020, leaving it with little room for error. Besides, analysts do not expect DORM to grow at the same rate as before; 15% per year for the next five years is the projection.

Will it return to its 30% CAGR growth days again? Your guess is as good as mine. Maybe these two acquisitions are the key to returning to the good old days. However, as the management focuses on paying off the loans from the recent acquisitions while integrating the three companies to achieve “synergies” and to extract cost savings, it will have less free cash to reinvest into its business so I personally doubt it can achieve that before 2027.

I like DORM, a small-cap stock that is pretty much under the radar. I think the shares are currently fairly priced (at least not cheap enough) in view of the higher risks and lower rewards. At $70 a share, however, the margin of safety widens, and I may start a small position and dollar-cost-average at that point. Or, if the growth rate increases over 20%, that will increase the margin of safety at the current price level of $78. But until either scenario happens, DORM is a HOLD for me now.

Read the full article here