Investment Thesis

Doximity, Inc. (NYSE:DOCS) delivered fiscal Q2 2024 results, and the stock soared. Indeed, its outlook turned out better than analysts’ expectations. However, I remain bearish on this stock and don’t believe this rally will last.

Case in point, I don’t find Doximity, at 25x forward free cash flow, to be an attractive stock. Consequently, I maintain my sell rating on this name.

Quick Recap

In my previous analysis, I said:

The bull case for Doximity is that it holds around $860 million of cash and nil debt. This means that around 16% of its market cap is made up of cash.

The bear case here is that investors are being asked to pay around 25x this year’s free cash flow for a business that is growing at around 10% to 12% on a go-forward basis.

When paying around 25x free cash flows, there are plenty of other companies that have ”clean” stories and operate blemish-free.

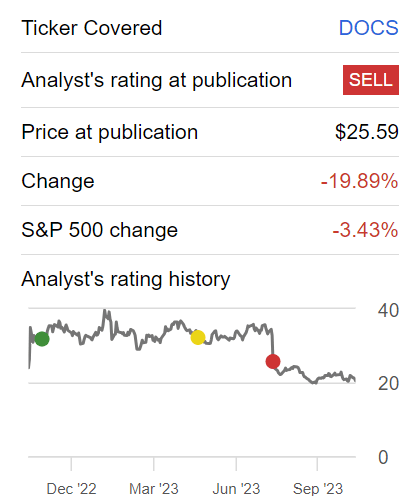

Since I penned my analysis, the stock continued to slide lower.

Author’s work DOCS

Lower and lower the stock went as investor expectations turned increasingly pessimistic. And here’s the thing, investors crowded around, pricing in further bad news. Ultimately, the bear thesis became too crowded.

Even though the share price is currently soaring in premarket trading, I argue that this stock remains a sell, as it’s still too expensively priced.

Accordingly, I stand by my earlier assessment. This stock is too richly priced, given that it has many hairs on this business.

Doximity’s Near-Term Prospects

Doximity derives its name from its role in creating proximity for physicians. It is a cloud platform enabling physicians to engage in collaborative efforts with peers, coordinate patient care, stay informed about medical news and research, and actively manage their professional trajectory through job search functionalities.

Doximity operates a professional network for physicians, offering a platform that connects medical professionals, allowing them to collaborate, share information, and access various tools and resources. The platform provides features such as a news feed, tools for peer-to-peer communication, and products like DocDefender and AMM designed for healthcare professionals.

Doximity’s near-term prospects indicate continued growth, particularly among its largest customers, with a notable increase in the number of million-dollar clients. Strong revenue performance, exemplified by a 28% year-over-year rise in $1 million-plus customers, indicates a robust position in the market.

Additionally, the introduction of new products like the pharma client portal demonstrates a commitment to innovation and meeting the evolving needs of its user base.

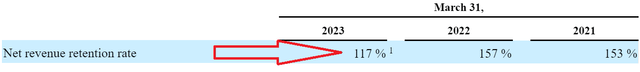

That being said, Doximity’s net retention rates have been falling. By looking at the data, this isn’t immediately obvious, as Doximity reports its net retention rates on a trailing twelve-month period. This smooths out its figures, so you need to keep in mind that, out of the trailing twelve months reported, this figure includes 3 quarters, plus its latest quarter.

DOCS SEC filings

What you see above, where the arrow points, is the trailing twelve months that end in March 2023.

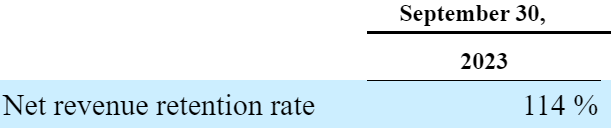

DOCS SEC filings

Whereas what you see here is the net retention 6 months later. And it shows that its net retention has dropped to 114%. However, this figure is a trailing twelve-month figure. Accordingly, I suspect that if we were to have the figures for just fiscal Q2 2024, the net retention figure would probably be around 112%, a meaningful compression from the 117% six months ago.

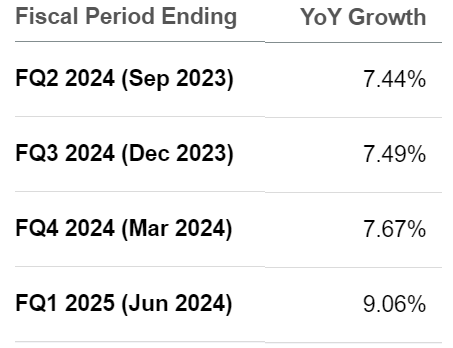

Revenue Growth Rates Continue to Slow Down

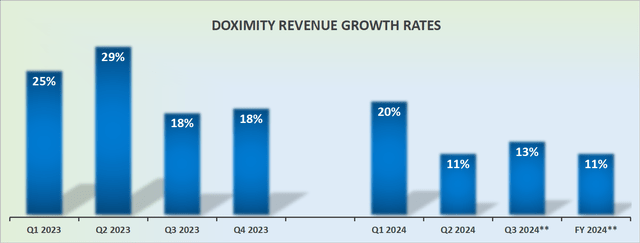

DOCS revenue growth rates

Doximity faces challenges primarily linked to macroeconomic uncertainties and market budget growth. During the earnings call, there was a clear indication of caution in the company’s approach due to these potential cyclical headwinds.

The uncertainty is reflected in several statements. For example, “We just aren’t yet sure exactly what that growth rate is going to look like.”

Another example includes:

The general approach to all things these days is just more caution at the macro level, given that our clients could invest that money at low risk at high rates these days as well instead of investing in our marketing.

Altogether, there’s clear evidence of “more caution [in the] longer viewpoint on our end.” This suggests a shift in the company’s perspective towards a more conservative outlook, which coincides with its net retention figures compressing.

What’s more, when we look ahead to its guidance, even if we expect Doximity to exceed the high end of its revenue guidance by 2%, it would still result in very low double-digit growth rates.

So, Why is the Share Price Soaring?

Because the Street got too negative on Doximity’s outlook.

SA Premium

Analysts expected Doximity’s growth rates to drop to high single digits. The fact that there are still double-digit revenue growth rates in this business was evidently welcomed by investors.

But this won’t detract from the fact that Doximity is still considered too richly priced.

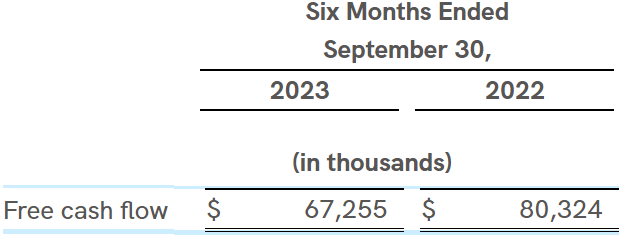

DOCS fiscal Q2 2024

In the best-case scenario, looking forward, Doximity is expected to generate about $180 million in free cash flow. This leaves this stock priced at 25x forward free cash flows, despite only delivering low teen growth rates.

The Bottom Line

In conclusion, as Doximity continues to navigate its market, the uncertainties loom large.

Despite its recent positive financial indicators and strategic moves, the skepticism persists. Paying 25x forward free cash flows for a stock exhibiting low double-digit growth rates raises substantial concerns about its valuation. The market’s eagerness to embrace double-digit revenue growth may have temporarily lifted the share price, but the underlying doubts about sustainability and the rich pricing persist.

As investors cautiously watch the evolving landscape, the question of whether Doximity’s current trajectory justifies its premium valuation remains open. I recommend investors steer clear of this stock.

Read the full article here